07/11/2014

There are many important lessons to be learned when you first begin investing in real estate, and perhaps one of the most crucial of these lessons involves the concept of leverage. Understanding leverage is not only critical to increasing your returns and fast-tracking your results, but also to protecting your asset position.

So what exactly is leverage?

Simply put, leverage is the amount of the purchase price of a property that is financed by debt. This leverage, coupled with your own investment of capital, your equity, is what is used to pay for your chosen property. The lending institutions are willing to engage in leverage because the property itself is used as security for the loan, therefore minimising their risk to an acceptable degree. When you leverage property above 80% of the value of the property you will be required to pay Lender’s Mortgage Insurance (LMI), but we’ll touch more on that in a moment.

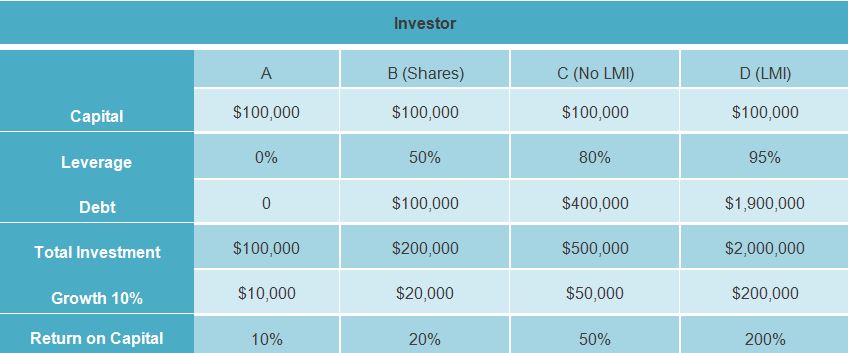

As you can see from the table above, by leveraging your available capital, you can dramatically improve your return on investment (ROI). This is why many investors favour investing in real property over investing in stock shares.

For Investor A in the table above, they chose to pay for the property using all of their equity and using no leverage. The property was located in an area where there was a 10% growth; so on the initial $100,000 investment, there was a $10,000 return on capital. Not too bad, right? But look what happens when you start applying a little bit of leverage to the situation and you will begin to see the power of this one simple technique.

For Investor B in the table above, they leveraged their capital at a 50% level, meaning they received a matching amount from the lending institution. Now the total investment is $200,000, so when the 10% growth occurs, the return on capital is $20,000 or 20% – which is 100% better than the amount gained for Investor A. That’s pretty dramatic!

Now for Investor C in the table above, the investor chooses to leverage their capital at the 80% level, meaning the lending institution will provide 80% of the financing for the property under consideration. This time the property is worth $500,000, but the investor is still only putting the same $100,000 of capital into the transaction while the lending institution bears the bulk of the risk by adding $400,000. As the 10% growth occurs, now $50,000 is earned, or 50% return on capital.

But the best is yet to come! Investor D has gone to a lending institution that allows them to leverage 95% of their equity using LMI and they’ve put the same $100,000 of capital on the line against a property worth $2 million, with the lending institution agreeing to leverage the remaining $1.9 million. Now, once that same 10% growth occurs, our wise investor makes $200,000, which is double their original investment.

As you can see from the table above, if you leverage your capital you can dramatically improve your returns on your investment. Banks will generally allow you to leverage property up to 95% (using LMI), whereas for shares the amount that can be leveraged is usually less. By looking at the above example, you can see that by reducing your deposit to buy a property from 20% to 5% you can double your return.

By simply reducing the amount of the deposit that you make on properties that you buy, and leveraging the balance of the transaction, you can more than double the return on your investment. This allows you to expand your holdings and create multiple streams of income from multiple properties. We have helped investors take advantage of leverage and equity in the past by coaching them and building a successful investment portfolio with them.

There is one note of caution. When lending, or leveraging, above 80% the lender is required to pay LMI to protect the bank’s risk. This can be capitalized to the loan, meaning that it will be rolled up into the loan amount itself and become part of the payments that you will have to repay. Now, LMI isn’t cheap – it can be up to 2.5% of the value of the property. However, by adding it to the loan as a percentage-only loan, you will only pay the LMI fee when you sell the property which could be in 10 years. If your property has doubled in value you won’t be concerned about paying the LMI when you sell, because it’s being able to borrow at that high percentage that got you the added value in the first place.

Leveraging is an investment strategy that works well for the beginning investor who may have limited funds or equity available to start their real estate investment portfolio or program. If the investor has substantial cash or equity available that they do not plan to use for real estate investment, then the above leveraging strategy may not be best suited to their real estate portfolio management or investments.

Jason Paetow is the Managing Director of AllianceCorp, a buyer's advocacy and property investment company. Jason has over 15 years of experience in the property industry and is an expert at property investment strategy, and in coaching and working with clients to optimise their success through education and support. He is a qualified Financial Planner, Mortgage Broker, REIV Licensed Real Estate Agent and a Licensed Builder. To find out more, please visit www.alliancecorp.com.au.

Jason Paetow is the Managing Director of AllianceCorp, a buyer's advocacy and property investment company. Jason has over 15 years of experience in the property industry and is an expert at property investment strategy, and in coaching and working with clients to optimise their success through education and support. He is a qualified Financial Planner, Mortgage Broker, REIV Licensed Real Estate Agent and a Licensed Builder. To find out more, please visit www.alliancecorp.com.au.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.