Expert Advice by Sam Saggers

28/07/2014

"Well, real estate is always good, as far as I'm concerned.

- Donald Trump”

It’s funded dreams, sustained lifestyles and left legacies. Real estate is an investment like no other.

The reasons to invest in real estate are numerous. Following are just a few of them. What are yours?

1. It’s safe “as houses”

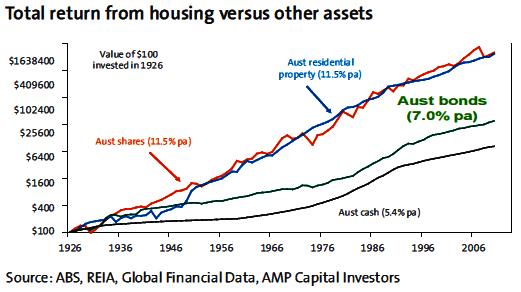

There’s a good reason this phrase is so popular and well known - it’s true. AMP’s research reveals that property values have grown since 1926 at a rate comparable to that of the share market - 11.4% per annum.

2. Getting started is easy

It’s possible to start with a home of your own to live in – and many investors do just that, however, new investors are realising the benefits of property investing. These investors choose to buy their investment property first to take advantage of the many benefits available, for example depreciation, property management and finance costs.

3. Researching property is easier

Understanding the stock market requires a huge commitment of time. Not only do you need to understand how the market works, you’ve got to research individual funds and review company data such as annual press reports and company releases. All of this information can, quite honestly, be overwhelming.

Researching the property market, however, is much less complicated. There is a learning curve, and it can be steep, but it’s much more accessible and once you’ve got the fundamentals down they can be applied to any market.

4. Financing is easier

Lenders’ portfolios consist mostly of home loans. It’s their bread and butter, so of course it’s easier to obtain a loan to purchase property than to purchase shares.

5. Leverage can boost your borrowing power

Since it’s possible to borrow a large proportion of funds to purchase a property compared to other asset classes, you have the opportunity to get more for your money.

For example, if you and a workmate have the same exact financial situation they may be able to borrow $300,000 to purchase shares, whereas you can obtain as much as $450,000 to buy a property.

If both of these assets increased at the same rate of 10% per annum, who would have more capital at the end of the year? Yep - you would! You would enjoy a capital gain of $45,000 over that first year compared to your friend who gained $30,000 over the same time frame - a difference of $15,000!

6. Property investing is about choice

You can choose how and when you want to invest in property depending upon what your goals are and your current financial situation.

Some popular strategies include the following:

Long-term capital growth

Invest in a proven growth location and let the market do the rest. There are also opportunities to boost this capital growth through strategies such as renovation (known as an add-value strategy).

Positive cash flow

Positive cash flow properties are necessary to allow an investor to continue to invest and/or make improvements to their property to increase their portfolio’s bottom line.

7. Total control

There are a number of things out of your control when you invest in shares; actions of your broker and of the individuals running the companies you’re investing in, as well as the actions of the market as a whole.

As a property investor, you have control over your asset’s worth (by increasing its value) as well as your returns (cash flow increase by raising rents) - something you can’t do with the share market.

If you’d like to find out more about how to obtain financial freedom through property investing it’s easy - just read through the many articles on this website and book your FREE seat now to attend our next Property Investor Night. Click here to find out more!

Sam Saggers is CEO of Positive Real Estate and Head of the buyers agency which annually negotiates $250 million-plus in property. Sam's advice is sought-after by thousands of investors including many on BRW’s Rich 200 list. Additionally Sam is a published author and has completed over 2000 property deals in the past 15 years plus helped mentor over 2200 Australian investors to real estate success!

To read more Expert Advice articles by Sam Click Here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.