The property markets of several lower profile Australian cities are exhibiting signs of strong growth, according to Propertyology’s analysis of recent economic data.

The outlook for Hobart remains superior to all other capital cities, and there’s a healthy list of regional cities with robust property markets, employment growth, and economies.

“Our analysis suggests that the property markets of most big profile cities will not perform as well as various major regional cities,” said Simon Pressley, managing director of Propertyology. “The rise of Hobart is the start of a new era of unsuspecting property market stars. There are several regional cities with extremely affordable housing and good economic outlooks.”

Hobart, TAS

Official data published by the Australian Bureau of Statistics (ABS) shows that the increase in jobs in the Tasmanian capital over the last 12 months was four times higher than the national average of 2.1%. This is more than double every other capital city.

“It’s no coincidence that recently released data by Domain confirmed that Hobart had the biggest increase in median property values of all capital cities over the 12 months ending June 2017,” Pressley said.

Hobart boasted strong growth in the June quarter, with median house prices now close to $405,000 and median unit prices near $311,000, according to the Domain Group.

Cairns, QLD

Cairn’s 6.3% employment growth for the year ending in May 2017 is three times above the national average.

“Cairns is Australia’s gateway to Asia. Demand from international students, domestic and international business conferences, and tourism are through the roof,” Pressley said. “A Cairns construction boom is about to unfold in the form of new hotels, resorts, and expansions of the Cairns convention centre, sea port, and Bruce highway.”

Dubbo, NSW

Dubbo, which serves as the capital city for the broader central-west NSW region, registered a 21.6% increase in employment over the two years ending in May 2017. Ambitious infrastructure projects, such as the hospital expansion, are driving the region’s economy. Other sources of economic stimulation include strong growth in the retail and tourism sectors.

Employment trends anticipate property market trends

According to Propertyology, employment trends are often precursors to property market trends.

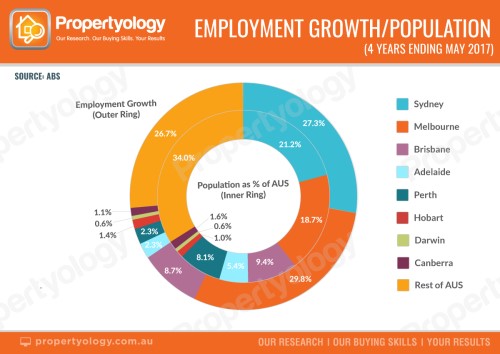

“The relationship between percentage of national job creation and percentage of total Australian population for all capital cities is remarkably consistent with how their respective property markets have performed over the last four years,” Propertyology said.

The correlation between employment growth and property market performance is evident in Brisbane and Perth, which are both below the national average employment growth rate, while Darwin saw a 0.8% retraction in jobs.

Due to continued growth in the Tasmanian economy, Propertyology forecasts that Hobart will continue to remain a “property market star” for the foreseeable future.

Click to enlarge

Related Stories:

QLD’s Lacklustre Economy Mirrors Its Property Market

Property Investors Eyeing Opportunities In Tasmania