According to CoreLogic RP Data’s latest Hedonic Home Value Index, the 12 months to the end of January saw Melbourne become the nation’s leader in terms of capital growth.

Released yesterday, the index shows the past 12 months has seen the median dwelling price in Melbourne increase by 11% to $595,000.

While Sydney’s median dwelling value remains significantly higher at $776,000, values have only risen by 10.5% in Sydney over the last 12 months.

“While still a high rate of annual growth, Sydney’s annual rate of capital gain is now at a 29 month low and has been progressively softening since peaking at 18.4% in July last year,” CoreLogic RP Data research head Tim Lawless said.

“Melbourne’s housing market has been more resilient to slowing growth conditions which has propelled the annual growth rate to the highest of any capital city, with dwelling values 11.0% higher over the past twelve months. The latest data reveals Sydney’s housing market is now playing second fiddle to Melbourne’s, at least in annual growth terms,” Lawless said.

Over the three months to the end of January, Sydney’s median house price declined by 2.1%, while Melbourne saw a quarterly fall of just 0.1%.

For Miriam Sandkuhler, buyer’s agent and the director of Melbourne based Property Mavens, the resilience in Melbourne’s market can be put down to the affordability it offers in comparison to Sydney.

“At the moment we’re dealing with a lot of interstate buyers who are seeing better value in Melbourne as well as a lot of local buyers who still see the market has something to offer,” Sandkuhler.

“Competition for anything priced up to the $600,000 mark is really strong, with real interest from owner-occupiers, investors and self-managed super investors as well. Even for the $600,000 to $800,000 price range in the middle and inner rings there is a lot of interest,” she said.

“In that market there’s a lot of interest for people looking to invest through their SMSF and from downsizers who already own their primary residence but are looking for somewhere to live in 10 or 15 years.”

While Sandkuhler said the Melbourne market would still be classified as a seller's market given that demand has banked up over the Christmas period, she does believe the market will balance out somewhat this year as more stock goes up for sale.

Sandkuhler also said Melbourne’s relative affordability had helped it weather the storm brought on by changes to investment lending.

“The APRA changes haven’t seemed to knock everyone out the market,” she said.

“Those that have the equity or a slightly bigger deposit are still looking around and they’re seeing there’s more bang for their buck in Melbourne right now.”

Outside of Sydney and Melbourne, there is somewhat of a drop of to the next best capital growth performers.

Over the past 12 months, Canberra has had the third highest rate of capital growth, with the median dwelling value up by 6% to $587,500, followed by Brisbane’s 2.8% increase to $478,200.

The median dwelling value in Hobart increased 2.3% to $332,500, while Adelaide saw a 1.1% increase to $420,200.

Perth was the worst performer over the past 12 months, with the median dwelling value declining 4.1% to $515,000.

Darwin also saw its median dwelling value deteriorate, falling 2.5% to $520,000 over the past 12 months.

Source: CoreLogic RP Data

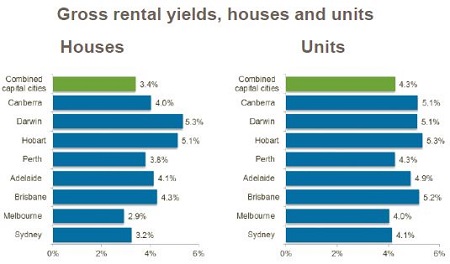

While the past 12 months have brought positives for owners in the majority of markets thanks to positive capital growth, landlords haven’t enjoyed similar growth conditions for their rental returns, with no combined capital city rental growth recorded in the 12 months to January.

“There hasn’t previously been a twelve month period when rents didn’t rise across our combined capitals index,” Lawless said.

“With dwelling values rising substantially more than rents in Sydney and Melbourne, this ongoing effect has created a compression in gross rental yields to the extent that gross yields in these cities are now only marginally higher than record lows.”

The flat rate of rental growth was caused by the tough conditions in Darwin and Perth currently, where rents have fallen by 13.4% and 8.6% respectively in the last 12 months.

Rents have also fallen in Brisbane (-0.7%) and Adelaide (-0.4%).

Source: CoreLogic RP Data

.JPG)