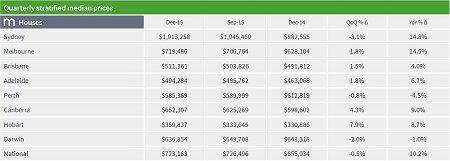

According the latest Domain House Price Report, Sydney’s median house price now sits at $1,013,258 after falling 3.1% in the three months to December.

The decrease is the first decline for Sydney since June 2012 and the largest quarterly decrease on record for the city.

Domain Group senior economist Andrew Wilson said the movement over the quarter definitely signals the end of Sydney’s upswing.

“The remarkable Sydney boom we’ve seen over the last three years is now clearly over, with the market unlikely to record any notable house prices growth until at least spring,” Dr Wilson said.

“While the median house price still remains above $1 million, if current trends continue it will likely fall below this benchmark by mid-year,” he said.

While the boom may very well be over, Rich Harvey, managing director of buyer’s agency Property Buyer, said property owners in Sydney should cast their eyes over the city’s entire cycle before worrying too much.

“It’s the slowdown that had to happen really,” Harvey said.

“Over the past three years we’ve seen growth of around 50% in Sydney and when that happens you’re always going to get to a point where the growth curve flattens out and that’s what we’re seeing now,” he said.

Sam Saggers, chief executive officer of Positive Real Estate agreed with Harvey’s outlook and said the decrease shows Sydney likely pushed too far past the affordability barrier.

“It’s simply a correction from on high,” Saggers said.

“I think recently we’ve seen a weaker market sentiment recently, which probably shows that prices had got out of reach for a lot of people and now they’re just pulling back a bit which is normal,” he said.

While the decrease may be a natural part of the cycle, Sydney’s December quarter did it have some in common with two markets it has been worlds apart from in recent years.

Perth (-0.8%) and Darwin (-2%) were the only other two market to see a price decrease over the quarter.

The longer term figures do show the difference between Sydney and its resource driven counterparts however; in the past 12 months Sydney’s median house price rose 14.8%, while Perth and Darwin have seen prices fall 4.5% and 1% respectively.

For the quarter, Hobart was the strongest performer, recording a 7.9% increase in its median house price.

The median house price now sits at just under $360,000 in the Tasmanian capital, having increased by 8.7% in the 12 months to December and Dr Wilson said it’s a market with “further potential.”

Canberra was the next best performing housing market over the quarter, with its median house price increasing by 4.3% to $652,307.

The median house price in the nation’s capital is 9% higher than the corresponding period in 2014.

Adelaide and Melbourne both saw 1.8% increases in their median house price over the quarter; however the yearly figures again paint a different picture, with Melbourne recording a year-on-year median increase of 14.5% to Adelaide’s 6.7%.

Brisbane’s median house price increased 1.5% over the quarter and posted a 4% year-on-year increase.

Source: Domain

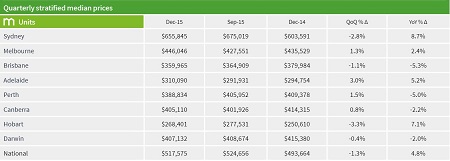

Looking at the unit market, Sydney was again hit by a record quarterly decrease as the median price fell by 2.8% to $655,845.

While it’s the first quarterly decrease in two years for Sydney, the median unit price is still 8.7% higher than 12 months prior.

Over the quarter, Adelaide was home to the best performing unit market, with the median price up 3%, followed by Perth’s 1.5% increase.

The median unit price increased 1.3% in Melbourne and 0.8% in Canberra.

Hobart was hit by a 3.3% decrease over the quarter, while prices declined in Brisbane and Perth by 1.1% and 0.4% respectively.

Source: Domain