“What do these so-called experts do all day?”

If you have asked this question after receiving a fund performance update from your superannuation provider, you are certainly not alone. Until recently, you may have paid little attention to your super, comfortable in the knowledge that your employer was contributing on your behalf and that your money was accumulating extra returns under the capable watch of a professional fund manager with years of experience and plenty of investment know-how.

However, these days comfort seems to be a thing of the past. People retiring recently have had their savings whittled away by inconvenient market slumps or poor investment choices and now an increasing number of Australians are choosing to take control of their own destiny.

Super funds are being scrutinised, criticised and deserted, as more workers begin to ask why they are paying management fees to a fund, for little to no return. Some are switching from their old fund to one with a better performance record, while others are joining the growing ranks of Self-Managed Superannuation Fund (SMSF) members.

YIP VIDEO: Super Property Concierge's Martin Jandera buying property through SMSF

SMSFs can have between one and four members, known as trustees, who are able to actively manage their money, without having to wait until they finish their working life to get a say in the matter. However, while trustees choose what their super is invested in, they are still unable to access returns for personal use until they reach retirement age.

According to the Australian Tax Office (ATO), there are currently around 874,000 people in Australian SMSFs. This is up from just over 557,000 in June 2005.

The number of SMSFs in existence is 458,561, with 69% of these being made up of two members, 23% of one member and 4% each for three and four members. The most common two member combinations are husband and wife funds.

Want more information? Click here for expert advice on SMSF and property.

The benefits

SMSFs have been growing in popularity on the back of three main selling points: control, tax and cost effectiveness.

Control

If you think you can outperform your regular fund’s chief investor, control is your greatest incentive. You can invest in asset classes that you believe will perform strongly, or to access assets that regular funds rarely consider, such as artwork, collectables and residential property.

Tax

The most obvious benefit for SMSF trustees is the discounted rate that income is taxed. According to the ATO, a complying SMSF’s assessable income is generally taxed at a rate of 15%, compared to as much as 45% for income achieved outside the SMSF. This income includes assessable contributions such as employer and personal; investment returns such as interest, dividends and rent; and net capital gains.

On top of this, net capital gains can be avoided all together, if assets are held until the fund transitions to pension phase between the ages of 55 and 65.

In some cases, an SMSF may pay no tax to the ATO, depending on how you tailor your investment choices. If you invest in companies paying a high level of franked dividend, the franking credits can be used to offset tax payable on income generated from other assets such as rental property.

Savings

You will encounter setting up costs and basic administrative costs when running an SMSF. You will also incur costs from any professional services you seek to engage, such as accountants, solicitors, actuaries or financial planners. However, you don’t have to pay for any of the latter if you are happy to go it alone.

Click here for expert advice on SMSF.

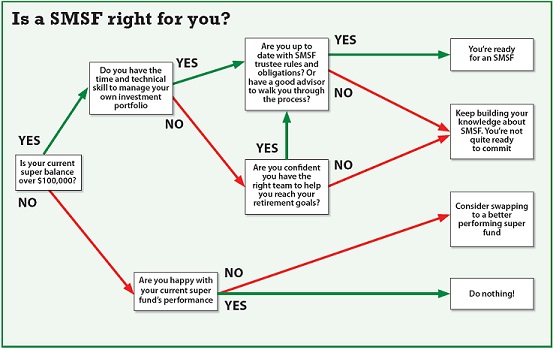

Are you the right fit?

If you want to take on an SMSF, you need to be the type of person that takes an active interest in managing your own investments. You should also be skilful and dedicated enough to perform your administrative requirements, which include creating an investment strategy, preparing a trust deed, reporting on investments, having an annual audit of your fund carried out and preparing financial statements. Finally, you must also be prepared to take legal responsibility for staying on top of all your compliance duties. If something goes wrong; say you accidentally breach one of the strict tax regulations, or you fall victim to fraud; you may be up for heavy penalties with no avenues for compensation.

Ken Raiss, director at accounting firm Chan and Naylor, says that while the above duties sound daunting, running an SMSF is not as bad as you may imagine.

“Extra responsibilities exist in an SMSF, but they’re really quite minimal,” he says. “With the use of proper advisers, the benefits should far outweigh the costs both in dollar terms and in effort.”

Raiss believes that good advice is important when starting out, but once you are up and running, it’s up to you how much time you want to spend.

“The admin stuff is not as onerous as people are led to believe,” he says. “Only the people who want the really active involvement, who want to constantly swap and sell shares and are very involved in their investments, whether in a super fund or outside spend the most time on administration. We have a lot of clients who like to buy property, which is set and forget, then put a bit of money through a managed fund and maybe buy a few direct shares. They wouldn’t even spend an hour or two a week working on it…I have an SMSF and I wouldn’t spend an hour a month on it. You can do as much or as little as you want.”

Raiss does warn that SMSFs are not for everyone.

“They are probably not suitable for people with very small balances,” he says. “Also, anyone who doesn’t want much to do with administration, or is likely to forget; or people who are happy investing with the flow and maybe don’t want to leverage into property or direct shares. It’s not a good or bad thing, but reflective of personality and what stages people are at in their life.”

Are you a SMSF candidate?

Chan and Naylor's Ken Raiss identifies the types of people he considers most suited to an SMSF:

|

You want control and flexibility |

You can choose your own investments, including exotic asset classes, as well as buy direct shares with more flexibility |

|

You are a property investor |

SMSF tax laws are being constantly revised to allow more flexibility for property investors. You can now buy a property with debt, to leverage potential funds in retirement |

|

You want to pool resources |

Because up to four people can be trustees in one SMSF, you can pool your super to get more money together for an investment, such as a deposit on a property |

|

You are a business owner |

If you own a business property, you can sell it to your SMSF. You receive the money for the business property, then by the time the SMSF pays it off; it will attract little capital gains tax and in some instances, none |

|

You have a high super balance |

All SMSFs are charged the same admin costs, regardless of the fund balance, unlike other super funds, which charge a percentage of the balance. Generation X members will have substantially more super than baby boomers, so SMSFs are likely to continue growing as they near retirement |

|

You have substantial money resources outside super |

Unlike non-concessional contributions, there is no limit to how much money you can lend to your SMSF, under what's known as an associated party loan. You can therefore put money in your super and start generating an income, which is tax-free if you're over 60 |

Generation next

The future of the aged pension has been the subject of recent debate in Canberra, while stories claiming that pension payments are inadequate for maintaining any kind of decent lifestyle have emerged across various media outlets.

Some people are now looking at SMSFs as an option for creating multi-generational wealth, which can be passed down through generations of families.

George Nowak, chief executive director of Charterhill, believes superannuation holds the key to making Australia a world leader in wealth sustenance.

“Families have the opportunity to involve their working children as part of an SMSF, to make the family superannuation model a multi-generational one, so there is a passage of wealth through the generations, down the blood lines,” Nowak says. “It is important families plan and maintain wealth and income streams sufficiently, so they’ve got enough capital to look after the income needs of the immediate generation, then flow on to the working people in the next generation and repeat the process again.”

Nowak says the industry has already been lobbying the government to get involved with this concept.

“That is the way to build a unilateral wealth in this country that really sets us up as a true leader on the world scene, because no other country is in a position to do what this country is able to do,” he says. “If you take the pressure off the aged pension in the future, then the country can get on with supplying the other components to life that are required.”

Want more information? Click here for expert advice on SMSF and property.

#pb#

For property investors

Since 2010, SMSFs have been able to borrow to invest in property, using limited recourse borrowing arrangements (before 2010 they had to be bought outright). The rules surrounding such investments have evolved each year, through ATO reviews. The most recent release, SMSFR 2012/1, was issued in May 2012 and seeks to explain in more detail the types of SMSF borrowing that are acceptable. The full document can be found online in the ATO legal database, at the following location: law.ato.gov.au/atolaw/view.htm?Docid=SFR/SMSFR20121/NAT/ATO/00001

In general, if you want to purchase an investment property using an SMSF, you must remember:

-The investment strategy of the fund must include property as an investment

-Properties cannot be bought from a member of the fund, or related party (friends or family), unless it is a business property such as an office or factory, which can be shown to have been purchased at market value

-Properties cannot be bought for personal use, ie members or related parties may not occupy or rent a residential property owned by the SMSF. This does not apply to commercial property.

-A property can be repaired, but not improved, using money from the SMSF. Some renovations, such as kitchen or bathroom, are now seen as repairs, as long as the room maintains its original form or state. It is not acceptable to change the nature of the property, a few examples of which include buying vacant land and then building on it; adding a room or granny flat to a property; or buying a house, knocking it down and building a block of units.

-Once a member reaches retirement age, the fund can sell the property to them. If this occurs when the super fund is in pension phase, capital gains tax does not apply.

The costs of running your SMSF

While you may save thousands each year on investment management fees and other costs associated with retail and industry super funds, you can still expect to pay the following in your SMSF:

Set-up

Depending on which provider you use, your set-up will be between $110 and $1,500. If your SMSF intends to use a corporate trustee structure, you will need to pay additional incorporation costs of around $426 (ASIC fees and preparation of company constitution). Bear in mind that the less you pay, the less you receive. For example, look at the products below:

$110- Trustdeed.com.au – Trust deed supplies the SMSF establishment package, including a PDF trust deed and other set-up documents which you need to complete yourself. The pack includes an instruction sheet.

$1,200- DBA Lawyers- The DBA Lawyers deal includes a soft and hard copy of the SMSF establishment package, corporate trustee set-up, a trust deed, a product disclosure statement, binding death benefit nomination pro forma, and all other set-up documents required. Also includes detailed instructions on how to execute the documents. The trust deed is written by a lawyer who is also a presenter and trainer of SMSF law and strategies to financial planners and accountants. DBA also offers a web-based annual trust deed update service.

Numerous products are available in-between and can be found with an online search.

Annual fees

Bank account fees - $0-$120 - The SMSF must operate a separate bank account in order to ensure assets are kept separate to personal assets of trustees.

ATO Supervisory levy - $200 - The SMSF must pay the ATO Supervisory Levy each year, which rose from $180 in 2011-12 to $200 in 2012-13.

Audit fee - $500-700 – The SMSF must be audited each year by an approved auditor.

Additional service fees

If you lack the time or confidence to take care of all fund administration yourself, a number of companies provide services such as tax return preparation, trustee minutes and other trustee documentation, investment record keeping, preparation of financial statements and investment performance reporting, among others.

Such administrative companies, and most accountants, will charge between $1,500 and $3,000 each year for these services. Industry figures agree that if you are planning to engage professionals to essentially run the SMSF for you, the aim should be to have at least $200,000 in super, so that it equates to no more than what you would pay a regular retail fund for management fees (around 1% of the balance).

Want more information? Click here for expert advice on SMSF and property.