A buyer’s agent can help you secure a better property, a better price, or both, provided you engage the right one. But before you do, we ask the experts which is the better investment: using a buyer’s agent, or getting a property education? Sarah Megginson reports

In days gone past, buyers’ agents were something of a rare breed, with only a handful in each city catering to a cashed-up, time-poor executive clientele.

Today it’s a burgeoning industry, with everyday homeowners, mum and dad investors and luxury buyers alike increasingly seeing the value in a buyer’s advocacy real estate service.

“The concept of using a buyer’s agent comes from the fact that most people only buy one or two properties in their life – their home and one investment. They don’t have the depth of experience of negotiating, researching and getting things right from only a few experiences, so that’s how buyers’ agents were able to start demonstrating their worth,” explains Michael Yardney, director of Metropole Property Strategists.

“Statistics show that most property investors fail – they want a level of financial independence, but we know that the majority never get past their first or second property. In fact, most of them sell in the first five years, which means they’ve obviously bought something that didn’t suit their needs.”

Using a buyer’s agent can help you get the ideal property for your situation, Yardney argues, but they won’t always save you money.

“Buyers’ agents don’t necessarily buy you cheaper properties, or save you their fee by negotiating you a better deal. Sometimes you don’t end up saving anything more than you would have without using an agent,” he says candidly.

“However, what you do is save the mistake of overpaying or buying the wrong property. Because you know if you buy the right property and it increases in value in line with your expectations, then the buyer’s agent’s fee is covered over and over again.”

Helen Collier-Kogtevs, managing director of Real Wealth Australia, counters that a better investment could be to use the money you would have spent on a buyer’s agent for your own financial education.

“When you look at your return on investment, spending $10,000 on educating yourself will pay dividends for years to come, and on multiple investments, whereas spending that on a buyer’s agent’s fee only generates an ROI for that particular investment,” she points out.

“If you are time-poor and wish to make a smart investment, and genuinely don't have the time or interest in sourcing your own investment, then by all means pay for a buyer’s agent. Otherwise, educating yourself so you can make your own smart, calculated decisions is the better way to go.”

“As a very general guide, buyers’ agents’ full-service fees work out to be 1.5–3% plus GST of the purchase price,” reports the Real Estate Buyers’ Agents Association of Australia. “This is similar to what most selling agents charge for selling a property. However, some buyers’ agents will negotiate a set or fixed fee in advance, depending on price brackets, degree of difficulty and other search criteria.”

Eliminates emotion

When buying property, whether it’s your own home or an investment, “people get emotional”, Yardney says. “It’s normal and it’s human, but it can also be costly. The buyer’s agent is there to represent you and to stop you becoming emotional about a property and overpaying.”

Helps cut through selling agent ‘spin’

Selling agents are occasionally accused of failing to reveal the full story to everyday property buyers, leaving out details here and there that could potentially taint a sale. When they’re dealing with a professional buyer’s agent, however, there’s a good chance they could wind up working together down the track, so they may be more forthcoming with information as a professional courtesy.

Strong negotiating skills

“They usually have good negotiation skills and are very familiar with intrinsic market value, which will help you to be sure you don’t pay too much,” explains Margaret Lomas, director of Destiny Financial Solutions.

Access to wholesale deals

Wholesale investment opportunities exist when a buyer’s agent introduces clients to a particular development and the developer waives the sales commission as a result. For example, a $500,000 property might usually include a $30,000 sales commission, which reduces the cost to $470,000. Even when a 1–2% buyer’s agent fee is factored in, the investor is still ahead of the game financially.

Access to off-market opportunities

A well-connected buyer’s agent will have access to properties before they’re listed on the open market, and even some deals that are never intended to have the public trampling through open inspections every weekend. This can be hugely beneficial when you’re searching for properties in a tightly held, rising market.

Leverage your dollar further

One way or another, you’ll pay, says Yardney. “You’ll either pay by the market, through overpaying, procrastinating, or making a bad decision, or you’ll pay the agent up front for their expertise, and they’ll save you from making these mistakes,” he says. “To me, it’s a form of insurance.”

Using a buyer’s agent vs going DIY

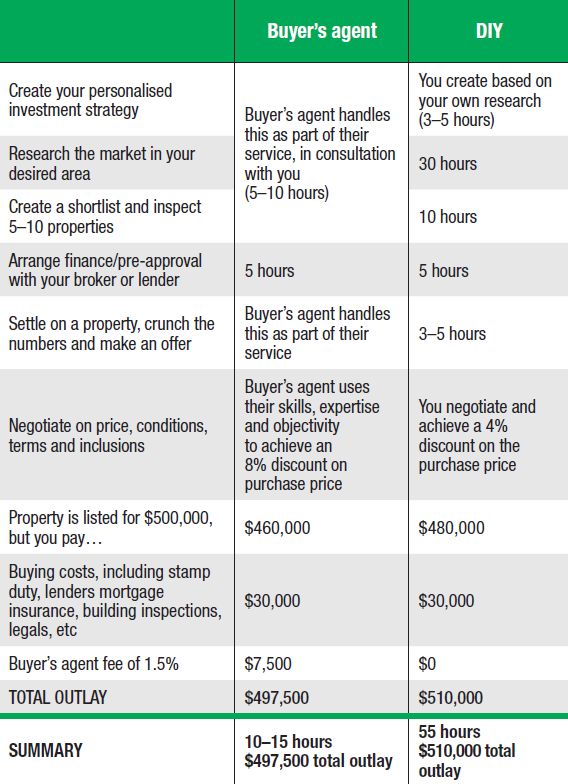

Using a buyer’s agent may not always save you money, but it will definitely save you time. It allows you to leverage someone else’s experience to your advantage, and may often save you from making a costly mistake. Here’s a breakdown of how a property purchase scenario could play out, with and without a buyer’s agent; your investment of time is represented in estimated hours:

Buyer's agent vs. DIY (Click image to enlarge)

When buyers’ agents don’t work

It’s important for investors to note that simply engaging the services of a buyer’s agent isn’t enough to guarantee you’ll find a profitable investment.

Even more important is your ability to be crystal clear about what you’re aiming to achieve, whether it’s gaining capital growth, renovating to add value, or adding a high cash flow deal to your portfolio.

Once you know what you want, a buyer’s agent can help you track it down, but that doesn’t abdicate you from the responsibility of doing your own due diligence to ensure the investment stacks up.

After all, if you were to buy a second-hand car and ask for your mechanic’s professional opinion, you would take their feedback on board. But you wouldn’t necessarily then buy that particular car sight unseen, without doing your own test drive and making sure it suits your needs.

“As well as knowing how to research, you need to acquire skills in negotiation, tax structuring, property selection, financing and much more,” says Lomas.

“A buyer’s agent can help you to do this. However, every time you want to buy another property you have to pay one again, and building a large portfolio could become expensive.”

You also need to carry out the same due diligence “as if it was your own deal that you found yourself”, says Simon Buckingham from Results Mentoring, adding that you should “never rely on a buyer’s agent or real estate agent to say a deal is a good deal”.

Yardney has just begun working with an investor who learnt this lesson the hard way.

“I recently received a phone call from an orthopaedic surgeon who earns $400,000 a year. He wanted to buy a property in Melbourne and he wanted to see if I could help,” he explains.

“I asked him if he owned any property and he explained that he had two investments: a house in a regional town in NSW and a mining town investment in Queensland. He’d bought both properties through a buyer’s agent. They were both positively geared, but they’ve also performed poorly when it comes to capital growth.”

Yardney asked the investor why he’d agreed to invest in those areas, and he replied, “Because the buyer’s agent advised me to.”

He was clearly a man unsure of his goals, and as a result he’d ended up with two investments that were not only performing poorly but were completely unsuitable for his needs. As a high-earning surgeon, this investor already pays around $150,000 per year in tax, at the highest tax rate of almost 50%. So why would he then invest in a positively geared investment that forced him to pay more tax?

“It didn’t add up. Here was a guy already earning $400k, so adding an extra $50 per week in positive cash flow to that income doesn’t really do anything to improve quality of life. What does it do then? It means he has to pay more tax!” Yardney says.

“I asked him, ‘Did they ask you what your goals are?’ and he said they hadn’t asked him anything beyond how much he wanted to spend.”

This predicament goes to prove that simply using a buyer’s agent “isn’t enough”, Yardney adds.

“There are a lot of people out there who call themselves buyers’ agents, when they’re actually selling agents who work for buyers as well, or reps of marketing organisations and developers,” he says.

“Others still are just not very good at what they do, which is why it’s important to qualify your buyer’s agent, just as you would any other expert you work with.

Using a buyer’s agent vs getting an education: which is best?

“Your property education is the number one investment you should be making, well before you even look at buying a property or engaging an agent. Lasting property success is about more than just finding one good deal. You need to educate yourself on all the ins and outs of property investing, which doesn’t end when you purchase a property. What about property management, insurance and tax planning? These are all important elements of investing, and if you don’t know what you’re getting into, you could make some costly mistakes.”

“Your property education is the number one investment you should be making, well before you even look at buying a property or engaging an agent. Lasting property success is about more than just finding one good deal. You need to educate yourself on all the ins and outs of property investing, which doesn’t end when you purchase a property. What about property management, insurance and tax planning? These are all important elements of investing, and if you don’t know what you’re getting into, you could make some costly mistakes.”

(Click to enlarge)

“If an agent has been buying and selling real estate for 10 years in one particular area, and they know what sells, what doesn’t and which properties are popular, that’s perspective – and that’s what you should be paying for. By leveraging their perspective and their years of experience, you can find out things such as which side of the street is worth 15% more than the other side because it’s got better views; or that one end of the street is closer to the highway and is therefore less valuable. The macro bit is easy; it’s the micro bit that is hard to master. And you can’t get that through monitoring properties or getting an education.”

“If an agent has been buying and selling real estate for 10 years in one particular area, and they know what sells, what doesn’t and which properties are popular, that’s perspective – and that’s what you should be paying for. By leveraging their perspective and their years of experience, you can find out things such as which side of the street is worth 15% more than the other side because it’s got better views; or that one end of the street is closer to the highway and is therefore less valuable. The macro bit is easy; it’s the micro bit that is hard to master. And you can’t get that through monitoring properties or getting an education.”

“I have always been a strong advocate of good-quality education. I’m not talking about seminars or courses offered by people who ultimately want to sell you a property, or make an introduction to someone who does. I mean courses that are truly independent, where there are no property transactions or potential transactions involved. Getting this education is a one-off cost that will then equip you for a lifetime of successful investing and help you to avoid the spruikers and sharks.”

“I have always been a strong advocate of good-quality education. I’m not talking about seminars or courses offered by people who ultimately want to sell you a property, or make an introduction to someone who does. I mean courses that are truly independent, where there are no property transactions or potential transactions involved. Getting this education is a one-off cost that will then equip you for a lifetime of successful investing and help you to avoid the spruikers and sharks.”