29/06/2018

One of the most common questions we field from investors at the moment is a simple one: Where should we buy next?

Anyone who has invested in Sydney in the last few years is likely to be fortunate enough to have a decent pile of equity behind them, which is usually attached to a burning desire to put it to good use in their next property play.

Meanwhile, those who didn’t profit from the Harbour City’s price boom are itching to make up for lost time by investing in Australia’s next growth market well before the rest of the pack.

So we’ve done an epic amount of due diligence to help you make smart, informed property decisions going forward.

It all began with one question: If you had enough cash to buy $1m worth of real estate, how would you spend it? And at the root of this is the real question we all want answered, which is: Where will we get the best return?

In the current fractured Australian property market, where we have access to extremely low interest rates and at the same time extremely expensive property markets, which areas are set to deliver the biggest bang for your buck, and which suburbs should be avoided at all costs?

Simon Pressley, head of market research at Propertyology, believes too many investors are still caught up in the idea that our unaffordable capital city markets are the only way to go. “Unfortunately, many people would opt to buy just one property [with $1m to invest with]. And if they lived in Sydney they’d probably invest there because they believe the Harbour City will always be the golden goose, but I disagree,” he says.

An investor who has $200,000 as a deposit, either through cash or equity, could conceivably buy property worth $1m while maintaining a healthy 80% loanto- value position. Pressley’s advice is to think like a sophisticated share investor and diversify. “With any property investment, research into the fundamentals and growth drivers of a location is vital, whether you’re buying one or three properties. But investment strategy is different,” he says.

“If a share investor had $200,000 and worked in a bank, do you think they would invest all of their money into that one particular bank stock? Of course not, because that would be putting all of their eggs in one basket. If something adverse happened to that bank or to the financial sector as a whole, 100% of their capital would be exposed to the resultant poor performance.

I apply similar principles to that astute share investor, which means we don’t invest all of our capital in one asset or in one community.”

Lesson one therefore equals: diversify your investment across several different areas to “take advantage of multiple opportunities and to provide a degree of protection from future downturns”. But where should you actually invest that money? Read on for our extensive market update.

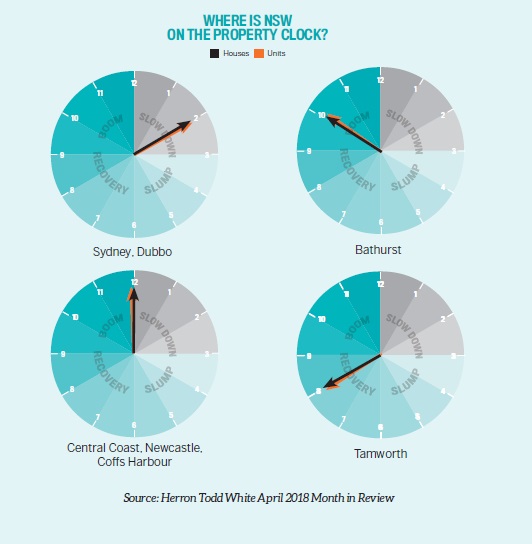

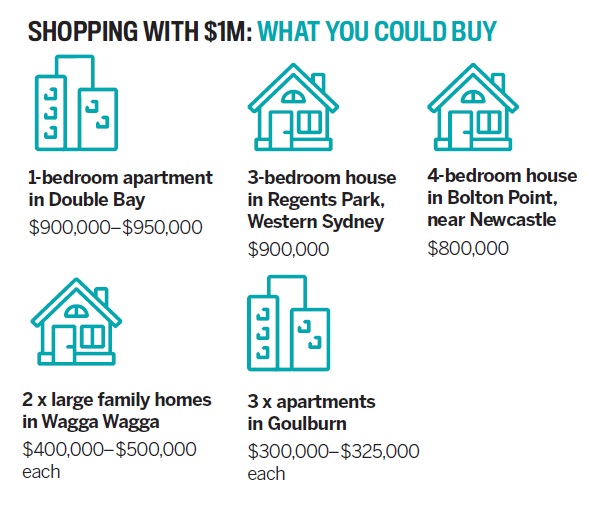

What $1m buys in NSW

Sydney has long been regarded as the most expensive city in Australia, so if you’re looking for affordability, you won’t find it here. The most expensive suburbs have median prices of up to $3m–$5m, and there is typically a lot of competition, especially in or near the inner city.

Sydney has long been regarded as the most expensive city in Australia, so if you’re looking for affordability, you won’t find it here. The most expensive suburbs have median prices of up to $3m–$5m, and there is typically a lot of competition, especially in or near the inner city.

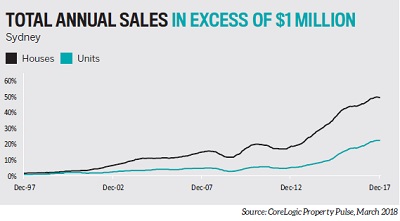

According CoreLogic’s Property Pulse media release, Sydney recorded the highest proportion of sales of at least $1m in Australia last year, with nearly 50% of houses and 22% of units selling for seven figures or more.

However, with property prices starting to track backwards in this city due to factors such as lending restrictions and subdued demand, many buyers are holding out hope that they will become more affordable.

“When the restrictions come into force a little more, the numbers will start to correct and slow down and plateau out. I don’t necessarily think they’re going to go backwards by any means, but it’s going to slow the market a little,” says Damien Lee, head of acquisitions at Caifu Property. In the meantime, regional areas have been picking up the slack. These pockets offer properties at considerably lower prices, and improved infrastructure provides residents with amenities and increased accessibility.

In the inner city, options would be limited if you were looking to buy at $1m. For instance, in the suburb of Double Bay 4km from the Sydney CBD, a one-bedroom apartment alone could set you back over $900k. On the other hand, the same amount could get you a four-bedroom house in Bolton Point, around 100km away.

“While $1m would buy you a standard suburban house in Sydney’s outer suburbs, your money would be better spent buying an ‘investment grade’ apartment in one of Sydney’s inner-ring suburbs,” suggests Dona James-Wells of Metropole Property Strategists.

- Around half of Sydney’s freestanding homes are worth seven figures.

- In 2012, roughly one in five Sydney homes were sold for $1m plus.

- By 2017, 49.3% of all houses sold were bought for at least $1m. This figure is up from 45.4% at the end of 2016 and 18.8% in 2012.

Source: CoreLogic Property Pulse, March 2018

BEST PROSPECTS FOR FUTURE GROWTH

to fall behind due to fewer growth drivers”

– Dona James-Wells, Metropole Property Strategists

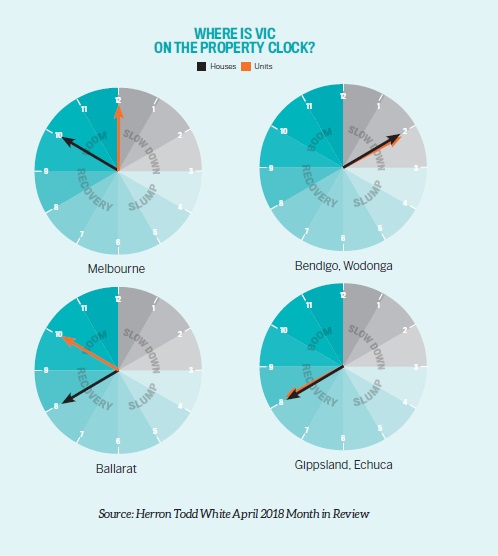

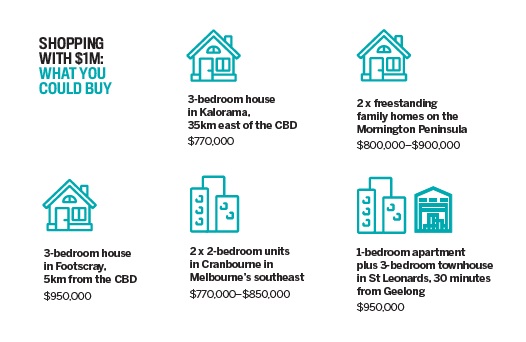

What $1m buys in VIC

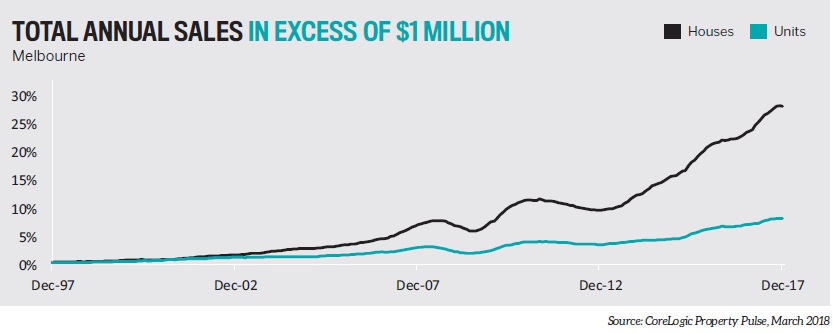

Melbourne has seen the number of properties in the city valued at $1m rise steadily in the past few years. According to CoreLogic’s Property Pulse report, over a quarter of all houses purchased were worth seven figures, while 8.3% of units sold hit $1m or more.

Melbourne has seen the number of properties in the city valued at $1m rise steadily in the past few years. According to CoreLogic’s Property Pulse report, over a quarter of all houses purchased were worth seven figures, while 8.3% of units sold hit $1m or more.

Generally neck and neck with Sydney in terms of growth and popularity, Melbourne is holding up much better than its peer in the face of downturns, which have been a result of investors pulling out following loan restrictions.

Suburbs outside of the city have benefited from buyers who were priced out of the Melbourne CBD, as pockets in the outer east have become quite attractive. The Mornington Peninsula has seen much growth, as have the west and northwest of Melbourne.

CoreLogic’s Pain and Gain report notes that in the December 2017 quarter units showed greater capital gain overall than houses did, which could inform the direction of the property market in the near future. “The big apartment projects in and around the CBD are coming through at a much slower pace, so vacancy rates will tighten further,” says Matthew Lewison, director of OpenCorp.

A big factor contributing to continued demand is Melbourne’s population growth. This helps the city sustain a consistent pattern of growth in the property market. “The Melbourne market does not usually achieve the same dizzying highs of year-on-year growth in the high teens.

Instead, it generally sustains more moderate growth for a period of three to four years then drops to low single-digit growth for the next two to three years, before picking up again,” Lewison explains. Thus, unlike in Sydney, $1m can stretch a little further.

It might get you a three-bedroom house in Footscray, just 5km from the Melbourne CBD, with change left over. For about the same amount, you can get both an apartment and a townhouse in the coastal suburb of St Leonards, 33km from Geelong.

- Almost 30% of houses sold in Melbourne in 2017 were worth at least $1m.

- This represents an increase of about 5% on the 2016 figure.

- The percentage of units sold for more than $1m in 2017 was 8.3%.

- In 2012, the percentage of seven-figure unit sales was just 3.5%.

Source: CoreLogic Property Pulse, March 2018

BEST PROSPECTS FOR FUTURE GROWTH

BEST PROSPECTS FOR FUTURE GROWTH

“There’s going to be more focus on more affordable corridors based on what town planning schemes actually deliver – your middle- to outer-ring suburbs of Melbourne. It’s going to get busier, but you will still see growth prospects in these areas”

-Damien Lee, head of acquisitions at Caifu Property

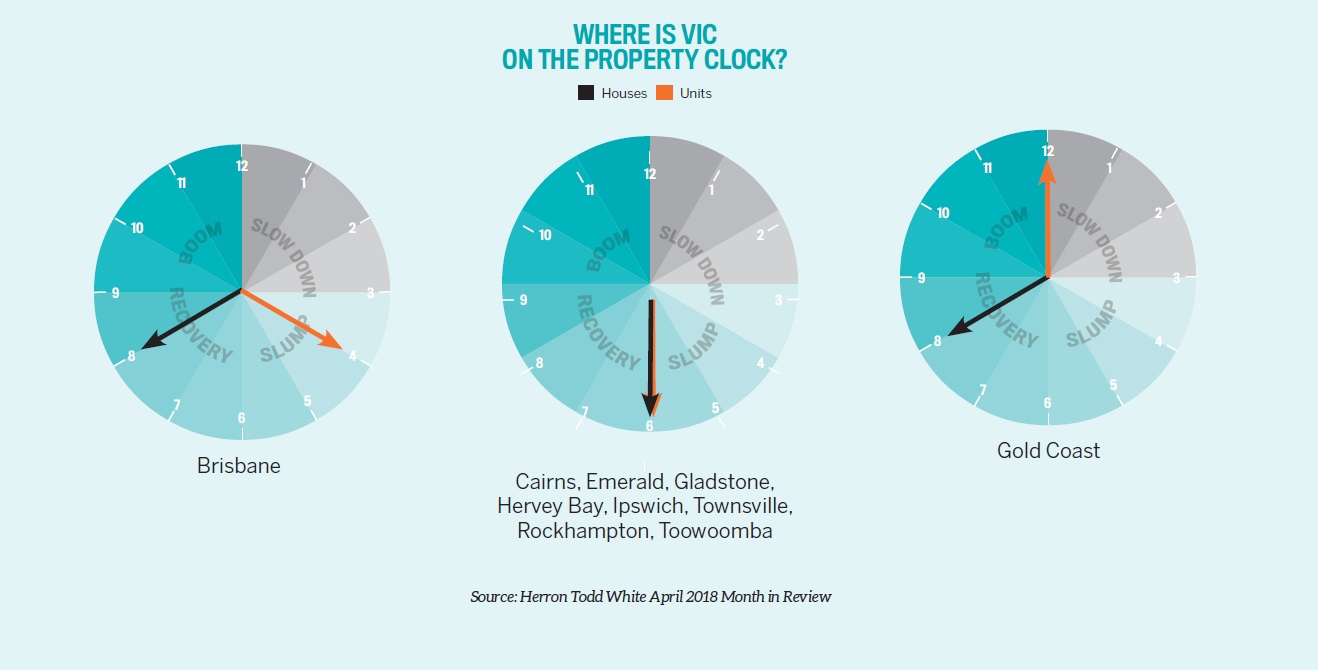

What $1m buys in QLD

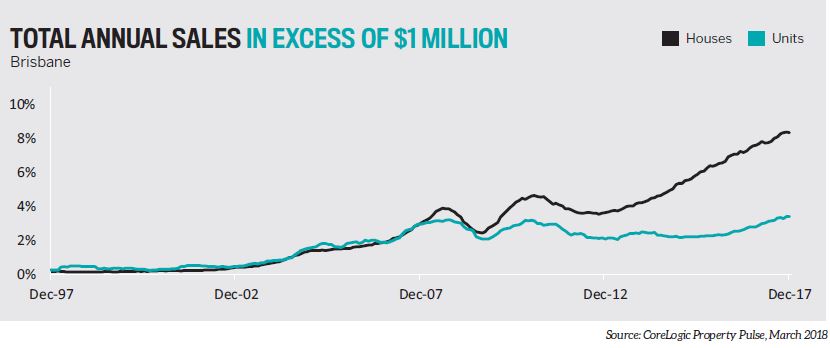

Though Brisbane isn’t making headlines as a bold, booming growth market, it does continue to record moderate price increases, leading to more and more properties selling above the magic $1m mark

Although value growth has been fairly moderate in Brisbane over recent years, the share of $1m sales has continued to climb,” says CoreLogic analyst Cameron Kusher.

“Throughout 2017, 8.3% of all houses and 3.4% of all units sold transacted for at least $1m. A year earlier, 7.5% of all houses and 2.8% of all units sold for at least $1m and five years earlier just 3.6% and 2.1% of houses and units sold for at least $1m.” Within the next couple of years, CoreLogic predicts that one in 10 houses will sell for seven figures or more in the Queensland capital.

This is a great sign of Brisbane’s potential in the near future, especially with dim short-term growth prospects in Sydney and Melbourne. This positive performance is not just limited to Brisbane. The regions of Southeast Queensland are going strong, especially the Sunshine Coast.

“Most of the migration I suspect is moving into Southeast Queensland, so Gold Coast and Sunshine Coast rather than Brisbane,” says Angie Zigomanis, senior manager of residential property at BIS Oxford Economics.

“That’s pointing to more of a softness in the Brisbane market compared to Gold Coast and Sunshine Coast. People are going to live in those areas and not necessarily have the need for an apartment like they would in Brisbane.”

In Brisbane, about $900,000 will get you two units in Albion, situated 6km from the CBD. On the flip side, $1m could buy you a two-bedroom apartment as well as a two-bedroom duplex in Minyama on the Sunshine Coast. For around $700,000 you could get a modern family house in Currumbin Waters on the Gold Coast, which would have a steady stream of tenants lining up to move in.

- Houses valued at $1m plus rose from 7.5% in 2016 to 8.3% in 2017.

- The percentage of units that sold above $1m was just 2.1% in 2012.

- This increased to 3.4% in 2017.

- Strong growth was recorded in the 2012–16 period, when the percentage for $1m-plus houses increased from 3.6% to 7.5%.

Source: CoreLogic Property Pulse, March 2018

BEST PROSPECTS FOR FUTURE GROWTH

BEST PROSPECTS FOR FUTURE GROWTH

“Our focus remains on Brisbane, as it is the jobs centre of Southeast Queensland, and it is now starting to look more attractive than the coastal markets from an affordability perspective” – Matthew Lewison, director of OpenCorp

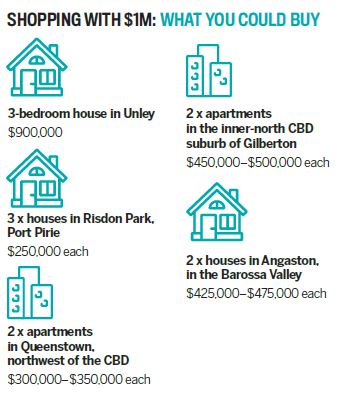

What $1m buys in SA

.jpg) Adelaide generally flies under the radar in the national property market, but its time could soon come. Although property prices went up by only 2.2% in 2017, CoreLogic reports that stock valued at a minimum of $1m is on the rise

Adelaide generally flies under the radar in the national property market, but its time could soon come. Although property prices went up by only 2.2% in 2017, CoreLogic reports that stock valued at a minimum of $1m is on the rise

“Over the past year, there were more Adelaide houses sold for at least $1m than there were sold for less than $200,000,” says CoreLogic in its Property Pulse report. Growth in this market has generally been steady, typically in low to mid-single-digit increments.

While Adelaide has traditionally struggled economically, especially in the job market as several manufacturers have pulled out of the city in recent years, new projects coming in could certainly help boost the city’s economic profile.

“The population worry about Adelaide is the job security. Over the last couple of years it’s lost a few big manufacturing plants, such as Holden,” says Damien Lee from Caifu Property. Nonetheless, infrastructure projects are happening, such as transport-related upgrades and new facilities like the hospital.

The incoming submarine project could also give a lot of support to the economy by providing long-elusive employment opportunities. With the worst of Adelaide’s population outflow considered to have passed already, the creation of these jobs could alleviate further brain drain.

In terms of value for money from an investment perspective, buyers can stretch their money much further in Adelaide than in the eastern capital cities. A three-bedroom house just 2km from the Adelaide CBD can be found for around the $900,000 mark. With $1m to spend, searching in the regional suburb of Risdon Park could yield you three houses with some change.

Approximately 10km northwest of Adelaide, you could buy a couple of apartments in the suburb of Queenstown for about $600,000. In other words, those investors with a long-term outlook may be able to secure good-value, affordably priced properties while the market is still at 8 on the property clock.

BEST PROSPECTS FOR FUTURE GROWTH

“I’m identifying Adelaide as the next market to go based on Sydney/Melbourne/Brisbane’s slowdown. I think Adelaide will pick up the most based on the sound base that it already has underriding it” – Damien Lee, head of acquisitions at Caifu Property

“I’m identifying Adelaide as the next market to go based on Sydney/Melbourne/Brisbane’s slowdown. I think Adelaide will pick up the most based on the sound base that it already has underriding it” – Damien Lee, head of acquisitions at Caifu Property

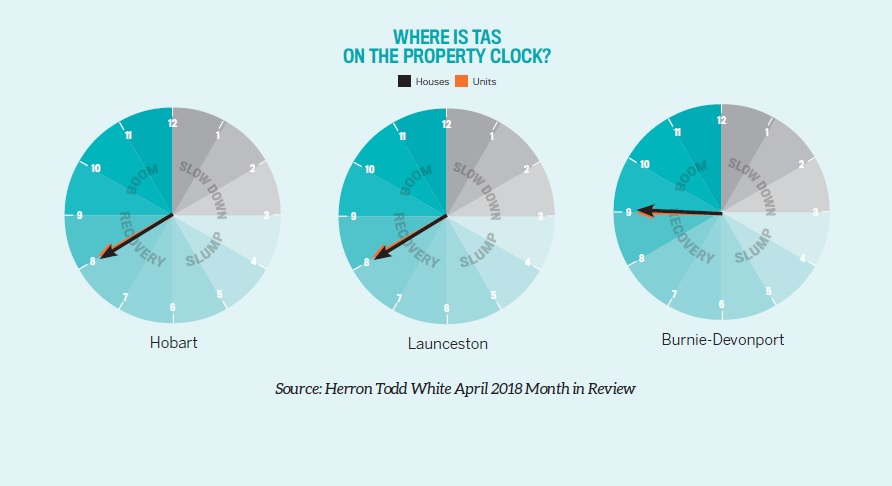

What $1m buys in TAS

Hobart is among the top prospects in the national property market, but given its status as the most affordable capital city in the country, that means very few dwellings actually sell for a minimum of $1m

Hobart is among the top prospects in the national property market, but given its status as the most affordable capital city in the country, that means very few dwellings actually sell for a minimum of $1m

If you would expect $1m to stretch further in Tasmania than on the mainland, you’d be right. Even though pockets of this state have surged in value recently, it remains one of the most affordable in the country.

For instance, the premium suburb of Sandy Bay, just south of the Hobart CBD, offers apartments priced at about $450,000. Further north in Latrobe, you could get a whopping three houses for $1m. The percentage of houses sold for $1m or more was just 2.8% in 2017, an increase of 0.5% on the previous year. The percentage of units, however, dropped from 1.3% in 2012 to 0.9% five years later.

“Not that long ago, the state of Tasmania was in recession – the state’s capital is today the runaway leading property market in all of Australia,” says Simon Pressley, managing director of Propertyology.

“The base-level ingredient for demand of any commodity, including shelter, is ‘affordability’. We now know Hobart is going gangbusters. I paid $280,000 for a three-bedrooom house [there] in mid 2014 … it has already increased in value by 30% and is growing, and the rental yield is far superior to any other capital city.”

Hobart certainly has affordability on its side, but it is also a much smaller market than its capital city neighbours to the north. At the 2016 census, there were around 222,000 people in the Greater Hobart area, with a population of around 50,000 in the city.

It’s important to remember that Hobart’s property market has languished for many years prior to this recent boom, so buying here may only suit those with a strategy of holding for the long term.

BEST PROSPECTS FOR FUTURE GROWTH

“Some of the demand will start spilling over into Launceston and eventually into other parts of Tasmania as well. I think there’s still more upside in Hobart – it’s still affordable to people coming in from the mainland, and that’s set to drive prices up”

“Some of the demand will start spilling over into Launceston and eventually into other parts of Tasmania as well. I think there’s still more upside in Hobart – it’s still affordable to people coming in from the mainland, and that’s set to drive prices up”

– Angie Zigomanis, senior manager at BIS Oxford Economics

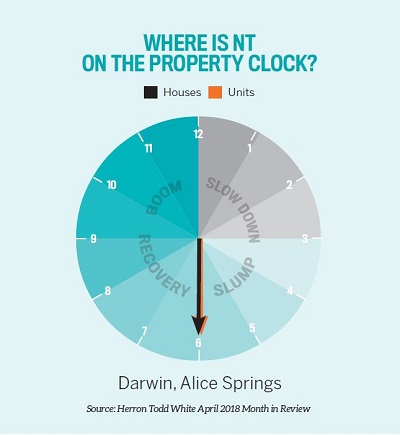

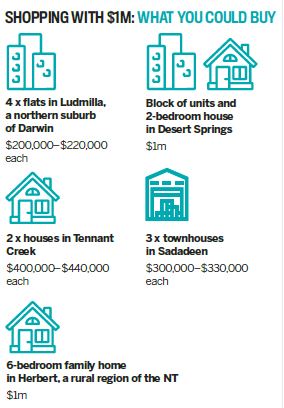

What $1m buys in NT

They've had three consecutive years of falling retail trade, there’s no new investment in major projects and infrastructure, there’s no apparent plan, and no one seems to care,” says Propertyology managing director Simon Pressley.

Compared to Darwin’s peak prices years ago, property prices in the NT capital city were down by over 20% as of February 2018. It follows that the percentage of dwellings sold for at least $1m fell as well – from 4.1% a year previously to 3.1% in the 12 months to February 2018. In 2017, sales of $1m units decreased to 1.3% from 2.3% in 2016.

For $1m, a buyer has lots of options in this market. Four flats in Ludmilla in the inner north of Darwin, for instance, will give you change from $1m. Sadadeen, a reasonably consistent performer in the NT, can offer three townhouses for around the same price.

BEST PROSPECTS FOR FUTURE GROWTH

BEST PROSPECTS FOR FUTURE GROWTH

“I don’t see the need for exponential housing growth in Darwin. The population is permanent, but it’s not full-time – it transitions on a three- to five-year period based on what contracts are going in and out”

–Damien Lee, head of acquisitions at Caifu Property

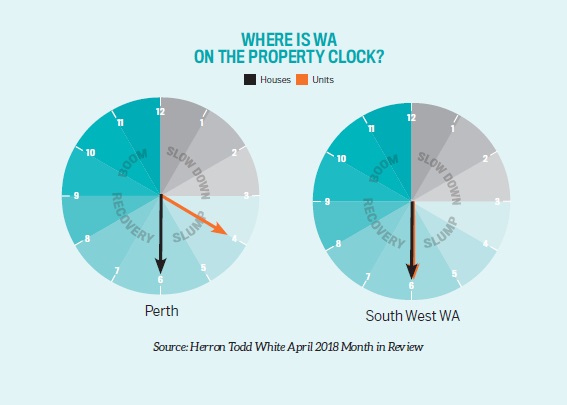

What $1m buys in WA

For the past four years, Perth has experienced only decline, as seen in decreasing property prices and a lower share of sales above $1m

For the past four years, Perth has experienced only decline, as seen in decreasing property prices and a lower share of sales above $1m

The percentage of units in Perth selling for $1m plus fell from 4.5% of the market to 3.2% in the 12 months to Febuary 2018. However, for houses the drop was less significant, with their share of seven-figure sales only falling from 10.4% to 10.3%.

Some experts believe that the Perth property market has already hit the bottom, whereas others think the city still has a year or so of decline to get through. “WA is the ‘wild west’. At the moment, it’s correcting itself quite hard, but I definitely see more opportunity coming back over the next 10 years,” says Damien Lee from Caifu Property.

For now, investors can take advantage of the affordability in the area – for instance, around $800,000 can already buy you two apartments in the Perth CBD or two houses in the suburb of Banksia Grove, about 27k north of the city.

BEST PROSPECTS FOR FUTURE GROWTH

BEST PROSPECTS FOR FUTURE GROWTH

“Don’t expect significant growth this time around, as the unwinding interest rate cycle will keep a lid on price growth in the middle and upper markets as the market recovers, but do keep your eye on this market this year”

– Matthew Lewison, director of OpenCorp

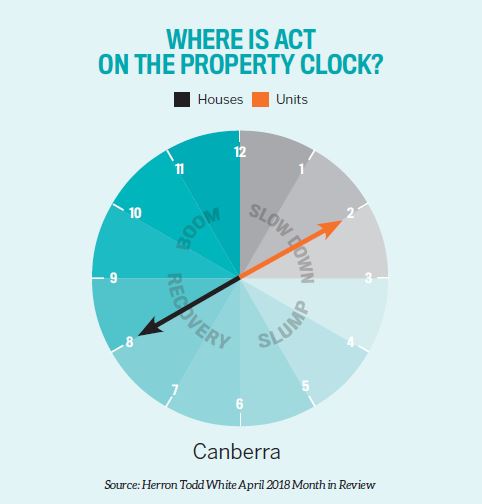

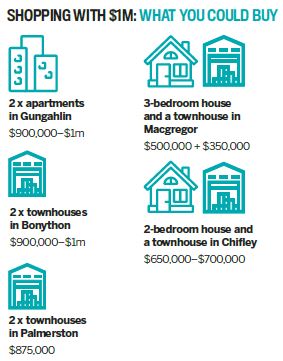

What $1m buys in ACT

One of Australia’s best-performing markets in 2018, the ACT is delivering the goods – but while houses are heating up, units are slowing down

Canberra saw its property values as a whole rise by 3.2% in the 12 months to February 2018. As a result, the share of sales of houses worth $1m or more has increased to 12.6% – up from 10.4% a year earlier and 4.8% five years ago. Canberra is a strong market with plenty of potential, but there is evidence that investors should act with caution, says Damien Lee, head of acquisitions at Caifu Property.

“I like Canberra overall, but I see it as more for the astute investor, someone that knows when to buy and when to sell. I don’t see Canberra as a long-term hold, because you play that marketplace with whoever’s in power,” he says.

For now, those with $1m to spend can go far – it can get you two apartments in the bustling Gungahlin district. The question is, should investors be buying units at all in this market, when that segment is tipped to slow down as the year progresses? The experts tend to agree that houses are a better play.

BEST PROSPECTS FOR FUTURE GROWTH

BEST PROSPECTS FOR FUTURE GROWTH

“Buyer activity for houses is still encouraging, and properties are selling quicker now than a year ago, with some of the activity coming from Sydney investors”

– Simon Pressley, Propertyology

This article was in the June 2018 edition of Your Investment Property magazine. The stats were compiled by CoreLogic and Kevin Turner caught up with Cameron Kusher from CoreLogic to discuss the results.

You can listen to the interview here:-

With thanks to

– the only place where you hear all Australasia’s leading property experts.