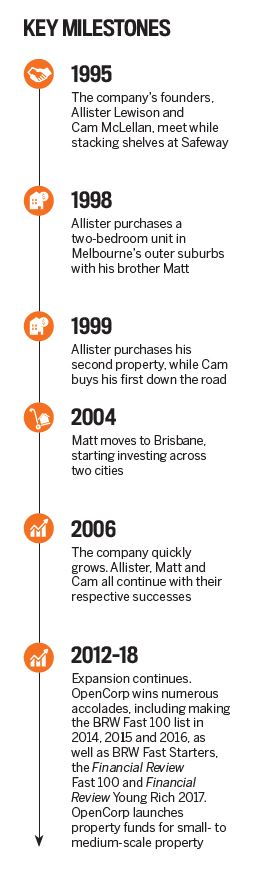

SINCE 2006, OpenCorp has been helping investors expand their portfolios and build wealth in the process. Your Investment Property sat down with OpenCorp directors Cam McLellan, Allister Lewison and Michael Beresf0rd to discuss the future of the Australian property market.

Left to right: Allister Lewison, Michael Beresf0rd, Cam McLellan

YIP: Do you think we’ll see big changes in the market in general, now that the election is over?

Michael: No, not really. Investment is a long game, and supply and demand are its key drivers. Factors like interest rates, inflation, job growth, wage growth and property growth are all just points of leverage around supply and demand – sometimes they move in sync, sometimes not. You just need to be prepared to weather the changes as they occur.

"Through a process of elimination, the deal of a lifetime can be found every day of the week – if you know how to find it."

YIP: You all made your start in investing around 20 years ago. But obviously there are different challenges in the market today, so how should newer investors approach things in 2019?

Allister: This has come about because the government has deliberately worked to decentralise capital city CBDs. It’s somewhat similar to how we see cities organised in, say, England. There are good, practical reasons for it. The decentralised approach reduces pressure on public transport and facilities while also allowing for new services to be provided in traditionally neglected areas. However, from a property investment standpoint it can make things trickier.

Cam: You’ve got to take a much more nuanced view now. Accordingly, one of the things we outline with clients is the developer’s activity chain. We teach them how to identify when the danger time is; when not to invest in property. We also look at the future of supply and demand within a given area so they can continually make smart investment choices. Through a process of elimination, the deal of a lifetime can be found every day of the week – if you know how to find it.

“Interest rates, inflation, job growth, wage growth and property growth are all just points of leverage around supply and demand”

Michael: At face value, it’s an understandable concern, but if you take a closer look it seems much less likely. Over the last 30-odd years we’ve seen the removal and return of negative gearing, the ‘recession we had to have’, the 1997 Asian financial crisis, September 11 and the GFC. I’m not saying that property prices will go up every day or year, but if there was a major market crash it probably would have occurred around those events, as opposed to interest rates going up or down a quarter of a per cent.

YIP: If you had a crystal ball, what would you predict over the next two to three years for property markets in the capitals around Australia?

Allister: We’re currently working through an artificial correction in numerous markets around the country and seeing property values take a bit of a dip. There’s been increased demand for the last few years, but the correction isn’t occurring due to oversupply; it’s largely because of the constraints that have been placed on borrowers. However, this will probably loosen up soon, as APRA is in the process of providing lending policy updates. This should make it easier for banks and other lenders to provide credit to people who need it.

Cam: All property markets are cyclic, too. Once you’ve got the right tools it’s easy to know when a market has peaked out or is beginning to move upwards again.

Michael: What people are currently paying in interest isn’t important; it’s how they’re being assessed by the lenders, which is always at a higher rate than the loan itself. Theoretically, we should see more buyers coming into the market and consumer confidence growing in the next few years.

Allister: Overall, I’d say it’s a great time to buy at the moment.

To find out more about how OpenCorp can help you safely invest in property to grow your wealth for a financially free retirement, visit www.opencorp.com.au

.JPG)