Are you currently holding an inferior property in your portfolio?

Our property markets have reached amazing highs over the last year and many investors have reaped the rewards.

While that is certainly great news, it has potentially covered up many mistakes’ that investors could have made without even knowing.

The old saying “A Rising Tide Lifts all Ships”, may well have applied to our property markets throughout 2021.

Everyone looks like a professional as rising property values superficially makes it looks like they got it right.

But the consensus is that our property markets will slow throughout 2022, with many predicting a downturn in 2023.

This means it may be the time you look to offload any underperforming assets before it is too late.

Here are my thoughts….

How do I know if my property is inferior?

Is your investment property considered “investment grade”?

While that may be a broad term, you want to hold an asset in your portfolio that will outperform the averages and deliver wealth producing rates of return.

Therefore, perhaps the simplest measurement would be to compare your property’s performance against the average, over the time you have held it.

Prior to the recent boom, we audited several our client’s properties here in Brisbane to find they had consistently outperformed the Brisbane average by at least an additional 2% per annum.

That may not sound like a lot but compounding over a decade at the average house price of $700,000, you could end up with an additional $300,000.

So, my first advice is to do the math!

If your property does not stack up and outperform the market, it may be time to consider an exit strategy.

Digging Deeper

If you are still in two minds about your investment property, you may want to dig a little deeper.

We start with a Top-Down approach, as the Location will be most important factor and will do 80% of the heavy lifting of your property’s performance.

You can read here to understand the approach Metropole take to find an investment grade property.

In short, we stick to the inner to middle ring suburbs of our bigger capital cities.

Areas where there is a huge amount of demand and very little supply and areas that are known, proven and trusted.

We look for a higher income earning demographic and favour a high land to asset ratio.

Then we get down to street level where it can be a little easier to spot an inferior property.

We would rule out:

- Buying off the plan

- Purchasing in larger apartment complexes

- Buying on, or backing onto busy roads

- Buying too close to a train line

- Properties with flood and storm water issues

If the location is not right and / or there are a few concerns with your property, it should raise a red flag.

You may be Running out of Time

As we turn the corner into 2022, what can we expect in year ahead?

Firstly, it became clear toward the end of last year, that our markets may have peaked.

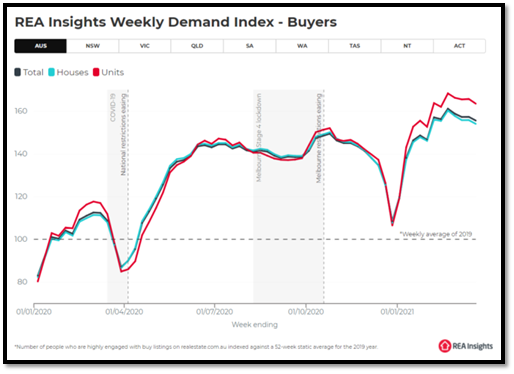

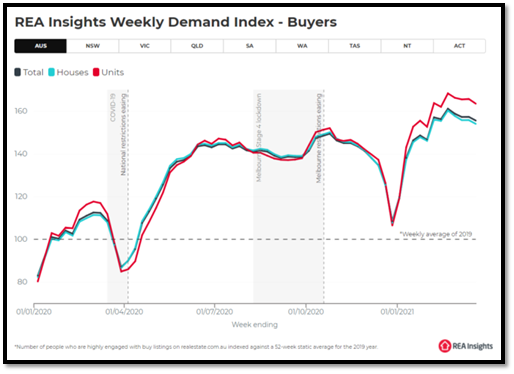

The REA Buyer Demand Index highlighted that demand around Australia had reached a peak and was trending downward.

In line with that, skyrocketing finance approvals also seemed to be following the same trend.

Another factor that will likely see demand easing further as the market is likely to be put in a temporary holding pattern when the upcoming Federal election is announced.

Historically people tend to put off making big decisions like buying property until after the outcome when there is greater certainty.

Also, you may also have noticed recently the media headlines, whipping us into a frenzy about rapidly rising interest rates.

At this stage there is not appetite to raise the cash rate from the Governor of the RBA, but that doesn’t mean the banks won’t raise rates independently.

Of course this will be another element that will add to further analysis paralysis for some property buyers and adversely affect demand levels.

Conclusion

If you have identified a property in your portfolio that is not going to give you superior rates of return, it may be an ideal time to move it on.

You don’t really want to own a secondary property when this property cycle comes to an end and we’ll experience a number of years of flatter or no growth.

So now may be the last opportunity to take advantage of a larger pool of buyers to offload your underperforming asset.

When the market does finally turn, any gains you have made could be easily lost, or potentially worse in a falling market.

If you would like to understand more about your portfolio and to prepare an exit strategy, why not let the team at Metropole assist you.

We have no properties to sell you and we can prepare an independent strategic plan to ensure you get it right.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.