The story of the three little pigs and their experience with property provides investors with valuable insights into how property booms occur and why they end.

Each of the three little pigs chose a different strategy, one building a house from straw, another from sticks and the third from bricks, but in the end, only the brick house was able to withstand the big bad wolf’s huffing and puffing.

Their experience closely resembles the three types of housing market booms, which are those created by investors, opportunity led booms, or those driven by genuine demand for more housing.

Investor booms are like houses built of straw

Like houses built from straw, investor created booms grow quickly, because investors don’t live in the properties they buy or sell. Their only motive is profit, so price growth can be speedy and spectacular, but is also often speculative.

The boom continues as long as the number of investors wanting to buy is greater than those trying to sell.

When the number of investors deciding to take their profit and sell begins to outnumber those wanting to buy, the growth quickly ends. As disappointment turns to dismay the remaining owners may all try to sell at the same time and prices can often crash, just like houses made of straw.

Opportunity booms are like houses made from sticks

Opportunity led booms can occur whenever housing finance becomes cheaper or easier to obtain, giving potential buyers more borrowing capacity.

At such times, renters take the opportunity to buy their first home, and existing home owners decide to upgrade, with the rise in buyer demand causing prices to grow.

Such opportunity led booms continue until new affordability limits are reached and buyer demand slows down. But sometimes they can start to fall apart, like houses made from sticks. This occurs if unemployment grows, or interest rates rise because some recent buyers may decide to sell while others are forced to and prices come down again.

Population led booms are like houses built of bricks

The third type of property market boom occurs when the number of people wanting to live in a suburb or city suddenly rises and housing shortages occur. The cause could be high numbers of overseas or interstate migrants, or a local transport project such as a new or improved road or rail project which makes an area safer, quicker and easier to access and more attractive to live in.

This last type of property market boom takes time to build momentum, as migrants usually need to rent for several years before they can buy a home, while transport infrastructure projects also take years to finish. However, it is the only boom where demand is driven by something as solid as a brick house – more people.

What type of property market boom will occur next?

Population driven booms produce far more reliable results for investors than opportunity led or investor created booms, and there is every reason to believe that when our international borders are opened again, a population driven boom will start.

We will receive a huge influx of migrants seeking an escape from the pandemic ravaged cities of Europe, Asia, Africa and the Americas. To predict what this huge rise in population may do to our housing markets, we have only to look back to previous times after our international borders were reopened after years of closure.

This is not the first time our borders have been closed

We have experienced international border closures before – during the First and Second World Wars, because overseas travel was dangerous and migration came to a standstill for several years. When our borders were thrown open in 1919 and again in 1946 we experienced our highest population growth ever, as thousands of immigrants and refugees fled war torn countries to make a new start in Australia.

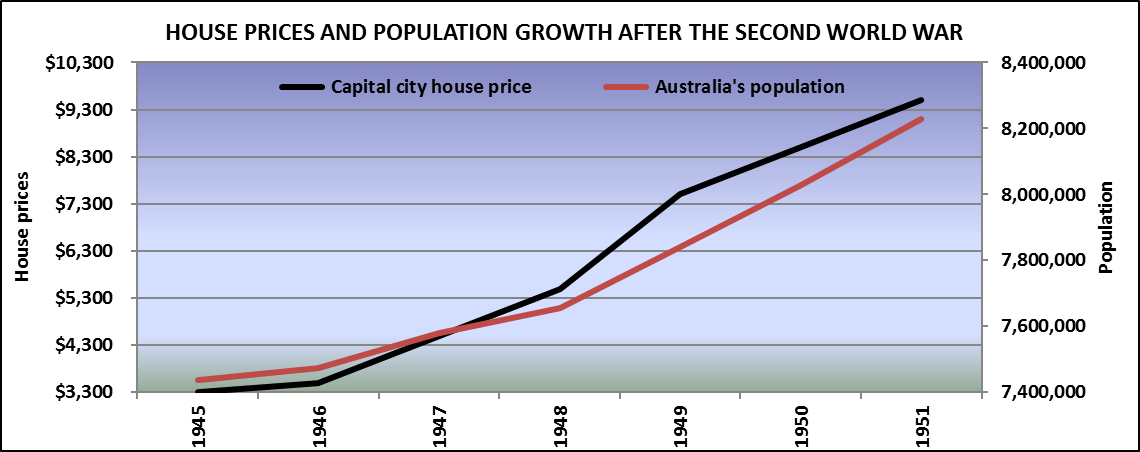

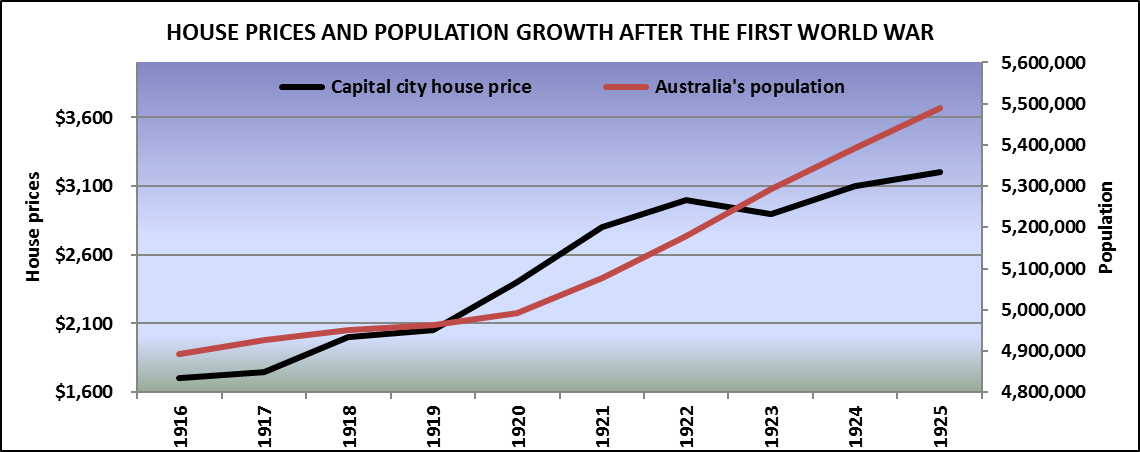

As the graphs show, this huge rise in housing demand caused housing prices to boom in just a few years.

Housing prices doubled and even trebled in the years after our borders were opened, and the similarities to our current situation are striking. Our international borders once again closed and huge numbers of potential immigrants are lining up, waiting to start a new life in a land that has weathered the COVID-19 storm much better than most.

How investors can secure the greatest benefits from the next boom

We can benefit from the forthcoming population driven boom by purchasing investment properties just before the borders reopen in areas where overseas arrivals are most likely to settle. These areas will experience high rental demand and as housing shortages develop and intensify, prices will rise as well.

In short, these areas will provide investors with the same security as the third little pig enjoyed when he built his house with solid and reliable bricks.

Sources:

Housing Australia, a Statistical Overview, ABS 1991, 1996, Australian Bureau of Statistics

Australian Demographic Statistics, 3101.0 Australian Bureau of Statistics.

Stapledon’s Index, Stapledon Nigel, Long Term Housing Prices in Australia

.................................................

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

Visit Lindeman Reports for more information.

He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts.

John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report.

John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

To read more articles by John Lindeman, click here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.