Is it time to put a regional town on your list of areas to consider investing in?

There is certainly a lot of hype in the media along with the usual property commentators who have a regional bias.

Many are suggesting investing in regional Australia because more of us are going to want to work from home, away from the big smoke.

So, will a regional town outperform a big capital city moving forward?

The problem is that this is an incorrect comparison – it is like comparing apples with oranges.

We have always said there is not one Brisbane or Melbourne property market.

A better comparison is will a regional town outperform a high performing suburb in a capital city.

Then it will become clear where the best long-term investment opportunities are.

Here are my thoughts.

Face Value

Many choose to look at the overall data when making decisions on where to invest.

Being a Queenslander, I will use the capital city of Brisbane and a regional town like the Gold Coast for my comparisons.

The Gold Coast is a much larger than the typical regional town, but the message will be the same, even for other smaller regions around the country.

Looking back over a full property cycle or two can give us a handle on what may lay ahead.

Capital Growth over the research period of 2008 – 2018 for Brisbane was 28.6%, while the Gold Coast registered 22.7%.

While it makes good headlines to aggregate the data, the broad-brush statements about our property markets hide the opportunities that sit below this superficial analysis.

The mean capital growth for a state or region really means nothing when you come down to how a particular property is likely to perform if you choose the right property, in the right location.

Stick to Fundamentals.

When selecting the right investment location, we take a top-down approach and then follow the fundamentals.

In short, Fundamental Analysis is the analyses of data that takes a decade or more to register significantly measurable change, as opposed to Technical Analysis that may change from month to month.

One of the key factors is to understand supply and demand factors on a macro scale.

For Demand we like to understand the population growth of an area.

Statistics during this period suggest that the population growth of Brisbane (1.193mil) was increasing at more than double what the Gold Coast (570,000) would see.

In regional locations, with the small population base, a small shift in interest in these markets (short-term) will make a big difference to perceived capital growth.

But will this be sustained?

I would suggest over the longer-term capital cities will always see significantly more population growth than regional towns.

People often ask me why we only have offices in Melbourne, Brisbane and Sydney and my answer is that 80% of people that move to Australia each year arrive at these ports.

We just don’t find the big trends!

When it comes to supply, it is important to understand the availability of land.

In the Brisbane council area, there is a very, very tight supply of land.

There is a level of scarcity and you cannot just create vacant parcels of land for new development of housing estates.

This is not so much the case in many regional towns as new estates with multiple stages are continually being released.

Land values are also significantly higher in our capital cities, with Land to Asset Ratio being another great metric you should consider.

I have explained previously why Income and Wages Growth are also an important fundamental to measure.

In our large capital cities, there are substantially more pillars to the economy resulting in higher paying jobs and people with multiple incomes.

People wages are rising above the average and they are willing and able to pay more for property to buy or rent in their preferred location.

Importantly, they also have higher savings rates and buffers and ride out the more difficult times.

Regional centres and towns have far less pillars to support their economy and as a result wages are modest and these areas are more prone to property collapses with prolonged recoveries.

In the case of the Gold Coast, it is far too reliant on tourism, local business and growth are heavily impacted by this.

Micro Factors

To use an analogy, fundamental analysis should be the cake, technical analysis and micro factors can play a part, but they should be more like the icing.

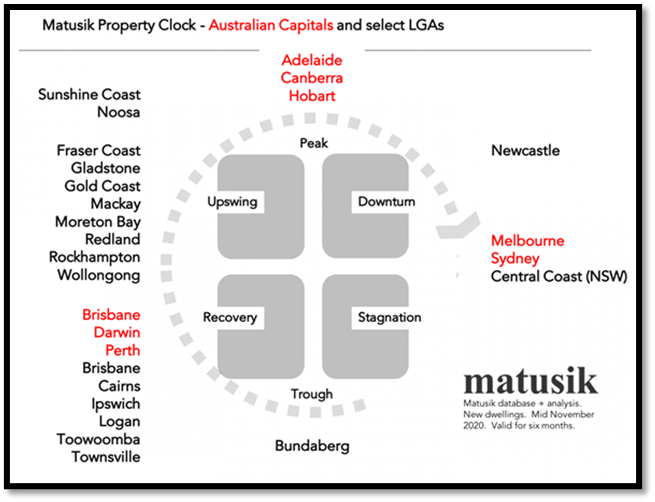

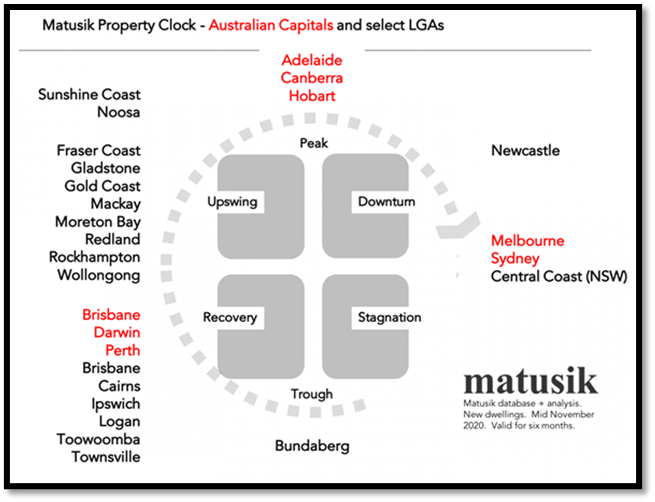

We often see the “Property Clock” concept put forward by many data driven analysists.

Again, while not a major factor, it can give you some insight and idea of what is happening in our property markets at a certain point in time.

This information was provided in late 2020 and we have seen our market strengthen to start 2021, but what is clear is that different markets are at different stages.

Here we had Brisbane in the recovery phase, while many regionals towns including the Gold Coast and Sunshine Coast are in the upswing phase.

So, this would also be another reason these regions are experiencing more growth at the present time than Brisbane overall and leading to more media hype.

However, it is merely a moment in time and a short-term scenario.

Along with market cycles, there are many micro factors you need to understand about regional hubs, whether it be seasonal drivers, farming, mining and tourism that may impact property.

In the case of the Gold Coast region, along with greater land supply, is that it is fast becoming a vertical city, which creates even more supply.

Digging Deeper

Digging deeper and not just following the media headlines can make all the difference.

Every property, in every street, in every suburb is different but the broad-brush data hides and disguises this.

If you can take a top-down approach, understand the fundamentals and dig below the surface you will be rewarded handsomely.

Being “on the ground” will also give you a level of perspective to add to the detail.

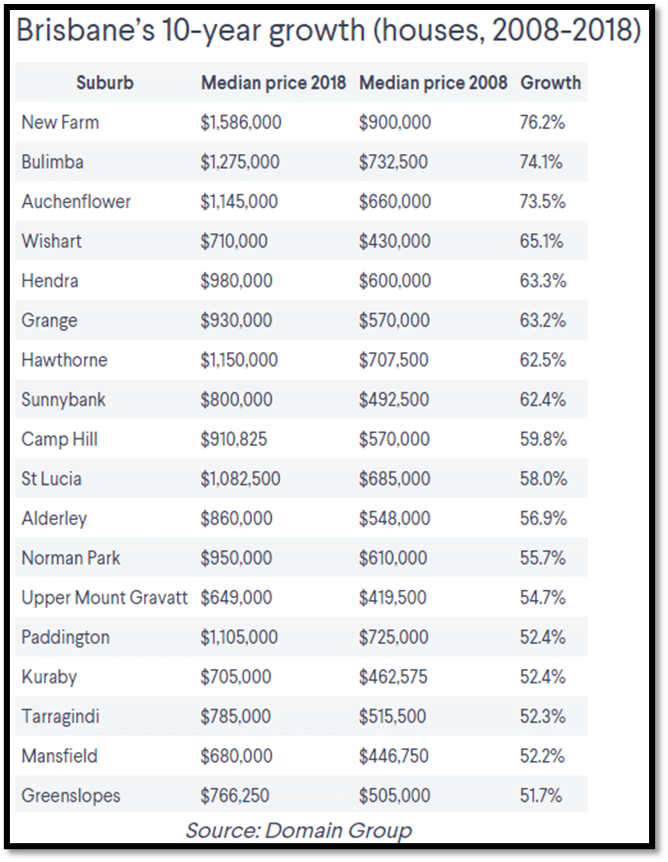

So, while Brisbane overall only performed at 28.6% over the decade, some suburbs saw triple the growth!

Once you are able to understand the fundamentals and not get caught up in headlines, it certainly becomes clear where you should have invested your money over the last decade,

With fundamentals unlikely to dramatically shift over the next decade in these types of locations, now is not the time to change tact.

With the potential for a far greater return and a lower level of risk, why would you invest anywhere else?

Summary

The pundits for regional areas talk about one small regional town with a few hundred thousand people and compare it with Melbourne Sydney or Brisbane with significantly more.

Do not take isolated data, property opinions and media headlines at face value.

Instead, dig a little deeper, take a long-term approach and to find the areas that will perform at above average, wealth producing rates of return.

Understand the big trends of where people are moving too and why, then look for areas that are land locked.

Locations where people can and will be able to pay more to buy or rent a property and then look at micro factors to understand the dynamics of the suburb itself.

While timing the market and understanding cycles can be beneficial, it is time in the right market that is of far greater importance.

In this case buying an average property in a regional town over the last decade would have seen growth of just 22.7% growth.

However, by looking below the surface and understanding the fundamentals you would have seen more than triple that amount.

The commentators may continue the regional versus capital city debate, but there is no argument between the regional centre versus the right location, right street and right property.

Now is not the time to make a long-term decision based on short term, superficial information.

..........................................................

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

To read more articles by Michael Yardney, click here