Where are our property markets heading in 2022?

Now that we've got two months of data under our belts the picture is becoming clearer.

Last year property values increased in almost every location around Australia, and that’s very unusual.

Around 98% of locations across Australia recorded price uplift; most had double-digit growth and the value of many properties rose by more than 20%.

However, moving forward, the various property markets will be very segmented, which is a more “normal” property market.

In other words in 2022 the value of properties in some locations will rise strongly, some will increase in value moderately, properties some locations will languish as affordability becomes an issue and a few areas will experience falling property values – all based on local demographics, economics and supply and demand.

Melbourne and Sydney market flat over February.

Despite strong buyer and seller activity, our housing markets experienced strong auction clearance rates of February, clearly still indicating a seller’s market, however property price growth over the month of February produced mixed results.

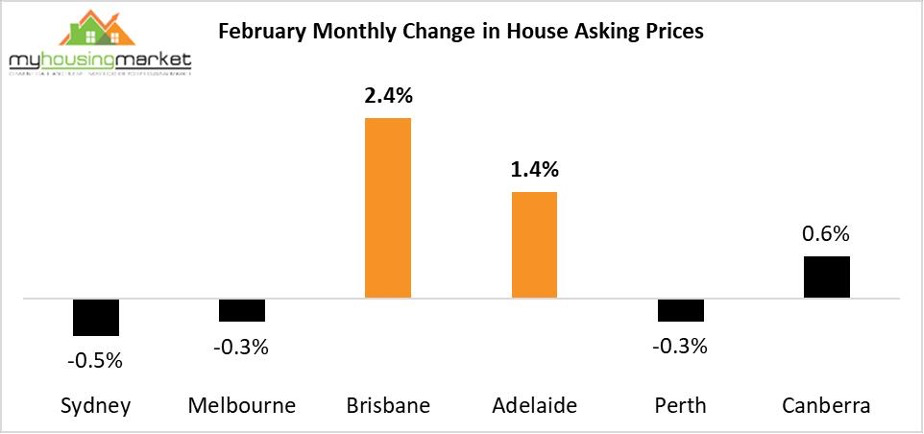

Dr. Andrew Wilson's My housing market showed strong growth in asking prices for properties in Brisbane and Adelaide, while house price growth in Sydney and Melbourne has moderated over February.

Source: Dr. Andrew Wilson’s My Housing Market

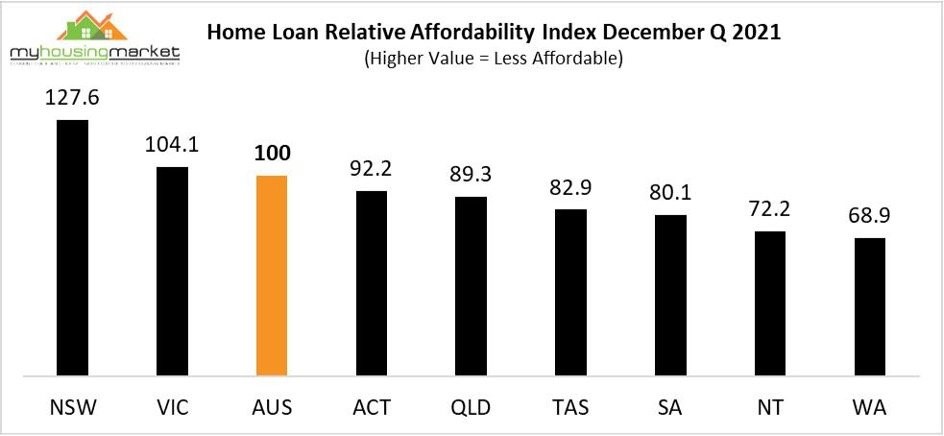

This fragmentation of our property markets clearly reflects the differing affordability levels between the capitals.

If you think about it, while wages around Australia are much the same, the median house price in Sydney is double that of Brisbane and considerably more than a similar house would cost in Melbourne.

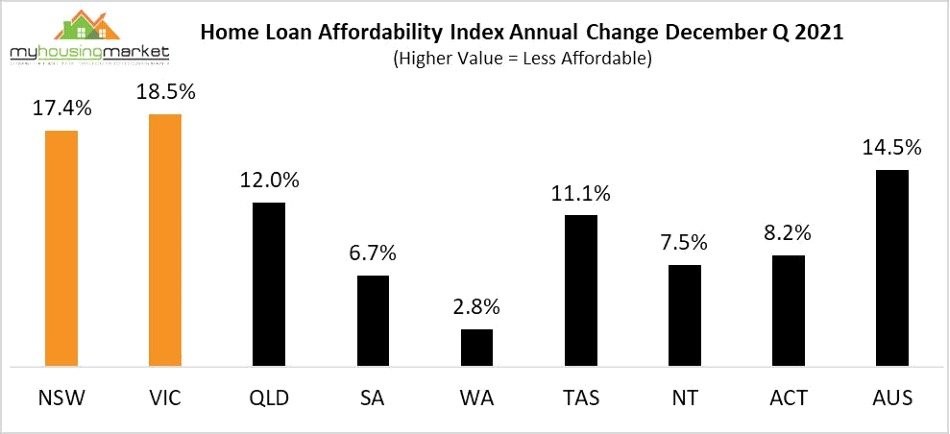

And considering that wages have hardly increased, yet property values soared by 20% or more last year, affordability is now constraining further price growth in more expensive capitals of Sydney and Melbourne as lending capacity has been maximised.

Source: Dr. Andrew Wilson’s My Housing Market

Dr. Andrew Wilson explains:

“The smaller capitals – particularly Brisbane and Adelaide continue to provide buyers with affordability advantages as strong demand continues to push up prices at similar extraordinary levels to those recorded by Melbourne and Sydney last year.”

So what’s ahead for our housing market?

While demand for housing will remain strong, it’s likely that we will experience lower and more fragmented price growth this year.

Overall house prices are likely to increase in the order of 4 - 5% in Melbourne and Sydney but Brisbane and Adelaide are likely to outperform with stronger growth.

At the same time, low vacancy rates at a time of increasing demand will make 2022 a year of solid rental increases.

Dr. Wilson explains:

Housing market demand will continue be supported by the imminent reintroduction of mass migration and rising confidence in a post-covid recovering economy and reinforced by a clear underlying shortage of housing.

Investor activity will also continue to support housing markets, with surging rents enhancing yields and supporting total returns.

The level of prices growth however will be determined by interest rates and incomes growth going forward which are likely to remain steady for the foreseeable future.”

..........................................................

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.

To read more articles by Michael Yardney, click here