The average household in a raft of suburbs around Australia will be pushed into mortgage stress if interest rates climb just 1%.

That was a headline doing the rounds over the weekend!

Only a few weeks earlier modelling by one of Australia’s most publicized property pessimists, who unfortunately keeps getting his predictions very wrong yet they keep getting headlines in the financial press, suggested that a minimum mortgage rate hike combined with a higher buffer rate as required by the recent APRA edicts to the banks would send thousands of residential landlords into financial stress and could fuel house price falls by the end of next year.

So will higher inflation lead to higher interest rates that will tip the scales and spell the end of the current property boom?

That’s one of the questions I’ll be asking Dr. Andrew Wilson, Australia’s leading housing market economist and Chief economist of My Housing Market in this week’s Property Insiders chat.

And I’d also like his insight into what’s happening with employment considering our unemployment rate shot up last month.

It seems the story about rising interest rates just won’t go away, and even though we’ve discussed it over the last few weeks in these regular Property Insider chats we really must address the speculation that this could lead to mortgage stress, not only for homeowners but for property investors.

And more even more importantly we need to address the concern that many will have after watching the 6 o’clock news or reading the papers and being told that the value of their home could plummet 15-20%.

Now we know that falling interest rates increase borrowing capacity which fuels housing price growth.

And while the opposite, rising interest rates decreases borrowers’ capacity, this doesn’t necessarily mean that the value of houses in Australian suburbs will slump.

So what is mortgage stress?

There are various definitions of what mortgage stress is, but it’s most commonly defined as a household spending more than 30% of their pre-tax income on their home loan repayments.

The underlying premise is that at these levels of debt, the average homebuyer will be struggling to repay their loan.

Around Australia house prices are up more than 20% over the last year, but that’s an average and in some suburbs, properties have increased 30 to 40% over the last two years.

While the current property boom has been favourable to those already in the property market, the rise in property values has been considerably more than the minimal rise in incomes, meaning that would-be buyers are either frozen out of homeownership or have to pay a significant portion of their income to service a home loan.

Those commentators concerned about mortgage stress remind us that last year the governments, banks and financial institutions gave various support packages to reduce the risk of mortgage defaults, but these have now in general been removed.

Yet looking at mortgage defaults or mortgage arrears with our banks would suggest that very few Australian households are currently suffering mortgage stress, and many are well ahead in the mortgage payments.

And we know that the banks have been only lending money to those who could comfortably handle a 2.5% increase in the mortgage rate and as of the beginning of this month this buffer has been increased to 3%.

Now the only reason why the RBA would raise interest rates would be to slow a booming economy at a time when inflation would be high and wages would have increased considerably.

Of course rising wages would in general mean that property owners would have less risk of mortgage stress.

Let’s look at what could cause a housing market crash

There is no doubt that at some time in the future we will experience a cyclical property market correction, but there is no need to worry about a house price “collapse” like some property pessimists are suggesting.

House prices “collapse” when people are forced to sell their homes and there is no one willing to buy them.

I accept that properties are expensive at present– but that doesn’t mean property values will crash, especially in our capital cities.

In fact, they’ve never crashed since housing market data has been collected in Australia.

Instead, what tends to happen is an orderly correction, with prices only falling slightly, because homeowners choose to simply remain in their home and ride things out, while most property investors also try and hold on rather than realising their capital loss.

On the other hand, a true collapse in house prices would require a significant external shock such as:

- Unemployment is high enough to trigger a waiver forced home sales, and that’s not going to happen.

- Interest rates rise so high that they would cause a raft of homeowners to default on the mortgage. The Reserve Bank wants this about as much as it wants another strain of coronavirus.

- A credit squeeze – APRA is currently making it a little bit more difficult to borrow money, but they don’t want to crash our property market either.

- A severe recession that would increase unemployment and cause homeowners to default – that’s not on the cards.

- A severe oversupply of property – currently we have an undersupply of the right type of properties that most homeowners want.

So while a crash is not on the cards, a correction will occur one day and at that time some properties will hold the value better than others.

Obviously, that’s the type of property you should own – A-grade homes or investment-grade properties in established suburbs and lifestyle locations

Unemployment

Last week Treasurer Josh Frydenberg admitted that the latest job e confirmed that “lockdowns cost jobs”.

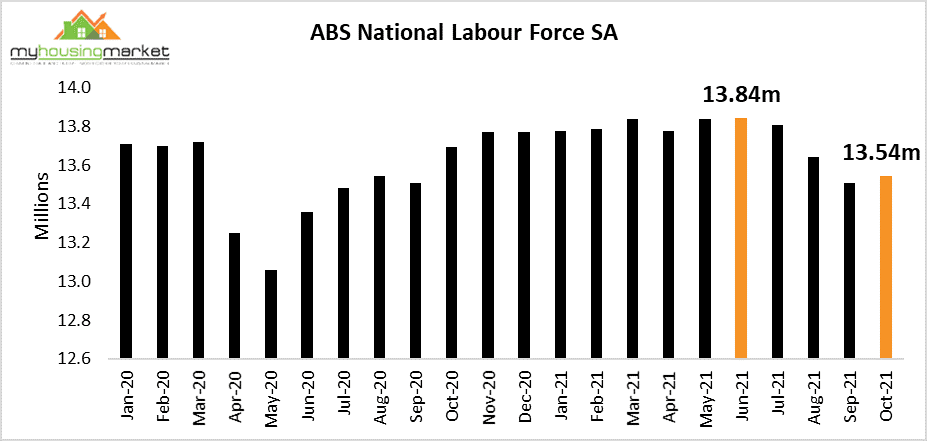

Source: Dr. Andrew Wilson – My Housing Market

Employment fell by 46,300 in October as the number of part-time jobs fell by 5,900 with full-time jobs down by 40,400.

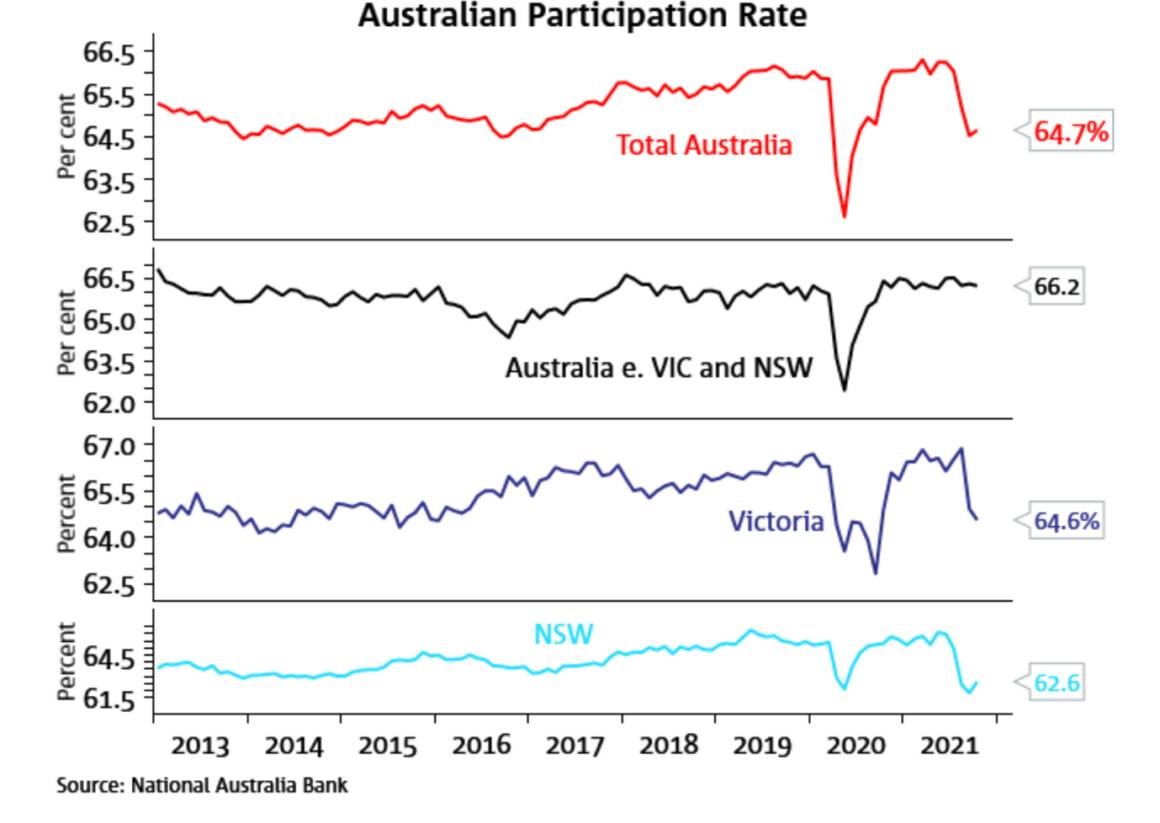

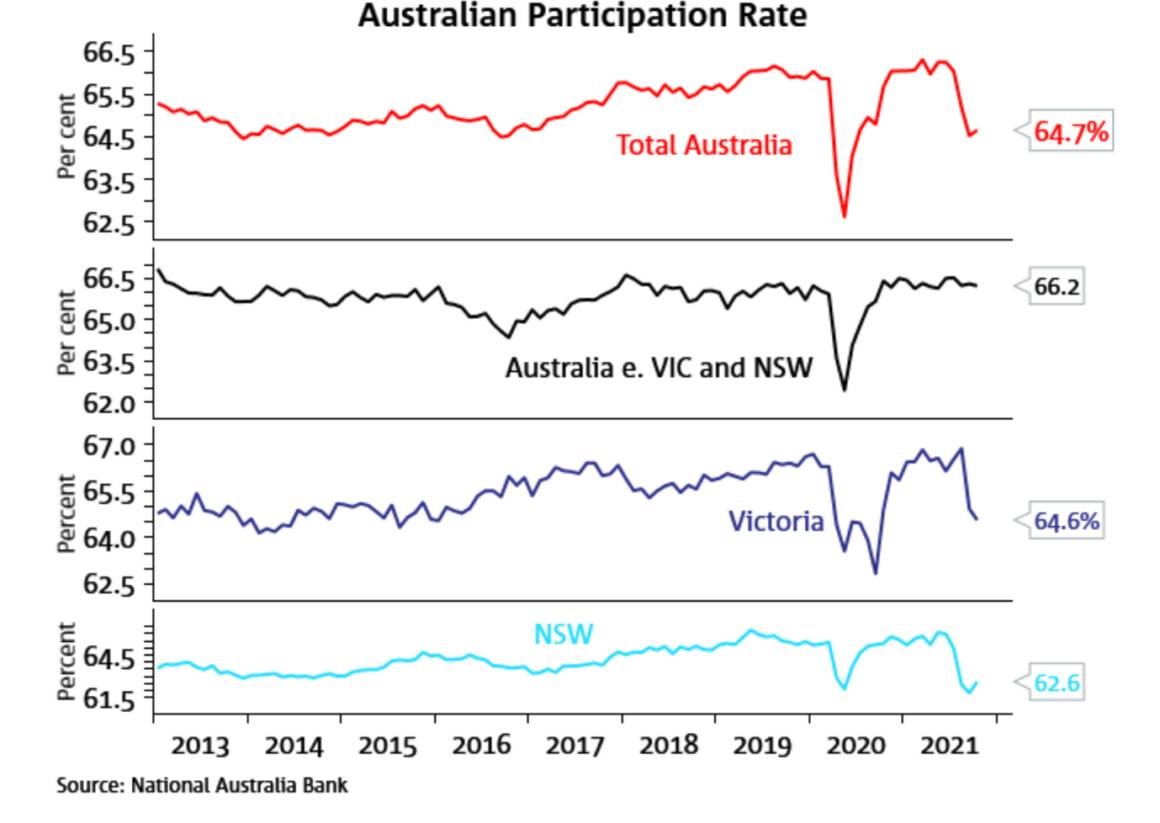

At the same time, the participation rate rose from a 15-month low of 64.5 per cent to 64.7 per cent.

This resulted in the unemployment rate rising from 4.6 per cent to a 6-month high of 5.2 per cent.

Hours worked fell by 0.1 per cent to 1,729 million to be down 0.4 per cent a year ago.

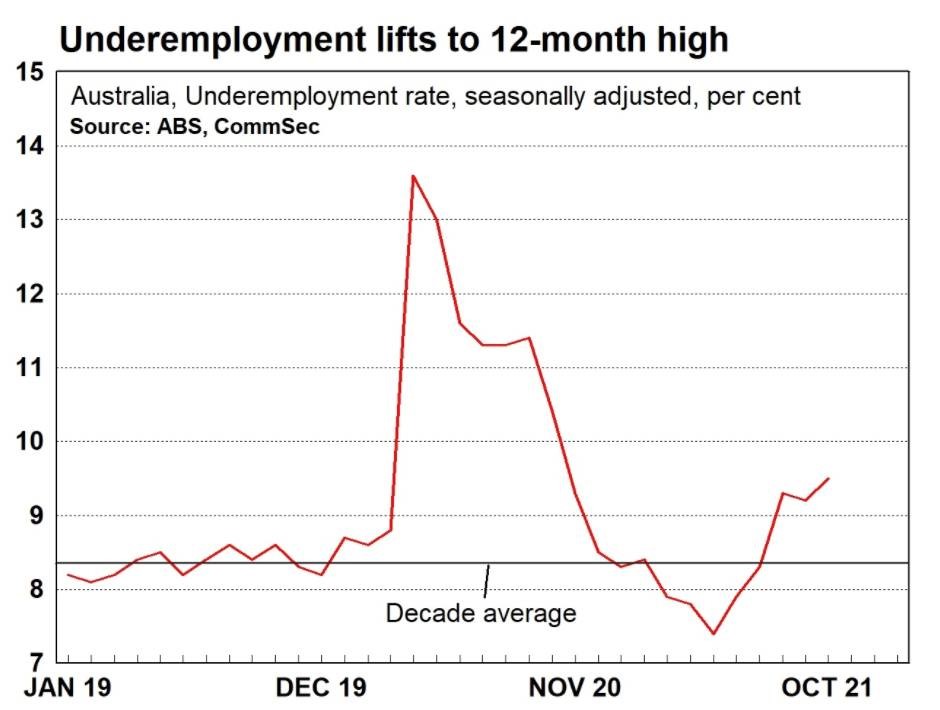

The underemployment rate lifted from 9.2 per cent to a 12-month high of 9.5 per cent.

Source: ABS and Commsec

But the Australian labour market has begun healing in November after prolonged Delta virus-induced lockdowns in Australia’s south-east contributed to the cumulative loss of 333,700 jobs between August and October.

In recent weeks, policymakers have pivoted from ‘zero Covid’ strategies to ‘living with Covid’ as vaccination rates hit the required 80 per cent thresholds, enabling greater mobility as social distancing measures were eased.

Leading indicators of labour demand have rebounded sharply since mid-October as employers position their business for reopening with the number of new job ads on Seek rising 10.2% in October, following a strong 8.8% rise in September which points to the unemployment rate resuming its downward trend.

This week’s auction results – another weekend of strong auction results.

Watch this week’s Property Insider video as we discuss how most cities continue to record generally strong results for sellers.

Auction clearance rates typically ease over the concluding period of the spring selling season driven down by higher listings.

Buyers are still out there, but with more choice, agents are reporting that there are fewer buyers interested in each property and fewer bidders registered for each auction.

And this weekend with more properties coming on to the market for sale, auction clearance rates were down, but still strong in Sydney and Melbourne.

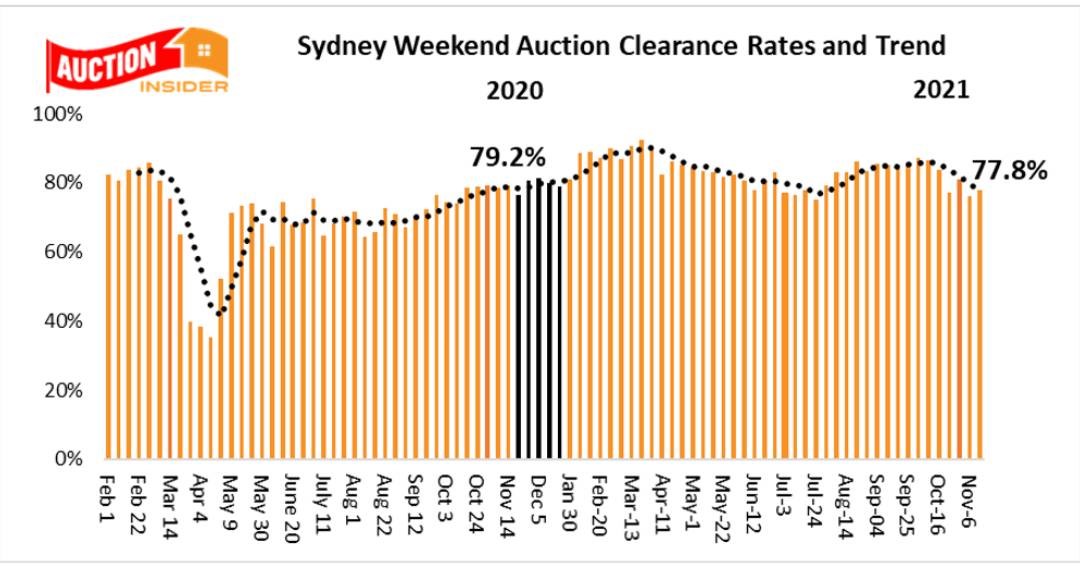

Sydney Auction Market

Steady Sydney is still a strong auction market for most sellers

The Sydney auction market steadied at the weekend, but clearance rates have clearly eased from the boomtime results recorded over previous months.

Sydney recorded a clearance rate of 77.8% this weekend, which was similar to the previous week’s 76.1% but again lower than the 78.4% recorded over the same weekend last year.

High listing numbers are impacting results, offering more choices for buyers and more competition for sellers.

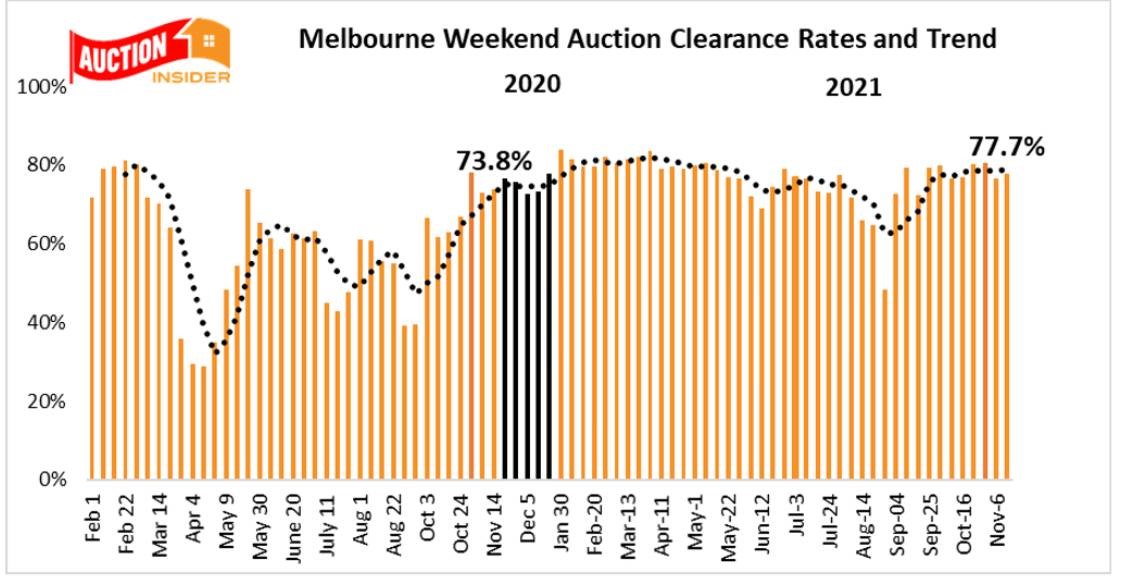

Melbourne Auction Market.

Melbourne auction market prices despite listings surge.

The Melbourne weekend auction market bounced back on the Saturday following the previous weekend’s two-month low result.

Melbourne reported a clearance rate of 77.7% on Saturday, which was higher than the previous weekend 76.5% and also higher than the 73.8% recorded over the same weekend last year.

The high clearance rate was reported despite a surge in listings with 1206 homes listed for auction at the weekend.

..........................................................

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.

To read more articles by Michael Yardney, click here