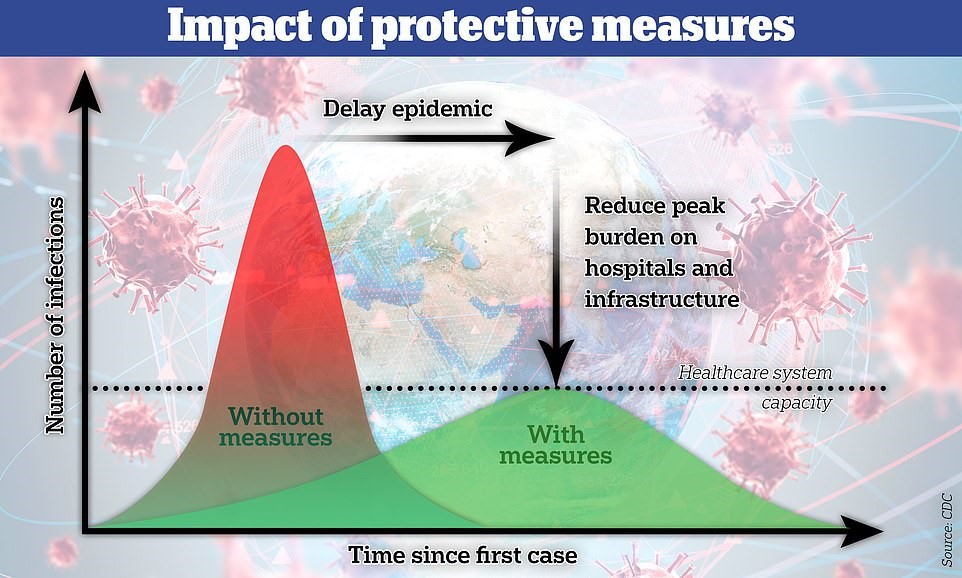

Australia is going through a tough and emotional time right now with Covid-19 dominating the news every hour of the day. And for good reason, the next two weeks will be critical for governments around the world to limit the spread of “peak infection rate” of Covid-19. The longer we can delay the pandemic, the less burden there will be placed on our hospitals. At the time of writing this post, there was a total of 299 cases with 5 deaths in Australia.

There is a lot of doom and gloom out there right now, but the fact remains, Australia has one of the best health systems in the world and the Covid-19 has a Mortality rate around 2%, which is significantly less than what was seen for SARS (10%), and for MERS (34%). If we can contain the disease and delay the pandemic at a similar rate to what we have done so far, our health care system WILL manage.

So what does all of this mean for commercial property investors? The below updates are my predictions for the Australian commercial property market:

I would like to start by saying if you own a commercial property with a strong tenant (regardless of their industry) and you have a long lease in place (more than 12 months), you should not see any interruptions in your income as a commercial investor. This is why we invest in this space – regular income from strong tenants that provides security.

Sectors at risk;

• Retail properties - Any commercial properties that are exposed to tourism will have some tough months ahead as the travel bans are all encompassing. Travel agents, airline companies, car rental companies, insurance businesses, any commercial property in a tourist reliant centre will struggle. Health experts expect the worst of this virus to pass within 3-6 months. Low interest rates and government stimulus packages could make the difference for these businesses

• Office space – office space could become less in demand as some businesses feel the pinch and need to reduce their fixed costs. Office space is one of the easiest fixed costs to reduce. Many offices are already telling their employees to work from home, however temporarily, to slow down the spread of the virus. If you own a office space that is unique or has a solid business in place with a long lease, you won’t notice an interruption to your rental income. However, the overall weaker economy will reduce the demand of office space in general.

Sectors less at risk;

• Medical properties - It goes without saying that most medical tenants should continue on strongly. However, there are some businessesthat will see appointments drop due to the requirement of self-isolations (eg. physiotherapists, chiropractors, dentists to name a few), but from my experience with these businesses, they should be financially strong enough to cope with the poor 3-6 months forecast.

• Industrial properties – As people stay home, there is a tenancy for more online ordering of goods. Industrial properties are used for their storage capabilities and I can’t see this sector weaking over Covid-19. Of course there will be some causalities, as some with specific businesses reliant on exports from China, Europe and other affected countries, although we are seeing a turnaround, specifically China, which seems to be getting on top of Covid-19 with only 10,000 active cases as of 16/03/2020. I believe the industrial sector will remain strong, and we will continually target this type of investment for my clients.

Biggest opportunities

• 0% interest rates! – Due to the economic threat posed by Covid-19, RBA slashed the rate to a historic low of 0.5%. Over the next few months the RBA will almost certainly drop interest rates another 0.5% to finish at 0%. Banks will be pressured to pass all of the cuts on. The most recent interest rate cut was passed on in full by all the major banks. This will result in further yield compression for commercial investments which in turn equals capital growth.

• Extra stimulus measures from the Government to help small business. Last week the government announced a $17bn stimulus package in response to Covid-19, with further measures to be taken as required. This will keep most businesses buoyant in what Is expected to be a weak few months ahead and hopefully Australia will be on top of the virus where the natural recovery will begin.

Although some sectors of the commercial property market will fall in tough times, others will no doubt remain strong. Investors need to remain vigilant, now is not a time to bury your head in the sand, especially when there can be some great buying opportunities, coupled with sharply dropping interest rates and less competition. I believe record low interest rates will have a bigger positive impact on commercial asset prices compared to the negative sentiment caused by Covid-19. Investors will always seek a return on their money, with lower interest rates and cash not accruing interest in the bank, commercial property will remain a viable option for many investors seeking a strong return. Those waiting for prices to drop, I feel they will be disappointed as the market will only tighten and growth will prevail.

The key focus for investors, is to look beyond the next couple of months as Australia’s fundamentals remain strong. Australia’s property market is regarded low-risk by many economies worldwide, with one of the strongest health care systems on offer. I feel that any losses as a result of the impact caused by the virus and the subsequent lock downs will be in fact recoverable as soon as peak number of active infected Covid-19 cases starts dropping. China looks to be on top of the virus with now only 10,000 active cases vs Italy’s 20,000 cases (ref: https://www.worldometers.info/coronavirus/), proving the lock downs do work. So there is light at the end of the tunnel for Australia as we enter this tough stage.

I believe we will come out of this a more confident nation as we have taken a battering in recent times with the drought, the bushfires and now this pandemic. Australia will be more confident as we will have proven to ourselves and the world, just how well this has been handled.

.......................................................................................

Scott O’Neill is the founder and director of Rethink Investing, a BRW Fast 100 property investing company specialising in finding rare positively geared properties all around Australia (commercial and residential).

Scott O’Neill is the founder and director of Rethink Investing, a BRW Fast 100 property investing company specialising in finding rare positively geared properties all around Australia (commercial and residential).

Scott is an experienced and active investor who was able to retire from his day job at the age of 28. With a current portfolio of 32 properties worth $20m, he is one of the most successful young property investors in Australia. O’Neill has a passion for all aspects of property, especially helping others find great deals.

Rethink Investing helps everyday Australians enter the commercial property market with ease.

It also specialises in helping clients purchase high-yielding residential properties using the same successful investing strategy. Call 1300 965 551 or visit www.rethinkinvesting.com.au

Disclaimer: This is general information only and should not be taken as financial advice.