Billionaire mogul Warren Buffett’s motivational investment philosophy is often quoted: “Be fearful when others are greedy, and greedy when others are fearful,” he says.

Now more than ever, this statement rings true. After all, there is plenty to be fearful about today, including stagnating property values, a shaky economy, a volatile mortgage market, and instability in federal politics that could shake the foundations of negative gearing.

But 20 years into the future – when Australian property markets will have cycled through more booms and busts, at different points in time and to different extents – it will be those investors who had the courage to invest when market sentiment was low who will be celebrating the greatest profi ts.

Think of it this way: if you were to talk to almost any investor or homeowner today who bought a property two decades ago, and you asked how much they paid for it, the price would generally elicit a gasp or a chuckle: “You only paid how much?”

It won’t be long before we’re fondly reminiscing at BBQs: “Remember when you could buy a property anywhere in Australia for under $1m?” With interest rates at historical lows – and they look set to stay there for some time – this could be the ideal time to add a property to your portfolio.

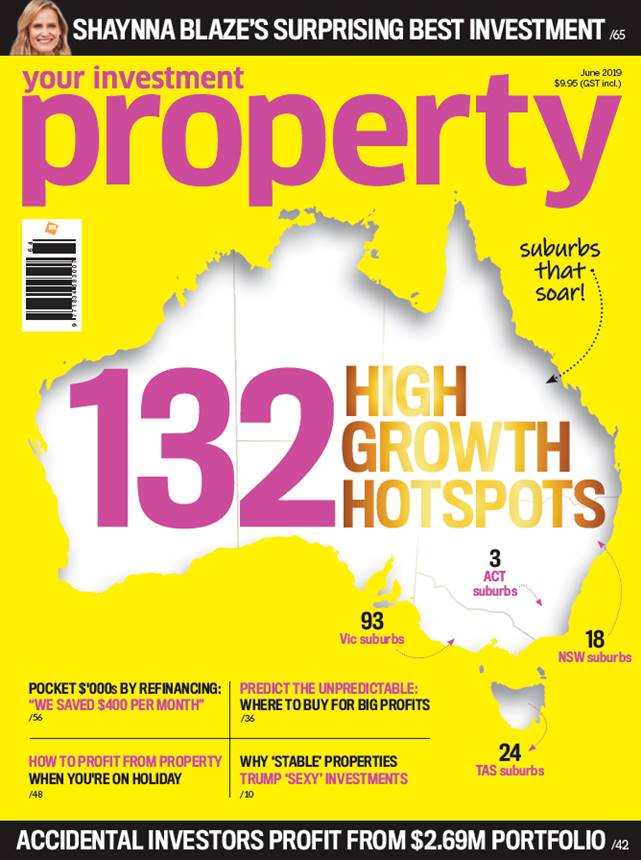

To give you the best chance of parking your investment dollars in a property that delivers ongoing capital growth, we’ve analysed thousands of suburbs to come up with this shortlist of 132 areas across Australia.

These are suburbs that have historically enjoyed strong capital growth of 8% plus per year; where rental demand is high and turnover of properties robust; and where average annual growth is expected to stack up over the long term.

LOCATING A ‘SURE THING’

- Is it safe to say these locations are a sure bet if you’re considering investing there? Unfortunately, there is no such thing. Investing in property always carries with it some inherent risks, including the risk of the property not growing in value, and the risk of vacancies and tenant damage.

- While we have done extensive research on these areas, we always recommend that investors do their own due diligence to ensure an area or potential property investment makes sense according to their own budget, goals, lifestyle, borrowing power and strategy.

- Before investing in property, it’s crucial that you have a strategy, which is essentially a plan or guide for your investment journey. Ask yourself: What is your budget and risk appetite? How long do you plan to hold the property for? How many properties do you want to own, and what is your ultimate goal?

- These are just some of the questions you need to ask when planning your investment strategy. It’s only when you have a clear idea of what you’re hoping to achieve, what your metrics are, and how long you plan to invest for that you can decide whether a particular property or location will suit your needs.

The full article highlighting all 132 high-growth hotspots and including suburb profiles, was published in the June 2019 edition of Your Investment Property magazine.

The full article highlighting all 132 high-growth hotspots and including suburb profiles, was published in the June 2019 edition of Your Investment Property magazine.

.JPG)

.JPG)