• 2 June 2016, Finder.com.au: “Property market could be in for hard landing”

• 21 June 2016, Herald Sun: “‘Soft landing’ predicted for housing boom”

• 21 June 2016, Business Insider Australia: “The RBA doesn't sound like it's itching to cut rates again”

• 21 June 2016, ABC News: “RBA signals another cut in interest rates on low infl ation, rising dollar”

Some might say we suffer from information saturation in our digital world. News stories and bulletins with click-bait headlines vie for our attention as we browse the internet, scroll social media, or check our email.

In an effort to stand out, news reports are sometimes skewed to represent the angle that will attract the most interest from readers.

In addition, we’re often not given the whole story, the one that includes all the facts from all the sources. That can create a very different – and misleading – picture of the issue.

The current concern around our property bubble is a perfect example. Are investors doomed because the bottom is about to fall out of the Australian market?

If you’re truly worried, that’s no surprise – here’s a small selection of some hair-raising headlines we’ve seen since October last year:

• “Five months until property bubble bursts”

• “Australian housing market facing ‘bloodbath’ collapse: economists”

• “Bad news home owners – the bust may have begun”

• “Sydney property market dips, but bubble hasn’t burst”

These alarming reports give the impression of an inevitable bubble explosion. But is that the full story? What’s really happening?

We asked six experts, from economists to property development directors, to weigh in on some of today’s most hotly debated topics. These experts have tackled real media reports, debunking, straightening out, verifying and putting to bed the issues that are creating unease and uncertainty in investor circles.

FACT OR MYTH #1

Is an unaffordability crisis locking buyers out of the market?

Media article title: “No end in sight’ for Sydney and Melbourne’s housing affordability crisis”

Released: March 2016

By: News.com.au

Quote from media article:

“Documenting the seriousness of the aff ordability crunch, the [Australian Population Research Institute] report out today warns Australia’s mortgage debt level has reached ‘dangerous territory’ hitting $1.45 trillion and growing by $100 billion a year. Sydney and Melbourne property seekers are the nation’s worst off , with record high housing prices in the capital cities causing a ‘social catastrophe’.”

EXPOSING THE TRUTH: FACT

Sam Elbanna, managing director of CPM Realty, Sydney

Sam, who is a strong advocate for first home buyers breaking into the apartment market, is a regular media source and author of many articles related to the property industry.

The current interest rate is the lowest in decades, and buyer activity has jumped up as a response, especially among the younger generation and fi rst home buyers, who see this as an opportune time to get into the market.

However, when comparing property prices – despite the much-talked-about flattening of the market or burst of the property bubble – price tags remain steady and strong, and in many areas they are moving up. For buyers right across the market, this translates to strong competition when it comes to having an offer accepted, or pushes prices out of reach at auctions.

Of course, having capital growth on the cards due to high demand is great once you have secured a property. But seeing your dream home or investment opportunity being pushed out of your reach before you get in, isn’t.

A recent poll undertaken by RealEstate.com.au indicates that more than half of all buyers fear not being able to afford a home. This translates for some into having to adjust size, condition or location of the property, be it a house or an apartment, in order to be able to afford it.

My recommendation is to look at ways to get into the market where there is some gain to be had, whether it’s the ‘worst house in the best street’, something with renovation or improvement potential, or you look at the next best location or perhaps buy off the plan, where capital gain is sort of built in.

The side effect of the affordability issue is that people being pushed out of the market will either opt for secondary locations, consider being rentvestors, or look at apartments versus houses. However, the key ingredient for capital growth remains the same: close proximity to shops, schools, transport, employment and entertainment centres.

A good idea is to look at fringe areas – those close to areas that have been performing well yet have not had the same price rises and still offer lower land prices than their more affluent neighbours. A good thing to remember, too, is that property is a stepping-stone game: if you can’t buy your ideal property now, buy somewhere else where the extra growth potential is going to take you one step closer in time to come.

In Sydney, for example, the North Rocks area has not yet experienced the boom and growth that Parramatta and the Hills District have, and offers considerably larger apartments at purchase prices that are almost one third lower, yet is also benefiting from the growing demand.

Another example is Greenacre, which piggybacks off Bankstown, allowing residents the luxury of a bustling neighbourhood with the affordability of a growing residential area.

With today’s access to market research and property data, these sorts of affordability pockets can be found in locations right around Australia, if you know what to look for.

HOW TO SORT OUT FACT FROM FICTION

• First, fact-check: Verify reports by researching the issue thoroughly yourself. Use reliable online sources such as CoreLogic and Your Investment Property's website at www.yipmag.com.au, as well as a range of industry experts and experienced investment mentors.

• Be objective: Remember that every investor’s situation is unique; don’t allow mass-marketed media reports to derail your personal strategy needlessly.

• Don’t lose sleep: Those doomsday predictions have another side to the story, and more than likely you’ve got some time to work out an action plan where needed.

• Remain alert: Unfortunately, the media build-up can actually cause the media's own predictions to happen. Keep on top of issues that are frequently hyped up in news reports, because they might actually be the snowflake that starts the snowball.

FACT OR MYTH #2

Will Brisbane really be the next city to price-surge like Sydney?

Media article title: “Is Brisbane the next property hot spot?”

Released: June 2015

By: Daily Mail Australia

Quote from media article:

“House prices in the sunshine capital set to soar in the next three years ... but Sydney and Melbourne will fall. Brisbane is Australia's only capital city that will see a jump in house prices.”

EXPOSING THE TRUTH: MYTH

Craig Sewell, foundation director, Mint360 Property

Craig’s knowledge of the property industry extends from sales and property management through to project marketing. He is the founder of Mint360 Property, a leading real estate firm based in Sydney’s eastern suburbs.

The Sydney property market seems to be only going from strength to strength, with property prices – for both houses and units ¬ continuing along a consistent growth path.

Many commentators and media sources have been pushing the idea that a similar rate of growth will be coming to Brisbane, and have tipped it as ‘the next Sydney’, and a hotspot for investors in the near future.

I believe that while Brisbane certainly does have its attractions for investors, and while it performed well in 2015, it still has a long way to go to achieve the rapid growth that Sydney has experienced. Sydney’s driving factors of strong population growth, desirability for foreign investors, and career and job opportunities are just not evident in the Brisbane market.

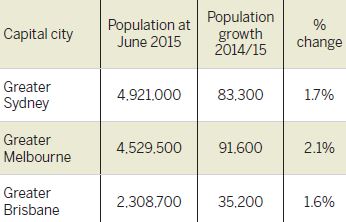

As the table below shows, Brisbane’s total population is significantly lower than that of its eastern cousins, and increased by less than half the number of new residents that Sydney’s did in the year to June 2015.

Brisbane’s smaller population and slower growth don’t support the continued high demand for CBD living seen in Melbourne and Sydney, where prices have climbed considerably.

While Brisbane house prices have seen some growth, the real concern for investors at the moment is the oversupply of units, and increased vacancy rates. It is such a concern that lending institutions such as Macquarie Bank have listed the Brisbane CBD as a ‘risky’ suburb and put lending restraints on investors.

With such a large number of new units being constructed in the relatively small CBD of Brisbane (compared to Sydney’s) there simply will not be enough demand to fill the supply.

It is also important to remember that investing in property is about finding the right property that fits your budget and strategy. Brisbane certainly offers attractive prices for investors looking to get into the market, with prices that are far more affordable than the equivalent in Sydney.

At the end of the day, you need to ensure you have done all the necessary research into the area and property you are looking at purchasing to ensure that it will be a solid investment within your budget.

FACT OR MYTH #3

Is there a dangerous excess of inner-city units?

Media article title: “Apartment supply boom a growing concern: Standard & Poor’s”

Released: May 2016

By: Sydney Morning Herald

Quote from media article:

“The Reserve Bank also said in April there was potential for banks to make ‘large losses’ from soured loans to property developers, amid concerns of a looming glut of apartments in parts of Sydney, Melbourne and Brisbane.”

EXPOSING THE TRUTH: MYTH

Nicholas Smedley, managing director of Steller

Nicholas is a prominent Melbourne developer specialising in medium-density apartment living across Melbourne's South East Corridor.

In the news, negative headlines are always more appealing to readers than positive ones. People are always more interested in stories that might affect them badly, and when it comes to the latest articles on oversupply potentially driving property prices up in our cities, this is no different.

Currently, the media are telling us that we are facing a sure housing crash due to the number of developers building apartments, which are exceeding current demand. These apartments are also typically smaller, located in densely populated areas such as the CBD or in suburbs close to it, and targeted at overseas buyers.

In these segments, the crash is a self-prophesising story. We are all aware of the glut, and in response to the perception created by the media, banks have been reducing and stopping loans to developers locally and from overseas.

This flow-on effect makes it risky for overseas developers, and in turn for the buyers of those projects, who are not usually owner-occupiers. However, for developers who are building quality products targeted specifically at the owner-occupier market, oversupply isn’t an issue. Having the fundamentals of location, quality materials, and a good floor plan keeps buyers buying and also keeps the banks happy to continue lending to them, as that is the market the banks are after as well.

Apartments are going to continue being built, and new stock will keep coming in with the support of the state government, which is happy to build 30% out and 70% up.

We strongly believe in the need to impose minimum standards. As long as we adopt the minimum standards that Sydney has in other major cities around the country, oversupply shouldn’t be a big problem.

WHY THE SYDNEY HOUSE MARKET WON’T CRASH

• Sydney has a growing population – and that’s not going to change.

• Australian mortgages are generally full-recourse, which means homeowners can’t just walk away and hand back the keys – lenders will chase them and borrowers must pay costs (unlike in the US), which is a factor many of those doomsday experts conveniently forget!

• With interest rates at record lows and tipped to reduce further, people are comfortably affording their mortgages. In fact, the RBA has reported that 25% of most homeowners are actually one year ahead on their mortgage payments.

FACT OR MYTH #4

Is an Australian housing bubble about to pop?

Media article title: “A bubble is building that could shake our economy to its core”

Released: June 2016

By: ABC News – The Drum

Quote from media article:

“When it comes to bubbles, Australian property ticks pretty much all the boxes. Valuations that stretch into far reaching galaxies, fuelled by a debt binge that long ago unshackled itself from any kind of relationship with household incomes, all encouraged by monetary authorities and an accommodating tax regime. Could it all blow up in our faces? Absolutely.”

EXPOSING THE TRUTH: MYTH

Niro Thambipillay, founder of Investment Prime

Niro is a property author and the senior property investment advisor at Investment Prime, a specialist agency that matches investors with properties in high-growth locations across Australia.

There’s a lot of attention being drawn to the prospect of a property bubble, and unfortunately these types of media comments only drive fear into the hearts of current and future investment property owners.

I’ve been investing in property for 16 years and have advised my clients on purchasing over $55.2m worth of investments in the last fi ve years alone. I’ve done my research into Australia’s market history and what’s coming. Let’s set the record straight!

Firstly, the concept of an ‘Australian property bubble’ is grossly misleading. Australia is a country of many markets and submarkets, almost all of which are at different stages of their growth cycles.

For instance, in the last few years, while Sydney prices have skyrocketed, Perth property prices have been as fl at as a pancake. Yet, when Sydney prices were fl at between 2004 and 2007, Perth prices were going nuts!

Let’s also look at history, which shows us that the Sydney market is one in which prices rise sharply in a short period and then experience several years of next-to-no growth, with perhaps a slight decline in some areas.

Nevertheless, after every boom the doomsday experts come out with their predictions of a price collapse. They did it in 2004 after the post-Olympics boom; they did it in 2008 after the GFC; and they did it in 2012 when American experts predicted the Sydney property market was signifi cantly overvalued and prices would crash – and they could not have been more wrong! Now they have surfaced again.

Yes, Sydney and Melbourne property prices are infl ated, but a crash is unlikely. More probable is a prolonged period of little or no growth, as history has shown us.

Remember, property investing is a team sport. Seek advice from an experienced investment property advisor and disregard the media hype, or you might miss out on some of the wonderful opportunities for growth that 2016 and beyond offers.

FACT OR MYTH #5

Is negative gearing to blame for Australia’s astronomical property prices?

Media article title: “Negative gearing helping drive housing prices up, Liberal MP John Alexander says”

Released: May 2016

By: MSN News

Quote from media article: “The high prices are the result of a combination of factors – supply and demand, record low interest rates, and the mining boom – but many first home buyers also blame negative gearing, which gives investors a big advantage in the market.”

EXPOSING THE TRUTH: MYTH

Shane Oliver, head of investment strategy and chief economist, AMP Capital

With AMP since 1984, Shane has extensive experience in analysing economic and investment cycles and what current positioning means for the return potential of different asset classes, such as shares, bonds, property and infrastructure.

Every time Australian residential property prices take off, calls erupt for negative gearing on investment property to be restricted or scrapped as many see it as being to blame for high house prices. But is negative gearing really to blame?

The short answer is no. Negative gearing is not the reason housing affordability is so poor in Australia. It has been in place for a long time and Australia is not alone in providing some form of ‘tax assistance’ to homeowners as most comparable countries do. Americans can even deduct interest on the family home from their taxable income. And yet our price-to-income ratios for houses are much higher – at around 12.2 times in Sydney and 9.7 times in Melbourne compared to 3.7 times in the US.

Rather, the real driver of poor housing affordability has been a lack of supply. In a well-functioning market, when demand goes up, prices rise, and this is eventually met with increased supply, which brings prices back down.

This response has been lacking. Residential construction has picked up over the last two years, but this follows nearly a decade of undersupply that

has to be made up. Consistent with this, rental property vacancy rates are still well below past cycle highs, and in Sydney they are quite low.

It short, while underlying demand for property has been solid thanks to strong immigration levels and household formation, supply has not kept up.

What we really need to do is make it easier to bring new homes on to the market – release land for development faster; relax (within reason) development controls; reduce tax and other impediments to the supply of new dwellings; and develop a long-term plan to decentralise away from our major cities. This would be the best way to help first home buyers and cool speculative interest in housing. Curtailing negative gearing is not the solution.

Removing or curtailing negative gearing could even make the situation worse by reducing the supply of rental accommodation at a time when rental yields are hardly attractive to investors.

It should also be noted that negative gearing is not actually a tax concession specific to property investment but arises because of the way the tax system works in allowing deductions for expenses incurred in earning income. So removing or curtailing the tax deductibility of interest costs incurred in property investment would create a distortion in the tax system as it would still be available for investment in other assets. As a result, the tax system would then have a bias against property.

Finally, Australia’s tax system is highly progressive, with just 10% of taxpayers accounting for 45% of tax revenue raised.

Given high marginal tax rates, money is being channelled through various tax concessions to reduce excessive tax bills. So maybe if we do want to reduce money flowing through negative gearing we should lower our high marginal tax rates.

FACT OR MYTH #6

Are landlords lowering rents to secure tenants?

Media article title: “Record low rental yields in Sydney and Melbourne a risky sign, Moody's warns”

Released: April 2016

By: Australian Financial Review

Quote from media article: “Over the past three years, the decline in rental yields has led to cash flow losses for residential property investors and made them more dependent on price appreciation to cover the losses, which in turn makes residential property investment more risky.”

EXPOSING THE TRUTH: FACT & MYTH (depending on the location)

Luke Spence, business development manager, Beller Property Group

Luke’s accolades include Property Manager of the Year 2011 and Leased Magazine’s Young Achiever 2012.

A broad-brush analysis of Melbourne’s rental market can be misleading. It

is inaccurate to critique the market as static and all-encompassing. The evolution of the property market has meant it is very much fragmented, and these sensationalised reports often only provide unclear and skewed insights.

Lower rental yields are only specific to certain areas of Melbourne, such as Melbourne’s CBD and Docklands, where oversupply of property is apparent and increasing. In other parts of Melbourne, such as city fringe suburbs like Prahran and South Yarra, rental yields are tracking steadily. In these areas, rental yields have remained stable over the past 12 months and we have also seen lower vacancy rates, despite increased development.

The demand is meeting supply and making investment within certain areas of Melbourne worthwhile for investors, due to the demand for new properties. Not only this but it is developers in these areas who are becoming more intuitive and responsive to the changing demands of the market, supplying owner-occupier stock rather than the investment-quality stock which blanketed the market for some time but has since become undesirable due to foreign lending restrictions. It is also important to remember that these analyses often only account for developments that currently exist, rather than those that are in the pipeline which have responded to the evolved market.

Over the past six months we have seen the lowest vacancy rates since 2006. With lower vacancy periods between tenancies, investors are capping losses, even if rents have to be slightly decreased to attract a tenant quickly.

Rental yields are determined by the strategy the investor chooses to use when renting their property – achieving a slightly lower yield for a quicker turnover of tenant may be worthwhile, as losses are capped and cash flow is ensured.

The nature of property investment means it is innately intertwined with risk. However, it is not always risky in certain areas of the property market. Oversupplied areas will have a direct impact on the rental yield anticipated for investments and will also impact on existing yields. However, areas that are meeting demand with supply will have a steady yield, if not an increased yield, in the next one to three years to come.