In total, approximately 10,500 apartments (across 58 projects) have begun construction in the densely populated inner Sydney area and will likely be completed at various stages over the next three years.

The area has become a significant focal point for both investors and owner-occupiers, but who have fared better in terms of capital growth in recent times – those who have purchased off -the-plan apartments or those who have bought established apartments?

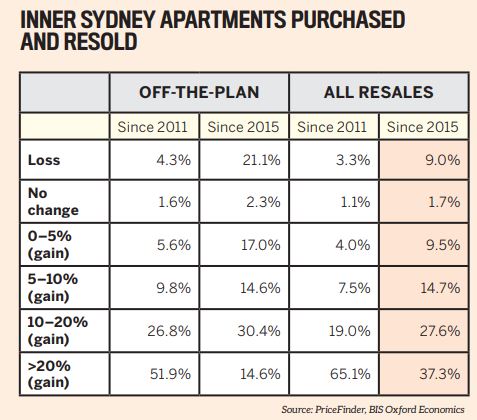

Analysis by BIS Oxford Economics has found that it is the established apartments that have consistently yielded better capital growth upon resale than off -the-plan apartments. This research was based on initial apartment sales occurring since January 2011 and subsequent resales of those same dwellings. The same analysis was also undertaken for apartments purchased and resold since January 2015, to show what more recent capital growth looked like.

While investing in apartments in inner Sydney has been largely a profitable prospect for longerterm holders – with just 4% of off -the-plan sales and 3% of total apartments initially purchased since January 2011 recording a loss – resales of apartments since January 2015 show that the investment landscape has become far more challenging in recent times.

However, even in this more challenging financial environment, approximately 89% of established apartments resold for a gain (while 11% resold at the same price or below), with results for larger apartments outperforming the smaller apartments in the resale market. This indicates that, while the apartment investment market in inner Sydney has defi nitely softened over the past four years, discerning buyers are still able to successfully achieve profi table investment outcomes.

By comparison, some 21% of off -the-plan apartments purchased since 2015 resold for less than their purchase price. The implications of a softer reselling environment could be significant. With these subsequent lower-value sales setting the benchmarks for the valuation of new apartments upon settlement, it would suggest that the greatest settlement risk for the current pipeline of apartments will occur in those areas that display the weakest resale performance. Effectively, the later the sale, the higher the settlement risk.

While those buying off the plan benefit from several tax advantages, avoid the uncertainties of auction and get to enjoy the ‘new-car smell’ that comes with a freshly built dwelling, they are also subject to the market risks of buying property in today’s market and settling in tomorrow’s market.

The apartment market in Inner Sydney has shown resilience in recent times; however, further softening in the resale market may see properties that fail to settle re-entering the market, particularly those apartments bought at the end of the cycle. This will place downward pressure on prices and could have a knock-on effect if such settlement failure then forces developers to discount in order to clear unsold properties.

Geof Snell

Geof Snell

is the principal property

economist at BIS Oxford

Economics