In Knight Frank’s Rightsizing – Australian Prime Residential Insight 2020 report, we’ve found there is growing demand for ‘rightsizing’. This is a downsizing lifestyle trend that is seeing people move away from large prestige houses on big parcels of land that require a lot of maintenance, towards luxury living in smaller but fully featured apartments.

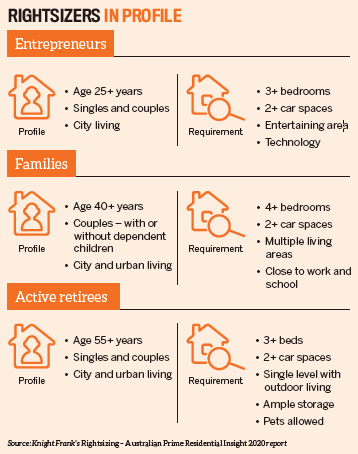

Rightsizers – which include active retirees, entrepreneurs and families – are looking for low-maintenance properties but with house-like proportions and great amenities.

The undersupply of luxury apartment product for rightsizers is one of many key trends investors should watch over the next three years.

In essence, rightsizers are looking for luxury apartments with at least three bedrooms and two secure car spaces in medium- and high-density projects in prime suburbs in Australian cities.

While ‘active retirees’ are one of the main rightsizing buyer categories for prime apartments, the other two main categories are entrepreneurs and families.

Perhaps surprisingly, rightsizing also appeals to the younger generation, and at a much earlier stage than in previous years given the agile, transient and global nature of their work and play.

Among active retirees, many buyers tell us their house is no longer required to provide the lifestyle they want. Often the cost to upkeep the home, pool and garden outweighs the surplus space they once desired.

Downsizing the living areas is not part of this change – the yard most certainly, but the new luxury apartment must be the right size, with amenities to match.

Rightsizers want to be in a walkable location with proximity to activity hubs and amenities. When it comes to the apartment itself, what they’re looking for is high security and a concierge for lock-up-and-leave; a reputable developer and builder with certainty of delivery; a single-level dwelling; in-house amenities; a good view and aspect; access to transport links; a sense of community within the complex; smart-living technology; and a new, modern building.

This prime trend follows a similar path to the wider market, with the average new house size built in 2018/19 falling 1.3% on the year before, while the average new apartment size grew by 3.2%, according to the Australian Bureau of Statistics report commissioned by CommSec.

Our research found that the share of three-bedroom luxury apartments being built over the next three years has fallen in Sydney to 44% for medium-density projects and 14% for high-density, and in Melbourne to 21% for high-density projects.

Brisbane’s medium-density projects have the largest share (87%) of threebedroom apartments to be built in prime suburbs, while Perth’s medium-density projects show the largest growth in the share of threebedrooms being built (from 27% to 50%). In the past three years, the Gold Coast saw the highest portion of three-bedrooms built, at 70% in medium-density projects, and this is expected to rise to 81% built by 2022.