“You have a pretty good bubble in Sydney and Melbourne,” he told AFR, pointing to Sydney’s 40% increase in prices in the past three years. “It is hard to believe it is very sustainable.”

• No bubble trouble

So do we have a bubble or not? The short answer is yes, but not for the whole of Australia, and it’s certainly not the scary scenario you may have been led to believe.

By definition, a bubble occurs when property prices are rising faster than income, finance is readily available, and there’s a lot of optimism about future growth in prices.

Shane Oliver, head of investment strategy and chief economist at AMP Capital Investors, says Sydney has become a bit “bubbly” and prices are very high relative to income.

“There’s a degree of bubble in Sydney and Melbourne,” he says. “There’s been some evidence that people are using the past price gains to get into property investment, believing these strong gains can continue. Melbourne and Sydney are at risk, but the other cities are nowhere near that state.”

• Demand and supply

Guy Bruten, senior economist–Asia Pacific at AllianceBernstein, says that while much of the attention has been focused on the sharp rise in house prices, particularly in Sydney, there has been a sizeable upswing in construction activity too.

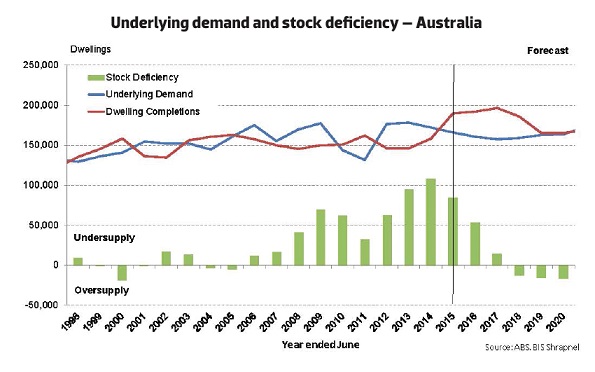

Bruten points out that in 2011 and 2012, before the mining boom started to peak, total housing starts were running at around 150,000 units per annum. In 2014, construction of close to 200,000 new dwellings was commenced.

“That looks set to be surpassed in 2015—perhaps reaching as high as 225,000 units, based on the run rate implied by building approvals data,” he says. “A 40% plus increase in the number of dwelling starts represents a meaningful swing in the supply picture for housing.”

Bruten’s concern stems from the fact that the surge in housing construction is happening at a time when population growth is slowing down.

“In 2008/9, Australia’s population was growing at about 450,000 per year. That’s now slowed to around 300,000, reflecting a sharp slowing in net immigration,” he says. “On average, there are 2.5 people per household. So – in rough, back-of-envelope terms – underlying demand for new housing to meet population growth has slowed from 180,000 per annum to 120,000. While there has been a prolonged period of underbuilding, that trend has now swung to overbuilding.”

However, the record-breaking residential building boom has already peaked and will soon begin to run out of steam, according to economic forecaster BIS Shrapnel.

“After recording strong growth over the past few years, we estimate that total dwelling starts reached just over 210,000 in 2014/15, an all-time record high,” says Kim Hawtrey, associate director at BIS Shrapnel. “From this level, national activity is then forecast to begin trending down over the following three years, with the currently high-flying apartments sector leading the way down.”

Even so, Hawtrey agrees that the surge in building construction is likely to push the national market into oversupply by 2018.

“Low interest rates have unlocked significant pent-up demand and underpinned the current boom in activity, but as population growth slows while construction activity remains strong, new supply will begin to outpace demand. This will see the national deficiency of dwellings gradually eroded and some key markets will begin to display signs of oversupply.”

• What does this mean for property prices?

The looming oversupply scenario is already starting to have an impact on pricing, according to Bursten.

“Growth in average rents, for example, has slowed sharply. Nationwide, rental growth has slowed from mid to high single digits in 2008/9 to just 2% now. And house price growth outside Sydney has slowed sharply too. Price growth in Perth and Brisbane, two cities at the heart of the mining boom-and-bust saga, is now negative.”

Despite the bearish outlook,

Bursten says he doesn’t believe a US or Europe-style downturn is on the cards.

“It’s not necessarily the case that the end game here is a housing collapse and carnage—taking a page from the US, Spanish or Irish playbooks. That all seems too alarmist, particularly as the price boom and the construction upswing have not been accompanied by rampant growth in credit.”

Oliver points out that the property collapse in the US was triggered by very strong price gains, deterioration of lending standards, and the boom in housing construction that resulted in a massive increase in supply in many areas.

“The reason property prices crashed in the US is because lending deteriorated badly. People who shouldn’t get a loan got a loan. We don’t have that in Australia. Lending standards are pretty tight and are tightening up as we speak, so the US-style crash is unlikely,” he says.

• What could trigger a price collapse?

While even the most bearish economists agree that a price collapse is unlikely, all the economists that we spoke to agree that the current price growth in Sydney and Melbourne is unsustainable and prices will inevitably fall.

Here are the three factors that could set off a massive price drop.

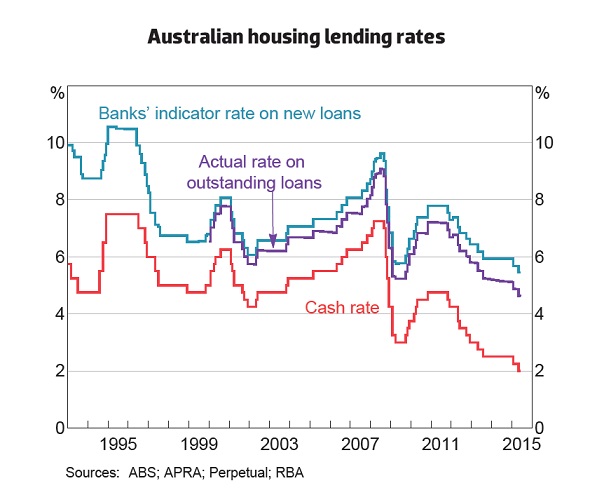

1. A significantly higher interest rate In order for prices to drop dramatically, Oliver says the interest rate would have to go up considerably.

“It requires a high interest rate, which is not happening anytime soon,” he says. “When prices do cool down, we’re likely to see a pullback of around 10% rather than a crash, because the conditions are simply not there for the bubble to burst,” he says.

Historically, the first rate hike doesn’t have much impact, according to Oliver. “You probably need a few interest rate hikes to cause a drop in value,” he says.

“We saw in 2009 that the first interest rate hike didn’t move the market much. It’s only after several rate hikes that it started impacting the market, and that’s not until we got to 2011, by which point the interest rate rose to 4.75% from 3%. Prices kept going up during the first few rate hikes, and it was only when the official cash rate rose to an onerous level of 4.75% and the mortgage rate went to 7.5% around 2010/11 that prices started to react.”

This means that from the current level, even if the interest rate starts rising next year, prices will remain strong until after a few interest rate hikes.

The good news is that the interest rate is unlikely to increase anytime soon. Even better news is that it won’t increase to the same highs that we’ve seen in the past, according to Oliver.

“I don’t think interest rates will go back to where they were in 2010/11,” he says. “People are more cautious now than they were back then. You probably need at least three rate hikes for prices to start coming off. That’s why I think it’s a late-2017 story. If the RBA kept the rate at a low level with no increase next year and then it started rising in 2017, you may not see much impact on the property market till late 2017 or maybe 2018. The RBA doesn’t want a price crash and wouldn’t just raise rates to a point that it would cause one. They would have to make a mistake or do something wrong for this to happen.”

2. Collapse of the economy

If the mining downturn triggers a recession nationwide, not just in Perth, then property prices are likely to suffer, according to Oliver.

“If this happens, unemployment would rise substantially and people would default and have debt servicing problems, and more properties would be sitting on the market at a time when demand is weak. This scenario could cause a price crash. This is a possibility. Recession is a risk in Australia, but it’s unlikely. The chance of it occurring is 20% because, even if Perth is struggling, other parts of Australia seem to be doing better off the back of the lower Aussie dollar and massive improvements in the economy in NSW and Victoria,” he explains.

Even so, a rise in the unemployment rate would be a concern, says Oliver, especially if it went up to 10% or above.

“That’s what happened in the US and Europe. I think it’s unlikely to happen here. The RBA would slash interest rates if that occurred. So far, despite the doom and gloom, the unemployment rate is only up to 6%. It’s hardly a cause of concern at this point.”

3. Property construction boom continues

Oliver also warns that, if the current strong growth in building construction continues unabated, then Australia could end up with massive oversupply hitting the market.

However, he concedes that while it’s a possibility at this point, “we need to see a few more years of strong construction activity for this to occur. I don’t see this happening due to the constraints in the land release program. These are not fast enough to achieve that, to support this kind of building activity and degree of oversupply happening.

“Even if we get higher interest rates, they’re unlikely to go to an exorbitant level; we haven’t seen the deterioration of borrowers that the US saw; and we’re not quite seeing the property construction surge that the US saw during

the GFC. It’s stronger now but just making up for the lack of construction during the past 10 years.”

• What to expect in the near to medium term

The most likely scenario, according to our experts, is that property price growth will ease where it’s been surging, but there’s unlikely to be a drastic drop in values.

“The property investor demand will slow down in Sydney and Melbourne as a result of the tighter lending by the banks, and this will slow down growth over the next 12 months. Sydney prices will probably slow down to 7–8% growth, while Melbourne will probably slow down to around 5%,” says Oliver.

Oliver expects other capital cities to soften as well, and Perth is likely to fall even more.

“The recent tightening in lending by banks is unlikely to cause a property crash. Owner-occupiers will find the going easier on the back of the bank’s drive to gain exposure in the owner-occupied sector to try to fill the gap left by investors. So while the property price gains probably will slow when the heat comes out of the Sydney market, the owner-occupier market share will rise, and this will act as a bit of a cushion to the market.”

The other factor to keep in mind is that the RBA might still cut interest rates. One of the constraints of another rate cut, Oliver says, is the efforts by APRA to slow down investor lending.

“If this is successful and Sydney and Melbourne prices slow down, then the RBA might say, we got what we want – the market has cooled, so now we can cut the rate again. The success of APRA’s move could actually bring on another interest rate cut.”

With all these changes happening in the market, it pays to be extra vigilant and get advice every step of the way. Make sure you buy properties with decent yields and where demand is strong. Don’t overcommit yourself and always set aside a healthy buffer.

Bright spots

While there are a number of challenges facing the market at the moment, Linda Phillips of Propell believes there are several reasons to remain optimistic. These include:

• The tighter restrictions on foreign investment will hardly put a dent in demand. Sydney and Melbourne still look attractive in US dollar terms, and Chinese investors still want to invest abroad, so demand for prestige property and apartments will continue.

• If our dollar exchange rate falls, it makes buying property in Australia even more attractive for foreign investors.

• It appears that the tax advantages of property investment, negative gearing in particular, will remain in place, making this the most effective form of investment, especially for SMSFs.

• Demand exceeds supply in Sydney by a wide margin, and that won’t change anytime soon, so prices will likely stay above where they are now.

• Melbourne is increasingly attractive, especially inner-city suburbs within 7km of the CBD, where most demand lies.

• Brisbane has held value through times of poor state economic growth. As growth returns, and the tourism and agriculture sectors improve, the outlook for Brisbane prices is positive, particularly in the inner-city suburbs and those to the south and east.

• Canberra is stepping into the light, with improved values, now that the purge of public sector jobs has ended. Stable employment makes this city an attractive prospect.

Negatives to watch out for

While the general outlook for the property market remains healthy, Linda Phillips of Propell says there are factors that could threaten the market. These include:

• Stubbornly low economic growth

Australia’s economic growth remains low and is hardly enough to outweigh the decline in the mining economy. If it stays at around 2.25% per annum, then consumer wealth will be under threat.

• Political uncertainty

Australia is due for a federal election in a year’s time. This creates uncertainty about policies on investment and business activity.

• Potential tax increase

At the moment we are being softened up for tax increases. A major hike in the GST rate and the mooted expansion of land taxes would reduce affordability.

• Tighter lending and higher cost of finance

Australia’s big four banks have to improve their capital ratios, which is going to result in an increase in domestic borrowing costs. The impact may be marginal for existing owner-occupiers, but investors are already seeing higher mortgage rates and lower loan-to-value ratios. This especially concerns those who bought apartments off the plan a year or two ago, who will now have to provide additional equity to settle their purchases, so some of this stock may find its way back onto the market.

• Weak global economy

With growth in China under threat, the Chinese stock market having fallen by 30%, and domestic growth slowing, this may reduce demand for and/or prices of our resource exports. The situation in Europe over Greece and the Euro is still in play and is causing businesses to hold off on expansion plans, as businesses do not like uncertainty, which may impact on our exports and reduce tourism potential.