Forget suburbs that have already experienced large-scale price falls, these suburbs indicate that they are going to see a massive slide in property values over the next six to 12 months at least. Is yours one of them?

Supply and demand. It’s something property strategists talk about over and over again, but with due reason. If you want property that will experience good capital growth, go for an area where the supply of properties is low but the demand for them is high.

It’s the reverse for properties that are going to see price falls. If the supply of properties on the market is high but there is little demand for them, prices will go the way of Mach-skydiving daredevil Felix Baumgartner – but there will be no parachute.

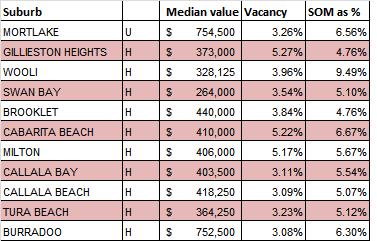

The following suburbs have high vacancy rates, coupled with a high supply of properties on the market and lackluster demand. This indicates that they are highly risky places to invest.

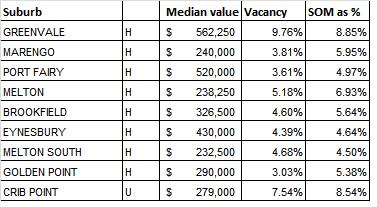

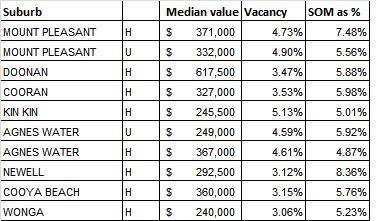

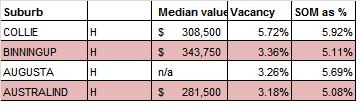

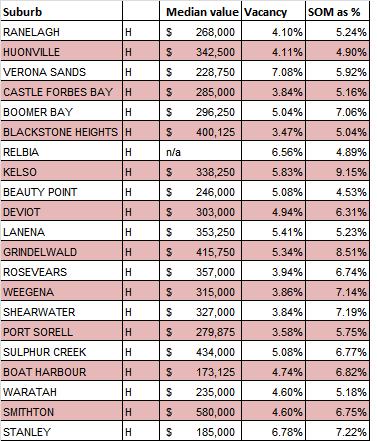

[Note: Where the amount of stock on market (SOM) exceeds 4% of properties within that suburb, this generally denotes heavy oversupply. Vacancy rates above 3% indicate markets where there is either an oversupply of rental properties: the higher above 3% the number is, the more severe the oversupply.]

New South Wales

Victoria

Queensland

Western Australia

Tasmania

Source: DSRscore.com.au