Many investors think that it is simply impossible to accurately predict when or where booms are imminent. In fact, accurate prediction seems to be so risky that some investors refuse to buy properties anywhere, unless a price boom is already underway – and this could prove extremely costly.

Many of us buy lottery tickets, and while we don’t know who will win, we do know that some person must – and that lucky person could be us. The concept of luck also occurs in the property market, with many believing that investors who make quick and huge fortunes from property are just plain lucky.

John Lindeman, property market author, educator and commentator, and director of Property Power Partners, says that whilst waiting for an area to “boom” may remove one risk, it introduces even more dangerous ones.

“For example, the boom could be about to end and recent buyers may discover that they have paid way over market value in suburbs where prices are falling and no one wants to buy,” he shares.

“Knowing the causes of booms empowers us to predict the effects. If we know with some certainty what causes property market booms, busts and slumps to occur, then we can invest with confidence in areas about to boom and easily avoid those suburbs where prices are about to crash.”

The good news is that we can confidently make such predictions about the effects if we know what causes them to happen in the first place, he says.

“There are some types of events that can lead to dramatic changes in prices and rents. The first are natural events, such as droughts or floods and the second are market driven events, such as a retiree led boom,” Lindeman explains.

“Each of these events leads to predictable changes in local prices and rents, so by knowing when and where they are occurring, we can identify the location, intensity and duration of price and rent changes that will result.”

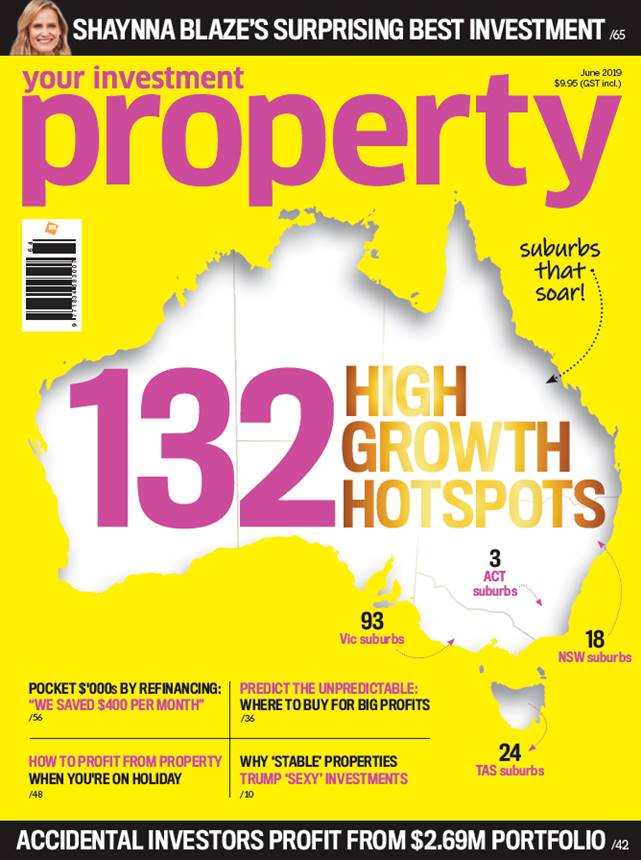

In the current issue, Lindeman looks at each of these in turn and see how we can predict the unpredictable.

For the full story of how to predict the unpredictable, read the complete feature article June 2019 edition of Your Investment Property magazine.

For the full story of how to predict the unpredictable, read the complete feature article June 2019 edition of Your Investment Property magazine.

On sale at news agencies and Coles supermarkets 9th May to 5th June or download the magazine now.