Eliza Owen of Onthehouse.com.au pointed out that despite the overall solid growth in values for Australia’s biggest cities, once you look closely, it’s clear that units have underperformed houses in a big way.

As such, investing in these types of properties is unlikely to give you the strong capital growth return that you get from established and detached houses.

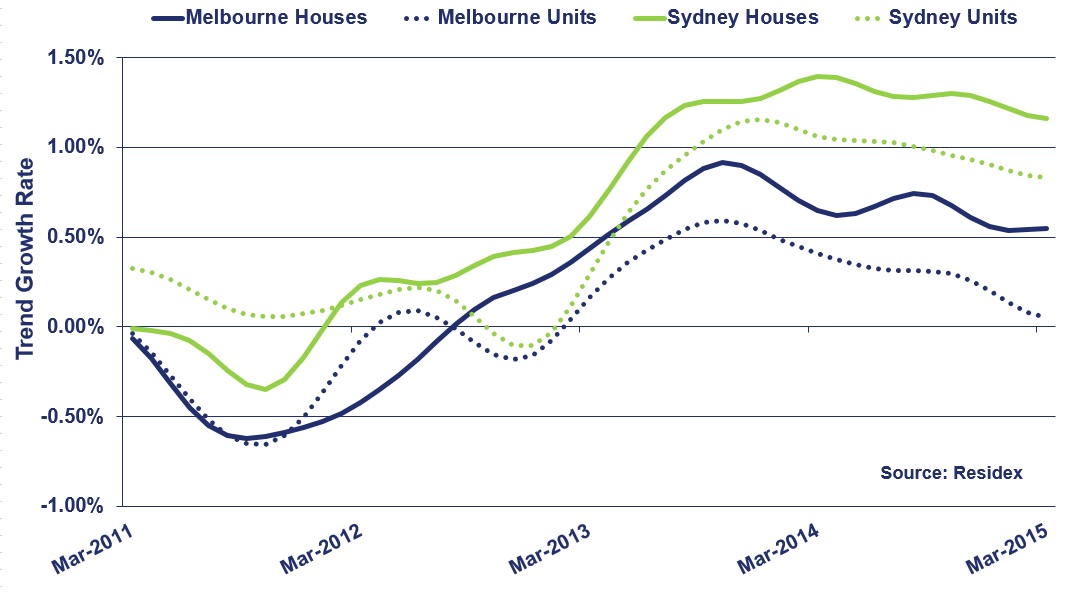

According to the stats from Onthehouse.com.au, Sydney’s house values grew by 3.18% compared to unit’s 2.21% growth during the March quarter.

The disparity is even more pronounced in Melbourne where house values rose 3.11% while unit values fell by 0.8% during the same period.

“Despite Sydney displaying consistent growth across both markets, it’s still clear to see that there is a larger divergence in growth between the two different dwelling types,” Owen said.

“Melbourne has demonstrated the most interesting performance trend throughout March, with such a huge growth in its house market offset by a drop in its unit market.”

Owen warned that while there are exemptions to the rule, the new units being developed in Australia’s biggest capital cities may not give you the best capital growth returns.

“These growth rate figures raise questions regarding the longevity of a unit investment. In fact, I would argue that new units are a mal-investment of resources in the long term, because they are developed in response to speculative investment, rather than actual demand for accommodation,” she said.

Owen pointed out that although units will present as relatively affordable, “it is clear they do not produce higher capital growth returns, particularly now when the unit market is showing signs of oversupply.”

“Broadly speaking, both Sydney and Melbourne might be coming to a position of oversupply,” Owen added. “I also think that the nature of units being developed in Sydney and Melbourne is not necessarily very high quality. They will have the potential of providing lower living standards for tenants. That means that as the market fluctuates, the new units would become less desirable and retain less value than property with higher quality. “

Graph: Houses vs units

Source: Onthehouse.com.au