Interest rate cuts and the return of lending to investors over the past year have seen the re-emergence of investors as a dominant force in the national housing market, states new data from the Australian Bureau of Statistics (ABS) and the Reserve Bank of Australia (RBA).

Housing finance data for January 2017 (published by the ABS) showed that during this period, demand from the investment segment of the market was continuing to surge. CoreLogic paired the ABS’ housing finance data with the RBA’s lending aggregate data to provide deeper insights into housing investor behaviour.

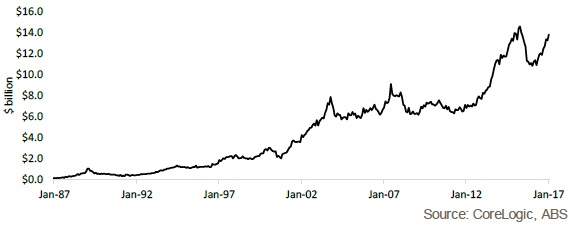

Investor finance commitments on the rise

Over the month, investors committed to a total of $13.8bn in finance for investment properties, representing a 4.2% rise over the month and a 27.5% increase year-on-year (the largest annual increase since August 2014). While the value of investor housing finance commitments remains below its previous peak, it has ramped up significantly over the past 12 months.

“In fact, the value of investor housing finance commitments in January 2017 was just -5.3% lower than its historic peak in April 2015,” said Cameron Kusher, CoreLogic’s head of research.

According to Rich Harvey, CEO of Propertybuyer, the decline following the April 2015 peak in new investor housing finance commitments was a result of APRA’s 10% speed limit in growth for investor finance, introduced in December 2014.

“It fell sharply after that time as banks introduced tighter lending standards and higher interest rates for investors,” Harvey said. “In addition, many people switched their loans from investment loans to owner-occupier loans to avoid the price premium.”

As a result of the sharp decline in investor finance commitments prior to March 2016, they have grown very strongly in the past 12 months. “If you average out the growth since 2012, it shows a steady but still strong increase in investor commitments,” Harvey said. “This is likely due to the relative strong performance of the housing market relative to other asset classes in recent years, the steady fall in the exchange rate since that time, and the record low interest rates (although they are now on the increase, independent of the RBA).”

Commitments are flowing towards established dwellings

It’s also evident that most of the investor housing finance commitments are flowing to established homes rather than new homes. “This isn’t really a surprise when you consider that the amount of established housing stock is substantially greater than new stock and new housing typically has a price premium over existing stock,” said Kusher. Over the month, $1.2bn in commitments were for new construction, compared to $12.6bn for established housing stock.

Investor housing credit is on the rise

In January 2017, investor housing credit expanded by 0.6% to be 6.6% higher over the year, according to data published by the RBA. Investor housing credit represents the total amount outstanding to mortgage lenders for the purpose of investor housing. “Much like the housing finance data, the credit data shows the impact of APRA’s recent curbs to investor credit growth which have slowed growth. However, more recently credit has once again started to expand,” said Kusher.

It is also interesting to note the ratio of investor finance to owner-occupier finance. “Historically, the level of owner-occupier and investor commitments track each other quite closely. Recently there was a larger than usual gap between the two following the introduction of the APRA guidance on growth in investor loans, and now that ratio is reverting to its longer term average,” Harvey said. “If the pace of growth in investor loans continues, then the value of investor finance commitments may approach that of owner-occupied commitments. However, APRA and/or the banks are likely to introduce further restrictions before that time if it is looking like a risk.”

Related stories:

A Summary Of The 2016 Housing Market

Figures Show Impact Of APRA's Investment Lending Crackdown