The PCA claims ATO figures show the dollar value of deductions claimed via negative gearing has fallen drastically in recent years, proving that investors aren’t exploiting the tax break.

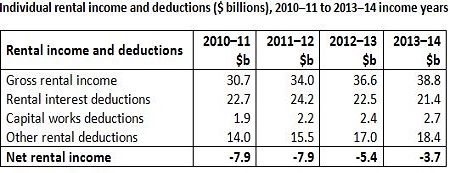

“According to the ATO, total losses from investment properties have fallen from $7.9 billion in 2011-12 to $3.7 billion in 2013-14”, PCA chief executive Ken Morrison said.

“This data puts a further hole in the case of those arguing for change,” Morrison said.

Source: PCA/ATO

Morrison claims the fact the dollar amount claimed via negative gearing has fallen so much in a relatively short period of time points to the fact investors are using real estate to sustainably build wealth, rather than use it for any tax breaks it offers.

“Australians are using property investment properly. They are using it to responsibly prepare for their retirement.”

“The current taxation arrangements for investment properties are working well – they are supporting prosperity, creating jobs and doing so in a way that is sustainable.”

Morrison also claimed that changes to negative gearing could jeopardise current rental stability in Australia.

“Investment in property is driving jobs, growth and keeping rents down. At the same time, there is absolutely no evidence that negative gearing is being abused.

“Importantly, Australians are experiencing a stable rental market due to increases in supply over recent years. 30% of this supply is the result of property investors.”