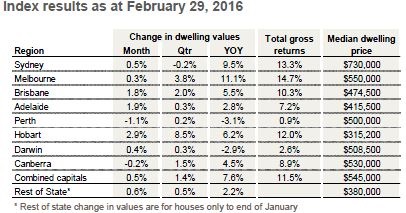

Released yesterday, CoreLogic’s February Home Value Index has revealed that dwelling values in Australia’s capital cities rose by a combined 0.5% in February.

In the three months to February, capital city values rose by a combined 1.4%, while they are up a combined 7.4% over the year.

While Sydney still holds the highest median dwelling value of any capital city market, the New South Wales capital is the only market that saw a decline in value in the three months to February, down 0.2%.

The median dwelling value rose 3.8% in Melbourne, 2% in Brisbane and 1.5% in Canberra.

Median values in Darwin and Adelaide rose 0.3%, while Perth saw a 0.2% rise over the three-month period.

In somewhat of a surprise, Hobart was easily the strongest performer over the quarter, with an 8.5% increase, while its 2.9% increase was also the strongest seen in the month of February.

The Tasmanian capital also had the third highest rate of growth over the 12 months to February, with its 6.2% increase behind only that of Melbourne’s 11.1% and Sydney’s 9.5%.

Source: CoreLogic RP Data

Tim Lawless, research head at CoreLogic, said that year-on-year growth is the strongest seen in Hobart since mid-2010 and is a prime illustration of how markets that have been underperforming in recent years are beginning to show signs of life.

“The trend in home value growth is showing signs of increasing in those markets that have previously underperformed. These include Brisbane, Adelaide, Hobart and Canberra,” Lawless said.

“Affordability constraints aren’t as apparent in these cities and rental yields haven’t been compressed to the same extent as what they have in Melbourne or Sydney,” he said.

The strong recent performance of Hobart is of no surprise to Rob Zubin, managing director of My Property Hunter.

“Right now there’s a pretty positive view of Hobart and its surrounds. Anywhere within a 20-minute walk of the CBD is really showing some good signs and proving to be pretty popular,” Zubin said.

“Right now the level of economic activity in Hobart and Tasmania is stronger than I’ve seen in anytime over the last 20 years. Right now we’ve got two or three major hotels going up, the university has a huge project going and so does the hospital,” he said.

Zubin said he expects activity to pick up even more in the next 12 – 18 months as those developments continue, while the state’s burgeoning tourism industry is also expected to continue to improve.

Zubin said he believes prices in Hobart are currently fair value, and he said the city has recently seen investors taking a much closer look at it.

“The last 12 months we’ve seen investors start to take a bit more notice. From 2009-13 they really shied away from here, but now the affordability issues in Sydney and Melbourne have them looking for somewhere with a lower base.

“What people are finding is that the market has a lot to offer. For those that want to take a bit more of risk, they can pick up a house on the north side of town for $150,000 and chase the higher yields.

“In the inner city, which is pretty affordable at around $350,000, you can get a bit more of balance with yields at around 6% and capital growth of 3% or 4% over the year.”

According to the CoreLogic index, Hobart boasts rental yields of 5% for houses and 5.1% for units.

Darwin, at 5.2% for houses and 5.3% for units, has the best yields in the country.

Melbourne, at 2.9% for houses and 4% for units, is the worst market in terms of yields.