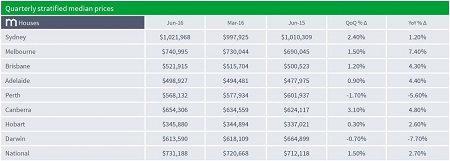

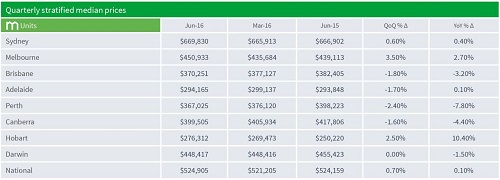

Figure from Domain Group’s June Quarter House price report show that house prices increased in the majority of capital cities over the three month period, while only three markets saw an improvement in unit prices.

“With the prospect of further interest rate cuts, it’s likely that house prices will continue rising in 2016, as improved affordability stimulates a surge in market confidence for both buyers and sellers,” Domain Group senior economist Andrew Wilson said.

“Unit price growth is also lagging behind houses, with record apartment building pushing supply ahead of buyer demand,” Dr Wilson said.

According to Domain’s figures, the median house price in Australia sat at $731,118, having increased 1.5% in the June quarter and 2.7% in the year since June 2015.

The median unit price on the other hand increased just 0.7% over the June quarter and 0.1% year-on-year to $524,905.

In Sydney, the June quarter saw the harbour city return to the million dollar club as the median house price grew 2.4% to $1,021,968.

Year-on-year house prices have grown just 1.2% in Sydney since June 2015, however the growth rate will likely increase.

“Last quarter, Sydney house prices dropped below $1 million, but they have bounced back as lower interest rates boost market confidence,” Dr Wilson said.

“The current growth rates are significantly lower than the rises during Sydney’s property boom but, with the revival of investor activity, it’s likely there are more increases coming for the capital.”

While Sydney’s annual rate of house price growth has slowed, Melbourne’s remains quite strong at 7.4% in the year to June.

The June quarter saw a 1.5% increase to a median of $740,995, which Domain claims is a record mark.

“Melbourne’s growth over the past year is the strongest result in the nation. The new record for median prices reflects the robust market, strengthened by rising buyer and seller confidence,” Dr Wilson said.

While Melbourne leads the way in terms of annual growth, Canberra recorded the strongest conditions over the June quarter as its median price rose 3.1% to $654,306.

Over the year, Canberra’s median price increased 4.8%, second best behind Melbourne, and Dr Wilson said confidence levels and prices will likely continue to increase.

Adelaide also saw strong growth over the year, with its median house price up 4.4% to $498,927, while in Brisbane the median house price rose 4.3% to $521,915 in the 12 months to June.

The median house price in Hobart was up 2.6% over the year to $345,880.

There is still no good news for the markets in Perth and Darwin, with quarterly and yearly falls recorded in both markets.

In Perth the median house price is down 5.6% over the year to $568,132, while in Darwin the past 12 months have seen the median price fall 7.7% to $613,590.

“With steep annual falls in house prices, [Perth] is a long way away from returning to a healthy market,” Dr Wilson said.

“Darwin prices have continued to decrease as demand from resource industry workers dwindles in line with the downturn of the mining economy.”

Source: Domain Group

For the unit market, Hobart was easily the strongest performer with its median price up 10.4% over the year to $276,312.

Melbourne was home to the best quarterly performance with the median price up 3.5% to $439,113 in the three months to June, while Sydney also saw a small quarterly rise.

Along with Hobart, Sydney, Melbourne and Adelaide saw annual increases, while prices are down in Brisbane, Canberra Darwin and Perth.

Year-on-year, the median unit price is down 7.8% in Perth, followed by 4.4% in Canberra.

Source: Domain Group