Is the Queensland property market turning a corner? New figures suggest that property prices in the Sunshine State have finally bottomed out, and are bouncing back strongly in some areas.

According to the latest quarterly data from the Real Estate Institute of Queensland (REIQ), the Queensland property market has turned around and posted positive results for the first time in 18 months.

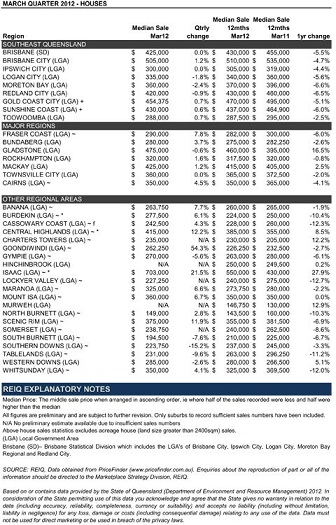

The March quarter median house price report from the REIQ found property prices across the majority of the state had increased, with sales numbers also showing significant improvement in some areas.

“Three months ago when we analysed the December quarter data it seemed to indicate we had reached the bottom of the market because prices were stabilising,” said REIQ CEO Anton Kardash.

“We predicted at the time that the March quarter data would be even more positive and it certainly is that. Property prices have grown in most areas and some regions have also experienced substantial increases in sales activity, which is a hugely welcome turn around.

“And while the March quarter figures contain plenty of good news, perhaps the best piece of news is some very healthy results in our tourism centres, which have struggled more than most over the past two years.”

The best performer out of all the major regions surveyed by the REIQ was the Fraser Coast, showing median house price growth of 7.8% to hit $290,000 over the March quarter. The REIQ also noted that the numbers of preliminary house sales were also up in the area by an impressive 42%.

Agents in the area have put its renaissance down to a busy Christmas period, as well as the area’s affordability.

Cairns saw a welcome comeback in its capital growth rates, seeing median house price growth of 4.5%. Its median house price now sits at $350,000, according to REIQ figures, and local agents believe that there is excellent value for money to be found in the area – especially at the upper end of the market.

“It is wonderful that Queensland’s tourism centres are starting to experience improving market conditions,” said REIQ chairman Pamela Bennett. “Fraser Coast and Cairns have not had much time in the sun over recent times so to see their markets starting to turn a corner are surely a sign of more positive results in the months ahead.”

Looking at Queensland’s booming resource regions, it appears that the Gladstone market has hit a flat patch, recording quarterly growth of -0.6%. Few investors will argue with its annual growth rate of 16.5%, however.

“Historically, it has been our resource centres that have led the charge during Queensland property cycles, closely followed by Brisbane, then our tourism centres and this pattern does seem to be repeating,” said Kardash.

“It’s still too early to tell whether this renewed confidence is here to stay, but a number of economic indicators, as well as lower interest rates, mean the future of our property market is certainly looking up.”

Brisbane saw its median house price rise by 1.2% over the March quarter to hit $505,000, according to the REIQ.

Are you looking at investing in Queensland? Join the conversation in the where to buy section of our property investment forum.

More stories:

Finding a property investment hotspot: 5 top tips

City vs country: where are the best property investment prospects?