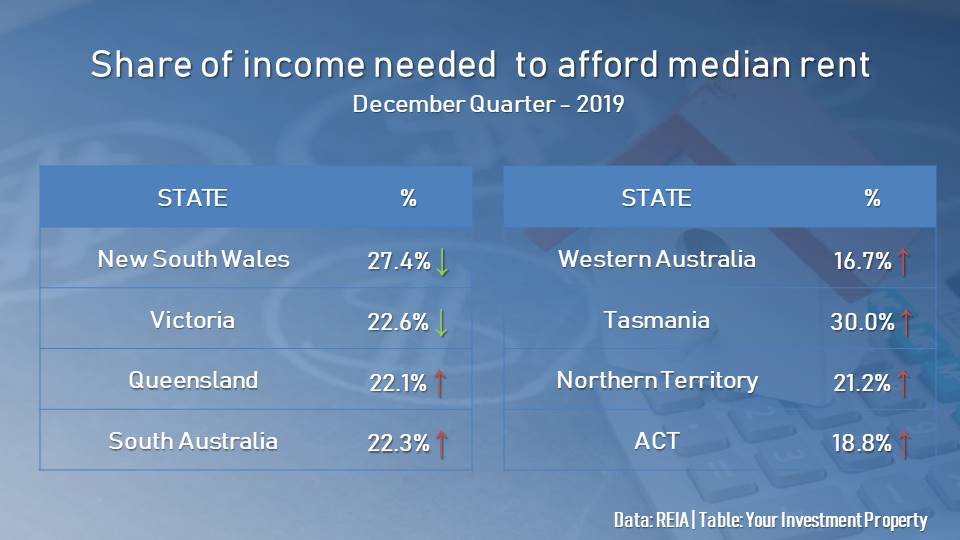

Rental affordability in New South Wales and Victoria improved over the final quarter of 2019, bucking the downtrend seen in other states, according to the latest report by the Real Estate Institute of Australia (REIA).

The share of income renters need to afford median rents was 27.4% in New South Wales and 22.6% in Victoria.

However, the most affordable median rents are in Western Australia. Despite the deterioration of affordability in the state, Australians only need to allocate 16.7% of their income to afford renting a property.

Also read: Victoria in need of rental units

The table below shows the share of income needed to afford median rents in each state:

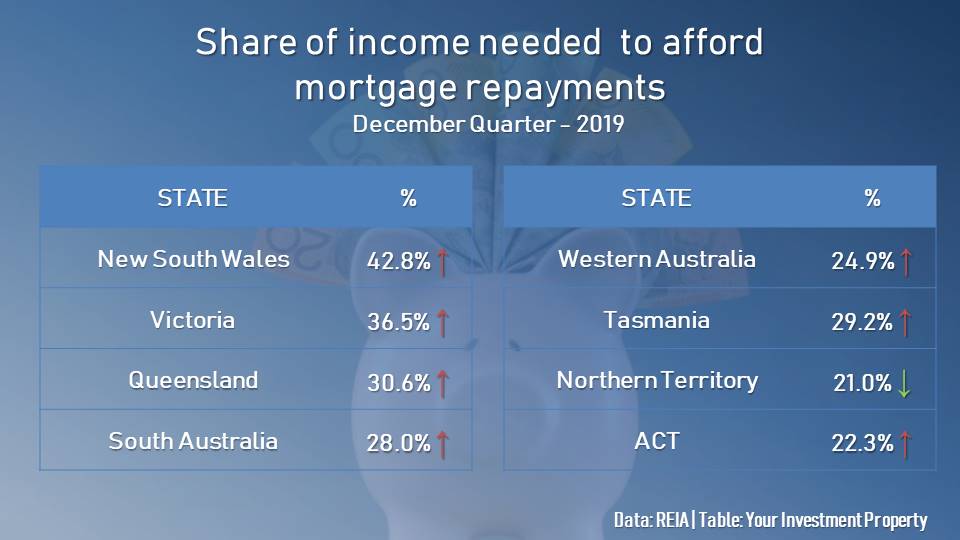

According to REIA, housing affordability across Australia declined by 2% during the December quarter. This means that the proportion of income needed to meet loan repayments has increased to 34.7%, on average.

Housing affordability declined in all states and territories except for the Northern Territory. This came even with the several rate cuts made by the RBA last year, which lowered the cash rate to a historic low of 0.75%.

As a result of the rate cuts, home-loan costs declined during the quarter, with the average variable rate hitting 4.8% and the average three-year fixed rate sitting at 3.1%.

Of all states, New South Wales recorded the most significant decline in affordability. Homeowners in this state spend 42.8% of their income on mortgage repayments.

The tables below show the affordability situation in each state during the quarter: