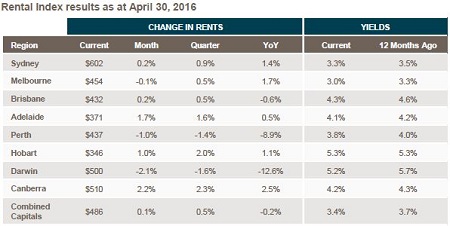

According to CoreLogic RP Data’s April Rental Review, the combined capital city rents grew by 0.1% during April, but were 0.2% lower than compared to April 2015.

The annual fall was the result of continued poor performance in the rental markets of Perth and Darwin, where rents have fallen 8.9% and 12.6% respectively over the year to April.

Brisbane also saw a fall over the year, with rents declining 0.6%.

Sydney (1.4%), Melbourne (1.7%), Adelaide (0.5%), Hobart (1.1%) and Canberra (2.5%) all saw modest rental increases over the 12-month period.

The combined capital city rental rate for a house is currently $490 per week and $467 per week for units.

Source: CoreLogic RP Data

CoreLogic research analyst Cameron Kusher said there is little sign that the rate of rental growth will pick up in the near future.

“We anticipate that the weakness in the rental market will persist over the year and rents will continue to fall over the coming months. The annual change in rental rates continues to be at its slowest pace since before 1996,” Kusher said.

“At the same time last year, rental rates increased by 1.7% which indicates a sharp slowdown in rental growth over the past year,” he said.

Kusher said it’s likely that landlords may have to drop rents in the near future as market conditions begin to favour tenants.

“Factors contributing to a slowing in rental growth include falling real wages, excess rental supply in certain areas and lower rates of population growth - all of which have impacted on demand for rental accommodation,” he said.

“With dwelling approvals at recent record highs and construction activity set to peak over the next 24 months, accompanied by many new properties still to settle, we anticipate that the weak rental market conditions will persist with rental growth continuing to slow and, or, fall in most capital cities.”

“Based on current market conditions, landlords won’t be in a position to lift rental rates and may actually need to reduce rents in order to keep their tenants. We see renters as holding a stronger negotiation position and where they now have the potential to upgrade into higher grades of accommodation for a similar or lower rent.”

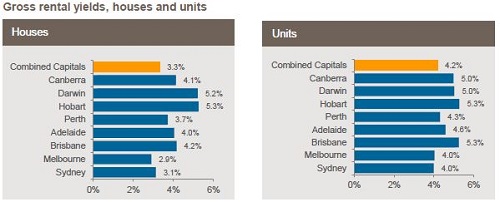

That is likely to have a further impact on rental yields, which have already hit record lows in some markets.

“In our two largest capital cities, we’ve seen rental yields move to record lows of 3.1% for houses and 4.0% for units in Sydney and in Melbourne, rental yields are at a record low 2.9% for houses and 4.0% for units,” Kusher said.

“With home values continuing to grow and rental markets expected to soften further, don’t be surprised if we see a further compression of gross rental yields over the coming months.”

Source: CoreLogic RP Data

According to CoreLogic’s figures, rental rates remain at record highs in Sydney ($602 per week), Adelaide ($371) and Hobart ($346), but are lower than their previous peaks in all remaining capital cities.

The decline in rents from their respective peaks are recorded at: -0.1% in Melbourne ($454), -0.8% in Brisbane ($432), -13.7% in Perth ($437), -17.3% in Darwin ($500) and -5.4% in Canberra ($510).