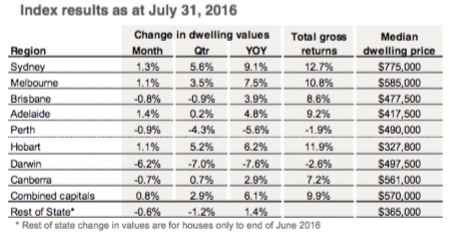

According to CoreLogic’s July Home Value Index, combined capital city dwelling prices increased 0.8% over the month, with the median capital city dwelling price now sitting at $570,000.

The July improvement now means capital city dwelling prices have increased 6.1% in the year to July 2016, which is the slowest rate of annual growth recorded since the year to September 2013.

It is also well below the peak annual growth rate of 11.1% recorded over the year to October 2015.

CoreLogic research head said the apparent slow down in price growth will likleky be welcomed, however housing affordability is likely to still be a concern for many.

“The recent moderation in the rate of capital gains should be viewed as a positive sign that growth in dwelling values may be returning to more sustainable levels,” Lawless said.

However, the growth trend rate is still tracking considerably faster than income growth resulting in a deterioration of housing affordability,” he said.

The July Index gives bragging rights back to Sydney, with CoreLogic’s figures showing it’s median dwelling price now sits at $775,000 after growing 5.6% in the three months to July and 9.1% year-on-year.

Melbourne was the next best performer, with its median dwelling price improving by 3.5% in the July quarter and 7.5% year-on-year to $585,000.

While their annual rates of growth are still solid, both Sydney and Melbourne’s are still below well below their peak annual growth rates of 18.4% in the 12 months to July 2015 for Sydney and 14.2% in the year to September 2015 for Melbourne.

Hobart also saw strong growth in the year to July, with its median dwelling value up 6.2% to $327,800.

In Brisbane, the median dwelling price of $477,500 went backwards in the July quarter, but was up 3.9% year-on-year, while Adelaide ($417,500) saw growth of 4.8% in the year to July.

Canberra’s median dwelling priced inched 2.9% higher over the year to $561,000.

The July index shows Perth ($490,000) and Darwin ($497,500) are continuing to struggle, with the two markets seeing monthly, quarterly and yearly falls in their median dwelling values.

Source: CoreLogic RP Data

While the majority of markets are still seeing prices rise, Lawless said there are some signs power is shifting to buyers.

The average selling time is pushing higher, with capital city dwellings now averaging 47 days to sell compared with 42 days a year ago, with total dwelling sales in the three months to July 17.9% lower than the corresponding period 12 months ago.

“As homes take longer to sell, vendors are starting to apply larger discounts to their asking prices,” Lawless said.

“Potentially, as buyers gain some leverage in the market and vendors become more flexible in their pricing expectations, this will assist in alleviating price pressures from the hottest markets such as Sydney and Melbourne,” he said.

While growth has cooled somewhat, the fact it remains in positive territory has had further impact on rental yields.

“The latest growth in dwelling values comes at a time when rental conditions remain soft. Capital city rents were down again over the month to be 0.6% lower over the past twelve months,” Lawless said.

The recent fall in weekly rents has pushed capital city rental yields to a new historic low of 3.3% with Melbourne now recording the lowest gross yield for houses at 2.8%, while Sydney now shows the lowest yield profile for units, averaging 3.9%.