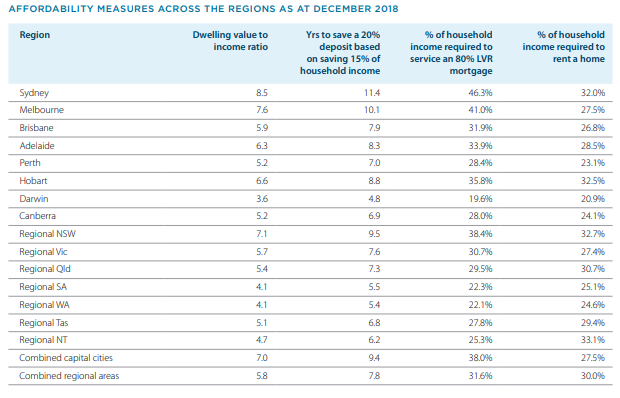

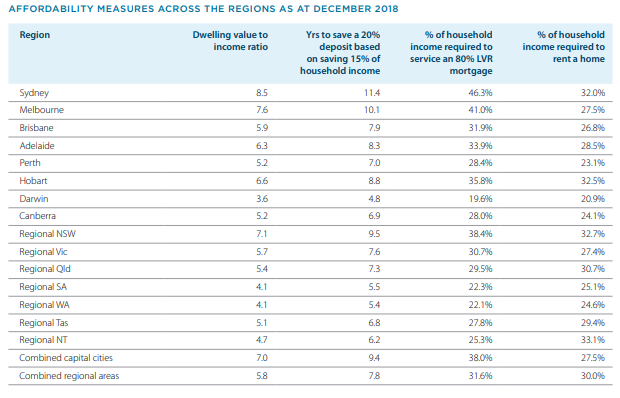

Average housing affordability in the country is the best it has been since 2016, according to research from CoreLogic and Australia and New Zealand Banking Group (ANZ).

“The recent drop in property values follows a long period where prices increased at a much faster pace than household incomes,” said CoreLogic’s Head of Research for Australia Cameron Kusher.

Data showed that property is at its cheapest in decades in some cities. Darwin and Perth are experiencing the most affordable conditions since September 2004. Hobart market, meanwhile, posted historically low prices.

"For the first time, we’re seeing suburbs and towns in every state where it is more affordable to buy than rent," said ANZ Home Owners Lead Kate Gibson.

The significant drop, together with record-low interest rates, lures more first-home buyers into the market, according to Gibson.

The report also found that Hobart is the least affordable capital city for renters, while Darwin is now the most affordable capital city for buyers. Sydney remains still the least affordable market to buy in, followed closely by Melbourne.

Kusher said, though, that falls are likely to end soon. “We predict that price falls will settle later this year, followed by modest price growth starting from 2020,” he said.

Larger image below

Source: ANZ-CoreLogic Housing Affordability report