Brisbane is one of the few cities that are bucking the overall downtrend in home prices, but will it continue to thrive despite the hikes in interest rates?

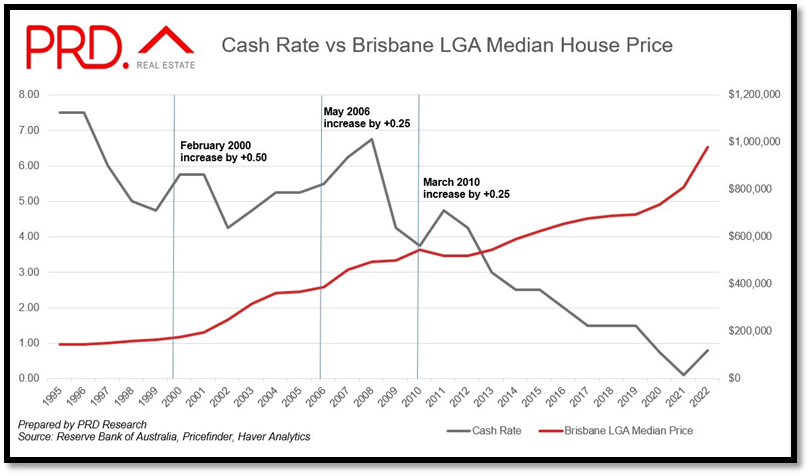

PRD Real Estate chief economist Dr Diaswati Mardiasmo said historical analysis shows that the Brisbane market kept going on a growth trajectory, despite cash rate changes.

“It certainly survived the February 2000 50bps cash rate increase,” she said.

The median house price in the Brisbane LGA was $164,000 in 1999, with a cash rate of 4.75%. Even with the hikes in 2000 that brought the cash rate to 5.75%, the median house price still increased to $175,000 and continued to do so in 2001 where it reached $197,000.

“The next cash rate increase was in May 2006, but only by 25bps — this time again, Brisbane LGA median house price thrived,” Dr Mardiasmo said.

“Brisbane median house price was $367,000 in 2005, with a cash rate 5.25%. It raised to $388,175 in 2006, with a cash rate of 5.50% and and increased to $460,000 in 2007, with a cash rate of 6.25%.”

However, there was a period when Brisbane median prices dipped — between 2010 and 2011, median prices in the city declined slightly from $545,000 to $520,000, when the cash rate increased from 3.75% to 4.75%.

“It is important to note that the increase in price prior to 2010 cash rate changes was not as steep as now, and back then we did not have the deep imbalance between demand and supply,” Dr Mardiasmo said.

“If we are being cautious, taking in the 2010-2011 experience, we may see a very slight softening in the market, followed by a levelling, before picking up steam again.”

Still, Dr Mardiasmo believes the Brisbane housing market would still be able maintain its strong position, allowing it to provide a good balanced opportunity for both buyers and sellers.

One key factor that would support growth in Brisbane house prices are the opening of the international borders.

“I just saw the number of international students arriving in Queensland, which is mostly in Brisbane, for March 2022 — we are up from 30 students in March 2021 to 4,190 students in March 2022,” she said.

“No wonder our property market will continue to grow. And that’s just the international students category – there are other international arrivals as well.”

Figures from the Real Estate Institute of Queensland (REIQ) showed median price gains of 3.23% for houses and 2.17% for units over the first quarter of the year.

REIQ CEO Antonia Mercorella said houses in Brisbane LGA had a median price of $1.09m over the quarter.

“While this may be sombre news for some, this still represents relative affordability compared to southern states, and arguably our capital city has been long overdue for its time in the sun after years of steady, but modest, growth,” Ms Mercorella said.

“What's pleasing about the latest results is that, again, it's not just our capital city performing - our regional centre property markets and communities also continue to benefit from a growth uplift.”

Ms Mercorella said Queensland still has all the fundamental ingredients for continued growth – a booming population, very low supply, strong and cashed-up buyer demand, relative affordability, and low interest rates.

“So even as we face more interest rate rises, we expect this will take time to noticeably impact buyer’s pockets and sales prices, and in the meantime, the clear supply shortage will continue to tip the scales in favour of sellers, as buyers compete to secure a property,” she said.

—

Photo by @jtc on Unsplash