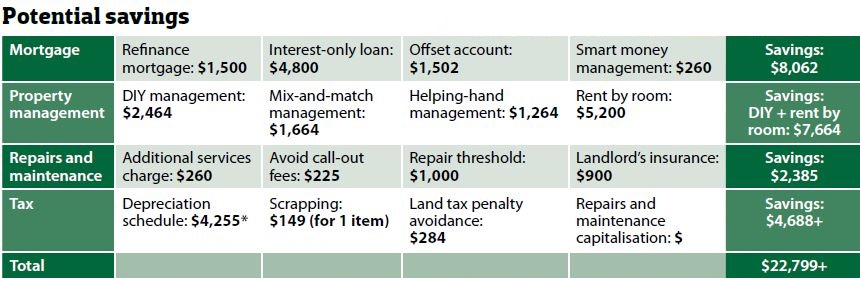

Along with “give up smoking/ drinking/fast food”, “save more money” is one of the most common New Year’s resolutions. For astute property investors – who tend to be more canny with their money than the average Joe – increasing savings is more than a simple wish. Rather, it is an important, ongoing goal. Yet, ironically, when you are already conscious of where your dollars are going (as sensible investors are), it can be hard to see where or how to save more. Fortunately, there are ways and means to do so. Here are 20 suggestions of how you can save more money on a property investment.

Mortgage

There are a number of changes that can be made to the structure and conditions of an existing mortgage, which can help you save significant amounts each year.

1. Refinance your mortgage

With interest rates currently as low as they are likely to go, and banks in competitive mode, it is a good time to refinance a mortgage. Results Mentoring coach Brendan Kelly says that if your mortgage is not already set at a fixed interest rate, it would be prudent to get it set at one immediately.

Find a bank offering an attractive two- to three-year fixed interest rate, and refinance with that bank, or negotiate to refinance at that rate with your existing bank, he says. “If you can do that now, that will save you money because fixed rates at the moment are much better than the variable rates.”

Savings calculation*:

- Mortgage: $300,000

- Existing interest payments: 6% per year, or about $18,000 per year

- Change to a fixed rate at 0.5% less a year = $16,500

- Potential savings: $1,500 per year

2. Go for interest-only loan repayments

Opting for an interest-only loan payment structure, instead of a normal principal and interest loan, can help save money. An interest-only loan essentially means you are not paying down your debt, rather you are merely servicing the loan itself. Kelly says it is only possible to do this for a period of up to five years, which means that in order to maximise the savings potential it would be a good idea to sell the property in a shorter time period. Otherwise, you will have just accumulated more debt to pay back in the long term.

Savings calculation*:

- Mortgage: $300,000

- Principal and interest repayments: 6.5% over 25 years, or $2,025 a month

- Change to interest-only repayments: $1,625 per month

- Potential savings: $400 per month, or $4,800 a year

3. Set up an offset account

A great way to cut your interest and make some savings is with a mortgage offset account. A 100% offset account works like a standard transaction account, but the money in the account is used to offset your mortgage loan. Interest is then only charged on the remainder of the loan.

Savings calculation:

- Mortgage: $300,000

- Offset account: $10,000

- Rather than paying interest on $300,000, you pay interest on $290,000

- Estimated years/months saved: 1 year 6 months

- Potential savings: $1,502 per year

4. Be strategic with credit

Smart money management using your credit card is a strategic way to save some funds. Empower Wealth’s Ben Kingsley explains that on a credit card there is an interest-free period of up to 55 days on repayments.

Put your bills and fixed costs on your credit card, he says. “That gives a rolling credit balance on that card. If the balance is down, there is an auto-sweep. This ensures no interest and allows that money to, essentially, be part of an offset account.”

Savings calculation:

- Rolling credit limit: $5,000

- Interest rate: 5.2%

- Potential savings: $21.60 per month, or $260 per year

5. Follow good practice

Sometimes it can be difficult to quantify exactly how much a certain tactic might help you to save, particularly on an annual or shorterterm basis. However, some of the following tactics are good practice and will end up saving you money, particularly in the longer term.

They include:

- Paying all your mortgage fees and costs up front

- Always checking your statements: mistakes can cost

- Remaining ever ready to renegotiate terms and conditions with your bank

Property management

It has become common practice for investors to use the services of a property manager, but if you want to save some cash, there are a number of other options when it comes to property management.

6. Go DIY all the way

The most obvious alternative to employing a property manager is to manage your property yourself. This tactic means you take responsibility for letting the property as well as for its day-to-day management.

A property manager usually costs 7–9% of a property owner’s rental income, Kelly says. “That means that if you get about $20,000 per year in rental income, about $1,400–$1,800 of that goes to the property manager. So, if you do your own property management you potentially could save that amount each year.”

Savings calculation*:

- Rent: $400 per week

- Property manager cost at 8%: $32 per week

- Letting fee: $800 (for 2 weeks’ rent on $400/week property)

- Potential savings: $1,664 per year (annual management fee) + $800 (letting fee)

7. Mix-and-match management

Another property management option is hiring an agent to do the letting only, Diane Bukowski, from Eezirent, suggests. “In many ways, it is the biggest part of the job. Most agents will do it for the equivalent of one to two weeks’ rent. After that, a landlord can do the rest of the property management.”

Savings calculation:

- Rent: $400 per week

- Property manager cost at 8%: $32 per week

- Potential savings: $1,664 a year

Savings calculation:

- Potential savings: $800 (for letting fee of 2 weeks’ rent on $400/week property)

8. Get a helping hand

If you are keen to DIY the management of your property to save some money, but hesitant to do so due to a lack of knowledge, there is another cost-effective option. Companies like Bukowski’s Eezirent and Renting Smart act as a helping hand to landlords who want to do their own property management, but would like a little assistance. Such companies usually charge about $400–$500 per annum.

Savings calculation:

- Annual management fee for $400 per property at 8%: $1,664

- Helping-hand costs: $400

- Potential savings: $1,264

9. Rent by room

Making changes to the way in which you rent out your property could lead to significant savings, without the need to make financial sacrifices. Kelly suggests renting out properties by the room (to students, for example) rather than to one family. “You might have a three-bedroom property. For a tenant family, you might get $350, but by the room you could get $450-plus.”

Savings calculation*:

- Rent three-bedroom house to one family: $350

- Rent three-bedroom house by room: $450

- Potential savings: $5,200 (due to the extra $100/week in rent)

10. Keep on top of market rent

Ensuring you are up with the play when it comes to the rent being charged on comparable properties in the area will help

save money. According to Bukowski, it can be very easy for landlords to short-change themselves in this area. Many landlords simply don’t put the rent up when they should, and that ends up costing them in rental income, Bukowski says. “Make sure you do, and it will save you long term, although it is difficult to put a figure on how much.”

Property maintenance

When it comes to property maintenance, there are a range of strategies you can adopt to make savings.

11. Charge for additional services

Increasing rental income by charging for additional maintenance services is, ultimately, a money-saving strategy.

For example, ask a tenant to pay more money for a service you would provide, like regular lawn mowing and maintenance, Kelly explains. “The lawn mowing might cost $10 a mow, but if you charge your tenant $15 extra per week for that service, that would give you an increase of $5 a week.”

Savings calculation:

- Lawn mowing and maintenance: $10 per week

- Charge to tenant: $15 per week

- Additional money for landlord: $5 per week, or $260 per year

12. Avoid call-out fees

Assuming your property is not too far away, avoiding call-out fees for minor repair and maintenance work is a money-saver.

There can be a $75 call-out fee for a property manager, but they may be called out over something tiny, and this could happen three times a year, Kingsley says. “That adds up.

Get your tenants to call you when there is a problem. If it is possible, DIY it, but if it is a major issue, get a tradesperson.”

Savings calculation:

- Call-out fee for property manager: $75

- 3 call-outs per year: $225

- Potential savings: $225+

13. Take greater control

Ensuring you have more control over what is spent on repairs by a property manager can make a big difference to your bank balance. According to Kelly, there is often a $2,000–$3,000 ‘don’t disturb the landlord’ threshold, and the property manager can go ahead with repairs if they come to less than the specified amount.

“If you wanted more control – and potentially less spending – then you could lower that threshold amount to, say, $500. That would mean you could then elect what you would actually spend on and how much,” Kelly says.

Savings calculation:

- Existing repair threshold: $2,000

- Reduced threshold amount: $1,000

- Potential savings: $1,000

14. Risk management

Maintaining your landlord’s insurance is a savings protector. For an outlay of about $300 a year, it protects you should natural disaster strike or tenancy problems arise.

Landlord’s insurance is worth every cent, plus it is tax deductible, Renting Smart’s Ben Levi says. “For example, if a tenant goes rogue, it can take at least three weeks to deal with the problem, so if it is a property that earns high rental returns it can be well worth it to be insured.”

Savings calculation:

- Landlord’s insurance cost: Approx. $300

- Defaulted 3 weeks’ rent (at $400 per week): $1,200

- Potential savings: $900

15. Thrifty tips

Once again, it can be difficult to calculate exactly how much particular strategies may help you to save. However, it is well worth keeping the following tips in mind, which may help you achieve your savings goals:

• Attend to any maintenance or repair problems immediately. Small problems left alone often become big problems that cost more.

• Get several quotes for any necessary repair work. Analyse and consider what each quote is offering to provide.

• Cultivate good relationships with key tradespeople. The power of friendship can go a long way.

• Always charge tenants for the outgoings you are entitled to charge for. The main one to remember is water consumption.

Tax

While most investors are aware that they are eligible for a range of different tax deductions, a significant number do not claim what they are entitled to, and/or they don’t claim correctly. Yet if you make use of the tax provisions available to you as an investor, it is possible to make significant savings.

16. Depreciation awareness

More landlords need to become aware of the benefits of depreciation schedules and claims if they want to save money. Get a registered quantity surveyor to put together a depreciation schedule for you, and it can pay dividends at tax time.

It is also worth noting that it is possible to go back and amend previous returns to claim missed deductions from previous financial years.

Savings calculation*:

- Property value: $420,000

- Rental income: $25,480 per year

- Property expenses (eg interest and rates): $32,000

- Total deductible loss: $6,520

- Tax depreciation claim: $11,500

- Savings: $4,255 for the year

17. Save via scrapping

Another often-overlooked means of getting a property tax deduction is through a scrapping schedule. An example of scrapping could occur if a landlord renovated the kitchen in a property between tenants,

Chan & Naylor’s Ken Raiss says. “A quantity surveyor would put the value against all the stuff thrown away, for example the cooktop, oven and dishwasher. They are then able to claim 100% of the remaining depreciation value left on each item.”

Savings calculation:

- Original value of cooktop: $215

- 2 years’ estimated depreciation: year 1 – $35.80; year 2 – $29.90

- Remaining claimable value: $149.30

Register for land tax, even if your property is under the threshold, Raiss advises. “If you are registered, you will be sent reminders. This means that if your property reaches the threshold, the resulting fees won’t catch you unawares, and there won’t be a penalty.”

Savings calculation:

- NSW land tax rate: $100 + 1.65% (threshold – $412,000)

- NSW late payment penalty: Land tax due plus accrued interest (an 8% premium rate and a market rate added together)

- Property value: $480,000

- Land tax owed: $1,188

- Penalty for 3 months’ late payment (at 8%): $284.16 (+ tax amount owed)

Many people write off repairs and maintenance costs they should be capitalising on. However, they need to be vigilant about what needs to, and can, be capitalised, Raiss says. “For example, if a landlord puts in a new kitchen, that is depreciation, not repairs and maintenance costs. But if a landlord does some upkeep work on the kitchen plumbing, that is repairs and maintenance.”

The amount you could save would vary, depending on the sum involved in the individual repair claim.

20. Claim everything you can legally

It is generally accepted wisdom that you should always claim everything you possibly can. As with depreciation and scrapping, the amounts this can save you will vary from claim to claim. However, Raiss says it is worth remembering that:

- Tenancy costs – like preparation of a lease agreement or costs associated with evicting a tenant – are immediately deductible expenses.

- It is possible for landlords to claim for travel expenses. The cost of travelling to and from properties is deductible.

- Getting a split loan, with two statements to better track deductible interest, allows you to swap funds between loans (apportioning interest each time). It also helps to get a tax deduction and to reduce compliance costs.