Things just got more interesting in the mortgage world. No sooner had the RBA had slashed the interest rate in May than the financial regulator came charging in with new rules targeted specifically at investors.

This resulted in the collective tightening of the lending conditions for landlords, either by charging higher interest rates or imposing lower loan-to-value ratios (LVRs), or both.

There is even talk of lenders managing their exposure by focusing on postcodes.

This is all in response to increasing pressure from the banking regulator, APRA, which has demanded that the 10% cap on property investor lending growth that it announced last December be adhered to.

“This is only the start of the tightening process,” says Philippe Brach, CEO of Multifocus Properties and Finance. “Over the months to come, I suspect tightening will be increased. These new policies will be in place until investors’ loans are under control to APRA’s satisfaction; that is, for the foreseeable future. The immediate impact of APRA’s intervention is that it is becoming harder and/or more expensive to get a loan from a deposit-taking institution for an investor.”

This is not the first time the regulator has used its power to control lending to influence the economic cycle, explains Shane Oliver, chief economist at AMP Capital. “The focus on varying prudential controls to achieve macro-economic outcomes was quite common up until the early 1980s but went the way of the dodo when it was concluded that it was only leading to distortions in the financial system, as people found a way around them.”

Why it’s happening again

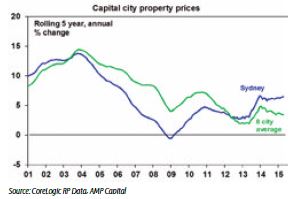

Oliver notes that the last major boom in Australian property prices in 2003 saw average home prices around Australia surge by around 15% per annum over the five years to the end of 2003. This resulted in a massive jump in housing-related credit, with property lending growing 21% and property investor lending growing 30% in 2003.

“This in part was fuelled by property spruikers running property investment seminars on a grand scale, and there was little doubt that house price gains were being extrapolated off into the future in investors’ minds and that this in turn was driving more property investment,” he says.

Oliver points out that the surge into 2003 took the ratio of property prices to household income from prices being around three to five or six times higher than income, and saw real property prices go from well below trend to well above.

“As a result, concern about a property bubble and poor housing affordability came to the fore,” he says. “It was ‘cooled down’ not by prudential controls but by a combination of ‘jawboning’ by then RBA governor Ian Macfarlane warning against the dangers of property speculation, and then the start of an interest rate tightening cycle as the economy improved. The collapse of a high-profile property spruiker’s business and poor housing affordability also helped.”

But while the prudential regulator made sure that lending standards were being maintained, prudential controls were not varied to achieve macro-economic outcomes.

This time it’s a bit different

There are a number of reasons why APRA has stepped in again, according to Oliver. These include:

• Property price gains are nowhere near as strong – over the last five years average capital city home prices have risen by just 3.5% p.a. In Sydney they have risen by just 6.5% p.a.

• The gains are not broad-based – while Sydney home prices are up 14.5% over the year to April, for the other capital cities the gain is just 1.7%.

• Credit growth is running at a fraction of what was seen in 2003, with total housing-related credit up 7.2% over the year to April and investor credit up 10.4%.

The tricky part for the regulators is the fact that both home prices and household debt levels are already very high relative to household income, as is the ratio of house prices to income compared to their long-term trend, says Oliver.

“Having never really unwound from the surge into 2003–4, they are fearful of letting low interest rates drive home prices much higher, given the risk to the financial system and economy should they then fall sharply,” he explains. “So to balance all these cross-currents there has been a return to using macroprudential controls in order to allow the low interest rates that the economy as a whole needs but at the same time keep a lid on the property market.”

While a downturn in property prices is unlikely until the interest rate starts rising again around 2017, Oliver thinks there are several risks related to this regulatory control, including:

1. APRA’s 10% cap on property investor lending growth could prove too lax, and on the other hand it’s hard to know when such regulatory tightening has gone too far, in which case the property market could slow more than expected.

2. There is also a danger that it will hit cities that are weak anyway (basically all the capital cities except Sydney and Melbourne).

3. Longer term, lenders and borrowers may try to find a way around such prudential controls.

New lending rules

The harsh reality is that APRA’s intervention now makes it harder and/or more expensive to get a loan from a deposittaking institution if you’re an investor. There are a number of ways banks have reacted so far, including the following.

#1 Some lenders are now making it harder to service a loan

The banks’ servicing models are now tighter.

• They’re also applying further stress-testing on borrowers’ cash flow and existing/new lending.

• Lenders have also reduced the proportion of rental income they take into account when calculating serviceability. In some states lenders will now assume 60% instead of 80%, which used to be the norm.

• Some banks are no longer allowing for the negative gearing effect in their servicing, as is the case with Westpac. As a result, investors will be able to borrow less.

• They’re also increasing the assessment rate, as is the case with CBA.

#2 Some lenders are reducing how much they will lend to investors

For example, Bankwest is now only allowing loans to 80% LVR, down from 95% previously.

#3 Some lenders are reducing or cancelling discounts on investor loans

Interest rates on investor loans are no longer eligible for ‘special pricing’ – the interest rate discounts over and above the standard discount.

• This will make it more expensive to hold a property and could adversely impact on your cash flow.

• For example, ANZ will no longer give any discount to pure investors (however, they will offer some discount if the home mortgage is also with ANZ).

#4 Some lenders are forcing investors to have a higher deposit

They do this by reducing the maximum LVR, as is the case with Bankwest.

#5 It’s now more difficult to get ‘cash out’ or a ‘loan top-up’

Lenders nowadays are asking for evidence of what the ‘cash out’ is for. Lenders are now restricting cash out to being used only for:

#6 By using a combination of the above

Real-life scenario

How do these new rules actually work in real life? Deanna Ezzy, finance strategist at Trilogy Investment Property Funding, put together this before-and-after scenario:

Assuming an investor has $1m in lending:

Before tightening

• Investor was able to use a lender that calculated OFI (Other Financial Institution) debt at the actual interest rate/repayment.

This meant that $1m of OFI interest-only lending would come to roughly $45,000 per annum (at a 4.5% interest rate).

After tightening

• The $1m of OFI debt now might come to around $82,000 (almost double), which is calculated at the stressed interest rate of 7.25% principal and interest repayments.

What this means

• That’s a difference of $37,000 on a servicing model.

• That $37,000 worked out backwards is enough to pay interest repayments on $822,000 of additional lending.

• That’s $822,000 that the same investor can no longer ‘afford’ in the bank’s eyes.

What should you do now?

How should investors deal with this tighter lending? Here are some tips from our finance experts.

#1 Don’t panic!

Although APRA has pressured banks to reduce investor lending, the lenders have implemented this through various methods, says Brach. “If one lender is no longer an option because they reduced their LVR (Bankwest, for example, with a cap at 80%), maybe another will still be suitable (ANZ, for example, will still lend to 90%, although there will be no discount for pure investment loans).”

#2 Consider smaller or niche lenders

Remember that APRA is the regulator of deposittaking institutions. “Lenders that do not take deposits are not under APRA’s jurisdiction,” says Brach. “Typically, mortgage manager and niche lenders may use this as an opportunity to grab some market share from the major banks. It is too early to see what they may do, but watch this space.”

#3 Get an unconditional approval before committing

For investors with little deposit or close to their maximum borrowing capacity, Brach advises that they should make sure they have their loan unconditionally approved by the bank before they commit to a transaction. “Buying off the plan might be risky for these types of investors as we have no visibility of where the market is headed,” he says.

#4 Enlist a good mortgage broker

Source a good mortgage broker who can give a clear opinion of what the investor may be able to do. “Note that for investors who don’t have borrowing capacity or deposit constraints, there is no issue in terms of getting a loan. It is only for those whose profile is at the limit,” says Brach.

#5 Cash is king

Lower the amount you intend to borrow by coming up with a bigger cash deposit. Review your portfolio to see how you can make the most of your available assets. “You might be able to access some equity from your existing property to be able to buy now,” says Dean Basset, mortgage broker at Rocket Property Group. “Look at saving cash to make up for the shortfall.”

#6 Stick with one lender

“It goes against the advice of experts that you should spread your borrowing in order to get more funding and reduce your risks. However, some lenders are still rewarding loyalty and are offering competitive rates as long as you have owner occupied lending with them,” says Rebecca Hona, mortgage advisor at wHeregroup.

#7 Get a new valuation of your property

Chances are your existing portfolio has grown in value. “You can use this to show the banks that you have a bigger asset base and therefore you’re a lowerrisk borrower. If you have borrowed at a higher LVR, you may be able to rework the loan with the same amount using the new valuation. This reduces the risk to the bank on the books, and benefits you as your overall exposure to the lender is lower,” says Hona.

#8 Shop around

Don’t just take one lender’s rejection as gospel. There’s always another lender who may be willing to adjust their lending criteria. This is a situation when a good mortgage broker can truly help. “The big banks will be the toughest, but there are smaller lenders and credit unions that may be very accommodating,” says Bassett.

#9 Adjust your strategy

“If you want to buy multiple properties over the coming years, you may need to look at cash flow positive or neutral properties instead of chasing negatively geared properties. This allows you to borrow the funds you need to reach your goals,” says Hona.

#10 Look at boosting your rental income

If your borrowing capacity is tight, consider increasing your rental income through renovations, charging higher rents, or even adding an extra room or granny flat.

#11 Pay off or consolidate your personal debts

Personal loans, car loans and high credit card debts could severely impair your borrowing capacity. Look at paying off or reducing them to increase your borrowing capacity.

.JPG)

.JPG)