The scenario

Let’s start with a case study couple: Glen and Michelle. They own two investment properties and their own home. They have all of their loans with one lender, one of the big four banks, and all three loans are cross-collateralised.

Their total lending is $1.42m, and their total asset value is $1.86m. They have $45,000 in savings and wish to buy another investment property in the next 12 months, but their bank won’t lend them any more money.

What are their options and how can they create a finance strategy to continue buying beyond investment property number two?

Summary

• Total value of owner-occupied home and two investment properties: $1.86m

• $1.42m in total lending against these properties

– all cross-collateralised

• 76.3% LVR

• $45k in savings

The challenge

A quick review of Glen and Michelle’s financial structure immediately reveals a basic mistake – all of their properties are cross-collateralised. This means the bank has taken the entire portfolio as security against their total borrowings.

As their LVR (loan-to-value ratio) is currently sitting at around 75%, the lender has in effect oversecuritised the total loan. This is in the bank’s interest as it reduces the risk. It also is a good business retention policy as it makes it more difficult for individual properties to be refinanced with other lenders.

However, for Glen and Michelle this is not such a good arrangement as they currently have no security to offer another lender.

The solution

The first step would be to approach the lender and request that each security becomes standalone.

In theory, this should be relatively easy to do, as the LVR is under 80%. However, a quick look at the individual loan amounts reveals that the individual LVRs vary considerably.

Glen and Michelle have owned their home for several years now. They live

in an area that has experienced strong growth over the years, and they have built up a considerable amount of equity.

Much more recently the bank has allowed them to use this asset to purchase two investment properties, and have lent 100% of the purchase price as well as funds to complete (stamp duty and legals, etc). As these properties are recent purchases and have had little time to grow in value, the loans against these properties are more than their value, and they have negative equity in both investment properties.

So what should they do? Table 1 provides the solution.

The loan against Investment Property 1 needs to be reduced to 80%. Assuming the value of the property has not decreased since it was purchased, the loan needs to be decreased to $440,000.

The original loan for this purchase was $575,000, so the difference of $135,000 appears as a second split against the owner-occupied property.

This simple restructuring exercise immediately frees up some equity loan, thus reducing non-deductible interest payments.

This simple restructuring exercise immediately frees up some equity. Taking the owner-occupied debt to 80% LVR ($720,000), we immediately potentially have another $68,000 which we could take as an equity release for investment purposes.

But hang on – all we have done is play around with the numbers. Glen and Michelle’s overall equity position and capacity to borrow remains unchanged. If they couldn’t borrow before, how have we suddenly manufactured greater serviceability?

Well, the simple answer is that we haven’t. Not yet, anyway. That would be Step 2. But first, let’s have a look at how banks assess borrowers.

How banks calculate your borrowing capacity

Most lenders are conservative.

When they are calculating your borrowing capacity, they build in buffers to protect themselves as well as the borrower.

For example, interest rates can vary over time, and the lender wants to make sure you can meet your obligations if interest rates rise. So you may be borrowing at 4%, but the lender is likely to be using an assessment rate of 7% or even higher.

As an investor you will be choosing to make interest-only payments, but the bank may do their calculations based on principal and interest repayments.

If you are purchasing an investment property, lenders will routinely allow you to add any anticipated rent to your other income for serviceability, but often they will discount it by 25% or more. So your $400 per week in rental income becomes $300 per week for the purposes of the bank’s ‘stress test’.

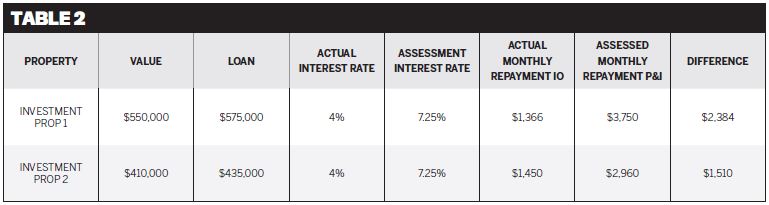

Let’s have a look at what that means in real terms (see Table 2).

Taking Glen and Michelle’s two investment properties as an example, their total actual monthly repayment would be $2,816 per month for their interest-only loans.

Although these two properties are cash flow positive ... they look on paper as if they are hugely negatively geared

However, at an assessment rate of 7.25% and with principal and interest repayments, they need to prove to the lender that they can afford to make repayments of $6,710 per month, almost $3,900 more than they need to pay.

Not only that but the $1,000 per week that they receive in rent gives them an income of $52,000 per year, but the bank only takes $39,000 (75%) of that into account. Basically, the lender is doubling the repayments and reducing rental income by a quarter.

Therefore, although these two properties are cash flow positive for Glen and Michelle after tax, after the lender’s stress testing they look on paper as if they are hugely negatively geared.

No wonder they have hit a wall in terms of borrowing capacity! So what can be done?

Not all lenders are equal

The first thing to bear in mind is that all lenders are different, and the way they calculate your borrowing capacity can vary. For example, you can go to one lender and they will lend you $450,000 based on your financials. You can take exactly the same financials to another lender and they will give you $680,000.

Some lenders will be more generous to owner-occupiers. Other lenders will be more generous to investors. There are lots of lenders in the marketplace, and infinite small variations in credit policy.

If you do not want to have your borrowing capacity compromised, it is essential to find a really good and experienced broker who has access to multiple lenders and can assess your situation and find the right lender

for you. They will be able to make sure that you have a sound financial structure in place that will support your long-term financial goals.

This means getting you a great interest rate, and recommending loans that have the flexibility that you will need in order to grow your portfolio.

But how do we get around this stress testing? Even small variations in credit policy from lender to lender will surely not make that much difference? This may be true, but read on…

Are all investment properties treated equally by the lenders?

The simple answer is no. Banks will stress test their own deals.

If you only use one lender the effects are cumulative, as in the case of Glen and Michelle. However, if you have properties separated out with different lenders, they seem to care less about the risk of each of your other properties. After all, it is not their risk, so they will take the actual interest rate and the full rental into account when they do their calculations. This makes a huge difference.

As you can see, the reason why Glen and Michelle have no borrowing capacity (despite the fact that their investment properties are cash fl ow positive) is that they only use one bank.

Now that we have completed an internal restructure with their current lender, and created three standalone properties, we can start to refinance the properties and reduce the buffering effect that has stopped them in their tracks.

Borrowing capacity reinstated

Simply by throwing a couple of new lenders into the mix, Glen and Michelle’s borrowing capacity goes from zero to an astonishing $980,000!

Their income is still exactly the same; nothing has really changed except their financial structure.

It seems so simple, so why did Glen and Michelle end up with a fi nancial structure that did not suit their long-term plans?

It is quite simple really. Their structure was never set up for or intended to benefit them. It was set up to benefit their bank. The bank wanted all of Glen and Michelle’s business, not just a measly third of it, and they did a good sales job!

Most people, including Glen and Michelle, are time poor. They want someone to make it easy for them. Less paperwork, less hassle. Your current bank has a lot of your information already, so they can make it easy for you. They can do all the hard work, put you in the right loan, make it easy.

You are relying on the bank as your trusted advisor who will give you the best advice. But as you can see, it doesn’t always work out quite like that.

Starting from the beginning

It is great that Glen and Michelle took the plunge and got started on their investment journey. It takes a leap of faith, and they were prepared to take that leap. However, before we move forward it is important to look back and see if there is anything that they can learn from their experience so far.

When Glen and Michelle got started they did it all themselves. They did not ask for help of any kind. Luckily, they have not made any huge mistakes and seem to have chosen some well-located properties that should perform well over time.

With hindsight it may have been a good idea to have found an experienced property investor who could have guided them through the process, pointed out the pitfalls, and given them reassurance that they were on the right track – because even though they have done reasonably well, they did have quite a few sleepless nights of worry. And they would certainly have ended up with a much more suitable financial structure.

Both investment properties are in their local area, so going forward Glen and Michelle will need to adopt a more national perspective and target new areas in order to de-risk their existing portfolio.

The other thing that Glen and Michelle are missing is a plan. Drifting slowly in the right direction means their financial needs are growing as time goes by, but often investors without a clear plan do not end up where they ideally would like to be from a financial perspective. It is much more powerful to have a specific financial goal and a specific timeframe.

Once they know what they want and when they want it, their property mentor and broker should be able to show them how property can allow them to reach their financial goals, and put in place an acquisition plan that will get them there.

Moving forward

Now that Glen and Michelle’s borrowing capacity has been reinstated, they are ready for their next purchase. Our restructure has released another $68,000, plenty for a deposit and buying costs. However, in order to achieve their financial goals they may need to look at multiple purchases over the next few years.

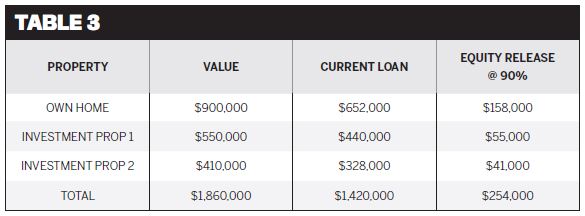

The area they live and invest in has done well in the past, but the last two properties have been purchased close to the top of the current cycle, and so they cannot expect too much growth in the near future from any of their properties. By taking their current LVR from 80% to 90% we could release a significant amount of equity. By doing this they would be able to cover the deposits for their next few properties without having to rely on equity growth from their current portfolio in order to move forward (see Table 3).

Simply by increasing the LVR, which they can now easily service, they have released a total of $254,000 for future investment purposes. This does not include the $45,000 in cash savings, which I would recommend they keep as a buffer in their 100% offset account.

So now that they have strong borrowing capacity as well as plenty of equity for deposits they can contemplate their next purchases. Simultaneous settlements can be stressful. However, they are keen to move forward as quickly as possible while they are finalising their long-term financial goals.

I have always found that the ‘one for now, one for later’ strategy works really well. This entails entering two contracts for two separate properties, one that is ready to settle right away, and the second an off-the-plan that at this stage would only require a 10% deposit. Bank loans are not required until settlement, meaning that Glen and Michelle only have to focus on one settlement in the immediate future, while the other one in the pipeline can be focused on once the fi rst property is settled.

Glen and Michelle will need to locate a suitable off-the-plan opportunity outside their own area, which is reasonably priced and at the right stage of the property cycle. Their mentor should have experience in off-the-plan purchases and be able to advise them.

From their total funds available of $254,000 we have used $119,000, and still have $135,000 available – enough for another two properties.

(See Table 4.) We still have to ensure that serviceability is maintained, and that would be the job of the broker.

In summary

Glen and Michelle came to us with a reasonable portfolio of just under $2m, including their own home. They wanted to increase their portfolio but were quite surprised to hear that their bank was unwilling to lend them any more money, despite the fact that they felt comfortable that they could cash flow further purchases.

With a bit of financial restructuring we have managed to get them to a point where they are in a position to potentially double their portfolio from $2m to close to $4m. They are also working on their long-term financial goals.

We are glad that we have been able to point them in the right direction and we wish them good luck for the future.

.JPG)