With investment lending currently under scrutiny, banks are tightening their criteria even more. Mortgage broker Marissa Schulze explains how you can get the banks to lend you more

For many investors, hitting the proverbial brick wall is often their biggest hurdle in growing their portfolio as quickly as they would like. Therefore, it pays to understand how the banks will view you as an applicant and to know how you can improve your borrowing capacity, even before you submit your application.

Back to basics

So, what do the banks look for when calculating your borrowing capacity? When they assess your application, they will take the following three things into consideration:

- Security

- Servicing

- Credit score

In other words, the lender wants to know that they have adequate security for the loan, and that you have the ability to meet the loan repayments and have a good credit history and track record.

To determine your strengths and weaknesses as a loan applicant, I recommend the following steps:

Step 1: Review your equity/security position

Step 2: Understand and improve your servicing capacity

Step 3: Understand and improve your credit score

STEP 1: Review your equity or security position

This means you need to determine the amount of cash and/or equity you have to contribute to your property investment purchases.

- IF YOU are buying an investment property, most lenders will lend up to 90% of the value of the investment property you are purchasing. There are a couple of exceptions to this where you can potentially borrow up to 95% of the value of the property you are purchasing if required.

- TO APPROVE a loan application the bank will want to see that you have a sufficient deposit to cover the shortfall in the purchase plus all the purchase costs (which on average equate to about 5–5.5% of the purchase price). In other words, you will need a deposit of at least 10% of the purchase price to be able to purchase the property.

- IF YOU are purchasing your first property, traditionally, this deposit will come from your cash savings. However, if you don’t have much in the form of savings but are keen to get started, there are some other options that you should consider including gift from family or a security guarantee from family, which allows your parents to offer one of their properties as security for a small portion of your loan.

- IF ASSISTANCE from family is not an option, then the best way to increase your deposit and ultimately allow you to buy your first property is save, save, save!

- IF YOU are already a property owner, you may be able to use the equity available in a property you own to allow you to borrow up to 105% of the value of the investment property you are buying.

- IF YOU want to use equity in your property(ies) to fund the deposit and costs on future property purchases it is important to know what the true market values of your properties are.

- A GOOD mortgage broker, who specialises in property investing should be able to order free bank valuations for you before you submit your loan application. This service is very valuable as it enables you to accurately understand the value of your properties in the bank’s eyes and how much equity you have available to you.

- IF YOU already have loans exceeding 80% of the total value of your current properties, the best way to increase your equity and ultimately allow you to buy more properties in the future is to look for cheap ways to add value to your current properties to lift their market value.

- FOR EXAMPLE, cosmetic upgrades or adding an extra bedroom or bathroom. If you are going to attempt this, ensure you do your research so that you only spend money on areas that will definitely result in an increased valuation of your properties.

STEP 2: Understand and improve your servicing capacity

Once you have sufficient deposit/equity to add to your investment portfolio, the next step is to ensure that you can service the new debt that you require to purchase your next investment property.

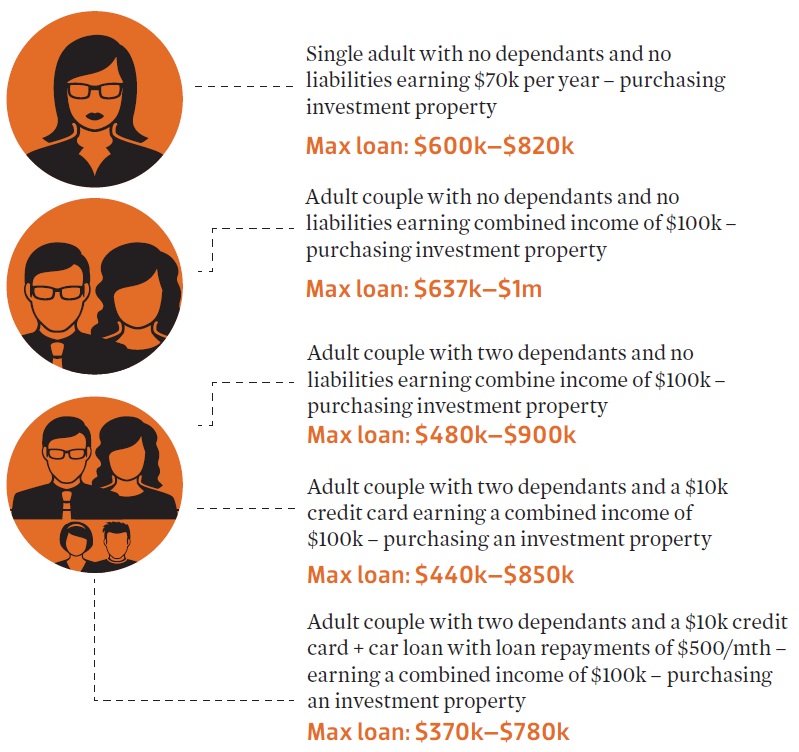

Every lender calculates servicing capacity differently and as a mortgage broker myself, I am constantly amazed at the variance in maximum borrowing capacities for different types of clients amongst the different lenders. While each lender looks at every scenario and situation differently, they all take into account the following factors in determining your servicing capacity:

Income

- Wage

- Profit plus add backs if self-employed

- Rental income

- Family tax assistance

- Pensions/government assistance

Expenses

- Living expenses

- Most lenders will now ask you to disclose your actual living expenses. Generally they would expect average monthly living expenses to be around:

- Single = $1,200

- Couple = $2,200

- Per child = $350

- Child support

- Childcare/Private school fees

- Insurances

Liabilities

These include:

- Other home/ investment loans

- Personal loans

- Car loans

Credit cards

Many people think credit cards don’t matter if they don’t use them but the bank looks at the limit not the balance.

Age

While lenders are not legally allowed to discriminate based on age of an applicant, most lenders will require the loan to be paid in full before an applicant reaches retirement age of 75 years. As a result, applicants over the age of 50 years will have to be able to show how they are going to be able to service the debt or clear the debt once retired. For example, if an applicant has sufficient superannuation and/or a substantial property portfolio that is earning a regular income and could be sold if required then age of the applicant is no longer a factor.

Dependants

Anyone that is financially dependent on you.

Banks’ ever-changing policies

The large variances in servicing capacities between lenders are due to the different policies each lender applies. For example:

Some lenders will only accept 70–80% of your rental income, while others will accept 100%.

Negative gearing

Some lenders are more generous with negative gearing add-backs in their servicing calculator than others.

Bonuses/overtime pay

All lenders have very different rules around what percentage of bonuses and overtime they will accept for servicing purposes.

Family tax assistance and child support income

Different lenders have different rules as to the maximum age of the children before they will stop accepting family tax assistance and child support as income for servicing purposes.

Assessment rates

When determining whether you can afford the loan repayments, the bank looks at whether you can afford the repayments at their assessment rate, rather than the actual interest rate you are paying.

The banks’ assessment rates vary between lenders but can be 1.5–2.5% more than the actual interest rate you will be paying on the loan. If you are already a property owner and have property loans, some banks will incorporate the repayments of these existing debts at their assessment rate, whereas others will use the actual repayments, which significantly increase your borrowing capacity.

An example of the variance in servicing capacities is shown in the table below:

STEP 3: Understand and improve your credit score

More and more, banks are letting computers determine whether a loan application should be approved or declined.

While there are still a few lenders who do not credit score and will assess your loan application with a human credit assessor and common sense, the majority of lenders put every application through an electronic credit scoring system before the application is looked at by a human.

The credit scoring system will give the applicant and application a credit score and will decide whether the application should be declined, or referred to a human credit assessor for assessment or approval.

If your application is declined by the computer due to credit scoring it can be very difficult to get that decision overturned by the lender and you may have to look at other lender options.

Case in point

Most people think that as long as they do not default on any of their financial obligations they will have a strong credit score but this is most certainly not the case. In my role of work, I have seen doctors earning $600k per year be declined for finance due to a poor credit score despite the fact that the applicant had strong security and strong servicing capabilities. This poor credit score may be put down to the fact that his net assets were low in comparison to his age and income and he had a history of shopping around for finance and as a result had numerous credit enquiries.

As another example, I have seen active property investors finance applications declined due to credit scoring. This is mainly the case for applicants that have multiple personal debts (eg credit cards and personal loans) and do regular balance transfers on their credit cards etc.

Banks credit score differently

Like their servicing calculations, every bank also has a different credit scoring system which places different importance and weighting on different factors.

Factors that affect your credit score

Some of the factors that contribute to your credit score include:

- Your age

- Your marital status

- Net assets you have accumulated

Many credit scoring systems will rank your net worth against your age and income to develop a picture of whether you are a spender, saver or investor and this will play a contributing factor towards your credit score.

For example, an applicant in their early 40s earning $400k per year with little assets to show may credit score lower than an applicant in their early 40s earning $50k per year with a house plus a couple of investment properties and savings.

- Credit history

Especially important if there have been any previous defaults, court judgements, bankruptcies, etc.

- Number of credit enquiries

Many people do not realise that every time they apply for finance an enquiry is permanently lodged on their credit report. This is also the case for purchasing things on interest-free terms, applying for personal loans and credit cards or doing credit card transfers. Most credit scoring system are harsh to applicants with many recent enquiries, and enquiries relating to personal debt including purchasing items of interest-free terms tend to result in lower credit scores.

- Length of employment with existing employer

- Length of time in current residence

- Personal loans and credit cards

If you are not sure of how your credit file looks, I recommend ordering a free copy of your credit report at https://www.mycreditfile.com.au/.

Top insider tips

If you want to maximise your servicing capacity so that you can achieve your goals sooner I recommend the following:

- Look for investment properties with strong rental returns

- Reduce your unused and unnecessary credit card limits

- Spread your debt over multiple lenders who will assess your other debt at its actual repayment rate rather than their assessment rate

- Eliminate or reduce personal loans as quickly as possible and/or consolidate these debts into your home loan to reduce the interest rate and extend the loan term

- If you are an employee, ensure you are getting regular payments from your employer If you are self employed, ensure you are declaring all of your income and keeping expenses to a minimum to maximise your profits and make sure your financials are up to date

- Most importantly, make sure you are working with a great mortgage broker who specialises in property investment. If you go directly to a bank, they can only tell you what your borrowing capacity is according to their policies. But if you work with a great mortgage broker, they will be able to determine the best lender and best loan for you to maximise your borrowing capacity and help you to achieve your goals sooner

To ensure you maintain a strong credit score I recommend:

- Ensure you are meeting all of your financial commitments on time every time

- Do not submit a loan application that you are not certain will be approved. For example, make sure you are working with a reputable broker who has pre ordered the valuations, done their research and is confident of approval before the application is submitted

- Do not apply for pre-approvals from more than one lender

- Do not apply for personal loans/car loans if you can avoid it

- If you are submitting an application, include as much detail as possible in your loan application. For example at least two phone numbers, email addresses, account numbers of credit cards, personal loans, savings accounts and other housing loans, previous addresses and employers, details of nearest relative not living with you etc.

- Pay credit card debt in full every month. If you are finding this difficult then you may be spending more than you can afford. So if you are serious about getting ahead financially cut up your credit card, focus on paying down any accumulated debt and try and adjust your daily spending to eliminate your reliance on your credit card.

- Do not buy items on interest free terms.

- If there are any enquiries or defaults that you believe should not be on your credit report follow the process to get these removed.

- If you have any concerns about your credit history or credit report, then be upfront and honest about these so that can find the right lender, who will accept your credit history and your application to increase the likelihood of approval.

Marissa Schulze is an experienced mortgage broker and director with Rise High Financial Solutions