Think you’re paying a fair price on your home loan? You might want to think again.

Recent data from the Reserve Bank of Australia suggests that Aussies are being overcharged for their home loans, especially when compared to new borrowers. In fact, the average interest rate for existing homeowners is 0.4 percent higher than it is for new borrowers.

Here’s the secret: if you’re not shopping around for a home loan, you’re probably paying too much. It’s common practice for banks to overcharge on mortgages, making a profit on homeowners who don’t shop around.

That’s where HomeLoansAustralia.com comes in. This comparison service lets borrowers compare rates from trusted lenders across Australia. Thousands of Aussies have used this service to get a lower rate on their home loan, without the hassle.

So how do you know if you’re paying too much for your home loan? The RBA revealed that the average advertised variable rate from the big banks is about 5.7 percent. If that number seems high, that’s because it is.

Banks often offer discounts on their advertised rate, which is why most existing homeowners pay an average interest rate of around 4.5 percent—but that’s not the whole story, either.

New borrowers appear to have the advantage: the average interest rate for loans issued in late 2018 is 4.1 percent. It’s easy to chalk it up to luck, which is just what the banks are hoping you’ll do.

You see, these lower interest rates aren’t exclusive to new borrowers. Almost anyone can get a lower interest rate, if you’re willing to compare.

A difference of 0.4 percent may not seem like much, but it can add up over time. Take the example of a 30-year, $400,000 home loan. With a 4.5 percent interest rate, a borrower pays $729,627 over the life of the loan. If that interest rate fell to 4.1 percent, the total cost is $695,806.

That 0.4 percent difference in interest translates to a savings of $33,821—and that’s just using average figures. The reality could be much worse for households across Australia.

Too many Aussies are paying thousands of dollars over the odds for their home loans, a phenomenon known as the ‘lazy tax.’ Fortunately, the lazy tax is optional, and it’s easy to avoid when you use HomeLoansAustralia.com.

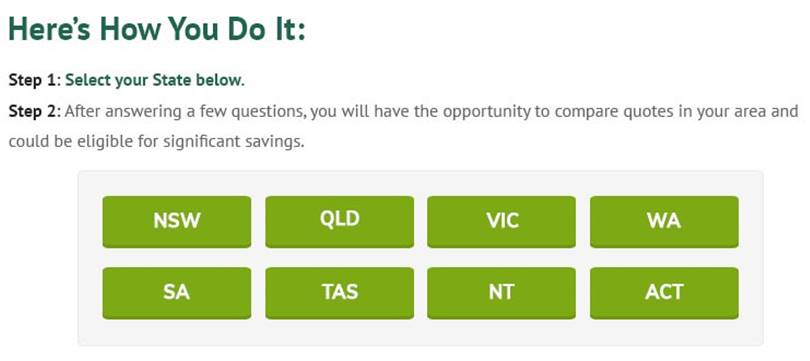

Finding a better deal on your mortgage used to be complicated, but Home Loans Australia has simplified the process. All you have to do is select your state and answer a few questions, then you’ll receive a quote on available home loans.

Aussies love this service because it doesn’t stop with a comparison. You’ll also get the chance to speak with a home loan professional, who works on your behalf to negotiate loan terms with the lender.

Once you pick out a home loan, your home loan adviser will help you with the paperwork. Everything can be done in a few clicks and a phone call, saving you time as well as money.

There’s no obligation to switch, either. Use the service to get your initial quote, so you have a better idea on where you currently stand. From there, you can decide what to do next—keep paying the lazy tax, or start saving your money.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.