According to the ATO, more than a third of Australian investors earn less than $37,000 per year. Low-income earners comprise a huge proportion of the investing market, and while they face specific challenges, the most committed, driven and creative among them can reap the biggest rewards. Sarah Megginson reports

Tanya Cleary sat on the edge of her bed, staring at her feet and wondering how she would ever find a way out of her predicament.

Stressed out and snowed under, she was at the end of her 20-year marriage and struggling to balance the responsibilities of working full-time and raising her three children as a single parent.

“I was going through a divorce, and I sat there one day and thought to myself, what am I going to do? I knew I needed to stand on my own two feet, but I didn’t know where to start,” Tanya says.

For Tanya, and for many Australians, the answer was found in property investing. Millions of Australians invest in residential real estate as a means of creating wealth for their future, but it’s not always easy to take that first step towards financial clarity, especially if you don’t have a huge nest egg behind you to get started.

“Often, the main problem for investors is not the low income itself. With interest rates so low at the moment, servicing the debt is not as bad as it once was,” explains Tim Boyle, mortgage credit advisor and author of Escape the Rental Trap.

“The main problem is that most banks require a deposit and they want it to come from the borrower through demonstrating ‘genuine savings’. For a low-income earner, it’s challenging to show genuine savings when most of their income already goes on day-to-day living expenses and rent or mortgage payments.”

That doesn’t mean everyday investors are locked out of the property market. Far from it. Just because you don’t earn a six-figure salary doesn’t mean you can’t afford to invest in property. But what are some of the barriers you need to overcome, and what strategies can low-income earners use to grow their property portfolio?

Risks and barriers for low-income investors

There are many risks and challenges that apply to property investing, regardless of the investor’s income level, but for low-income earners the two biggest barriers are consistent: amassing a deposit, and finding a bank that will lend to them.

In order to build a solid property deposit you need to know exactly what target figure you’re aiming for, as this will give you a goal to work towards, explains Helen Collier-Kogtevs, director of Real Wealth Australia.

“Without a goal to work towards, it’s like you’re jumping into your car and driving towards your new home, without having an address to aim towards or a map to guide you,” she says.

“Goal setting is so important, and for many first-time investors their first step won’t be shopping for property or speaking to a bank about their borrowing power – it will be getting their own financial house in order so they can work out exactly where they stand now and where they’d like to be in 12 months’ time.”

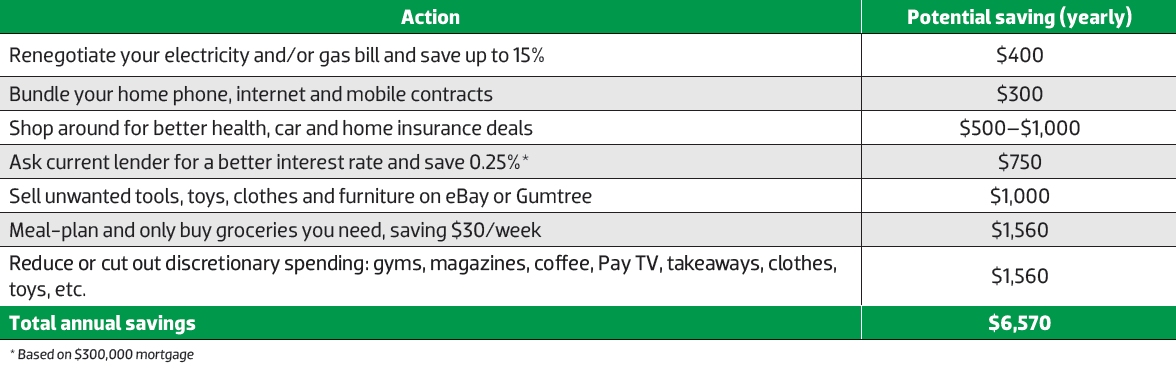

Do a budget

You need to do a budget so you can identify opportunities to save money.

Get your finances into shape

Do this by consolidating debts, cancelling credit cards, renegotiating your regular bills, and creating a savings plan.

“I know an investor who, earlier this year, contacted all of her personal utility suppliers to negotiate better deals. She achieved a 16% discount on her electricity bill for 12 months, reduced her Pay TV subscription package by $40 per week, and lowered the mortgage interest rate on one of her investment properties by 0.15%,” Collier-Kogtevs says.

“By making a few phone calls, she tells me she’s saving almost $3,000 on her everyday household bills. It may not be a property deposit in and of itself, but every dollar saved certainly helps.”

The beauty of getting your finances in order is that, regardless of your next steps as an investor, simply by creating a solid foundation you will pave the way for a better financial future.

“When you’re unclear about your finances, it’s impossible to move forward with focus and drive,” says Collier-Kogtevs.

“By having control over your finances it will not only help you get ahead as an investor but you will be able to manage your lifestyle more effectively, which is a skill everyone can benefit from.”

Bundle your savings with a $3,500 tax return cheque and you’re $10,000 closer to your next property deposit – before you’ve even put a savings plan into place!

Success Strategy #1: Joint ventures

Want to fast-track your journey towards property ownership? One of the most common ways to do so is to buddy up with a partner and invest as a team.

| Advantages | |

| Split the risk, and the cost | Applying for a loan with a partner or family member may be a good way to boost your deposit, increase your borrowing power and split the repayments. |

| Move forward when other options fail | Collier-Kogtevs embarked on several successful joint ventures at the beginning of her investing career when she ran out of deposit funds. “At the end of the day, it’s better to own 50% of something rather than 100% of nothing,” she says. |

| Drawbacks | |

| Your JV partner might want to sell before you’re ready | It’s crucial that you establish a timeline upfront, with a minimum time that you’ll own the property before either partner can sell, or you may expose yourself to the risk that your JV partner wants to ditch the property much earlier than you do. |

| Your JV partner may stop paying their mortgage | If you treat the entire transaction as a serious business dealing – even if your JV partner is your sibling, best friend or parents – you’ll minimise your risk of being stuck paying someone else’s mortgage. You need to have formal JV documents drawn up through your solicitor at the very beginning, which are really clear on everyone’s roles and responsibilities. |

Success Strategy #2: Commercial properties

Most property buyers default to residential real estate when contemplating their first investment, but investor James Dawson says there are often far greater profits to be made on commercial property investments.

| Advantages | |

| Lower outgoings to support your investment | Commercial tenants not only pay you rent but they also cover most of the additional outgoings, such as body corporate fees and council rates. |

| Less maintenance costs | “When you buy a little office, they don't come with bathrooms and kitchens to renovate,” James says. “And generally, it’s in the terms of the lease that the tenants should be maintaining the carpets and walls with fresh paint when required.” |

| Drawbacks | |

| Higher deposit required | You’ll generally need a 20–30% deposit to qualify for a commercial loan, which can be a challenge for low-income investors to save. |

| Double the due diligence | With commercial properties, sale prices are actually determined by the rent, which means you’ve got to make sure that both the property and the tenant stack up. It’s crucial that you don’t rush your due diligence when researching the local rental market, or you could face the risk of overpaying. |

Success strategy #3: Positive cash flow properties

Investors often mistakenly believe that the only place they’ll find positive properties is in mining towns, but investor Tanya Cleary says there are opportunities all over Australia, if you’re prepared to do your due diligence and employ out-of-the-box strategies.

| Advantages | |

| More affordable entry prices | At a time when Sydney property prices are becoming out of reach for all but the most cashed-up buyers, regional properties offer an affordable opportunity to add to your portfolio. |

| No need to dip into your income to service your investments | Other than the odd unexpected maintenance expense, a positive cash flow property pays for itself and then some, so you won’t need to dip into your own income each month to pay for your regional investment. |

| Drawbacks | |

| Requires a bigger appetite for risk | It’s not always easy to find positive cash flow deals, which often requires investors to be creative. For example, Tanya created her own positively geared opportunity after renting a property to tenants by the room, boosting her rental yield from $420 to $500. |

| Potential for lower capital growth rates | Capital city properties generally appreciate in value faster than their regional counterparts, although it is possible to find investments that deliver the best of both worlds. “I buy discounted properties in growth areas with positive cash flow," Tanya says. “It sounds like the Holy Grail, but if you are dedicated to finding positive cash flow deals, you will." |

Leveraging lenders to your advantage

As a lower-income earner, you need to find a lender who is willing to extend funds your way, and there are certain banks you should approach over others, says Steve Jovcevski, home loan expert at Mozo.com.au.

“The first and most important thing lenders look at is the borrower's ability to service the loan, regardless of their income. Generally speaking, the larger banks are more inclined to lend to a lower-income earner, because they are more willing to take on the risks often associated with this kind of borrower,” he explains.

Jovcevski used a borrowing calculator from one of the major banks and found that the absolute minimum income required to borrow anything was around $1,300 per month, or $16,000 annually. “The amount lent was $6,860 – not quite enough to buy a home!” he says.

Regardless of which lender you use, you’ll have access to the best and most flexible loan products and interest rates if you can show “a long and positive history of regular saving, and diligence when it comes to spending”, he adds.

“A good deposit always shows the borrower’s ability to save,” Jovcevski says, “and that’s something that is well regarded when a bank is assessing the loan.”