28/09/2018

Short-term rentals have a reputation for being both risky and time-consuming, but if investors have an effective safety net in place, they could soon enjoy incredible returns. Nicola Middlemiss reports

Australia's tourism industry has seen a significant shift in recent years, with many travellers now choosing to rent accommodation on a short-term basis rather than stay at a hotel or guesthouse.

In fact, the number of Airbnb reservations made in Sydney jumped from 28,000 in December 2016 to 41,000 in December 2017, creating a potentially lucrative opportunity for property owners. However, despite the rapidly growing market, many investors still shy away from letting their properties out on a short-term basis, because they’re afraid of badly behaved occupants who may damage their hard-earned assets.

Natascha Winkler, senior guest experience manager at property management firm MadeComfy, says these fears are largely unfounded and often stand in the way of serious returns. “The media tends to focus on party houses, but from our experience they’re actually very rare,” Winkler says.

“Everyone thinks it happens all the time, but we manage over 4,000 guests every month, and so far we haven’t seen any radical cases like the ones that are sometimes shown in the media.”

Based in Sydney but with a presence in both Melbourne and Brisbane, MadeComfy specialises in managing short-term rentals and oversees the entire process – from bookings and guest communication through to housekeeping and maintenance.

When asked why investors should consider letting out their properties on a short-term basis, Winkler says there’s one reason in particular that far outweighs the rest.

“First and foremost, it’s the money,” she says.

“We regularly see our properties achieving rental yields of 7–11%.”

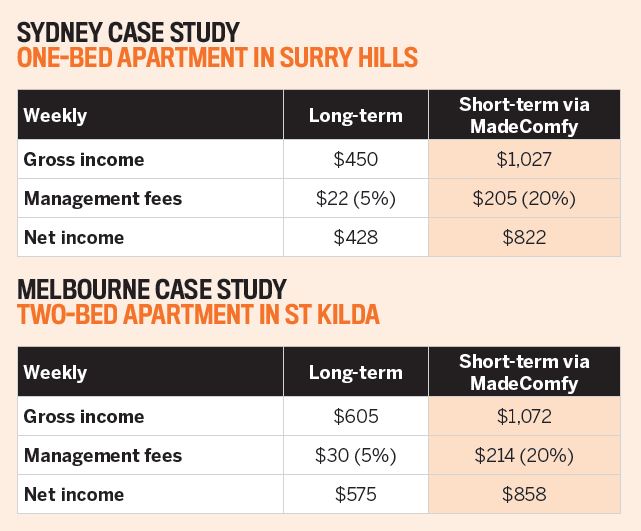

Even after MadeComfy’s fees are deducted, property owners can still expect to see returns that are more than 40% higher than those achieved through traditional methods, Winkler says.

It’s an incredible feat, considering rental yields for Sydney apartments are currently at a 12-year low.

According to the latest report from BIS Oxford Economics, rental yields for apartments in the region fell to a disappointing 3.57% in 2017 – down from a high of 4.95% in 2009 and even dropping below the 2015 trough of 3.66%.

So how is MadeComfy managing to buck the trend?

"Property owners can expect to see returns that are more than 40% higher than those achieved through traditional methods"

Part of it comes down to the company’s dynamic pricing approach, which adjusts rates on a daily basis after factoring in location, seasonality and supply and demand, while also looking at net returns per week, month and year.

Part of it comes down to the company’s dynamic pricing approach, which adjusts rates on a daily basis after factoring in location, seasonality and supply and demand, while also looking at net returns per week, month and year.

However, perhaps most important of all is the seamless guest experience and highquality finish that ensures investors can charge a premium price per night.

“We have the property professionally photographed and listed; we provide 24/7 communication and in-person check-ins; we have a housekeeping team which makes sure the home is perfectly clean; we have hotel-quality linen and compile a welcome pack; we set them up with amenities in the kitchen and the bathroom, and we can cater to meet the individual needs of most guests,” says Winkler.

Whether it’s arranging for repairs to appliances, offering advice to guests on local attractions, or even responding to emergency situations, MadeComfy has a dedicated team on hand to help at all times.

“It would be incredibly difficult and time-consuming for a homeowner to provide that level of service, but it really is so important because that’s what leads to five-star reviews,” she says.

According to Winkler, the importance of five-star reviews cannot be understated, as an overwhelming number of travellers now rely on online recommendations before booking accommodation.

“Ninety-one per cent of people who travel only book if there are reviews, and 84% trust online reviews as much as a personal recommendation – this shows how important it is,” she explains.

“That’s why, if we take a property on without any reviews, we make sure to follow up with guests to see if they’re happy to share their experience. Once you have a couple of them, you can really see how it picks up and you can start to charge more for the property.”

The higher price also deters unruly visitors who may pose a risk to an investor’s property, she says. “If you have five-star reviews you can charge a premium, which is what every investor wants, but it also means you’re less likely to attract a certain type of traveller who may just be looking to have a party,” says Winkler.

Of course, it’s not the only step MadeComfy takes to minimise the risks for homeowners. “We have minimum-length stays, which deter people who may just want to party for one night; we do guest vetting, we do ID checks, and we have house rules that are clearly communicated,” Winkler says.

“That’s all part of finding the right guest and reducing the fear some investors may have that their house is going to be damaged.”

is senior guest experience

manager at MadeComfy.

Do you want to learn how to achieve 7-11% reantal yield returns with your investment property?

Visit www.madecomfy.com.au today.