Buying at the bottom of the market, when prices, competition and confidence is low, could be a lucrative strategy. You’d be able to cherry-pick the best property at a rock-bottom price and then ride the upward swing in prices.

Todd Hunter, buyer’s agent and founder of wHeregroup, says it’s the only way to invest.

“When a market tapers right off, developers begin to delay their projects, because there’s no one buying. This means there are no new properties hitting the market, but there are still people moving into the area, which lowers the vacancy rates and puts pressure on the housing market,” he explains.

“Once a market has been flat for three to five years, you’re going to start to see the rebound, and when the market starts to increase again, that’s when I stop buying and move on.”

“Once a market has been flat for three to five years, you’re going to start to see the rebound, and when the market starts to increase again, that’s when I stop buying and move on.”

“This has happened recently in Southeast Queensland. We had been active in that market, but when there are fewer discounted prices, and there are multiple offers on the table and properties start selling really fast, that’s a sign to leave a market,” he says. “It’s great news for us, though, as it means all of our properties are going up in value and we’re making money, so it’s time to move on.”

How can you tell when it’s time to move in?

Hunter’s method for acquiring bottom-of-the-market properties that are set to surge certainly seems appealing. But how can everyday investors follow his lead and time various property markets for themselves?

It can be difficult isolating a market in the ‘sweet spot’ – that is, post-slump but pre-boom – as you have to truly invest in due diligence and understand the market inside out.

“You have to understand the cycles and make sure you’re buying in an area that is trending sideways or rising,” explains Mark Kelman, investor and founder of Achieve Property in Sydney.

“Ideally, you want to buy in an area that is trending up, because if the market drops further you lose your advantage, even if you buy below market value. No one wants to purposefully buy in a market that is going down.”

Your first step is to gain an understanding of where each market sits in terms of its property cycle.

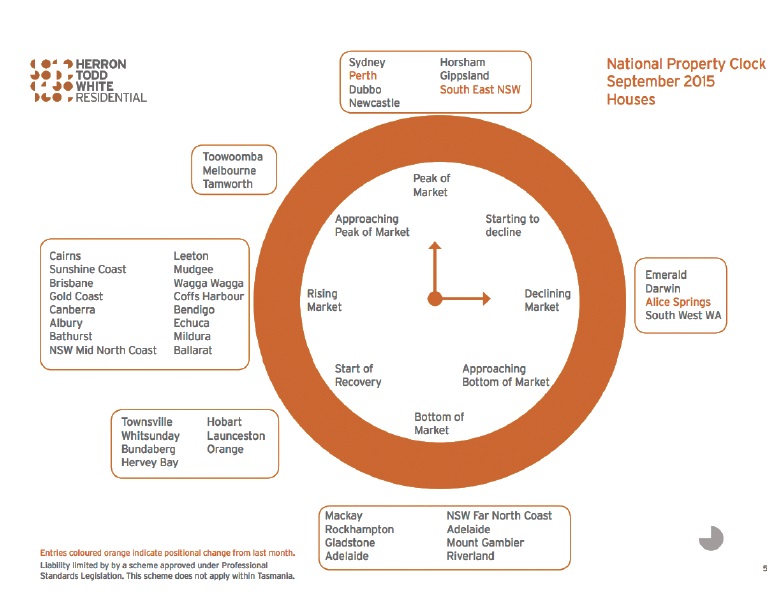

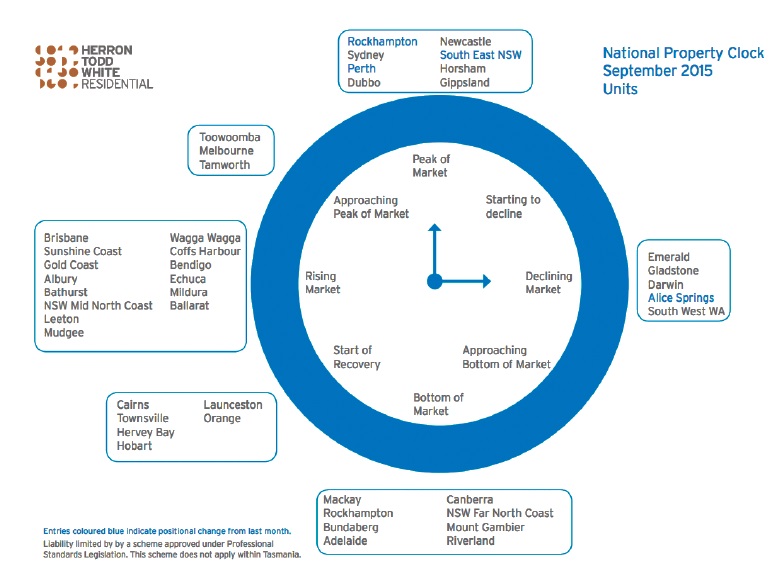

“There are many groups that assess data and have good reporting on market cycles. CoreLogic RP Data provides market data reports on peaks and troughs in the cycle, and Herron Todd White also provides a monthly report,” explains Sam Saggers, CEO of Positive Real Estate.

“Historical trends can be helpful. For instance, if a market has been very quiet, it’s a good sign that you may get growth. Rental returns and yields are also a great sign, because in a flat market at the bottom, there is not much construction happening as there are no buyers. The rental market is starved of choice and therefore the rental returns are strong.”

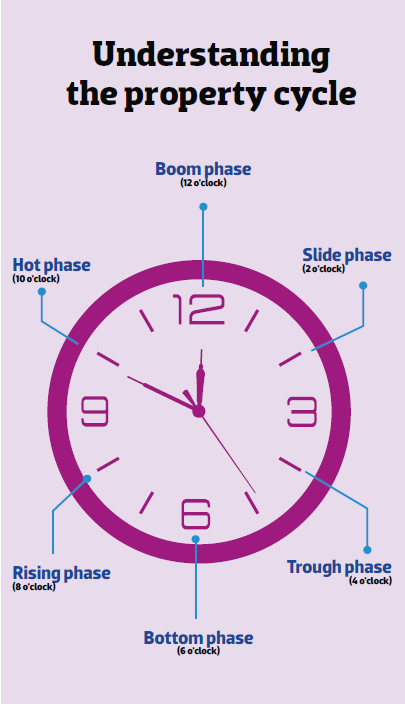

Understanding the property cycle

According to Saggers, there are six main

phases of the property cycle. These are:

• slide

• trough

• opportunity/bottom

• rising

• hot

• boom

The risks of timing the market

Buying at the bottom can be a good way of setting yourself up for future growth. The main challenge for investors is that “you just don’t know how long the market will remain soft”, Saggers warns.

“Generally, yields are at their best at the bottom of the market, so you can generally get good cash flow to hold the property during this period. But buying at the bottom does not mean that in six months’ time the market will enter a growth phase; it could take four years or even longer,” he says.

As well as the opportunity cost of this time – after all, that’s four years that your money could be invested in a growth market, generating strong capital increases – you face the risk that you may have mistimed your investment all together.

“Predicting property cycles is an impossible task; if it could be done consistently, everybody would be immensely wealthy,” says Tim Boyle, credit advisor and mortgage broker at Finalytics Financial in Melbourne.

“Sometimes you may buy near the top, sometimes the bottom, but you generally won’t know that until several years later. Investors should remember that, over the long term, property values rise – there is decades of data to demonstrate this.”

The cost of trying to predict a market cycle and waiting for the cycle to turn down before buying can be very high, he adds.

“If a market goes up 10% while you were waiting for it to turn down, you are up for another $50,000 on a $500,000 property and you still have nothing to show for your efforts,” Boyle says.

“I encourage clients to think longterm so cycles get ironed out over time, by following the old adage, ‘Don't try to time the market; it is time in the market that rewards’.”

Nevertheless, many investors are making big profits by identifying solid areas that haven’t seen a growth spurt over the past few years.

Over the next few pages, we’ve examined opportunities in each capital city, and show you which suburbs and properties might be worth taking a closer look at.

Hot phase

Sitting at 10 o’clock, you should avoid buying during this phase. Prices will be shooting up quickly. This is a fantastic market for selling but a poor one for buying. It lasts for about a year, and the psychology is excitement and thrill.

Key points:

• Everyone is excited and talking about the area.

• Demand is high.

• Time on the market is very short.

• Vendors consistently receive their asking price, or even more.

• People are willing to negotiate a lot higher than the asking price. Also known as approaching peak, the expansion has occurred and all buyers are believers.

Rising phase

The market is at 8 o’clock – the absolute best time to buy for most novice investors.

Key points:

• Interstate investors investing in the area (will push prices up).

• Auction clearance rates in excess of 50%.

• Local investors beginning to return to the market.

While buying at 6 o’clock is great for getting discounts, often in a rising market property valuers are still looking to the past for data and will value the houses even lower, and because the market is actually rising, you can realise your profit a lot faster.

Otherwise known as the start of recovery and a rising market, the market indicators are easy to read and they point towards growth, which is already happening and more is certain to follow. This generally lasts for three years, and the feelings are of hope and optimism.

Bottom phase

Sitting at 6 o’clock – this is a great time to buy. This time on the property clock is often referred to as an ‘opportunity market’ as it is easy to buy at a discount from panicked sellers.

Key points:

• The corresponding psychology is capitulation.

• When a market has hit rock bottom, it will be sitting still.

• There will be a small volume of sales and lots of great opportunities to achieve discounts from desperate vendors.

• At this point, the market sentiment is one of resignation, which normally lasts about a year.

• This does represent a great time to buy, and for those investors willing to gamble that the bottom really has arrived, it’s possible to achieve amazing results.

Boom phase

Sits at 12 o’clock, which means you should not be buying; this phase is a great time to sell. Obvious signs of a boom are lots of interest from the media and rampant growth for three years in a row. Otherwise known as market peak, this is the ceiling on market growth within any normal cycle. Its length is roughly six months and its corresponding psychology is euphoria.

“Always remember: The A-class buyers buy at the bottom of the market. B-class buyers buy in a rising market and C-class buyers buy at the top of the market. The A-class buyers sell to the C-class buyers, and the C-class buyers take the 12 o’clock to 5 o’clock loss in the market. Therefore, you should buy between 5 o’clock and 9 o’clock on the property clock, as anything outside of this isn’t a wise investment,” advises Saggers.

Slide phase

Sitting at 2 o’clock, which follows a market high and is when the market begins to cool.

Key points:

• Values start to fall by around 5–10%.

• Duration lasts a year.

• People are in denial about the market’s viability.

• Leave the market at this time, even though people are still sticking it out.

Trough phase

Sitting at 4 o’clock and is easily recognised as a falling market.

Key points:

• Desperation grips the marketplace, with values floating above the CPI(Consumer Price Index) at a 3–4% growth rate.

• It can take up to five years to work through this cycle, but if you’ve been watching the markets you won’t have to worry about this stage.

• At this stage, people can assume the market has ‘bottomed out’ and will buy at this time although the market has further to fall.

• Otherwise known as a general slowdown, approaching the bottom, the market psychology is fear and desperation.

Melbourne, Victoria

Market characteristics

• Median dwelling price of $755,500 (CoreLogic RP Data).

• Values rose 10.5% on this time last year (as at August 2015).

• A very steady market, Melbourne has enjoyed strong growth in the inner city.

• Growth is starting to spread to some of the outer suburbs.

• Job growth for tradespeople and manufacturing industries has fuelled growth in the budget markets.

• A building boom has created an apartment oversupply in the inner suburbs, but it has also created jobs and economic growth, which has been positive overall for the property market.

• An undersupply of apartments may emerge in middle-ring suburbs, due to political and planning barriers related to high-rises in suburban Melbourne.

“Melbourne was a little sideways last year. It looked to be running out of steam towards the end of 2014 but it really did rebound quite strongly through autumn, and part of that has been due to a rebound in the local economy and a building boom in the CBD,” Wilson says. “In terms of an oversupply, you never really get to the point where supply and demand are matched; it takes three years to build and plan a high-rise, so developers are always going to have to do models to predict demand. Overall, it’s fairly consistent between different price levels and regions, and a steady market moving forwards.”

Where to find the best opportunity

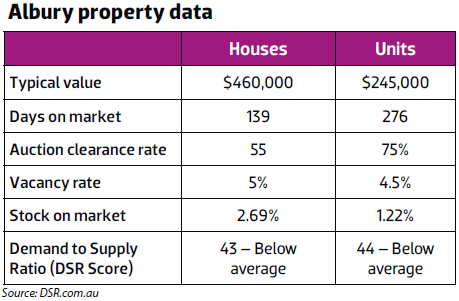

Area in focus: Albury-Wodonga

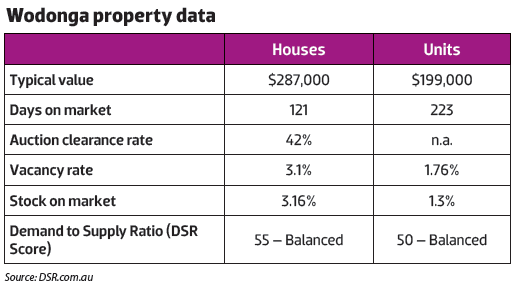

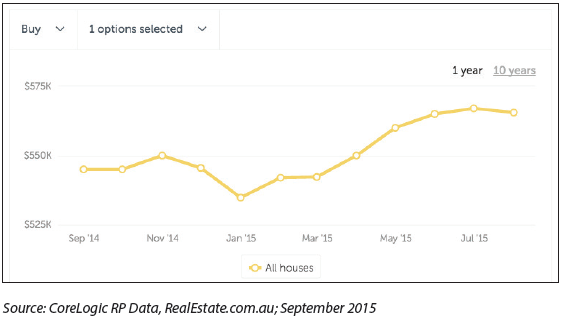

Property values in the regional community of Albury-Wodonga, which comprises twin cities perched on the border of Victoria and NSW, have experienced sluggish growth since 2006.

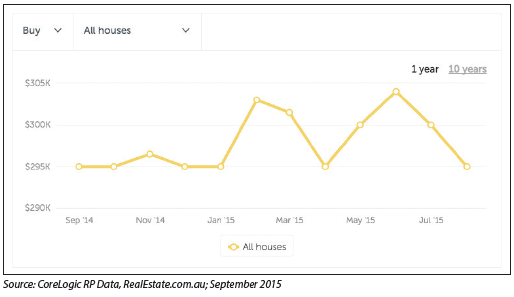

Back then, the median house price was $350,000 in Albury and $250,000 in Wodonga – and by 2013, prices had only minimally moved up, to $369,000 and $279,000 respectively.

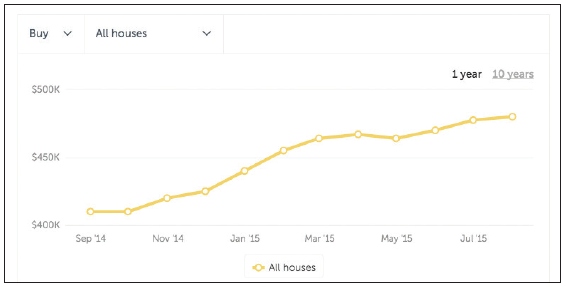

In the last two years, property values have begun to trend north, particular in Albury, with October last year becoming a turning point for the busy regional hub.

“As an important part of the regional economy, Albury-Wodonga is bolstered by its diverse industries, as the cities are home to a $90m Woolworths Regional Distribution Centre... and it’s the corporate headquarters for Mars Corporation,” explains investor and property coach Todd Polke.

“The city produces a gross regional product worth above $5bn a year and boasts a robust, growing and diverse economy that is working towards a sustainable economic future. The apartment market in particular could stack up for those investors looking to add a high-yielding investment to their portfolios, where houses might be the better option for growth in the region.”

The ‘ripple effect’ stands to positively impact on large regional markets such as these, adds Mark Kelman. “In particular, in places like NSW and Victoria, I’d be looking at the large regional centres, as a lot of those areas haven’t yet grown and are delivering quite high yields,” he says. “Because the capital cities are peaking, the yields in the cities have dropped significantly, so investors are heading to these larger regional areas. It’s affordable to buy property there and get good returns...”

12-month property price growth: Albury

12-month property price growth: Wodonga

Perth, WA

Market characteristics

• Median dwelling price of $605,000 (CoreLogic RP Data).

• Values fell by 1.8% on this time last year (as at August 2015).

• A sharp decline in the Perth economy due to the lower price of iron ore, combined with unemployment climbing steeply from mid-4% to mid-6%, has had a huge impact on property markets.

• Rationalisation in mining companies and a net loss of interstate migration is furthering hampering the city’s growth as a lot of people are looking for work in the stronger economies of Sydney and Melbourne.

• A recovery in Perth will require a massive improvement in local economic conditions, as tens of thousands of jobs have been lost.

• Investor numbers are down and vacancy rates are the highest in the country, following skyrocketing rents.

• There are still suburbs in Perth that represent good buying and provide reasonable yields; it’s a matter of getting as close to the city centre as possible, Wilson says, as “you’ll still be able to find tenants”.

“While Perth is definitely experiencing slower growth, with so much negative chat about Perth, in a sense it’s become a little self-perpetuating. Investors aren’t able to get cash flow happening and so people are – to a large degree – sitting on the sidelines,” Wilson says. “The winding down of FIFO employment has taken a lot of demand away from rental property in Perth, and that’s worked its way into the system. It’s all been exacerbated by confidence, and I’m not quite sure we’ve seen the bottom of that market yet.”

Where to find the best opportunity

The unemployment risk

“The rule of thumb is avoiding a high unemployment rate. Looking at Perth, for instance, you need to do your ‘finger on your pulse’ test. What is the unemployment rate? Yes, you can probably buy cheaper, but as an investment you have to be able to lease it. Being able to attract a premium rent and avoiding a high turnover of tenants is key,” says Wilson.

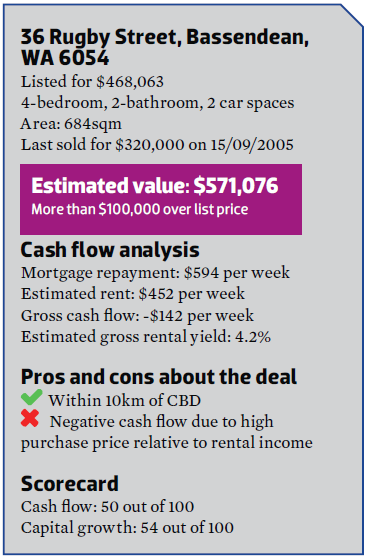

Area in focus: Bassendean

What’s on the market?

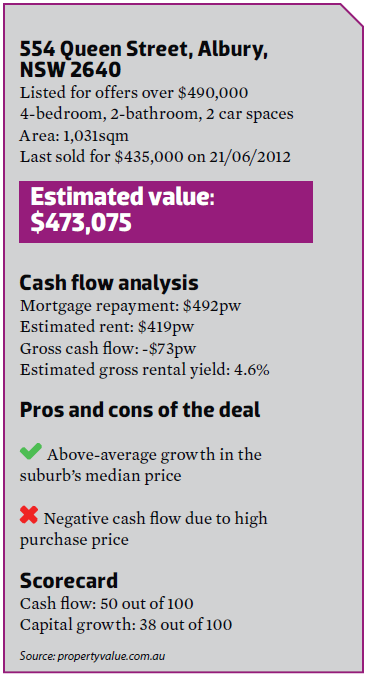

Propertyvalue.com.au analyses a property currently advertised for sale and examines its investment potential based on the available data.

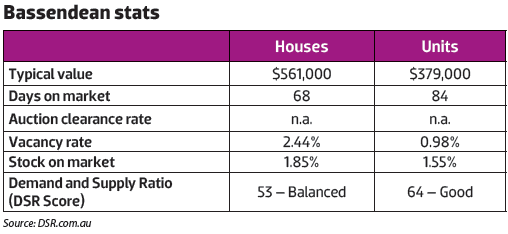

Northeast of the CBD and directly north of Perth Airport, Bassendean is an established residential suburb bounded by the Swan River.

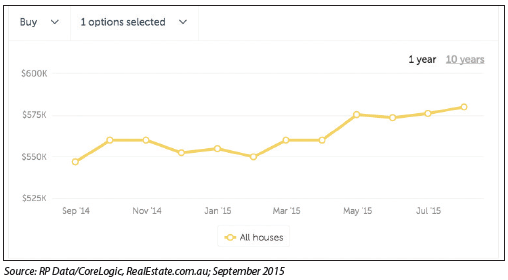

Property price growth has been consistent, albeit sluggish, over the last decade, with median house prices increasing from $401,000 in 2006 to $553,000 in 2014.

Over the last 12 months, while the rest of Perth has entered a slump and property values have declined overall, homes have held their value in Bassendean – and in fact, they’ve grown by more than $25,000.

Perth Airport has recently opened the final stage of a $200m expansion and makeover of the International Terminal, which forms part of a $1bn strategy to transform the airport.

This heightened level of construction and activity could explain why Bassendean has such strong vacancy rates. While Perth overall is suffering from a high vacancy rate of 4.4%, landlords in Bassendean are contending with much more appealing rates of 2.44% for houses and 0.98% for units.

12-month property price growth

Brisbane, Queensland

• Median property price of $514,500 (CoreLogic RP Data).

• Values up 4.3% on this time last year (as at August 2015).

• The Queensland economy has been impacted by a downturn in coal exports.

• Growth is likely to be steady closer to the city, while high listing numbers are keeping supply ahead of demand in the outer north and outer west suburbs of Brisbane.

• Adjacent markets such as Ipswich, Moreton Bay and the Sunshine Coast have moved a little sideways.

• The Gold Coast – which has had a quiet run for a number of years – is starting to move. “It’s had a lot of economic activity and is probably the strongest-growing market in Southeast Queensland, maybe with Toowoomba as the only exception,” says Wilson.

• Significant levels of new apartment construction are happening in inner-city suburbs such as Hamilton, West End and Nundah. There are concerns about an oversupply; however, this activity coincides with a growing appetite for apartment and inner-city living.

“Brisbane’s an interesting market. It was expected to be one of the leading markets in 2015 and there was a lot of confidence about rising buyer activity, but it’s been a little disappointing so far,” says Wilson.

“Price growth was largely flat as concerns over the Queensland economy worked their way into the equation. That said, recent tracking shows the market is starting to pick up again, especially the inner-city suburbs, with very high auction results. Confidence is high and while I don’t think prices are likely to grow at the same rate as last year, it’s largely a steady market.”

Where to find best opportunity

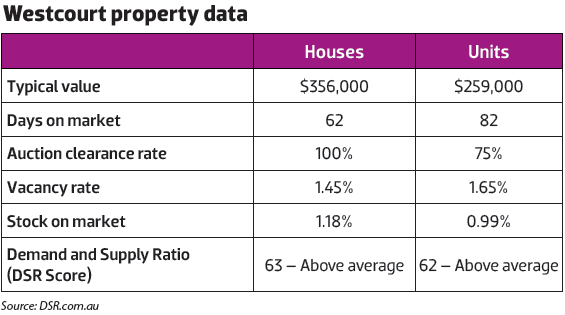

Area in focus: Westcourt

While plenty of investors have been focusing their attention on Brisbane property opportunities, Cameron Patterson from InReach Investments suggests those looking to stretch their dollars should consider regional markets further north.

He recently helped a client secure an apartment in the Cairns suburb of Westcourt. Located near the CBD, the area has experienced backwards growth over the last decade.

Over the last 24 months, however, median prices have begun trending upwards, with the median apartment value increasing from

$150,000 in 2012 to $180,000 in 2013, and $220,000 in 2014.

“There were eight sales for properties located lower in the complex, ranging from $158,000 to $170,000 in 2012 and 2013; this is probably where the market bottomed out,” Patterson explains.

“My client, Robyn, bought this one for $170,000 in June 2014, so we secured it very close to the bottom, and by May 2015, based on recent sales, it’s worth about $225,000. My data models are suggesting the area is going to undergo another capital growth surge, so this story could get even better soon.”

Buying at the bottom pays dividends for first-time investors

Melbourne-based investor Robyn McCorkelle never imagined that she’d be browsing the lush, tropical neighbourhoods of Cairns for her first investment opportunity.

But while researching potential property deals under

the guidance of her mentor, Cameron Patterson at InReach Investments, it was the deals on offer in Far North Queensland that kept landing on her radar.

“In terms of having a criteria and a location in mind, I didn’t have a plan at all – I just knew I wanted to start to invest to look after our future,” Robyn explains.

“Cairns appealed to me as there is lots of development happening and opportunities for potential growth.” Robyn is thrilled with the performance of her property, which is located in a large complex with a pool and plentiful amenities and facilities in the central suburb of Westcourt.

“My plan is to hold on to it long term so I can build up some equity and buy again, with a view to building a property portfolio,” Robyn adds.

“I’m saving some more pennies myself, then I’m hoping to buy again soon. I have no idea where I’ll buy next – there’s so much opportunity all over Australia, it’s just a matter of doing your research. It’s really quite exciting.”

Adelaide, SA

Market characteristics

• Median property price of $455,000 (CoreLogic RP Data).

• Values rose by 1.8% on this time last year (as at August 2015).

• Officially ranked at the bottom of the market.

• Eastern seaboard buyers are now taking a much closer look

Where to find the best opportunity

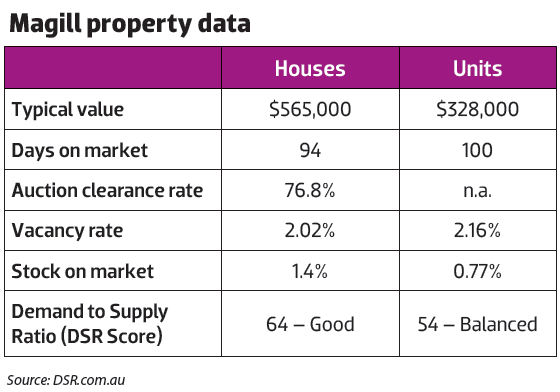

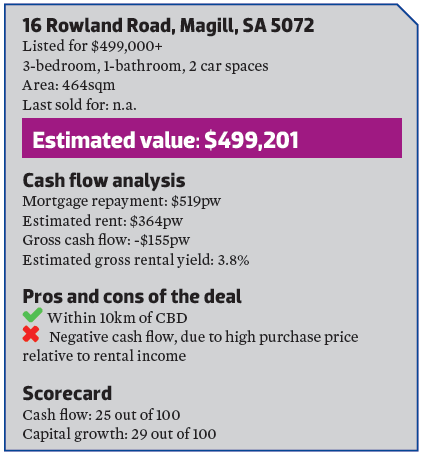

Area in focus: Magill

If you’re looking to add an Adelaide-based investment to your portfolio, you need to seek out a property that ticks all the boxes of a fundamentally strong investment, advises Robert Klaric, CEO and founder of The Property Expert International.

“States like South Australia have lagged behind; they’ve got some upside because they haven’t gone through a boom and the only place for them to go is up,” he explains. “The criteria for investors should be to stick within a 10km zone of the CBD. If you buy 20km to 30km out, properties in these areas don’t necessarily make good investments; you need to buy as close to the centre of town as possible. It’s a bit more expensive than those properties in areas further out, but it’s close to the city, close to transport, close to work, and you’ll always find a tenant.”

Look for properties that appeal to tenants and buyers, offering:

• easy access to public transport and major road links

• a good lifestyle and appealing amenities, such as access to parks, beaches and shopping

• a strong ‘cafe culture’

• a sense of community and plentiful opportunities to ‘get some down time’

What’s on the market?

Propertyvalue.com.au analyses a property currently advertised for sale and examines its investment potential based on the available data.

Sydney, NSW

Market characteristics

• Median dwelling price of $935,000 (CoreLogic RP Data).

• Property values surged 17.5% on this time last year (as at August 2015).

• $300,000 increase in median property prices recorded in less than three years.

• The markets out to the west attract high yields and offer lower entry points, but growth in those suburbs is declining.

• There are fewer investor numbers in the market, as encouraged by APRA.

• Very strong period of growth of near 8% in the June quarter, but this is starting to moderate.

• Over the next 12 months, Sydney is expected to continue to produce some of the highest growth rates of all the capital cities.

“There’s no doubt that Sydney’s property market is losing that super-heated energy,” says Andrew Wilson, senior economist at Domain Group. “It’s a mixed bag, with some areas still doing OK, but in the budget markets in the south and southwest, clearance rates are falling.

“Moving forward, growth will be flattish, but Sydney will certainly continue to grow, and it will continue to be the fastest-growing capital city market in Australia. It has a strong local economy and that drives strong migration, which is part of that supply and demand chain. It will remain the fastest-growing of the capitals, even in its moderating phase.”

Where to find the best opportunity

There are few suburbs within Sydney that would qualify as being at the bottom of the market, but there are plenty that are nearing their peak, warns Veronica Morgan, principal of Sydney-based Good Deeds Property Buyers and co-host of Location, Location, Location Australia.

“The thing with Sydney is that it’s not one whole, big market. You just need to look at the difference between the auction clearance rates in different areas to see how each market operates; recently, the clearance rates in some areas had dropped to 50%,” she says.

“Clearly, their cycle in an area like Southwest Sydney is much more aggressive than in the inner west, where the clearance rate has barely dropped at all.”

Buying quality property in a quality area is the best way to actively invest in Sydney, she adds, because these types of property experience much smaller peaks and troughs in their property cycles.

“Their growth may slow, but their values don’t drop. When people are buying in risky areas where you’ve got to time your investment well, that’s really concerning,” she says.

“You have to remember that low budget does not equal low risk.”

If you can’t afford to buy in a prime Sydney market, Morgan suggests you “get creative”.

“I’d look at a family member or friend who also wants to invest and can’t afford to buy on their own, and see if you can combine resources. It’s a lot safer than buying a cheaper property in a speculative market,” she advises.

Todd Hunter’s 3 criteria for buying at the bottom

Todd Hunter’s 3 criteria for buying at the bottom

1. A genuine depressed or fallen market

“It varies slightly, but I like to see between three and five years of a market being depressed before I buy there. Having said that, you need to know why it’s depressed. If it’s a mining town that has experienced a downturn, that won’t recover for a very long time. But there could be places in Perth, Adelaide or Victoria that have been depressed for a while and they’ve slipped under the radar, but employment, vacancy rates and the fundamentals of an appealing place to live are present.”

2. Houses, never units, priced under $400,000

“I’m not a fan of units or townhouses, as I don’t like strata – it’s an unnecessary evil and it’s an unknown entity. Strata contributions can eat away at cash flow. My only strata property is my office, and it’s the most painful property I own! Plus, it’s the land that increases in value, so I focus on houses.”

3. Motivated vendors

“I look for towns where the attributes and fundamentals are there, but where I can get in and do some really strong negotiating, because the vendors are over it and they really want to sell. I have a strategy that involves putting in a lot of offers on a lot of properties, so I can really fish out the most motivated vendors.”

Canberra, ACT

Market characteristics

• Median property price of $610,000 (CoreLogic RP Data).

• Values fell by 0.8% on this time last year (as at August 2015).

• Canberra has been plagued by uncertain politics over the last half-decade, resulting in job losses and low confidence. “Every time there looked to be a revival in real estate, there would be a budget full of doom and gloom,” says Wilson.

• In 2015, Canberra is likely to record four consecutive quarters of house price growth; this is the market's best performance since 2009/10.

“Canberra is a good-news story, as it’s finally up and running after a roller-coaster ride over the last three or four years,” says Wilson. “You have to remember that in 2011 Canberra was on track to meet the Sydney median – but a number of horror budgets slashed public service spending, which worked its way into confidence and resulted in job losses and service losses. It’s certainly well and truly in catch-up mode. Canberra will clearly move into third position this year in terms of growth.”

Darwin, NT

Market characteristics

• Median property price of $509,000 (CoreLogic RP Data).

• Values fell by 4.6% on this time last year (as at August 2015).

• Despite stagnant growth, Darwin remains one of the highest-priced capital city markets in Australia.

• Lower demand from interstate buyers, and a notional downtown in the resources sector, has continued to subdue Darwin’s market, leading to relatively high vacancy rates.

• Inner-city construction has moved faster than demand.

• When the city had a capital growth surge a few years back, it was magnified by Darwin’s smaller size. “Existing stock was bought up quite quickly, which caused a mini boom,” Wilson says. “Affordability is a key factor and we’re now seeing an adjustment from that price growth from a few years ago.”

“Darwin has been strongly affected by the downturn in

the resources industry, particularly the decrease of the FIFO workforce. There’s a growing lack of demand from management groups and interstate jobseekers, which has taken a lot of the demand out of the market and pushed prices sideways and downwards,” explains Wilson. “Prospects are reasonably positive, as they have the Ichthys gas fields to the north, and it’s exposed to other resource export markets, such as tourism and agriculture. I would say it’s more of a market pause than a significant shift down.”

Hobart, Tasmania

Market characteristics

• Median property price of $336,000 (CoreLogic RP Data).

• Values rose by 1.5% on this time last year (as at August 2015).

• While it looked set for a market revival early this year, it failed to eventuate after a promising start. Next year may be a repeat of the same.

• In recent years the market has, at best, moved sideways; median property prices are still below where they were

in 2010.

• Vacancy rates in Hobart are among the lowest in the country, with SQM Research recording a vacancy rate of 1.1% in August 2015.

“Hobart really is a market that is remarkably affordable, but it has fallen off the radar because it’s stagnant. It’s a really slow, low-growth housing market, and while prices aren’t falling sharply, the market is largely directionless and it has been that way for three or four years now,” Wilson says. “That market is clearly all about the economy, and it would really need a substantial improvement in Tasmania’s economy before there’s an upswing.”