We all have different reasons for investing in property, but it ultimately boils down to one main goal and one goal only: to make money.

For those who are organised, disciplined and have a clear strategy, achieving a target of $1m in property equity within a decade is not just a pipe dream. Rather, it’s an entirely achievable goal – and you don’t need to dive into high-risk, get-rich-quick schemes to make it happen.

Solid residential investments, along with equity manufacturing strategies, including subdividing, renovating and developing, are the key to success here. And with banks increasingly favouring commercial lending of late, commercial investments could also form a major piece of the puzzle.

As with residential investments, selecting the right commercial property is crucial to your success, which is why doing extensive due diligence is key.

“To get started in commercial properties, you typically need 30% as a deposit. However, in recent times commercial finance has become easier for the everyday Australian – many banks now offer LVRs of 75–80%,” says Scott O’Neill, director of Rethink Investing.

“You will always have financial hiccups. There will always be something that goes wrong that you don’t expect, and it is different for every deal"

“This trend is expected to continue as the banks seem to have greater appetite for commercial lending market share.”

O’Neill adds that, for many Australians, ”one commercial property would do more for them than owning half a dozen quality residential properties!”

Whether your strategy involves commercial or residential properties, old or new assets, or a mix of all of the above, there are clear steps you can take towards building your property wealth. On the following pages we outline the five key steps that will help move you forward on your property journey, with your eye firmly on the prize of seven-figure profits in just 10 years.

STEP 1: SET YOUR FOUNDATIONS

Before you jump head first into buying an investment property, you should establish a strong base for investing. This means having a clear vision of what you want to achieve as a property investor, along with the financial footing to get started.

Setting goals not only helps you figure out the right strategy to implement but keeps you on track as your journey moves forward so you can be sure that you’re meeting your targets in the best possible way. And if you’re not, you can pivot and adjust your strategy to suit.

“You need a solid plan – it should include what you are hoping to achieve through property investing, how many properties you are planning to buy, how you are planning to structure the mortgages, and how you are planning to buy – such as in your own name, joint names, in a trust or even an SMSF,” explains Catherine Smith, CEO of Wholistic Financial Solutions.

“I believe the essential element in property investing is to get the financial foundations right. You wouldn’t buy a property without checking it was structurally sound, would you?”

Whether your plan involves focusing on cash flow, long-term capital growth or a combination of both, and regardless of the property types you choose – apartments, houses or commercial premises – this clear road map will help you get a realistic view of your financial standing.

Then you can work out exactly how much you need to save to get going.

“In terms of savings, an investor would need at least 15% of the purchase price to cover the deposit, stamp duty and fees to get started, as banks are currently only lending 90% of the value of the property. So for a $500,000 property an investor would need $75,000,” Smith points out.

“It’s more difficult for investors at the moment due to the restrictions on lending since the royal commission.”

One practical way of preparing as an investor is to consider your standard of living and how that affects your ability to invest.

“Many young investors are rentvesting – that is, they are renting where they want to live and investing in more affordable areas. Some are staying home with parents whilst investing. We have had a single 19-year-old earning only $65,000 be able to buy an investment property,” Smith says. “Yet a couple earning $250,000 combined were not able to borrow due to their high cost of living, which included regular dinners out, private-school fees, holidays and spending on clothes, hairdressers and cosmetics.”

A common aim of property investors is to set themselves up for a comfortable retirement, early or otherwise. But while you’re still in the workforce, it’s important to understand and maximise the resources you have, and be aware of your risk profile.

“We’ve had a single 19-year-old earning only $65,000 able to buy an investment property… Yet a couple earning $250,000 combined weren’t, due to their high cost of living”

“As property investment is the pivotal aspect of setting yourself up for a self-funded retirement, it’s essential to minimise your purchasing and holding costs and get as many tax dollars as possible to assist you to pay for your investment property. The more property you can have for the least out-of-pocket expenses the better,” explains Financial Advisers Australia CEO John Hehir.

He highlights professional advice as important when you’re setting yourself up in properly so you understand these factors. Property investment isn’t a solo job, so you should always be ready to engage people who know better and can give you objective opinions, especially when it comes to your risk profile.

“Nine out of 10 people never buy a second investment property because they were not properly informed or prepared,” Hehir warns.

“It is essential to have someone impartial to the investor to go through and score all of the ‘real risk’ aspects of owning an investment property long term so that when the fi rst bump in the road comes along they don’t panic and sell when they should be holding their investment.”

A healthy financial profile suggests you are prepared to handle debt, so you don’t worry too much about short-term losses.

Rocket Property Group CEO Ian Hosking Richards also advocates that new investors should seek out expert opinions so they can avoid making major mistakes right off the bat.

“Property investing can be a very complex subject for the uninitiated. It is often counterintuitive, and does not easily lend itself to a theoretical approach,” he says.

“When I got started, I found a couple of experts who had already been investing for many years and had achieved the kind of success that I was looking for. As a beginner, I think it is wise to be open to guidance from more experienced investors. Otherwise, you could be on a very steep learning curve.”

STEP 2: CREATE A STRATEGY

As an investor, you need to think realistically and craft an investment strategy based on your personal circumstances rather than trying to follow in someone else’s footsteps. Your lifestyle can affect how you invest, so the next step towards becoming a property millionaire is to create a personalised strategy

Once you've set your investment goals, it’s time to think about how you can achieve those aims. When building a portfolio, having a plan of action is crucial so you don’t waste time and money on pursuits that don’t actually help you get where you want to be.

According to Results Mentoring director Brendan Kelly, the factors investors need to think about when deciding on a strategy are the desired outcome, the cash they have at their disposal, their borrowing capacity, their level of related skill and expertise (such as in bookkeeping and project management), and how much time they have to give to the process.

Financial limitations in particular can be a common hindrance for many first-time investors, so it’s important to gauge your capacity in this area carefully and realistically.

“In your endeavour to build a property portfolio, you may have discovered a financial limitation. It could be the pool of cash you are able to access, or perhaps your borrowing capacity is low. In either case, you will need to adjust your original investing approach and begin your journey with more affordable properties,” Kelly advises.

“An alternative may also be to incorporate your lifestyle with your investing. If you have enough cash to purchase a place to live but not enough to invest as well, it might be worthwhile taking on a temporary living experience for a better investing outcome.”

Your borrowing capacity plays a major role in the strategies you are able to employ, as it often takes more money to execute a more complicated but cash-intensive strategy that can put you on the fast track to considerable equity.

“In today’s finance environment, lenders more willingly offer finance to those that can demonstrate great financial control personally,” Kelly explains.

“This means a good savings track record, minimal frivolous spending, clear accounting for where your money goes, and a regular and reliable pay cheque.”

Boosting your financial standing is not something you can necessarily handle on your own – at times, a little help can be exactly what you need. For instance, a joint venture can be a great way to get started as a property investor, especially if you can create a set-up that will benefit both you and the other party.

“If you find yourself with a small bank balance but you have a great job, it might pay to team up with a retiree that you may know who has access to cash and would love to improve their financial position, but who is unable to borrow money because they aren’t employable,” Kelly suggests.

Setting your strategy’s key criteria

If an investor’s goal is to hit $1m in equity within a decade, their mindset needs to be about investing for the long term and reaping the benefits of capital growth, not just searching for passive income.

As a result, you need to be willing to give up time to your investing journey, especially as you map out your acquisition plan.

“As an investor evolves into considering more complex strategies, a greater commitment of time is required,” Kelly says.

“As with everything, though, the greater the developed expertise you have with a strategy, the more systems you will have developed to build efficiency and confidence and reduce the burden of time.”

Time also needs to be given to research and determining where and what you can buy. Will you look into capital cities, which generally offer stronger capital gains, or take a greater risk with a fledging but affordable, high cash flow regional market that could eventually boom?

“In today’s finance environment, lenders more willingly offer finance to those that can demonstrate great financial control personally”

“This may mean investing in more regional towns, smaller properties on smaller blocks or perhaps units or apartments rather than houses or townhouses. Thinking this way may allow you to access the property market and begin to build your wealth as you continue to save and reach those promotions,” Kelly says.

Regardless of the direction in which you choose to go, you want to set clear criteria to inform your buying decisions. By educating yourself extensively on the market, you will get a better idea of specific targets, such as the level of growth you want to see in a few years’ time and the return rates that will sustain your portfolio throughout the journey. Once you know what you’re looking for, you can then proceed to buying your first property.

STEP 3: TAKE ACTION

You can only plan so much before analysis paralysis sets in. Time in the market is essential for capital growth, so by Step 3 the time has come to get moving and actually start building that portfolio you’ve been dreaming about, whether it’s composed of residential assets or commercial property

With your strategy in hand, it’s time to go shopping. The good thing about investing today is that you don’t need to pound the pavements for the perfect property – you can browse Australia-wide property listings from the comfort of your own home.

Websites like RealEstate.com.au and Domain offer comprehensive listings of dwellings on the market all over the country. You can sort them based on how you’ve set your criteria, whether that’s price point or location. You may also want to engage a buyer’s agent who specialises in working with investors to assist you in fi nding the right properties for the right price, in the right place.

Many people think that owning an investment property is only the domain of the wealthy, and that much of your personal time and effort needs to be plowed into the pursuit, but this doesn’t have to be the case, especially when there are experts out there who can help you.

“I like to choose the most hands-off strategy: buy new from a reputable builder and be guided by a much more experienced investor. Then choose service providers with care, and let them get on with their job. Don’t try to self-manage your investment property, particularly when you are already paying someone else to do it,” says Rocket Property CEO Ian Hosking Richards.

When you’re buying a property for the purpose of renting it out, it’s also important to consider what your desired tenant would want.

“I spend a lot of time building up a profile of my target tenant: where they want to live, what type of property, what level of specification they will pay top dollar for,” Hosking Richards adds.

“Once you know what they want, you then go out and purchase a property that will attract them; this helps to minimise vacancies.”

When it comes to putting together a property portfolio, many investors stick to residential property. It’s considered the safe, comfortable and less intimidating choice, and the risks are easier to grasp than those of commercial investment, despite its cash flow potential.

But there’s more and more reason to get into commercial investment. There has been a misconception that commercial investments are not good for long-term gains; however, Rethink Investing’s director, Scott O’Neill – who has seen tremendous success with this type of investment – says this is not the case at all.

“Many investors fail to understand the overall wealth benefits of this asset class – namely, the income equity growth side of things over an extended period of time. High-yielding commercial property has the ability to pay itself off in 10–12 years, as well as also benefi ting from capital growth,” he says.

Many investors fail to understand the overall wealth benefits of commercial property – namely, the income equity growth side of things over an extended period of time”

“In general, the value of a commercial property is generated from three main areas: rental income, the interest rate environment and the strength of the lease. Once you understand these basic areas, you will see capital growth as a major wealth creator for commercial investors.”

Commercial properties typically attract tenants who are looking for extended leases, as they would rather not uproot their businesses. Moreover, as with residential property, location is key to maintaining a commercial property over the long term. So investors should look out not just for yield but also for where the tenants will be coming from. A strong location means you will worry less about a tenant leaving, as you’ll easily be able to find the next one.

Cities are often ideal locations for commercial investment, as their larger populations and the convenience they offer keep vacancies low, while landlords can earn yields of around 7–8%. Nonetheless, regional investments can work to your advantage, as long as you’re in the right area.

“You’ve just got to be in the most convenient spot you know. If you’re going to go into a retail format, maybe you want a corner block that always has a real estate o ce tenant in there, for instance,” O’Neill advises.

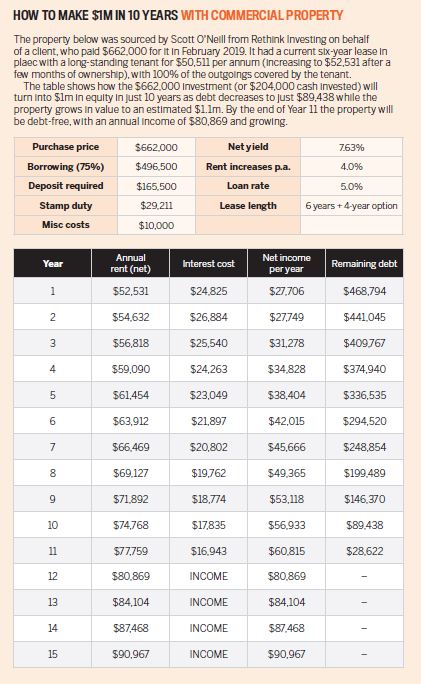

“Commercial interest rates typically start from 3.6%, depending on the lender and whether they are fixed or variable In our property example [see table, p31], we assumed 5% interest-only rates for the numbers, considering we are using the income from the asset to pay it down as soon as possible,” explains O’Neill.

“In Year 10, this property would only have $89,438 of debt left and a value of approximately $1.1m. Incredibly, at the end of Year 11 the property will be completely debt-free, producing an income of $80,869 and growing each year after that.”

This one property would do more for many investors than owning half a dozen quality residential properties.

“As with residential property, finding the right commercial property is the key,” O’Neill adds. “There is much more due diligence required compared with residential properties, but when you get it right, the returns can be far greater.”

STEP 4: MANUFACTURING GROWTH

Savvy investors don’t just buy a property, sit back and collect the rent. They look for ways to get the most out of their investments through diversification and value-adding strategies like renovating

Property is one of the most diverse ways to invest because it doesn’t just have to be about what you’re familiar with. There are investors who have found success investing someplace they haven’t been to personally, whether that’s overseas or interstate. It’s about where you can find not just growth but positive cash flow as well.

Results Mentoring director Brendan Kelly notes that in order to sustain a property portfolio an investor needs to be able to pay down debt, especially on negative-geared investments.

When buying in sought-after suburbs around the major capital cities, rental yields will vary from 2% up to 5% perhaps, depending upon market conditions at the time of purchase,” he says.

“Depending on interest rates and other holding expenses, the property just purchased is likely to be negatively geared, meaning the expenses required to continue to hold the property exceed the revenue coming in from the rent.”

Given the need to have funds flowing in consistently, an investor should make room in their portfolio for balance. With interest rates currently at a low, they can capitalise on properties that offer yields of around 5–6% and remain in the black.

“A balanced portfolio is paramount for long-term capital growth. Having a balance means that it can be easier for an investor to manage repayments and costs over the long term without experiencing financial stress,” says Helen Collier-Kogtevs, CEO of Real Wealth Australia.

But what of the investments you’ve already got? Are they lacking aesthetic appeal, or failing to stand out in the local market? With a little work and spending, you can pump up the value of your existing properties.

“When done right, renovating, developing and subdividing can be a fantastic way to generate growth as long as the strategy is what the market wants,” Collier-Kogtevs explains.

“You need to start with a good, solid base of quality properties that you can add value to in order to manufacture growth. Ways in which this can be done include selecting properties that can be either subdivided, strata-titled or renovated at a later stage.”

Adding value is one of the best ways to sustain a property for long-term growth, especially when combined with other strategies.

Renowned renovation expert Naomi Findlay says, “Regardless of the way you use renovation, at all stages you are looking to generate value in the property. This value can then manifest as a profi t if you were to sell it postrenovation, an increase in value which can be used to leverage borrowing or improve your lending position and utilise it for other investments.

“Renovation doesn’t need to be used as a standalone strategy. In fact, many of my students use it in combination with other strategies such as subdividing, developing and short-stay accommodation.”

It is vital when renovating for the rental market that you understand what tenants want, Collier-Kogtevs explains.

“Sometimes, investors design or decorate to their own personal taste or preferences, which is not always ideal. Therefore investors need to do their research,” she says.

“When I’m ready to embark on a renovation, I often spend some time going to open houses or display homes to get a feel for what is on trend and what people want in their homes. That makes it easy to select paint colours, the latest accessories, floor coverings and outdoor entertainment spaces.”

While you want to maximise the potential of your property when renovating, it is crucial that you remain realistic. You need to understand market trends and how much growth you can generate, otherwise you may wind up overspending for limited returns.

“A common pitfall for investors is underestimating the renovation budget or overestimating the value of the completed project. This can lead to incomplete renovations or under/overcapitalising on a property,” Findlay warns.

For this reason, Collier-Kogtevs recommends that investors do a feasibility study before embarking on value-adding projects – regardless of size – so that they know exactly what they’re getting into.

“Renovation does not need to be used as a standalone strategy. In fact, combine it with other strategies such as subdividing, developing and short-stay accommodation”

“If developing is the strategy used to manufacture growth, investors need to understand the market – suburb or town – they are in so that they build what is in demand and not what they think is best,” she says.

“For example, if there is a suburb where three- to fourbedroom houses are in demand, it may not be a good move to build one-bedroom properties. This could limit your ability to manufacture growth.”

Local agents and property managers are generally a good source of information, as they are very familiar with the market and the preferred price points of tenants.

STEP 5: RINSE AND REPEAT

Building a million-dollar portfolio takes time, persistence and a willingness to go outside your comfort zone, whether you’re a new investor or one with a few properties already under your belt

Property investment is about playing the long game, so you need to be ready to stay in the ‘buy and grow’ cycle for years to come. The more properties you acquire over time, the more experience you gain, and your decision-making as an investor improves. The important thing is to stay realistic.

“Ten years is definitely an achievable time frame to create $1m in equity, but you will need upfront capital or borrowings. The national average growth for property is 6.8%, so you would need to conservatively invest $1.3m–$1.4m to make $1m in capital growth,” explains Interlinked Property Solutions director Sally Dale.

“Start small and slowly build up over that time frame. Spread your risk across locations, plan your strategy and build on your investments.”

Ultimately, there’s no perfect formula for getting that first million in property, as it’s a process that will vary across different types of investors and markets.“Every investor is unique, so personal considerations such as financial circumstances, property strategy plans, risk appetite and the number of years until retirement all influence the right mix of properties for someone to build a sustainable portfolio,” says Interlinked Property Solutions COO Rhonda Olsson.

“Researching this mix is where the real work lies when developing a property strategy that is achievable and effective.”

Keeping your time frame in mind can infl uence your strategy, as will your personal end goals, since the defi nition of ‘a comfortable retirement’ will differ for everyone.

“Every investor is unique and needs to defi ne their desired retirement lifestyle and what that translates to in dollar terms. The longer the time frame the less aggressive an investor needs to be. Shorter time frames often require higher-return investments to be part of the mix,” Olsson says.

“Remember, people are not always just selling up at retirement. Properties are a source of ongoing income, not just capital growth. Properties acquired can generate a healthy fortnightly income. The key is to reduce debt as quickly as possible, re-borrow and then go again, but keep focusing on paying down debt quickly.”

“Be confident, take action and stay on track with your property strategy, because most people just get stuck, procrastinate, don’t start, or start and don’t progress any further”

Making your first million in property within 10 years is an achievable goal as long as you keep your eyes on the prize.

“On the whole, over the last few decades Australia has seen exponential growth in the property market, and those cycles are likely to continue. There are markets within markets, and you need to know what to buy and where, to suit your individual strategy,” she says.

“Be confident, take action and stay on track with your property strategy, because most people just get stuck, procrastinate, don’t start, or start and don’t progress any further."

The greatest ‘sacrifice’ an investor will make in order to get to their first million is the time it takes to research thoroughly and make choices on that basis. As long as you know what and where you’re buying into, an investor shouldn’t need to make unnecessary sacrifices.

“Aggressive investing is a matter of perception – like anything, you will get back what you put into your property investment. Support from experts who can set up your strategy is essential for aggressive investment,” she says.

For Brendan Kelly of Results Mentoring, achieving $1m in 10 years will be dependent on the effort you put in.

“Aggressive investing is a matter of perception – like anything, you will get back what you put in”

“Skill up in understanding how the property market behaves and reading market movements. Know a selection of different strategies. Get in touch with leading property-related service providers and other investors. Brush up on tax and legal structuring knowledge, as well as negotiation tactics,” he advises.

“With the right support and activity, $1m in equity is possible to achieve much sooner than 10 years. Such a target is an aggressive one and does require a more active approach by the investor.”

In the end, investment is not a race, and it won’t matter how long it actually takes you to get to a million. Making a firm commitment to learning and growing as an investor is the key. Even if it takes you 20 years, you’ll reach your goal by following a clear plan and being persistent, even through the tough early stages!