Ask any veteran investor what they most regret and chances are they will say they didn’t start early enough. John Hilton consults the experts to see how youngsters can begin their investment journey safely and profitably

The ripe young age of 18 is the time when people are legally able to get a home loan, but very few are ready to borrow at this stage.

The reason? There are many, according to Marissa Schulze, a mortgage broker at Rise High Financial Solutions. Firstly, young people who are just starting out typically lack investing experience and knowledge about where and what to buy.

Then there is the matter of acquiring finance, as they inevitably have little savings. And this is made all the more difficult by their short employment history, and the fact that surging capital growth in some capital cities has pushed many suburbs into unaffordable territory.

Schulze can sympathise more than most with these challenges, as she was 18 herself when she bought her first investment property.

The year was 2002 and she had managed to save a deposit of $7,000 while working part-time as a checkout attendant at her local supermarket.

“While I was certainly nervous and a little scared when I bought my first investment property and entered into a loan at the age of 18, the excitement and adrenaline of the experience far outweighed any fear,” says Schulze.

“As soon as the first property was under my belt I could not wait to get the next one and the next one and keep building my portfolio.”

And despite being well aware of the challenges facing young investors, Marissa also believes they have advantages that their older counterparts lack.

“When you start investing at such a young age, you have no dependants, little financial responsibilities, nothing to lose, everything to gain, and your risk appetite is at its peak,” says Schulze.

But the real beauty about buying young is that you can truly take advantage of the fact that time in the market is more important than timing the market.

“And if you start young you have a great advantage to achieving your financial dreams and goals sooner,” Schulze says.

“For an ambitious 18-year-old, property investing can be highly addictive and is very exciting.”

Getting motivated

Before young people can even think about investing, they must have the drive and ambition to make one of the most important financial decisions of their lives.

Deanna Ezzy is a mortgage broker at Trilogy Investment Property Funding and the winner of Your Investment Property’s Mortgage Broker of the Year award for 2013.

After growing up in New Zealand, she was motivated to get into the Australian property market and take advantage of the First Home Owner Grant offered in this country. So, at the age of 24, Ezzy and her cousin entered into a co-borrowing arrangement and bought a two-bedroom apartment in Queanbeyan, NSW.

“It was the only way at the time that either of us were able to enter the property market,” says Ezzy.

How can you motivate yourself? Here are some of the strategies that worked for Deanna Ezzy

- Find someone who has done or is doing what you hope to achieve. Being able to 'see' the rewards, property growth, equity generation and journey can really help give you your WHY. I think that doing something without knowing the WHY will hinder your ability to stick to the plan and succeed.

- Get excited about goals! Start small, and be kind to yourself. Give yourself realistic and achievable timeframes to achieve your goals. I have a 1.8m x 1.4m whiteboard on my dining room wall, filled with weekly goals, monthly goals, annual goals, inspiring quotes, 'to do' lists, and my WHY. Looking at your WHY, and having your goals staring you in the face each day, is a great motivator and helps you stay on track.

- As you do things, you get to physically cross them off the list! It’ll give you a great sense of accomplishment and pride in yourself for getting stuff done. It’s hard evidence to show yourself that you’re achieving your goals and moving forward.

- Figure out where you’d like to be in three years, five years, and 10 years.

- I recently sat down with a financial planner, which helped me work out what steps I need to take, and in what order. I sometimes felt like there was so much I wanted to do, so many goals, that I didn’t know where to start, and it was a bit overwhelming. Someone else giving you some direction can really help put it all into perspective and make it all feel achievable.

Schulze says working with a strong team of professionals is at the absolute core of being successful as a young investor.

In fact, she recommends that they should only take advice from people who are investors themselves and who have achieved what the young investor wants to achieve.

The most important experts to consult include:

Ezzy strongly agrees, and adds that researching the right team is even more important than researching the ins and outs of loans and the property market.

“In most cases, you’re far too busy doing what you’re good at to really have time to thoroughly research every single aspect about buying a property,” says Ezzy.

“Word of mouth is always a great way to find someone who is good at what they do.”

Saving for a deposit and managing cash flow

For Ezzy, the biggest issue for young people today is saving for a deposit. This is especially true in the present environment of credit cards and online shopping that this generation of young people has grown up in.

“A lot goes into learning how to earn money, but no one really gets taught how to manage it,” she says.

Ezzy herself grew up without any knowledge of how to manage money, but has come a long way over the past decade with the help of her mentors.

And even though she knows that many people love spreadsheets for managing cash flow, she is not one of those people.

“I think managing cash flow just means being disciplined,” she says.

“The word ‘discipline’ sounds painful but actually gives you a sense of achievement, stability and control.”

She recommends doing small and clever things to save money, which can all add up to big savings. These include things like:

- Washing and ironing your clothes instead of dumping them at the dry cleaners.

- Instead of paying $120 for a manicure/pedicure each fortnight, wear closed-in shoes or do your nails yourself.

- Buy Light n’ Easy meals for two weeks of the month. This means you have no excuse to blow money on eating out. It’s also portion and calorie controlled.

- Buy a coffee machine and forgo $5 lattes each morning (three months of 1x$5 coffee per day = $450, which is enough to buy a really great coffee machine.

- I find it really exciting to see my bank balance balance go up. That is more exciting than blowing my money on a new pair of shoes or getting my nails professionally manicured.

Young people who would struggle to afford a property by themselves could consider a co-borrowing situation, in which two or more owners agree to share the costs of ownership between them. On the positive side, in addition to sharing the burden of the home loan, “The entire experience and excitement of buying my first property was also shared with someone, which was nice, and it made it feel less daunting,” she says.

However, she acknowledges that there are better ways for young investors to get into the market. The obvious disadvantage of co-borrowing is that if you have a difference of opinion in the future about what to do with the property, then things might get messy, she says. For example, one party may wish to sell, renovate or refinance the property against the wishes of the other co-owner(s).

Schulze agrees that it’s not best way to obtain a loan, highlighting that it will significantly limit future borrowing capacity and the opportunities of all involved parties.

“It can be detrimental to your credit rating if your co-borrowers do not keep up with their obligations,” says Schulze. “Our preference is always to try and work out a way for the borrower to do it on their own first, and only look at other options as a last resort.”

In order to be successful at co-borrowing, young buyers should pair up with co-owners who have similar goals and financial circumstances. Furthermore, even if you have a strong relationship with the co-borrower, it’s best to plan for the worst. Before buying the property, speak to a solicitor or conveyancer to understand all your options for any unforeseeable events.

A co-ownership agreement is a legal document which sets out the rights and responsibilities of each of the owners. This is essential for all those looking to enter a co-borrowing arrangement, because it acts as a guide for co-owners should any unforeseen issues arise with the property or the owners. It is one way to avoid legal disputes which can be exceptionally expensive, particularly for young people.

Parents becoming the guarantor

A guarantor is typically a parent (or other senior family member) who allows the equity in their property to be used as further security for your loan.

To use a guarantor, the borrower must be able to service the entire loan on their own income. The loan is in the borrower’s name, not their parents’.

In these circumstances, the guarantor is linked to the loan by the guarantee. This guarantee can be released and the guarantor’s responsibility stopped without the loan being repaid in full.

If your parents are in a position to help and are willing to become the guarantor, then this a great option, says Schulze. This will also save you lots of money by avoiding mortgage insurance. It’s important to note that mortgage insurance is payable when the loan is 80% of the mortgage price.

In particular, for those who are struggling to finance a deposit but can meet the loan repayments, a guarantor is a great option. Indeed, in Ezzy’s opinion, saving for a deposit is the hardest thing for a young investor to do and can often seem impossible.

“As much as we would all love to be disciplined and be an expert managing cash flow, being a Gen Y myself I know that the reality is that a lot of people struggle with the deposit,” she says. On the other hand, your parents are risking what is most likely their prized asset, should you be unable to pay the loan.

“If you go down this path, make sure you split the loan in two portions: the portion that your parents are guaranteeing and the portion that they are not guaranteeing. Focus on reducing the portion that your parents are guaranteeing quickly, so that you can release your parents’ guarantee ASAP,” says Schulze.

It's also important to bear in mind that not all banks offer the option of parents becoming the guarantors, and it can be quite complex to figure out, so it's best to speak to a broker if you're considering this option.

Also, keep in mind that if you are unable to pay the loan, the lender--and even your guarantor--can take legal action against you.

Schulze explains three examples of how parents becoming the guarantor can work:

3 ways your parents can help you get into the market

1. You borrow 100% of the purchase price (one loan) and the parents guarantee the loan, but their guarantee is limited to the total loan amount.

This exposes guarantors to the most risk. To remove the guarantee in the future, applicants will have to get the LVR down to 80% if they want to avoid Lender's Mortgage Insurance (LMI), or down to 90% if they are happy to pay LMI at the time of removing the guarantee. This process will involve a brand-new credit application as well as a new valuation.

2. You borrow 100% of the purchase price (one loan) but this time the parents guarantee the loan and is limited to the amount they are guaranteeing (for example, just 20% of the loan).

This exposes guarantors to a lot of risk (but slightly less risk than the previous option). Once again, in this scenario, to remove the guarantee in the future, applicants will have to get the LVR down to 80% if they want to avoid LMI, or down to 90% if they are happy to pay LMI at the time of removing the guarantee. Also, this process will involve a brand-new credit application as well as a new valuation.

3. You borrow 100% of the purchase price but the loan is split into two portions (for example, one portion of 80% and one of 20%).

The 80% loan is only in the name of the purchaser and does not have a guarantee attached. The 20% loan is in the name of the purchaser, but the parents guarantee this facility. As soon as this 20% loan is paid out, the guarantor is automatically be removed. This is the best option where a family guarantee is required. The guarantor's risk is limited, and it is very easy to remove the guarantee without asking the bank account to grant credit approval for a new valuation to be undertaken.

Growing your portfolio as a young person

Schulze’s first investment property was a three-bedroom semi-detached house in Taperoo, a suburb just north of Port Adelaide.

The purchase price was just $82,500, and buying it so cheaply was integral to Schulze being able to build her portfolio. She believes the fact that this property appreciated so quickly was the catalyst for her being able to buy a second property and a third one so quickly.

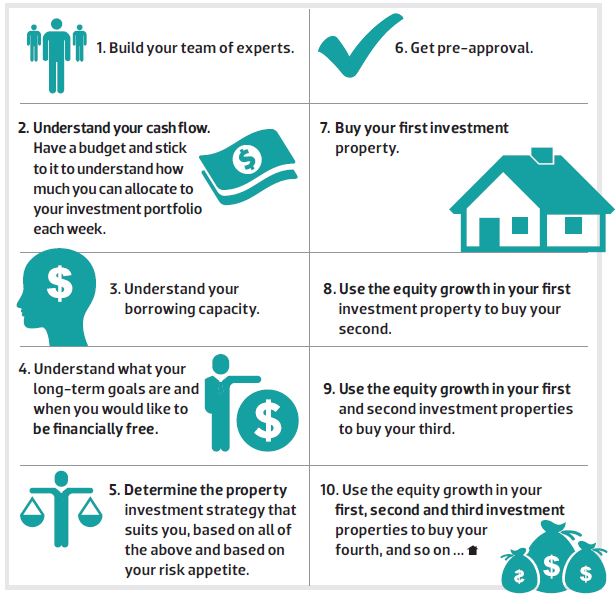

Indeed, she proceeded to build a portfolio of 16 properties by the time she was 30, which shows just what a young investor can achieve if they set their mind to it. The formula she used is a practical model for young investors.

What lenders offer young people

The following are three very different examples of what lenders are offering:

ANZ: ANZ Security Guarantee

- Allows another person, generally a family member, to use the equity in their home as additional security for a portion of your loan amount.

- You avoid paying the premium for LMI.

- You can maximise the amount you can borrow (up to 100% of the purchase price, plus costs such as stamp duty and other legal fees).

- Choose from a range of ANZ home and residential investment loans to suit your needs.

- Guarantors will generally be parents, parents-in-law or step-parents; however, ANZ will consider other guarantor relationships and determine if a security guarantee may be acceptable.

- Guarantors can determine what portion of the loan they will secure (they don’t have to provide a guarantee covering 100% of your loan amount).

- You can split the cost of buying a home with family and friends, while retaining individual control of your finances.

- You can borrow more funds than you would otherwise be able to afford on your own.

- Buy the property you want, rather than settling for a cheaper option.

- Split the costs of your home any way you like, and let each borrower decide how they want to manage their loan repayments.

- Each borrower can access a range of features, including redraw facilities, mortgage offset accounts and lines of credit.

- You must seek legal advice and all sign a Property Share Authority Declaration form before entering into a Property Share Agreement.

- Parents lend you up to 20% of the property’s purchase price. Bluebay Home Loans provides the rest. You repay them with interest, like any other official loan but at half the rate of your home loan.

- When the house is sold, you repay your parents (or you can repay them sooner if you choose to make extra repayments).

- Parents are not on the title of the home.

- Parents’ house is not used as security for your home loan, so they get to help you without risking their asset.

- You can still qualify for the First Home Owner Grant and stamp duty concessions (if eligible).

- You can also potentially save thousands on mortgage insurance.

Traps to avoid

Avoid ‘get rich quick’ schemes. Property is a long-term investment.

Don't buy what you cannot afford to hold forever. Managing your cash flow is the most important part of being a successful investor, and you need to know how much a property is going to cost you to hold before you buy it. Regardless of what your plans are for that property, only buy a property you can afford to hold forever. If you do this you will never lose money on property because you will never be forced to sell when the market is down.

Don't procrastinate. If you are young, you have a real opportunity to get a head start in life that will make your future so much better in every way. So reallocate some of the money you are currently using on buying new clothes/shoes and going out, and buy a cheap investment property to get into the market.

Marissa Schulze's formula for breaking into the market