We have been told property investing is for the long-term. In fact experts we’ve interviewed talked about keeping your investment for as long as possible due to the high cost of buying and selling. Yet here we are telling you that you can fast-track your portfolio by tweaking your strategy without putting your finances and your sanity in danger. Yes, we have been told by our trusted experts it can be done.

Over the following pages, you’ll see different strategies from our resident experts, Ben Kingsley at Empower Wealth, Brendan Kelly at Results Mentoring and Jo Chiver from Property Bloom. They’ll show you step by step how to take your investments to the next level quickly and safely so that you, too, can enjoy the financial freedom that you’ve been dreaming about.

Ben Kingsley's plan

How do you achieve this result?

- Research relentlessly - Research is king. It’s extremely time-consuming, but the results are life changing. Spend a good deal of time understanding the market you’re interested in, what makes it tick, what would drive growth in values and rents, as well as the demand and supply situation.

- Look for opportunities in the Big Three - There is opportunity in the three biggest cities (Sydney, Melbourne and Brisbane) for this strategy to work. It is possible in Perth and Adelaide but it’s harder again because the big incomes don’t just come from the CBDs.

- Ensure you buy under median value - Buy the properties at or below median value. Although this strategy is proved to work with quality period homes, it works best in the price range where more of the market can afford, and this is usually properties priced under the median.

- Focus on buying quality property, not bargains - Don’t expect to get a bargain – the values of properties in these areas aren’t going to be bargains, and there is good reason for this – these properties are in demand. Expect to pay fair market value.

- Ensure there is high owner-occupier demand - Make sure your true competition is from owner-occupiers and not from other investors. A great indicator the you are in good location is when your main competition is coming from people who want to live in the area/property, as it a great measure of the appeal of the area.

How the numbers work look like in real life

Assuming you’ve done all your legwork in determining the right property in the right area, here’s how the two strategies compare side by side.

In order to design a workable game plan, we assumed the following:

- The first 5 years would be the accumulation years to fast track your outcome.

- Purchase price of $500,000 at 10% deposit (90%) LVR

Baseline execution

If the purchase price is $500,000 and the costs are 5% of the purchase price, then it will cost $525,000 to complete the purchase of each property. Lending ratio is assumed at 90% which equates to a $450,000 loan. Therefore the funds to complete each property will be $75,000.

Using the baseline execution and assuming the property value grew 8% within 12 months, you get an equity gain of $40,000 during the first year.

However, if you factor in the buying cost (5%) and a deposit (5%), you won’t have enough funds to buy another $500,000 in year 2. Even at higher LVR of 95%, you still need $50,000 to buy your next property.

Timing the market execution

With the perfecting timing strategy for growth, you would be able to invest every year, thanks to the strong increase in the value and rent of the property.

Both strategies call for meticulous research. The only difference is the first year’s growth of 20%, which then allows for the equity release to occur earlier and hence the acquisition of more properties sooner.

End of year 1 assessment

Baseline execution

Investment property #1 will return cash flow positive within 10 years and 3 months

Timing-the-market execution

Investment property #1 will return cash flow positive within eight years and three months.

What does this mean?

It’s clear that timing the market to achieve a strong capital growth outcome with a short period of time provides for superior investment returns. The example used above clearly shows that because the value of the property has grown, not only have you benefited from the greater net gain in equity, but you also had two further benefits:

- You can use this equity to purchase sooner

- The increased rental income, given the increased value of the property, means the property will show positive cash flow sooner

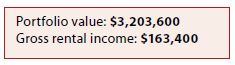

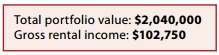

Your portfolio at 5 years

Baseline execution

By the end of five years, you would have accumulated three properties given that each property has only achieved 8% growth p.a during the accumulation phase.

Timing-the-market execution

This strategy has yielded five properties – one per year – as the equity gain of $100,000 per property has allowed for the acquisition of a new property each year.

Your portfolio at 10 years

After the accumulation phase of the first five years, no additional properties are bought, demonstrating that with superior asset selection coupled with the benefit of time, your superior investment returns just keep on giving.

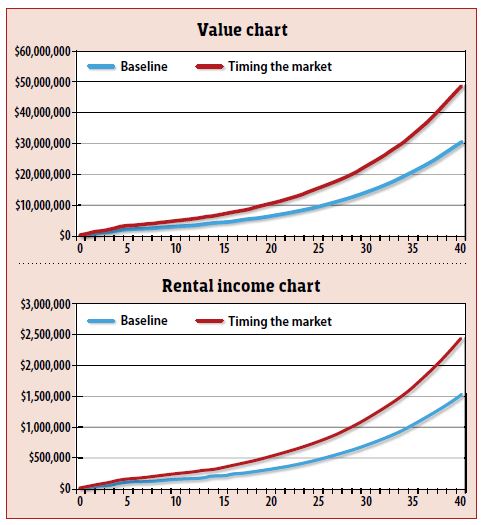

See the charts below and the table opposite for a comparison of the results of the strategies. The table assumes the values of the new acquisitions occurring throughout the five years are included. Timing-the-market execution assumes rental income increased by 20% in the following year after value growth of 20% has been achieved.

Top tips to executing the timing the market strategy

As you can see, timing the market can help you ramp up your profit significantly and safely over shorter period of time.

The properties best suited for this strategy ranges from quality period homes to standard and tired units.

- Study the area/location and then drill down to the properties that are in demand in this area.

- Eliminate the areas with ample existing supply of property, as well as the areas with new stock to come online in the short terms, i.e. new subdivisions or new medium- or high-density approved developments on-mass as this will increase supply and stagnate values.

- On the demand side, study the auction clearance rates closely, down to the property type and number of bedroonms, as this drills you down to where real demand lives in real time results. For example, you might have a suburb that has 15,000 dwellings – so the median value is really only going to be a guide, but what if 2-bedroom apartment in that area have a clearance rate of over 80% Then you know for a fact that there is extremely strong demand, and limited supply, so you are going to see a quick uplift in values, and that is what timing the market is all about.

- Track each property type by number of bedrooms, and watch their trend patterns.

- Combine this with lifestyle and demographic/socio-demographic research around incomes and age ranges and changes between census periods, and you will be well placed to find areas in city locations that have the real uplift in values (20%) in a year, and that will also sustain the longer-term trend of growth as they become ‘blue chip’ locations.

Make no mistake, this strategy looks amazing on paper and it’s the pursuit of every investor to get the best returns they can. What’s interesting about this strategy compared to most of the other strategies talked about when referencing ‘fast and safe’ is that almost all of them require active or ‘hands-on’ work – really a second job to make it happen quickly.

This strategy however is all about the skill of the investor and the analysis they undertake to seek out the right opportunities and the right time.

Interestingly, it also highlights that it can be done successfully by focusing on growth-property areas, which in many cases can be city locations or major town locations; and this is also often reduces the downside risk to the investor as the growth drivers in a city location are more reliable and less volatile then speculative locations like mining centres.

#pb#

Jo Chiver's plan

Strategy: Small development

I started investing in property over 12 years ago. The first strategy I used was to buy off- the-plan apartments. Back then, there was a shortage of new dwellings in Sydney and developers were offering good purchase prices at a discount to the market value.

It was a risky strategy as you need to rely on buying in well and on capital growth to occur while you wait to settle on the property, which can take 12 months or more. Lucky, for me it worked well as the market during 2000 – 2003 was moving forward.

As I settled one apartment purchase, I’d draw out equity to settle the next. I did this four times before coming to my senses and realising that the properties I was settling were all going to be negatively geared. I could not buy any more negative property as I was also in the process of growing a family, and cash flow was limited.

I would certainly not recommend the buying-off-the-plan strategy now. As I leant more and became more experienced, I realised that the real profits were gained through the development process. This got me thinking about being a developer rather than buying from a developer.

I knew I couldn’t afford to develop property in Sydney so looked to larger regional areas. I decided that the Hunter Region of NSW was a good area. There were large land sizes, affordable prices, cost effective builders and a strong local economy with good employment prospects.

After I finished my first development, a three-unit project, I had created a really good amount of equity. And having now developed over 70 properties, I know that small residential developments can be a great way for investors to boost their portfolio quickly.

How to make this strategy work

It’s important that you understand the costs involved in developing. At Property Bloom, we only look for relatively ‘safe’ development sites: land that we know should not cost more than estimated to develop. We base our build estimates on similar projects that we’ve recently completed, this gives us a good understanding of what the build costs should be.

But property development will always hold some unknowns, and you need to allow a contingency for this. We don’t know exactly what all the costs will be until we are under construction. It’s also important to have a good understanding of what the end values of the dwellings may be. If you buy in areas where there are comparable sales references for the properties you will be building, this means your estimated end values should be fairly accurate.

A good development strategy for a first time developer and investor wanting to boost their portfolio is a dual occupancy project, ie buying land where you can build two dwellings. Where we develop, there is usually opportunity to create around $100,000 in equity through the development process within about 12 months. This does not take into consideration any capital growth that also may occur during the development period. That is a bonus if it occurs.

If you are developing when the market is moving up, then you have timed your development well. Even if the market is flat, you can manufacture some equity. The equity created is purely because you are the developer and you are adding value to the land not with one dwelling but with two.

Your step-by-step guide to dual occupancy development

1. Get finance pre-approval

It’s important, before you start looking at development sites or any property, that you have a pre-approval from a lender in place. You can give your bank some example figures as a starting point, and once you’ve found the property then update the costs to ensure you can borrow that amount.

2. Understand the council requirements for dual occupancies in this area

Read council’s Local Environment Plan (LEP) and Development Control Plan (DCP). This will let you know the size of land you’ll need for your dual occupancy and what is permissible. If you don’t understand them, make sure you use a good architect or builder who does, and they can help you determine if a site will suit this strategy.

3. Focus your attention on the area you want to develop in

Make sure the location is correctly zoned for dual occupancies. It’s important to narrow down to one or two suburbs based on your research. This is a really important stage and you need to understand the area well. You’ll soon become knowledgeable and know when you see a good dual occupancy site and if it is well- priced.

4. Search for land that meets the dual occupancy criteria

- Size: Look at the frontage and know what the minimum width is for your dual occupancy. If it’s a duplex site, you may need a minimum of 18-20m frontage. This will depend on the duplex design you want to use.

- Look at the depth and size to ensure the land is large enough to meet the DCP requirements, including the outdoor private space. Check the land zoning allows for a dual occupancy and check the Planning Certificate to see if it is in a bushfire or flood zone.

- You can still develop in these areas but it will add to your build costs. Ensure the land is relatively flat with a slight slope to the street, unless there is a drainage easement at the back. Make sure there are services to the site; electricity, sewer, gas.

- Have your builder look at the site. This is very important as the builder will look at the land from a different perspective.

Once you believe the site meets the development requirements, run your feasibility to ensure the project will be viable. You will need to know what other units/villas have sold for in the area and what is in demand, and base your end estimated values on this.

What is the current rental return? This will give you the expected yield on completion. Most importantly, you need to have a good understanding of the build costs. The build costs will evolve over the design and planning process. Your builder can give you an estimate once a concept plan is available, but as the full Development Application (DA) plans and documentation are available, the builder will then need to run a full tender.

You can cross check this against your original estimate. If it’s in line, lodge the DA; if it’s not, go back to the design and look at areas where you can reduce costs. Once the plans are approved, the builder may run a second tender if council asked for any changes. If not, then a last tender will be generated once the engineer’s plans for the Construction Certificate (CC) are available.

6. Make an offer on the dual occupancy site

Ensure you request a long settlement period with permission to lodge a DA from the vendor. You can get all the design work and perhaps even have the DA and CC approved before you settle on the land; this will reduce your holding costs. Make sure you include the subdivision on your DA.

7. Get an unconditional construction loan

Once you have the DA & CC approvals, you can then go back to your lender to obtain your unconditional construction loan. As soon as this is in place, the builder can start.

8. Start construction

The build phase for a dual occupancy should be around three to four month or so, depending on weather.

9. Prepare your property for tenancy

Once the building works are completed, an Occupation Certificate will be issued. You can now have your villas tenanted.

10. Get a depreciation schedule

Don’t forget to order a depreciation schedule, this is simple: just email the plans and builder's tender and any other cost details to your quantity surveyor.

11. Apply for subdivision certificate

You can now apply for the subdivision certificate, and once council issues this, you can register the subdivision (after your lender has signed off on it). There is no need to register immediately if you are planning to hold and not refinance immediately as you may find rates will be a little less for one title than two. But if you want to refinance and draw out the equity created, you should register the subdivision first then apply for the refinance as the villas will be valued higher on their own title than ‘in one line’ of both on the same land title.

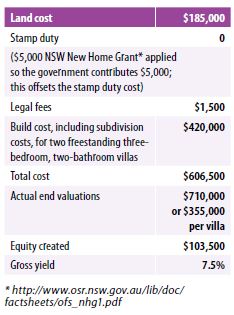

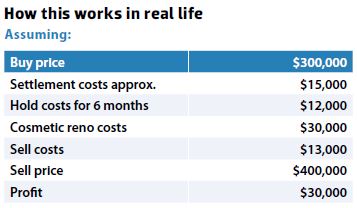

How it works in real life

Here’s an example of a dual occupancy project we recently completed:

Hold vs sell

Going back to my once negatively geared portfolio: as I held or sometimes clung onto these properties over the years, they have all become cash flow positive. That proves to me that holding property for the long term is important. I think if you are going to go to the trouble of developing property, you may as well hold it, but the beauty of a dual occupancy is the flexibility it gives: you may like to hold one dwelling and sell the other.

My personal strategy is to only buy property that has strong development potential. You don’t have to develop immediately, but be aware of what value you can add through renovation of an existing house, subdividing and building new dwellings.

#pb#

Brendan Kelly’s strategy

Buy, add value, sell. Repeat.

Step-by-step guide to making fast profits

The master plan

1. Buy house for cosmetic renovation and resell in 6 months.

To calculate roughly how much you can borrow, take a third of your total gross income and divide it by the current interest rate. The bank’s basic rule of thumb suggests about a third of your gross income will go towards debt servicing.

Banks have different criteria so make sure you check with your target lender.

2. Choose how to finance your investment: your options

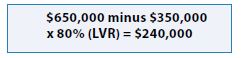

If your serviceability does not allow you to borrow the amount you need, you can consider taking a line of credit on your home.

Say if you have a loan of $350,000 and your home value is $650,000, you could borrow $240,000. You can use this as a deposit to your investment property.

3. Use rental income to boost your borrowing capacity

If you’ve got little or no more ability to draw on your own income to borrow in order to buy, you would need to go where there’s an assumption of reasonable rental income.

The rent can then be considered to increase the income and therefore increase your borrowing capacity.

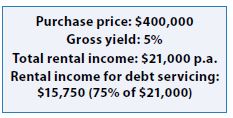

Broadly speaking, the bank will take 70% to 75% of the gross rent towards income servicing debt.

So what does that mean? If you buy a $350,000 property on a 5% yield, you’re earning $21,000 in rent a year. If you take that $21,000 a year and you take three quarters of that which the bank says can go to servicing debt, that means you can use $15,750 of that rental income towards servicing debt.

If you take that $15,750 and then you divide that by 0.055, it gives you $286,363- the amount you’re allowed to borrow based on the rental alone over and above what you’ve already got. If you’ve got $240,000 of line of credit established and you can borrow $286,363, then you have around $526,000 to play with.

4. Choose your strategy

If you’re looking to make a more solid capital impact on your asset base, then high-yield properties will not get you there fast. They will get you there but it will take years longer. If you want to get there quicker, the way to achieve this is to add value in some form, such as by renovation and subdivision. With renovation, stick to cosmetic, rather than structural. Subdivision involves buying a piece of land big enough to be divided it into two or more lots.

I pick this buy, reno, sell strategy to start with because it’s simple, easy and no time delays by anybody else. You essentially control the process.

How to make this strategy work

1. Factor in the buying cost

You need to allocate around 5% of the purchase price to cover for legals, stamp duty and other expenses.

2. Decide how long you’re going to hold it for.

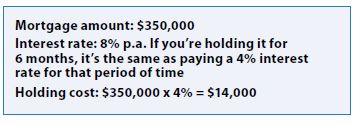

You will then do a renovation for about three months and try to sell it on a six-week campaign. You also need to settle at the back end for a purchaser on a six-week settlement period. So from settlement to settlement, you need six months, that’s how long you need to hold it for and pay a loan for.

3. Factor in holding cost

The worst thing you can do when taking on an add value project is not to cover the costs to completion. If you don’t cover the costs of completion, then you find that you don’t have the cash flow to service debt.

Make sure you calculate the interest rate based on a 2% buffer. For example, even though you can get 5% or 5.5 % interest rate at the moment, assume an 8% interest. That way you’ll have enough buffer for the eventual rate rises.

So on a 6-month period at 8% interest rate per annum, your holding cost will be $14,000.

4. Factor in reno cost

Broadly speaking, budget 10% of the purchase price on renovation costs, which is $35,000 in this example. You will need to invest an amount of money in renovation to make a significant enough change to the presentation of the property in order to create a certain impact difference with a buyer so that they will pay more. If you overcapitalise and the market is not willing to pay for it, then you have blown your money. If you don’t do enough to make the change, then you’re not going to get the price you need to make a profit. What we find is traditionally, 10% of the purchase price for a cosmetic renovation is sufficient to make a reasonable visual and aesthetic impact.

5. Factor in selling costs.

Selling costs usually represent around 3-4% of the sell price. This includes agent’s commission, advertising and tax.

6. Calculate the profit you want.

Your profit generally targets a minimum of 10% of the purchase price, so in this case, $30,000. You will need to decide much do you have to sell it for profit of $30,000. Once you have added up all the cost, you’ll find that you need to add 33% to the purchase price to determine the price you need to sell the property for to make a profit. This means that, at a purchase price of $300,000, you need to be able to sell it for $400,000 to realise a profit of $30,000. Now you can add this profit to your income and you can go again on a slightly bigger deal.

Top tips to maximising your profit and reducing your risks

Buy, reno, sell is a more direct, controlled approach to investing. You’re not reliant on other people; you’re not reliant on market changes and demographics. You’re in control of your money, provided you know what you’re doing. Using this strategy, you will accumulate capital quickly. So it’s a matter of knowing where to buy, buying in the right area, and making sure you ride the wave of growth wherever you can. While the transaction costs are high, you do end up with more money than what you’ve started with.

Here’s how you can supercharge your profit.

- Treat the costs like the cost of doing business - Of course, you need to be mindful of the costs of doing business. Make sure there’s a margin in it for you after all costs including tax. But if you use this strategy in the right way, and go again, you’ll have a greater capacity to build your equity faster than you do if you held on to it.

- You need to ensure you buy where there’s demand - This means population is growing, disposable income is rising and infrastructure are being developed. Provided you can get in those areas, the prices will continue to climb, over a long period of time.

- Spend time studying the market you want to invest in - If you can get in at the right time and read the market well enough to know that you’re getting in at the low end or at the start of the climb, and selling at the peak or just after the peak of the climb, then you’re going to get a lot of growth very quickly. If you do a renovation during that period as well, then you’re going to get more money again. You’re going to get profit on top of your growth.

- Consider renting out your property while prices are rising rapidly - If you’re thinking of selling at the start of a climb, consider renting it out and holding it until you reach the crest. This way, you will get growth for doing nothing.

- Exit when the market is flat - Don’t hold on to your newly renovated property in a flat environment. It will not serve you. If the market you’re in is going to be flat, it’s better to take your money out and go somewhere else and go again.

- Get over your resistance to the cost - People get anxious around capital gains tax. They would rather hold on to a bad investment than pay capital gains tax. They sacrifice any profit or growth just so they don’t have to pay tax. It just doesn’t work. Pay up. Move on. Make money.

- Make sure that the market can absorb your selling price - When using this strategy, the more important figure to take into account is the sale price, not the purchase price. You need to make sure that the market can tolerate this new and higher price, otherwise you’d end up having a property that nobody can afford.

- Ensure to stick to your strict timeline - You have only got six months to do this right from settlement to settlement. If it takes longer than that, you are going to erode profit. If you take shorter than that it is going to add more profit. But essentially, six months is your window to do it.

- Avoid renovating in a falling market - You can renovate in a flat or rising market and still walk away with a profit, but you don’t want to do it in a declining market. You maximise your ability to make fast profit by doing it in a growth market but you don’t have to. It’s not dependent on a growth market. It’s dependent on the numbers that you have today.

There’s always growth in the Australian market somewhere. If you’re able to find those areas of growth and get in at the right time and out at the right time, you’ll be able to make money quickly. You don’t have to time the market accurately. But if you can ride consistent waves of growth and be prepared to sell at the top end, you’re going to achieve your goals faster.