03/12/2018

If there’s one thing investors say time and time again, it’s this: “I wish I’d started buying property when I was younger”.

From a wealth-creating perspective, investing in your 20s or even your teens is the ideal time to start. It’s when you have the longest period of ‘time in the market’ ahead of you, and you generally have fewer responsibilities at home, such as kids and your own home mortgage, so there is less on the line if things turn pear-shaped with your investment.

That said, there’s a reason people in their 20s are not generally jumping into homeownership and investing at record rates, says Paul Wilson, founder of We Find Houses.

“It’s quite likely that in your 20s you’re not ready to actually enter the property market, though the financial habits you develop at this stage in life will definitely have an impact on your future capacity to do so,” he says.

“You’re only in your 20s, so keep your expectations ... in check. You don’t deserve to be living ... in your dream home just yet”

“This is an extremely busy and changing time of your life, with vast uncharted waters – new jobs, relationships, responsibilities, both personal and family-related, and you’ll be working out what you really want to do with your life and what course it will take.”

For those in this age group who are feeling the pressure to jump on the property ladder before it’s too late, Wilson cautions you to be realistic.

“You’re only in your 20s, so keep your expectations balanced and in check. You don’t deserve to be living your dream lifestyle or to be in your dream home just yet – you’ve not worked hard enough to justify that, and more than likely you don’t have enough disposable income to do so anyway,” he says.

Instead, Wilson suggests you develop good financial habits: don’t blow every cent you earn, and have a savings goal that does require a certain level of compromise.

“If your savings plan still enables you to eat out regularly, carry an expensive car loan and travel regularly, while keeping up with all the latest in-season fashion and tech trends, then chances are that you are not demonstrating financial discipline and you have significantly underestimated your savings goals. You don’t need to live your life like a pauper, nor do you need to live like there is no tomorrow,” Wilson says.

Time is on your side, he adds, so there is no reason to rush in and hope it all works out. “Hold a greater level of respect for the money you have under your control, whether you’ve had to work hard for it, or you’ve been lucky enough to have it handed to you via a gift or inheritance,” he says.

“And if you want to invest, begin with investing in your own financial literacy and your career in order to maximise and protect your income so you create a solid foundation on which to build your wealth for future property investment.”

Key focus for investors in their teens and 20s

- Get a job and upskill to maximise your income.

- Invest in knowledge and personal development.

- Cut costs to maximise your savings so you can invest earlier in life – eg live with flatmates to share the rent; buy a cheaper car; take your lunch to work.

- Minimise or eliminate credit card or personal debts that will affect your ability to save.

- Invest as early as you can to enjoy the compounding interest effect.

Source: Daniel Walsh, director and buyer’s agent, Your Property Your Wealth

Tech-savvy and educated

While this age group is the least likely to be thinking about wealth creation and retirement, the number of younger Aussies who are keen to get a financial leg-up earlier on seems to be increasing.

In a recent Deloitte study of 4,000 people, it was found that, when compared with the same cohort five years earlier, more than double the number of those aged 18 to 24 had a focus on saving – with a house deposit and future wealth (along with travel) being their biggest aspirations.

“If you want to invest, begin with investing in your own financial literacy and your career in order to maximise and protect your income”

“What is most interesting is that 81% of these respondents wanted guaranteed, safe and stable returns. It turns out that, of all the age profiles, these were the most conservative,” says property educator and mortgage broker Jane Slack-Smith.

“This age group is tech-savvy; they are being introduced at university to budgeting and savings tools like QPay, and they are managing their money. Many are also working an extra job to further increase their savings. I know from over the last 13 years of writing mortgages and seeing people’s fact-finders that I am seeing more and more 25-, 26-, and 27-year-olds buying property and working extra jobs to do it. This is not the age of instant gratification – this age group is fast becoming the savvy investors of the future.”

First foray into property: Huan Wang

Mechanical engineer Huan Wang, 29, has recently embarked on his very first investment property – an off-the-plan apartment in Landing, the first stage of the Sanctuary development in Wentworth Point in Sydney.

“I chose this property because it is close to where I am renting, and the property developer, Sekisui House, has a good reputation for building stylish, quality developments,” Huan says.

Paying $810,000 for the twobedroom property, which is 90sqm internally and has an 11sqm balcony and one car space on the title, Huan says the location was a key selling point. It’s around 16km from the city and close to Parramatta, Rhodes, Sydney Olympic Park and surrounding suburbs.

It is also close to amenities, being in close proximity to shopping centres, schools and entertainment. There are several transport options, including the ferry on its doorstep, bus and train services and the proposed light rail to Parramatta.

“I believe I paid a fair price for the size of the apartment. I liked the overall design and floor plan, the architectural drawings, solar plans and the future masterplan for the development,” he says.

“By the time our apartment is completed, I believe the rental return will be around $670 a week.”

While pleased with his first foray into property investing, Huan, who is married with one child, is in no rush to add to his portfolio just yet. But when he does, he plans to “buy a onebedroom apartment as an investment” as his next real estate play.

Huan Wang, 29,

just bought his first property

For those aged in their 20s who are keen to take the plunge and invest in property, what is the next step?

After diligently saving a property deposit, you’re now ready to make that all-important first property purchase. You may want to either buy your own home or, perhaps as a ‘rentvestor’, stay renting in the suburb where you enjoy living, while purchasing in a more affordable location.

“Your first property, regardless of what type, is always the most important, because this first property is your stepping stone and can literally set you up for a financially secure future,” says Chris Christofi, founder and CEO of Reventon.

“Ideally, your first property should be purchased at a fair market price, be of good-quality construction, located in a strong growth area close to lifestyle amenities, with the potential for solid increases in value over time. It should also have a good Walk Score, the measure of the property’s location and the ability to walk from here to the suburb’s transport, shops, parks and schools.”

Without the potential to increase in value relatively quickly (or in some cases, if poorly selected properties actually decline in value), this first property “will impact on your ability to purchase again in a few years’ time, if and when you are ready to grow your portfolio”, Christofi adds.

“If you’ve been smart when purchasing your first property, having looked at all your options and sought expert advice, in three to four years’ time the property should increase substantially in value.”

Even if it takes a little longer to do this – it could take up to 10 years to see significant growth – you are still giving yourself options for your financial future, Christofi says. “You could then get your property revalued and use your equity, or a percentage of the property that you own, as a deposit for a second property, kick-starting your investment portfolio.”

Two properties deep: Sam Maurer

Sam Maurer, a 28-year-old marine technician from Sydney, is already on the path to building wealth through property investing, having acquired two investment properties in the last few years.

Working full-time for the Royal Australian Navy, Sam says he had witnessed fellow colleagues successfully investing in property, so he decided to explore his options.

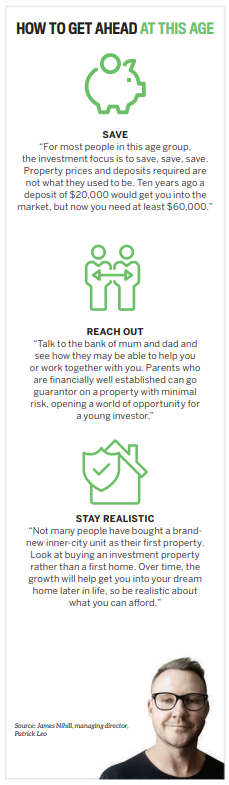

With the guidance of investment specialist Patrick Leo, he bought his first property at the tender age of 21 – a three-bedroom, two-bathroom house in Brisbane, priced at $360,000.

“I knew I needed to be smart with my money, but I wasn’t sure if property investment was right for me. Getting some professional advice gave me the confidence to move ahead,” says Sam.

In 2016, with his Brisbane property continuing to demonstrate growth, Sam decided to dive into his second investment. He snapped up a three-bedroom house in the north of Melbourne for $379,900.

“My focus has always been on the long-term results, as I hope to eventually buy my own home one day with the profit I earn from these investments. I’m finally in the financial position I’ve always wanted to be in – I can sit back and watch my money work for me.”

Sam Maurer, 28,

already owns two

investment properties

Related stories:

How to invest in property at any age

Investing in your 50s and beyond