Want to exit the rat race early but don’t know how and where to start? Your Investment Property spoke to a leading property investment advisor and found out how you can do it

It may sound out of reach if you’re just starting out your property investment journey, but retiring sooner is possible with the right strategy and mindset.

It has certainly been the case for so many successful property investors we’ve come to know over the years.

So how can you build a portfolio that will earn you the income you need to be able to leave your day job and pursue what you love?

In Part 1 of this article, we enlisted the help of a highly successful property investor and advisor to come up with a detailed plan and practical steps to guide you through the process.

THE GAME PLAN

There are three distinct phases of investing that investors tend to go through. Each phase has its own way of thinking, its own principles and its own action steps and will require different levels of expertise and help at different points.

Your success depends on how you set yourself up in each phase to be able to move through the next phase.

Three Phases of Investing

1.ACQUISITIONS PHASE

This is probably the most critical phase of your portfolio. Making a mistake at this point can potentially cost you truckloads of cash and lost time, and have some serious opportunity costs, so it pays to get it right.

2. CONSOLIDATION PHASE

This is where you’re going to consolidate to reduce debt, lower your LVR, and increase cash flow.

3. LIFESTYLE / LEGACY PHASE

At this point you’ve achieved financial freedom and your focus now is on maintaining this freedom. This means managing it in order to achieve the lifestyle you want and leave a legacy through the wealth you have created.

THE GOAL

- Replace a $120,000 pa net income within 10–15 years using pure rental income

- Target retirement age: 40–45 years old

Now, could we do it faster? Sure, but this is all about a measured approach that everyone can pick up and apply.

As you go through the game plan, think about how you’re going to apply the strategy, principles and steps to fit your personal situation. Some of you will be further ahead; some will be further behind. It doesn’t matter where you are; the same principles still apply.

YOUR 5-STEP PROCESS BEFORE BUYING ANY PROPERTY

- Design your end game. Understand your outcomes from building a portfolio and what your end portfolio is going to look like.

- Understand your financial situation, including not only your current finances but the habits that got you to where you are in life now.

- Build a strategy to begin moving you towards your outcome. Remember that this strategy is a constantly evolving process in line with your changing personal and professional circumstances and the choices you want to create in your life.

- Choose a market that suits the purpose of your strategy.

- Choose the right product and the right deal.

STEP 1: DESIGN YOUR END GAME

The first thing to do is understand what your end portfolio is going to look like to get the $120,000 per annum income.

Most people in this situation tend to immediately ask, “How many properties do I need?” Wrong question. The number of properties you own is actually irrelevant; it is the net value of assets and the net rental yield you receive from them that is the end result we are looking for.

- Start with the end in mind and make every decision based on how it will move you closer to your end result

- It is not about how many properties you need. It is about the result they are going to create for your portfolio.

CRITICAL QUESTIONS TO ASK YOURSELF BEFORE INVESTING

- Where do I want to hold my properties?

- What rental yield can I expect to receive?

- What is the net value of assets I need?

It is critical that you answer these questions in this order as, depending on the answers, each can dramatically change your final outcome. Let me explain.

1. Where do I want to hold my properties?

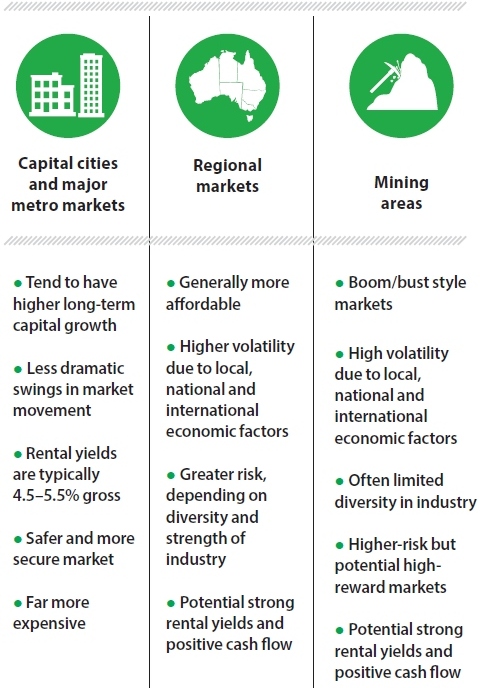

There are three markets to consider:

Each market is certainly going to have its own characteristics and strengths and weaknesses that just go hand in hand.

If you are trying to create sustainable wealth and financial freedom, you want your properties to be in safe or even semi-boring markets that just tick along.

This means buying in major cities or regional markets. You can add another level of safety by diversifying into different cities so you don’t have all your eggs in one basket.

2. What rental yield can I expect?

By choosing to buy and hold properties located in capital cities and major regional centres, you can expect to get a moderate rental yield of, say, 5% gross yield on average.

3. What’s the net value that I need to retire?

- To get the desired $120,000 rental income, let’s divide that by the 5% expected rental yield, which will leave you with $2.4m in assets.

- Keep in mind that this is a gross figure, so now let’s add some costs on there for property management, maintenance, rates, and body corporate perhaps? I tend to use a figure of 25%, but feel free to adjust.

- $2.4m plus another 25% gives us a required portfolio of $3m in net assets, renting at a 5% rental yield on average, and diversified in major capital cities or major regional markets.

$120,000 / 5% = $2.4m

Total net asset value needed to retire:

$2.4m + 25% x $2.4m = $3m

You will need a $3m portfolio diversified across the major capital cities and major regional cities, renting at a 5% gross rental yield.

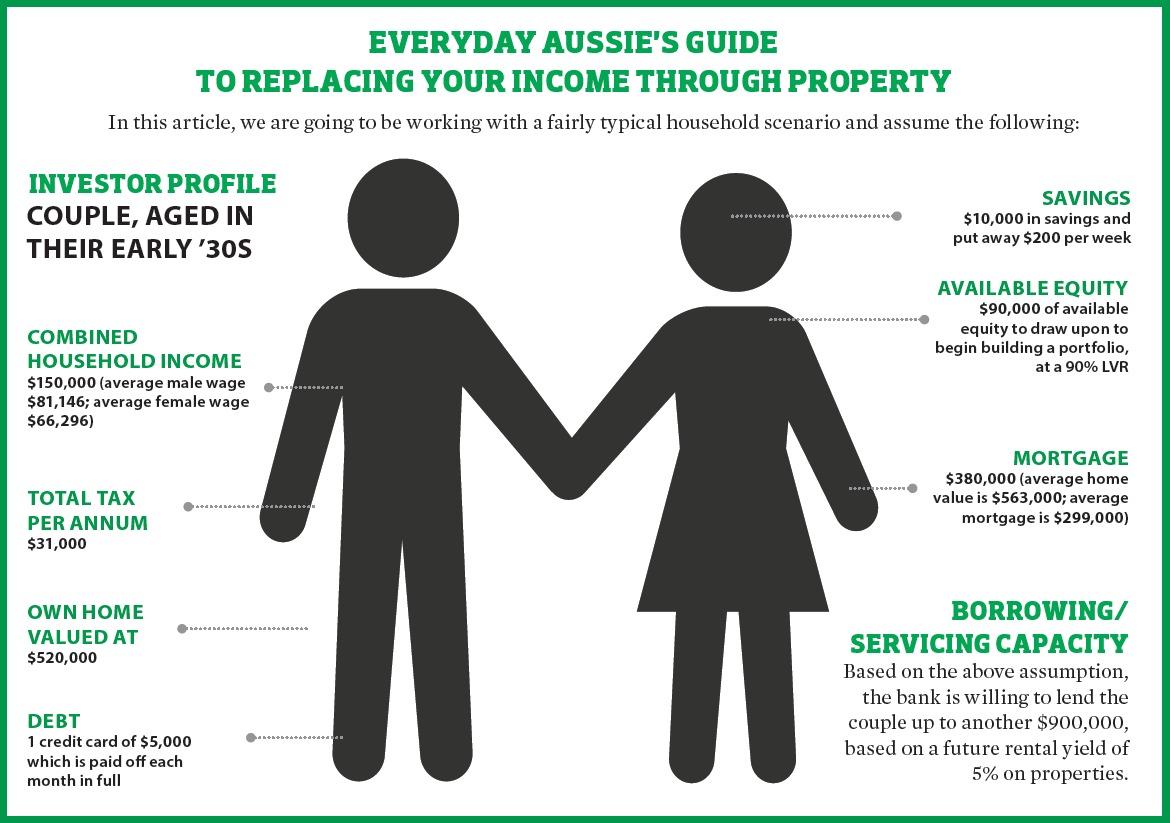

STEP 2: UNDERSTAND YOUR FINANCIAL SITUATION

After the end destination is determined, we come back to understanding where you are now. There are a few things I want you to look at here.

YOUR ASSETS

Critical information you need to formulate your strategy:

- Current value of your property

- How much equity you have access to

- What's your current maximum serviceability based on your situation?

YOUR FINANCIAL HABITS

It’s not about how much money you earn; it is about what you do with your money that builds wealth. I have seen many high earners remain broke, and many low-income earners with good financial habits quickly build themselves into an enviable position. Ask yourself these questions:

- Do you have a budget and a system for managing your income and expenses?

- How much are you saving each month?

- What is your relationship to debt, and how do you handle it?

- Do you schedule time to manage your money? If so, how often?

- Is wealth education a habit for you, even in the smallest way?

OPPORTUNITIES IN FRONT OF YOU

Ask yourself, how can I do more with what I have? How can I get my money and every part of my life working harder for me where money is involved?

- Is there opportunity to add value to your home with a strategic renovation, and is it worth it?

- Do you have prospects to increase your income at work or through other opportunities?

- Can you reduce some unnecessary spending by doing an audit of every expense in your life?

- Can you eliminate debt or move some debt from a high-interest to lower-interest environment?

RISKS THAT MAY EXIST

Your ability to build wealth depends on how you can protect yourself and ride through tough times.

When I was younger I was very aggressive in building my portfolio, but I didn’t protect myself to ride these things out, and I then had the incredible ‘gift’ of losing almost everything and then rebuilding it again. I say it was a gift because it has made me a far better property coach and educator now, and I can help ensure others don’t have to go through the same experience.

- Do you have buffers in place for your personal life and portfolio?

- What if something happens to your primary source of income?

- Is your job safe?

- How is everyone’s health that you are responsible for in some way?

- If you have a home, how is it holding up? Are there potential risks of major works being required? Or of the market going backwards significantly?

Just ask: What could go wrong and how can I protect myself against the possibility?

FINANCIAL POSITION

Where are you sitting financially and how are you poised to move forward? The following is what we want to know.

- What are the banks willing to lend you, based on your serviceability?

- How much buffer do you need to put aside to protect yourself and your life?

- How much property buffer do you need to start with?

- How much equity/cash do you have left after taking out those buffers?

- What loan-to-value ratio (LVR) will you be investing at? Most people who are starting out tend to borrow at 90% or 95% LVR. Just keep in mind that a higher LVR means a lower cash flow from the property and possible negative gearing, so ensure you have your buffer in place.

- What is your buying power? What is the maximum amount of real estate you can afford to buy based on the amount of cash and equity you have to invest and the LVR you intend to begin investing at?

I know there are a number of questions to be answered here, but remember that at this stage of your portfolio – to be honest at any stage of your portfolio – you don’t need to know it all. You just need to know how to get the information and help when it is needed, from a reliable source.

It’s crucial to have a solid team around you who understand what you are trying to create and can give you the guidance you need. At this stage of your portfolio your mortgage broker is critical, and I would obviously highly recommend having a property coach working with you, or a buyer’s agent if that is appropriate for you – someone who can help you make sure your first property is a cracker.

WHAT’S YOUR BUYING POWER?

Based on our assumption, the couple:

- have $90,000 in equity they can use

- already have $10,000 in savings to use as a personal buffer

- will put aside another $20,000 from equity to use as a property buffer

This now leaves $70,000 in equity that we can use for deposits and costs so we can begin building a portfolio. So what’s the maximum amount of real estate we can afford to buy based on $70,000 in equity and a 90% LVR? In addition to a 10% deposit, buying costs will amount to 5%, so factor in a total entry cost of 15%.

Maximum purchase price: $70,000 divided by 15% = $466,000

WHAT SHOULD YOU BUY?

Should you buy a house, a townhouse or a unit? What price point? Where? All of those different decisions have to be made at some point. This is definitely a relevant question, but we are not there yet.

STEP 3: DECIDE AND BUILD YOUR STRATEGY

Every property you buy has to serve a clear purpose in your portfolio in order to continually transition you from the acquisitions phase to the consolidation phase, and beyond to your ultimate outcome and lifestyle/legacy phase.

LONG-TERM ASSET ACCUMULATION AND CAPITAL GROWTH

• These are properties in solid and major locations that tend to outperform the rest of the market over time.

• These are blue-chip properties and will be the ones you will tend to want to hold long term.

• Your ultimate portfolio of $3m may simply be four of these types of properties owned outright at a value of $750,000 each, bringing in $120,000 cash flow.

SUPPORTING STRATEGY

• These are properties that are as close as possible to being self-supporting, so you don’t have to dip into your back pocket every day to cover your mortgages.

• The cash flow generated from these properties will also support your servicing, so the banks can continue to lend you money to invest.

ACCELERATION STRATEGY

• This strategy is not about buy and hold like the growth strategy; it is about buy and trade.

• The purpose of these properties is to make a profit, which can then be used to accelerate your other strategies and ultimately deleverage your portfolio.

• You may use the profits to create bigger deposits in order to lower your LVR for future purchases.

• You can also use them to reduce the debt of your other buy-and-hold properties in chunks of cash rather than trying to pay them down little by little. This is a much faster way of eliminating debt.

• The important thing to know is where you are making money in the deal. I tend to implement this strategy with the intention of trading the properties over the coming three to five years.

• Obviously there are positives and negatives with each of the strategies above, but it is time to stop thinking about an individual property and begin focusing on portfolio construction and how each strategy adds value and supports the potential drawbacks of the other strategies you are working with.

LIMITING FACTOR

There is usually one limiting factor and it is either how much physical cash or equity you have for deposits and costs, or the level of servicing you have.

Maximum buying power: $460,000

Maximum servicing for future deals: $900,000

As you can see, the limiting factor is buying power. This means the primary purpose of this first deal should be all about creating more equity in order to build up another deposit for the next deal.

However, we do need to ensure that our servicing remains solid into the future, and we will still want to have a reasonable rental yield of a minimum of 5%. We can also look for opportunities to increase this by furnishing the property or doing minor cosmetic renovations, for example.

Knowing that the primary purpose is to create more cash and equity, start looking at other areas in your life where you can achieve this.

- Look at your savings ability.

- Do an audit of your expenses.

- How can you increase your income?

- What about your tax? Although I would never advise anyone to invest purely for tax reasons, it can be handy when building a solid portfolio. The more tax we can get back, the faster we can generate more deposits for future deals. Aim to maximise your deductions and target newer properties if possible.

STEOP 4: CHOOSE A MARKET THAT SUITS THE PURPOSE OF THE STRATEGY

Considering that this property is going to form the foundation of the ultimate portfolio, we will be targeting either capital city locations or major diversified cities that are in the right stage of the cycle and can also deliver long-term results.

Based on our strategy, we now ask which market is offering the conditions and fundamentals to deliver the results we are chasing?

A FEW THINGS TO CONSIDER

Critical information you need to formulate your strategy:

Price point

Obviously the market has to offer opportunities at the price point you can afford and that is right for your strategy.

Stage of cycle

Which markets are in the right stage of the property cycle, sitting between 6 o’clock and perhaps up to 10 o’clock?

Potential to deliver the desired outcome

To the best of your knowledge, through strategic analysis and due diligence, does this market have the potential to deliver the desired result?

EMOTIONAL CHECK

Take careful note that your emotions should be left out of this, as well as the desperate desire to invest in the suburb or city you live in just for the sake of it. This is a business, and you are making business decisions and not personal decisions based on emotions.

I have bought the vast majority of my properties sight unseen, and have helped thousands of investors to do the same. You can do all the research you need, sitting in front of a computer with an internet connection and a phone.

If you really want to go and see a property, buy a ticket and get on a plane and get a feel for it. You are getting ready to buy an assets in the hundreds of thousands of dollars; a few hundred dollars on a plane ticket is hardly a high price to pay if that is what you need to make you feel comfortable.

I still suggest, however, that you get yourself educated and understand how to research and make decisions based on effective due diligence. It will serve you greatly in your portfolio.

In today’s marketplace, I would definitely be considering Brisbane and Newcastle as key go-to markets.

STEP 5: CHOOSE THE RIGHT PRODUCT AND THE RIGHT DEAL

Finally we can focus on finding the right deal. Again your due diligence in this space is critical. You have done all of the work to truly understand what type of deal you are looking for and why. Now it is down to execution of that strategy and ensuring the actual property you wind up buying is going to deliver the desired results for your strategy.

Make sure you have a due-diligence checklist to work from to ensure you have a system to follow to make decisions.

- Choose the right product for the market and equity gain. What type of property in the area (house, townhouse, villa or unit) is in greatest demand by the local population?

- Always ask, how will this property fulfil its purpose? And how am I making my money in this deal?

- Run your numbers and understand them and how they will affect your cash flow, your buffer and your servicing.

CRUCIAL NEXT STEPS

I know the above five-step process might seem arduous, but the right property will emerge when you undergo a strategic process. This is the key difference between those who are investors and those who go into the market as gamblers.

PRICE POINT: Maximum value of approx. $450,000

RENTAL YIELD: Minimum of 5% gross rental yield

LOCATION: Brisbane or Newcastle – within 15km of the CBD

DEAL TYPE: Whatever will deliver the result in equity gain, whether it be a pure growth strategy, a renovation or a construction strategy, for example a house and land. However, the newer the better to claim maximum depreciation and reduce tax

As we settle Property 1, it is now time to start planning for number two. Even though, financially, our couple are not in a position to act on anything just yet, we still want to have a destination and a plan in mind.

This is such a critical component of achieving any success in life: as you achieve a goal, make sure you have a new one set, and keep your momentum moving forward with strategic action steps to accompany the plan.

ACCUMULATING THE NEXT DEPOSIT

If we want to purchase the next property within a 12-month period, we know we are going to need enough capital for the deposit and costs for another deal. We would need:

- A loan for between $350,000 and $450,000, which will be at a 90% LVR

- Deposit: $50,000–$70,000

- Buffer: $10,000

So how and where are we going to get this capital?

1. Calculate the equity gain for Property 1

If we bought the first property for $450,000 and its value rose by 7%, which is reasonable in this market, then we would be able to pull out $31,500 within that 12-month period.

Available equity: $450,000 x 7% x 1 year = $31,500

2. Calculate the equity for the family home

Let’s do the same for the home, which was valued at $520,000. If this property grew at only 6% within the next 12 months, we would expect to pull out another $31,200 of equity from it.

Available equity: $520,000 x 6% x 1 year = $31,200

3. Calculate how much you could save during this time

We already know that our couple are currently saving $200 per week, which over a 12-month period will be $10,400.

Total potential savings: $200 x 52 = $10,400

4. Estimate the tax refund you would get back

The average tax return for an individual is approximately $3,800, according to the ATO. If we add in a newish property, we would expect to receive another $5,000–$10,000 back. So we would expect a return of approximately $13,000 conservatively for the couple.

Tax refund: $13,000

Total available capital:

$31,500 + $31,200 + $10,400 + $13,000 = $86,100

If we put $10,000 of this into the buffers, this would leave $76,100 available for the next deal, giving a maximum buying power of around $400,000, and as long as the servicing is still fine, then we are ready to act again.

- For this next deal, I am going to play close attention to servicing for the future of the portfolio. I know that investors’ servicing levels tend to be the biggest barrier to expanding their portfolios.

- As your portfolio increases along with your debt level, the banks are going to start to get more conservative and place a higher risk rating on you as a borrower.

- You need to think about how to keep the banks happy and keep your portfolio nice and cash flow neutral-to-positive if possible.

- It’s now time to target a higher-yielding property while still being in a location that can generate equity gains.

PRICE POINT: Maximum value of approx. $400k

RENTAL YIELD: Minimum of 6.5% gross yield (always looking for an option to increase)

LOCATION: Major capital city or major diversified regional location

DEAL TYPE: Whatever will deliver the result in equity gain and cash flow

- Understand what market is going to deliver this result, what specific product to buy, and the deal itself.

- In some market cycles you can simply buy properties with high yields and it is easy. But in the current market yields have dropped across the country.

- We need to focus on how we can manufacture our yields through renovations or dual incomes or similar.

RINSE, WASH, REPEAT

I could walk you through an entire projected 10 years in the property markets, and I have done this in other articles for Your Investment Property (see Issue 87: Game Plan: How To Build $1 Million Property Portfolio).

But the point of this article is to guide you through principles that work and deliver results to get you to that $120,000 per annum income, meaning you no longer have to turn up to work just because you have to in order to pay the bills. Instead you can choose to work because you want to. That is true financial freedom: having choice.

FUTURE PURCHASES

The next purchase will likely be for the purpose of setting up our first acceleration strategy, with the outcome being to trade the property over a three- to five-year period. We do this so we can begin deleveraging the portfolio. Make sure you go through the five-step process before making this decision, as a lot might have changed over one to two years.

Take our couple’s situation: they will be in the acquisitions phase of their portfolio for approximately eight to 12 years just using a conservative and balanced strategy.

They may trade some real estate and get involved in some more active strategies, such as duplex builds, as they become more experienced and confident.

At this point we will transition into a heavy consolidation phase in which we will begin to sell down, migrate money from lower-quality to higher-quality properties, and execute an exit strategy towards the desired lifestyle outcome.

EXIT STRATEGY

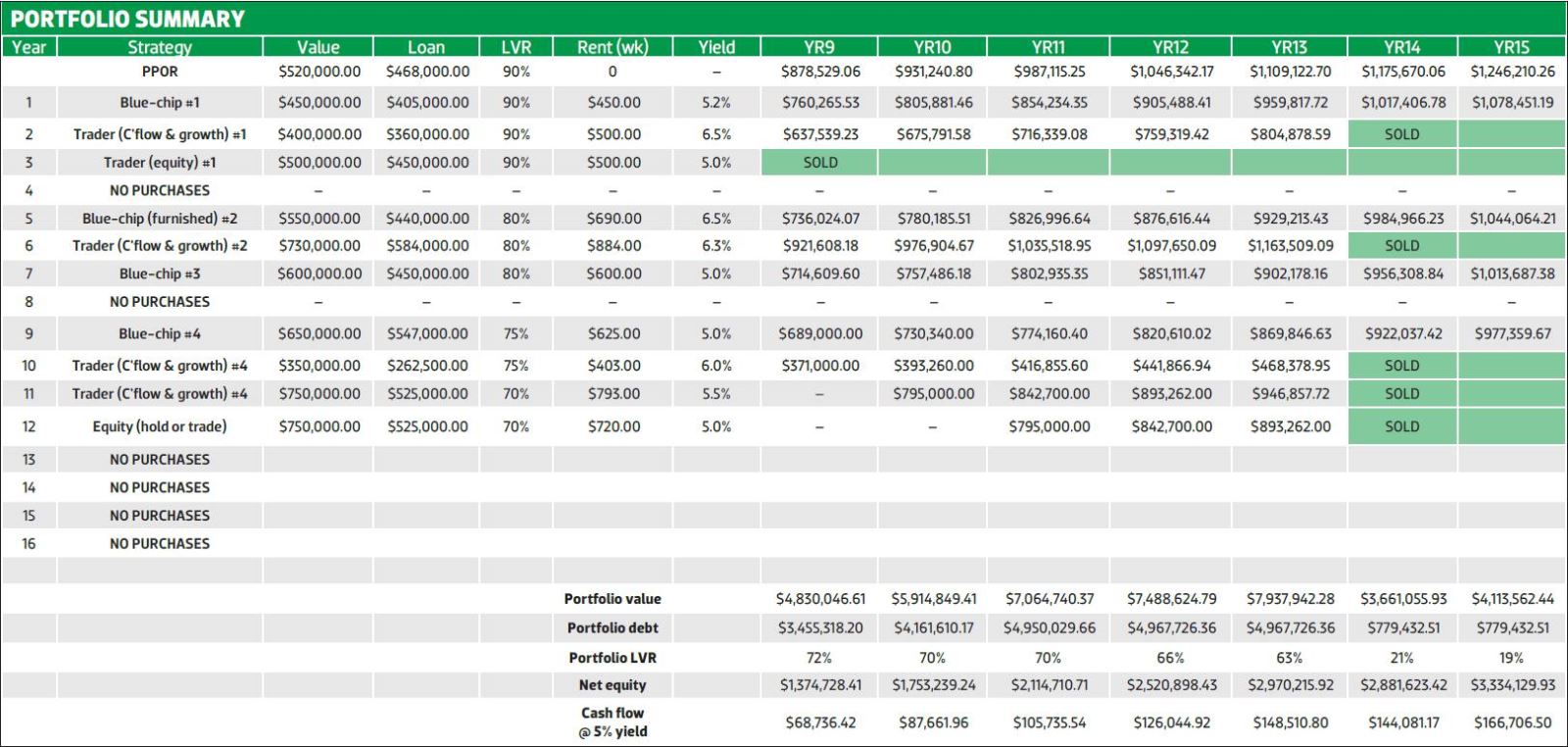

Exit strategy work is definitely a fine art as we are setting things up for a secure financial future, plus giving the investor the option to continue moving forward if desired. I am going to give you the end result of a purchase plan I modelled out in huge detail over a 15-year period, just to give you a really solid reference. Following are a few things you need to know about the plan.

- I have mapped this out using a 6% capital growth rate as standard, which is reasonable. Some markets will obviously outperform, while others will underperform.

- I haven’t added value on to any properties at all – two of the properties were purchased at 6% under market value, and I have furnished one of the blue-chip properties to increase yield.

- My rental increases were, on average, 3% per annum in line with inflation.

- I also used tax deductions and a savings amount of $200 per week.

- I have drawn equity out of the properties each year.

I haven’t been very specific as to where I am buying or what type of property, because frankly – in case you haven’t picked up on it yet – I don’t care what the property is; I care about the result it is creating. That is, apart from the blue-chip properties which I will want to accumulate in three to four major capital cities and will be very specific on location and type, etc.

The other properties are there to serve a purpose in the portfolio, so it is all about the overall portfolio and strategy and not about the individual deals.

THE PORTFOLIO WALKTHROUGH

Year 1

- Purchase one blue-chip property to serve as the foundation of the ultimate portfolio.

- Draw equity out of the principal place of residence (PPOR) up to the maximum 90% LVR, and complete on this property at 90%.

- Set aside a hefty buffer to keep a solid sleep-at-night factor present.

Year 2

- Buy Property 2 purposely to trade later on.

- Target stronger-yield properties to maintain servicing and the day-to-day cash flow of the portfolio.

Year 3

- Buy Property 3 purely as an equity builder. We’re buying this with the aim of trading in three to five years’ time and beginning to eliminate debt. We need this in the portfolio so we can deleverage over time, to not only move closer and closer towards our ultimate cash flow outcome but to de-risk our own lives and, according to the banks, so we can continue to get lending.

Year 4

- No purchases to be made this year as we let the portfolio settle down and give it some time to grow further.

- At about this time in a lot of portfolios, I see banks starting to get a little gun-shy of investors with this many properties.

- It is a good time to think about dropping to an 80% LVR. This will increase our cash flow, increase servicing, and de-risk our personal situation.

- Letting things be is not only about getting more capital growth but also about allowing wages to increase, rents to increase, and also tax and cash savings to increase.

Year 5

- Buy second blue-chip buy-and-hold property to add to the portfolio at this time, which is something we will focus on doing every few years.

- Drop all purchases and equity releases to a maximum of 80% LVR at this point.

Year 6

- Buy property to trade, and focus on getting some cash flow as well. I have this listed as one property for around $700,000; however, remember it is not about the number of properties but about the result.

- If you wanted to do this over two smaller price point properties, no issues. Again, we are stacking up a deal for future trading to eliminate debt and continually support our servicing and cash flow.

Year 7

- We will also drip-feed the third out of four blue-chip properties that I have in mind for the ultimate portfolio this year.

- Stop drawing equity from the PPOR. Up until this point, we have been drawing equity from the PPOR to serve as seed capital for the property business. The rest of the portfolio has a life of its own now, with four investment properties, so we are going to stop drawing equity from your home now and leave it be. You can always draw equity at any time if you want to accelerate the portfolio, as long as servicing is fine.

Year 8

- • No purchases to be made in Year 8.

- • Trade the first property of the acceleration strategy, which we picked up in Year 3 of the portfolio.

- • After we take out agents’ selling costs and capital gains tax, we are left with a net cash amount of $140,000.

- • Now you have a choice to make. Some might like to pay this amount off their home loan, which makes perfect sense to do so. However, it will slow down your investment portfolio somewhat. Neither is better or worse, just a slightly different road leading to the same place.

- • As the goal of this article was to reach that ‘let’s replace our income’ outcome, we are going to use this money to pay down the debt on the first blue-chip property we bought in Year 1, and at this point we will no longer draw equity from this property either.

Year 9

- Time for our fourth and final planned blue-chip buy-and-hold property, and we will also pick up a little trading deal to go with it for around $350,000.

- After the year-long hiatus and the sale of the first property, we are now dropping the LVR for all future purchases to 75%. This is just part of our systematic deleveraging over time as we continue to build our portfolio.

Year 10-11

- Now that we have our established blue-chip portfolio sitting and growing for us, we are really heading into consolidation time, which means we can focus on eliminating debt from the portfolio.

- To do this, however, we are still going to accumulate for a few years and then eliminate rapidly in a single year.

- At Year 10 we have an investment portfolio valued at $5.5m, with a net equity position of just over $1.7m.

- Look at how rapidly things can accelerate from this point, now that you have a strong portfolio foundation in place.

- We will make the final purchases at this stage of the portfolio – in both Years 10 and 11 – based on pure trading strategies.

- For the final one you may decide to choose a property as part of a longer-term portfolio or alternatively to trade. This all depends on the outcome you desire. You can choose to continue building your portfolio after this point, or not. We can set it up in multiple ways, so it is important now to design that strategic exit to give you the choices you want.

Year 12-13

- The portfolio is just going to sit for the next couple of years, and towards the end of Year 13 we will eliminate rapidly from the portfolio.

- Our exit is pretty simple: we want a result of $120,000 net income, and to hold a small but solid blue-chip portfolio that is diversified in different markets.

- Everything is on the chopping block apart from our four core blue-chip properties. After the sale of five properties, less agent’s costs and CGT, we exit with $1.33m in cash.

- During the acquisitions phase we have not used all of the equity we released or the cash we saved or the tax that was refunded. In addition to this cash amount from the sale, we have an extra $300,000 in cash sitting there and another $100,000 in equity. This comes to a total of $1.733m.

- We will leave a $100,000 cash buffer aside and use the other $200,000 in cash to pay down the home debt to $390,000, which is at a 35% LVR.

- The full $1.33m in cash and the additional $101,000 in equity will be used to eliminate debt from the investment portfolio.

- We will pay blue-chip Properties 1 and 2 off almost completely, leaving a small amount owing to keep the line of credit facility open, meaning that we can go back and withdraw equity at any time if we want to continue building our portfolio.

- With the remaining cash, blue-chip Property 3 will be paid down to a 26% LVR, with a debt of $231k. The final blue-chip property sits at a 63% LVR with a remaining mortgage of $547k.

THE END RESULT

So where does this leave our portfolio? The fun stuff!

- We now have a home with a value of $1.109m, with only $390,103 still owing and an LVR of only 35%.

- We have a strong portfolio of four good-quality properties in good-quality growth locations valued at $3.661m, with a remaining debt of only $779,432 and an LVR of only 21%.

- This gives us a net equity position of $2.881m, very close to the outcome we were chasing of $3m in property, which could be rented out on average at a 5% rental yield to give a $120,000 income.

- Currently, with this portfolio the rental cash flow at a 5% yield is $144,000 gross.

Incidentally, if you left the portfolio for one more year, your net equity position would rise to $3.334m and you would have got there, still within the 15 years, using a measured, strategic and balanced strategy to achieve financial freedom.

The important thing for you to take from this is that it is possible. There is no difference between you and other investors who create these types of results. The only difference is in the desire and commitment to move forward – despite all of the reasons you can come up with as to why it won’t work – and get an education and have a strategy for investing success.

Disclaimer

The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.

The expert: Todd Polke

Todd is a well-known property coach, lifestyle strategist and professional speaker.