“We needed to find a place to live, and it actually started as a game, with me going to inspections and making silly offers,” Kerry says.

“For example, there was a property on the market for £450,000, so I’d offer £350,000 – I was generally making offers between 20% and 25% below the asking price.”

There was method to Kerry’s madness: “I figured out that in order to get by as a single mum and working full-time, I needed to buy the biggest place I could afford – or couldn’t afford – and then I could rent out some rooms to help pay for the mortgage.”

Eventually one of her low-ball offers paid off. When a real estate agent unexpectedly called to tell Kerry that a vendor had accepted her price, she scrambled to pull the finances together.

“I didn’t know any differently; I didn’t know I could say I wasn’t interested any more!” she says.

Fortunately, Kerry was able to borrow 50% from the bank and 50% from her parents at market rates.

Turning lucky chance into profit

Suddenly, Kerry was the owner of a six-bedroom semi-detached home that she candidly describes as “the ugliest house on the street”.

What it had going for it were two top-floor bedrooms, each with their own en suites. To help pay the mortgage, Kerry rented out the two top-floor spaces plus one other bedroom.

Kerry also generated her own capital by extensively renovating the outdated building and interior.

This huge, accidental leap into property became Kerry’s stepping stone to her next purchase. When she returned to Australia in 2003, she refinanced the UK home in order to purchase a large townhouse 3km from Sydney City in Forest Lodge.

“I suddenly realised the power of leverage. Understanding leverage and how to use it – that’s how you build up your capital income”

KERRY’S TIPS FOR RETIRING WEALTHY

• Continually invest in self-educating yourself.

• Start out with a focus on financial freedom.

• Have a buy-and-hold strategy to build your nest egg, so you are not just property-flipping. • • Diversify into different areas to maintain a consistently growing portfolio.

• Chase residual income. You pay your bills from your 9am–5pm income, but you make your fortune between 5pm and midnight!

“I increased the home loan from £300,000 to £550,000 and used that extra money to buy a place to live in Australia,” Kerry explains.

Her low-ball offer and value-adding renovations meant that just two years later she was able to sell the UK property for £400,000 more than her purchase price.

While she had already leveraged some of those profits into her Sydney property, the sale produced additional profits that were burning a hole in her bank account; that is, until she decided to invest again.

“I think I'm always going to be working to some degree, but it’s really nice to know that every month there’s an income coming in”

But first she prioritised her financial growth by making a bold decision. Three years after buying the townhouse in Sydney, Kerry altered the course of her investment journey by choosing to rent out the Forest Lodge townhouse and instead buy a smaller, cheaper home to live in.“I realised that it was a huge place and I would be better off renting it out, because I could make a lot more money renting it than living in it,” Kerry says.

In fact, in buying the Sydney property, Kerry had inadvertently purchased a renter’s dream. The townhouse featured all the highly sought-after factors that tenants want from an inner-city lifestyle, including a double garage, quick access to the city and spacious living.

Realising the possibilities

Kerry says it was at this point that she truly saw the potential of property as a tool for wealth creation.

“I had wanted to live in a place that was big and ‘look at me’, but then I realised I could actually rent it out for $1,000 a week,” she explains.

“So I rented a place for a while, and I was paying $500 a week, and I suddenly realised the power of leverage.”

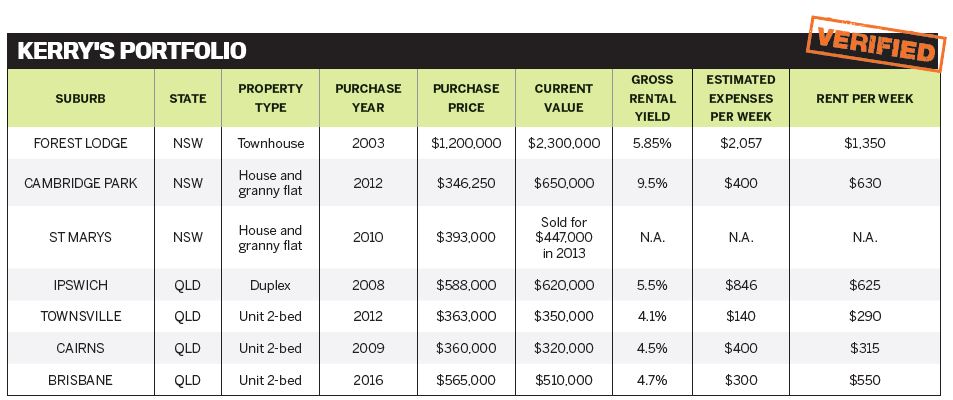

With this new mindset, Kerry went on to buy several more properties across NSW and Queensland. Her diverse portfolio includes new duplex builds, detached houses, townhouses and units.

Kerry is now in a position where her properties are providing a strong passive income stream. At 56, she plans to semi-retire in four years’ time.

“I plan to go from interest-only repayments to principal and interest, and will start to reduce my mortgage to ensure that I have a decent income when I retire,” she explains.

“I love that I now have properties that give me an income stream. It’s residual income, which is the best income!”

Kerry doesn’t plan on buying more properties – although she’s not ruled the idea out altogether – but she also doesn’t plan to wind up her entrepreneurial projects completely when she retires. Kerry is passionate about helping people create fun and freedom in their lives, which she

does through a VIP travel club called Dream Trips, a venture that gives her the opportunity to travel and share her enthusiasm for creating financial freedom with others.

“I think I’m always going to be working to some degree, but it’s really nice to know that every month there’s an income coming in, and you don’t have to worry about being made redundant or something like that,” Kerry says.

“No one can take your property away from you, unless you’re highly geared.”

While Kerry’s properties are all positively geared, the biggest equity booster is her Forest Lodge property in Sydney. “I bought that property for $1.2m in 2003, and now it’s worth up to $2.4m,” says Kerry.

Trial-and-error education

The townhouse in Forest Lodge may have been the accidental hero of Kerry’s portfolio, bought before she understood growth indicators and leverage, but Kerry has since learned the signs of a good property.

Despite poor advice from property groups and naysayers, she has paved her own way to success.

“When everybody was telling me not to buy another property, that’s when I stopped telling people [what I was doing], because it could have gotten me into a negative mindset,” Kerry says.

“People can really put you off by telling you the property market is going to crash all the time. So I just quietly went and bought another property, and then another.”

Some of the advice Kerry received hasn’t quite panned out the way she expected. For instance, taking heed of suggestions to diversify to locations beyond NSW, Kerry bought a duplex and three units in Queensland.

“I was introduced to properties in Queensland, and my thought process at the time was that New South Wales was on fire and Queensland was flat, and surely that would turn around,” Kerry explains.

“One of my properties is in Ipswich, where there is a lot of infrastructure going on and I thought it would increase in value, but it hasn’t happened yet.”

But despite a capital gain of just $30,000 in eight years, the Ipswich duplex has been a solid performer in terms of rental consistency, with one half being continuously tenanted by a government agency.

“Hindsight is a beautiful thing,” Kerry says. “Diversification is the key to financial freedom and people say to hedge your bets and buy in different areas. But I think if I’d stayed in New South Wales I’d be doing a lot better.”

KERRY'S TIPS FOR ROOKIE INVESTORS

• Don’t buy sight unseen.

• Do your own research and due diligence.

• Make an offer and don’t be scared to walk away.

• Maintain your investments, or small issues can become big ones.

• Don’t overthink your research so much that you don’t take any action.

Kerry realises that, along the way, she sometimes relied too much on advice from people who wanted a sale and didn’t necessarily have her interests in mind.

“I think I didn’t do enough research in the beginning and I made some rookie mistakes,” she explains.

“I actually even had one agent doctor some documents without my knowledge.”

Sharing the wisdom

Of course, Kerry clearly remembers the best advice she ever received, which came from her own mother.

“Many years ago, as a family, we had to earn money, and my mum got some advice from someone she respected, who told her that property was a way for her to be financially free,” Kerry says.

“She started investing in property and she tried to teach me, but I didn’t really get it until much later.”

Her parents bought and managed their own properties; however, Kerry believes in employing a reliable property manager to care for her investments.

“If you get a good one, they’ll look after the property. But even then, you’ve got to be on top of it and make sure they’re doing the right thing,” she says.

Kerry is quick to advise people to find a way into property, even if it means doing things a little bit differently.

She admits that she is considering selling two of her assets to fund the purchase of an unencumbered ‘dream home’ – 18 years after accidentally buying the worse-for-wear six-bedroom home in the UK, which eventually turned into a $5m portfolio and $2.5m in available equity.

“I often say to people that are starting out that even if you’re buying a place to live in, and you’re on your own, buy a two-bedder and rent one room out, as it will help you to pay your mortgage,” Kerry says.

“I’m passionate about showing people that residual income is important,” she adds.

“For me, my properties and my VIP travel club Dream Trips are my residual income for life.”

GRANNY FLAT GROWTH

A clever strategy to boost both capital value and rental income within your portfolio is the addition of granny flats. Kerry has embraced this strategy with two of her property purchases, and it has successfully boosted the value of both properties, while also adding significant rental income.

The first, in St Marys, NSW, was an older home bought in 2010, though it initially caused Kerry some financial headaches, she admits.

“The property had been renovated prior, and I spent an awful lot of money fixing problems where they'd done a poor job,” she explains.

“The roof caved in, it flooded, and there were problems with the plumbing.”

Some of the financial burden was alleviated by the income produced by the one-bedroom detached granny flat she built on the block.

Similarly, Kerry spent $100,000 on a granny flat on her property at Cambridge Park. She also cosmetically renovated the original property, at a cost of $35,000.

“The land was big enough that I was able to add a two-bedroom granny flat, and it’s awesome,” Kerry says.

“I'm getting $260 a week in rent from the granny flat – that's a good return on your money!”

Adding in the rental income from the main house, the Cambridge Park property is earning over $2,000 a month – an excellent return on a property with just $200,000 remaining on the mortgage – and providing a gross rental yield of around 9.5%.