After all, that’s where his property journey began – with a book on building wealth through investing that is familiar to many Australians.

“My mum got me Rich Dad Poor Dad to read when I was younger, and then as soon as I had a full-time job I started saving for a deposit,” he explains.

“I had one property when I met my wife, Kate, and together we have built a really good portfolio.”

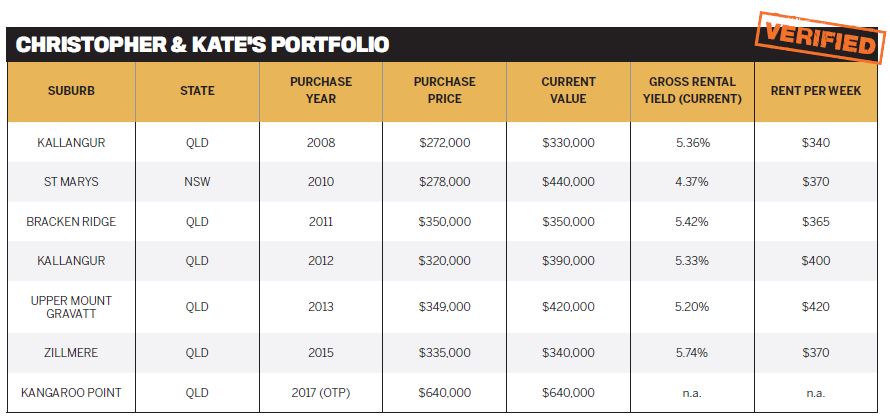

Christopher and Kate have built a portfolio of six (soon to be seven) properties, located primarily in and around Brisbane.

Their Queensland-centric investing journey began back in 2008 with a property at Kallangur, located just north of Brisbane in the Moreton Bay region. Purchased for $272,000, the home has been continuously tenanted and today rents for $340 per week.

They went back to Kallangur in 2012 and picked up a slightly larger property in the same neighbourhood for $320,000. This now rents for $400 per week and has proven to be popular with tenants.

In between these purchases, the pair turned their attention to St Marys in Sydney – a move that turned out to be very savvy.

In 2010, when they paid just $278,000 for their St Marys investment, Western Sydney was considered a relatively downmarket suburb in which to own a rental property.

Of course, we all know how the story unfolded, with Sydney property values booming in recent years.

“That’s a unit that we actually bought off the plan. We purchased it in 2010 at the bottom of the market and it has increased in value by a significant amount,” Christopher says.

It’s little wonder that Christopher and Kate credit their St Marys investment as one of their best purchases: the rental home has grown in value by more than $150,000 since they bought it, driving strong equity growth for them to leverage into further properties.

Learning and leveraging

Looking back on their investment journey, Christopher admits that they didn’t have much of a strategy to start with.

“I think our biggest regret is not getting the right advice at the start,” he says.

“We basically started buying properties. We have bought really well and got some good bargains, but we haven’t seen a strong capital gain yet. If we had got the right advice at the outset, we would be in a much better position of being able to choose to work or not work [now].

“There is a lot of media hype at the moment about there being an oversupply of properties close to most CBDs, which I think is true. The trick is selecting the ones that stand out from the pack, as we think these ones will be highly sought after”

“In saying that, we are still in a good position. Our portfolio is now self-sufficient and we get a return off it each year.”

They began working with the team at Positive Real Estate in recent years and Christopher says this collaboration has helped them become better skilled at handling the property-buying experience.

“For instance, they now understand that it’s important to know exactly how much a property is going to cost them per week before they even set foot inside it for inspection.

“It’s also crucial to leave the emotion at the door: this is not a property that you would personally live in, but it must be easy to rent,” he says.

Getting mentoring and guidance has also helped the pair to define a more structured strategy going forward.

“We think it’s important to stick to major capital cities where there are many buyers and sellers on any day. Our goal is to secure high-quality new property that is really close to the CBD of the city that we are looking at,” Christopher says.

“There is a lot of media hype at the moment about there being an oversupply of properties close to most CBDs, which I think is true. The trick is selecting the ones that stand out from the pack, as we think these ones will be highly sought after.

“In the near future, we are going to monitor each capital city in relation to where they are in the property cycle. As they move to the top, we’ll sell some of the underperforming [properties] to then recycle capital into cities that are on the way up.”

Playing the waiting game

Currently, the couple own six properties and they’ve committed to one more off-the-plan purchase that will be settled in late 2017.

“We are also hoping to secure another property by the end of the year,” Christopher says. “Our overall property strategy is to buy and hold, but we will sell underperforming properties.”

Having begun investing 12 years ago, Christopher has put this theory into practice, selling a few properties over time that failed to reach their potential.

Ideally, the couple hope to drive strong growth through their portfolio so they can eventually sell some of their assets and use their profits to reduce debt at retirement.

This will leave them with a strong ongoing rental income to live off in retirement.

“Basically, it will provide an income stream so we can chose to stop work when we feel like it,” Christopher adds.

“If we had the opportunity to go back and do anything differently, we would take more notice of the various property cycles. We have done really well in buying the right type of property, but we have just bought it in the wrong cities. Our time will come; it’s just a waiting game from here.”