The theme is financial freedom, yet one line stands out above the others: “You don’t get rich with a nine-to-five job”.

Indeed, Desmond points out that a full-time career might make you more money to spend on things like a better bottle of wine, a newer car or a bigger house. However, that’s generally about it.

“The real wealth is in investing your money to make it work harder for you,” he says.

Additionally, Desmond says progressing further up the corporate ladder can just lead to spending even more time working. Therefore, this can mean missing out on precious time with your loved ones, and on the chance to explore things in life that you are truly passionate about.

“People say a holiday is awesome, but if you could make it a lifestyle that would be bloody awesome,” Desmond says.

Travelling the world is just one of the goals for Desmond and his wife Jennie. In fact, they hope their property investments will enable them to retire in five years’ time.

Not a bad outcome for a couple who are both just 30 years old.

And thanks to their wise decisions since their early purchases, this dream may well become a reality. After all, their big ambitions have enabled them to buy a massive eight properties since 2013.

But let’s start by rewinding to when the journey first started in 2009.

THE ‘SUCCESSFUL FAILURE’

When Desmond was just 25 years old he developed a profound thirst to get ahead in life. At that stage he knew he wanted to get into some kind of investing, and he liked property because it was something he could see, touch and, most importantly, understand.

The solution was to buy a two-bedroom unit in Bruce, a suburb of the Belconnen district in Canberra.

“My family lived in Bruce for a couple of years, and around that time the First Home Owner Grant was increased, so I felt like I needed to take advantage,” he says.

“We just saw the first thing that was built in our suburb, which was convenient because it was close by.”

But after making the purchase for $330,000, it’s fair to say that this property came with its challenges.

“Buying my first property was very difficult and a very big commitment,” says Desmond.

“I was beginning to understand the value of money, as I was putting nearly all my pay cheque into the home loan every fortnight.”

He calls his first property a “successful failure” because even though it has not been a financial success, the learning experience has been priceless.

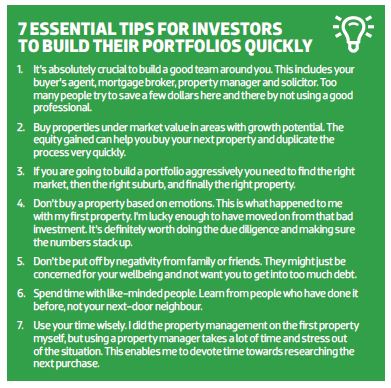

After buying this unit Desmond learnt some valuable lessons from making the following mistakes:

• He bought the property based on emotion and without any research or proper guidance.

• He did the legwork of talking to each bank instead of going straight to a mortgage broker.

• He did the property management by himself, which was stressful and time-consuming.

• He listened to friends and family for property investing advice, instead of the experts.

“I sacrificed a lot of time and money,” says Desmond.

“I could have paid each professional to find the right property, structure my loan properly, and to look after the property, which would have got the best outcome from it. This would have freed my time to focus on researching the next investment.”

In particular, doing the property management himself meant that he was forced to wait for people to show up and see if they wanted to rent his apartment. For someone like Desmond with a full-time job, this was time-consuming to say the least.

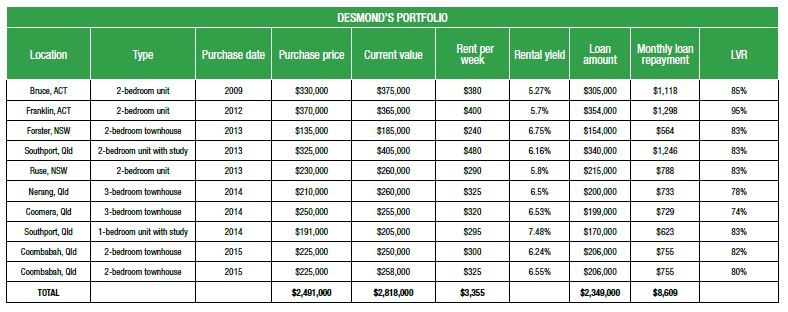

Desmond and Jennie have held this property for six years and have not been impressed with its capital growth. Indeed, during that time it has only grown by $45,000 to $375,000.

Moreover, his next property, a two-bedroom unit in the ACT suburb of Franklin, was also a letdown. The property was not showing capital growth, and Desmond knew the time had come to make some radical changes to his strategy.

LOOKING INTERSTATE

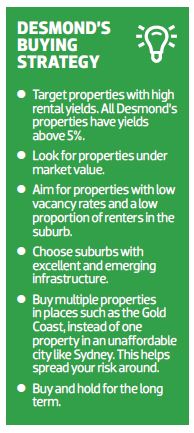

With Desmond’s properties in Bruce and Franklin not performing as well as he had hoped, his attention turned to looking outside of the ACT. It was also at this point that he started using a buyer’s agent.

“As soon as I started using a buyer’s agent I began seeing some solid results,” he says.

“That’s why I believe you should get the professionals to do it.”

Desmond and Jennie settled on a $135,000 two-bedroom townhouse in the coastal town of Forster in the Mid North Coast region of NSW.

“Using a buyer’s agent really changed our mindset on how to buy property, as we have not seen this property physically,” Desmond says.

“Forster had a very low entry point to be able to pay for the deposit, and strong cash flow to be able to support the property.” And the results of this property have been much better than the two they own in the nation’s capital.

The two-bedroom townhouse has grown in value by a healthy $50,000 since 2013. It also boasts a strong rental yield of 6.75%. But, best of all, the equity gained in this property provided them with the opportunity to look for more.

OPPORTUNITIES IN THE SUNSHINE STATE

Following the success of the Forster property, Desmond and Jennie decided to give Queensland a try.

“Queensland has been supressed since the GFC in 2009, and now there have been strong signs that its market is recovering,” says Desmond. “We have seen the NSW and Victoria markets growing, and the Queensland market usually follows them as well.”

SUBURB FACTS

• Southport is regarded as the CBD of the Gold Coast city and is 73km from the Brisbane CBD.

• The suburb is expected to benefit from the 2018 Commonwealth Games and the related infrastructure.

• It currently has excellent university and medical infrastructure, not to mention the sought-after precinct of Chinatown Gold Coast.

• This suburb is right in the centre of where a lot of the white-collar employees work, says Desmond.

PROPERTY FACTS

Desmond believes that the two bedrooms his unit offers are ideal for the young professional demographic that targets Southport. He also argues that when you lease properties that have more than three bedrooms in this suburb, they are more expensive and appeal to a smaller target market.

Desmond and Jennie also used a buyer’s agent for this property purchase. Desmond says the amount of effort that was put into finding the property and negotiating the price was worth every dollar of the agent’s fee.

“The average Joe's like us would never have been able to secure a property like this,” he says. Not only has the property increased in value by a strong $80,000 but it also has a solid rental yield of 6.16%.

And these are not the only reasons why this property is the one Desmond is most proud of.

“We were allowed to withdraw so much equity out of it and in such a short time that we got to buy a couple of properties with it,” he says.

They then bought a $230,000 two-bedroom unit in Ruse (52km southwest of Sydney) before targeting two three-bedroom townhouses in the Gold Coast suburbs of Nerang and Coomera for $210,000 and $250,000 respectively.

GETTING THE RIGHT MINDSET

The greatest challenge of Desmond and Jennie's property journey so far was starting investing without a mentor.

“I did not have the proper education or a mentor,” says Desmond.

“How I got motivated was listening to these life coach quotes like from Robert Kiyosaki with Rich Dad Poor Dad and stuff like that.

“I got really intrigued about how much can change if you change your mindset.”

Desmond just wishes he’d had the right advisors and mentors around him right from the start.

“Your mindset changes so much when you are talking to like-minded people who have done it before,” he says.

Their recent buying frenzy has taken his total number of properties to 10, after picking up eight since 2013.

Most recently, Desmond and Jennie have bought two two-bedroom townhouses in Coombabah, which is another suburb in the Gold Coast.

“Coombabah has good rental yields and is only 15 minutes from Southport, which is set to benefit from a range of infrastructure upgrades,” he says.

LOOKING TOWARDS RETIREMENT

Desmond and Jennie hopes to buy more properties in the near future, just as long as they meet certain criteria.

“If it has strong cash flow and is under market value with an upside of potential growth, why wouldn’t you do it? That’s a thing I tell my colleagues around here,” says Desmond.

"We have influenced a lot of people around us, and we thought, ‘Why not share our story?’”

.JPG)

“It’s been going up and up and really showing results,” says Desmond.

Most of the successful property investors who Desmond has researched have a buy-and-hold strategy, and that is something he is trying to emulate.

“When time goes on the value of those properties will compound up and up. You can then buy more properties or just create a passive income out of it,” he says.

“It’s an addictive cycle to do, and it’s very healthy.”

In order to do that, Desmond and Jennie are putting their money towards investing, and making sacrifices now so that they can benefit from them in five years’ time.

That is when Desmond and Jennie are planning to do even more travelling around the world. In fact, they just got married this year and spent their honeymoon in Bali. Travelling on adventures together is something they would like to do twice a year once they are happy with their portfolio.

“Not everything is about working a nine-to-five job,” Desmond says.

“Property is a good, safe way to get to your goals in life.

“We hope to help people around us who want to be financially free, so they can enjoy what life is really about – enjoying exploring the world, instead of working a third of our lives each day to pay bills.”

.JPG)