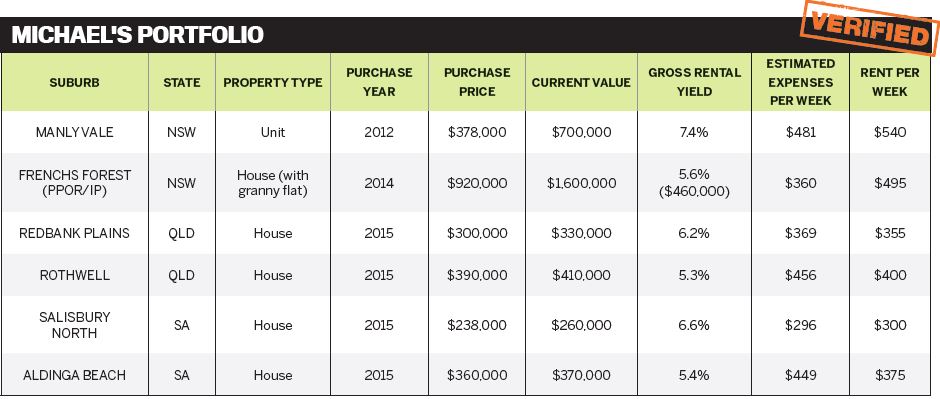

In the past 11 years, Michael has amassed a portfolio of six properties, totalling over $3.6m in value. Ultimately, he wants to add another four to the mix, bringing his total number of real estate assets to 10.

“We knew that investing in property could create wealth, but it wasn’t until after we bought our first one that we started to seriously see how it could work in reality”

Humble beginnings

Growing up with a father who ran a design and construction firm while working as a chartered surveyor and building designer, Michael was exposed to the world of property from an early age. He began work on his father’s building sites as a labourer when he was 16, and went on to study architectural engineering at Leeds University.

“My dream was to buy and renovate property, and then sell them or hold on to them as an investment,” Michael explains. “The plan to get a job and save for a deposit took a bit of a detour when my girlfriend and I decided to take a working holiday to Australia for a year.”

“We had been renting along the Lower North Shore in small one-bedroom units, but we knew that to be able to afford to buy our own place we needed to compromise on location and move further out,” Michael says.

“Once we had the loan repayments under control, we felt determined to save as hard as we could for the next deposit, which would be an investment property.”

Just over a year later, Michael signed the agreement on his first investment: another unit in Manly Vale worth $378,000.

“We had managed to save up a 5% deposit, and we paid about $5,000 in lenders mortgage insurance to be able to get into another property as soon as possible,” Michael says.

While he recognised the risk of buying in the same area as his own home, he trusted his extensive research on the suburb – a manoeuvre that has paid dividends as the unit has almost doubled in value in four years.

Believing it would have been too risky to purchase a third property in the same neighbourhood, Michael decided to diversify his locations when he bought subsequent investments.

“In hindsight, though, it would have been great to buy another apartment in Manly Vale, as the market has been so strong over the last four years!” he says.

With two assets then under his belt, Michael’s ambitions in real estate were no longer a dream. He could truly see property as a tangible device for wealth creation and the path to a passive income; so much so that within a short time frame he was able to access the mounting equity in his Sydney properties and leverage the purchase of four more – all in less than five years.

Targets and tenacity

For Michael and Sarah, who is now his wife, one fundamental of their success is a steadfast and binding strategy, one that they drew up after buying their first investment property.

“Now we have a robust long-term property investment plan in place which outlines all our income and expenses, assets and liabilities, lifestyle and financial goals,” Michael explains.

“We have a very clear picture of what we want to achieve and how we are going to get there.”

Michael’s plan took into account changes in circumstances, including starting a family. He planned to acquire neutral or positively geared properties so that his portfolio would pay for itself while his wife took time off work to have their daughter.

Michael’s extensive research into real estate is based on a two-tiered strategy: buying and holding for strong long-term growth, and adding value through renovation and development.

“We prefer to buy within one hour of major capital cities, as this is where the biggest population growth will occur over the next 50 years or so,” Michael says.

“We assess the fundamentals, including employment growth and economic diversity, and then narrow the search down using data from price growth trends, vacancy rates and sales volumes.”

“So many people jump into property investment without any strategy in place, then after two or three years end up selling, as they don’t know where they’re heading”

Michael regularly checks his investment purchases against his long-term plan.“Our strategy is a bound document that I can benchmark against, and having it written down on paper is a strong motivator,” he says.

“So many people jump into property investment without any strategy in place, then after two or three years end up selling, as they don’t know where they’re heading. Factoring in expenses, these people walk away with little or nothing to show except a strong resentment against property investment.”

Even when they upgraded their own home, Michael says he and Sarah searched with an investment mentality. They ended up purchasing a split-level home in Frenchs Forest in northern Sydney, and kept the existing tenant in the lower-level flat – effectively turning their own home into another investment.

“From a cash flow perspective it has worked out great, with smaller non-deductible mortgage repayments than we had before, as the rent from downstairs covers more than half of the mortgage,” Michael explains.

Their multipurpose home in Frenchs Forest – which Michael chose knowing there would be significant infrastructure improvements in the future due to the new hospital – has produced the result he was counting on, growing from $920,000 to $1.6m in three years.

While Michael gives credit to the booming local market, he says some of the growth was also manufactured through their ongoing renovations.

Creating $1m plus in net worth

Michael’s smart property purchases have driven his available equity over the $1m mark.

In conjunction with the successful Frenchs Forest home, his first investment purchase was another huge boost to his net property worth. He was able to snag the two-bedroom Manly Vale unit under market value, and improved its capital growth by renovating it throughout.

“Watching the stagnant on the market, and negotiating well with the agent and vendors, allowed us to purchase the property for almost$60,000 under its initial listing price,” Michael says.

“The negatives of the property were superficial, and the huge effort that Sarah and I put into renovating the unit within three weeks has paid dividends since we have owned it.”

As a result, their rental return has increased from $450 per week to $540 over the last four years.

To diversify his assets and spread the risk, Michael’s next four purchases spanned Queensland and South Australia. His buying criteria included a minimum 5% yield and a vacancy rate of less than 3%.

The two Adelaide purchases also fit his ‘hold and develop’ approach to manufacturing capital. The houses have the scope and zoning permission for building a set of townhouses on each block, which Michael plans to do in the next eight to 10 years.

“Building two townhouses will give us future valuation uplift once we have depreciated the majority of the remaining value in each of those houses,” he explains.

In the meantime, the Salisbury North home in Adelaide – purchased for just $238,000 – is producing a 6.6% yield, while the Aldinga Beach property returns 5.4%.

MICHAEL’S STEPS TO SUCCESS

• Know your strategy and how long to hold on to each property, and understand your cash flow.

• Save money with focus and determination.

• Write your long-term strategy down and refer to it regularly. Manage your risks by having a cash buffer.

• Research diligently, diversify locations and always use the numbers as your guide.

5 WAYS TO BOOST CAPITAL GROWTH POTENTIAL

1. Buy a property that suits the largest demographic within a suburb, to appeal to the widest pool of tenants and buyers.

2. Look for areas with high expected population growth – generally this occurs around capital and regional cities.

3. Buy stock with the potential to add value through renovation or development.

4. Add a granny flat or secondary dwelling to the block, if the area demands it.

5. Buy and hold, rather than house-flipping. Long-term capital growth is all about time in the market.

In the meantime, the Salisbury North home in Adelaide – purchased for just $238,000 – is producing a 6.6% yield, while the Aldinga Beach property returns 5.4%.

The road to 10 properties

As well as planning to release himself and his wife from the need to work for income, Michael is amassing a portfolio with his children in mind too.

“We want to ensure our children are financially secure for the future,” he says. “We’re aiming for 10 properties with a combined value of $8m.”

Setbacks won’t slow down the couple’s plans for long either.

“Our original plan was to buy our next two properties in 2016 and 2017, but due to the birth of our daughter and starting my business we had to delay those purchases and adjust our strategy,” Michael explains.

“Now we’re looking at buying Properties 7 and 8 at the end of 2017 or early next year.”

Enthusiastic about the opportunities that property presents for gaining financial freedom, Michael began helping friends and family embark on their own property journeys, and started his own blog. He has now taken his passion a step further and founded STRAND Property Group.

“When I’m negotiating with sales agents, I always remain true to my word and never lie about my position or use underhand tactics to gain an advantage”

His goal for this business is to guide clients in creating their own strategies, and to help them to acquire good-quality properties.In particular, Michael hopes to educate new investors on designing the right strategies for themselves, as well as on risk mitigation and analysing their long-term cash flow.

“Always ensure that you have a good cash buffer left over after all the deposit and purchase costs, to allow for future maintenance expenses,” Michael advises.

“And you can minimise market risk by buying in different areas – that way, if one submarket is not doing as well as the others, your properties will experience different trends at different times.”

Above all, Michael believes in conducting the business of property investment with integrity, and plans to continue doing so.

“For example, when I’m negotiating with sales agents, I always remain true to my word and never lie about my position or use underhand tactics to gain an advantage,” Michael explains.

“I believe that being true and honest with all parties that you deal with throughout the property investment journey allows you to build credibility and gain trust.”